The companies are increasingly turning to Artificial Intelligence (AI) and Machine Learning (ML) to improve efficiency, accuracy, and customer service. Predictive analytics, underwriting, claims processing, fraud detection, and customer service are some areas where AI and ML are being applied. By analyzing large amounts of data, insurers can predict and set policy premium accurately. Automating the underwriting and claims processing procedures enhances insurers' decision-making abilities and accelerates the benefits delivery process, resulting in improved operational efficiency and customer satisfaction.

Disability insurance providers are offering more customizable policies to meet the specific needs of customers. Customers can choose the coverage level they need. The length of the waiting period, and the benefit period. Additionally, disability insurance providers are integrating their policies with other benefits, such as life insurance and retirement plans. This provides customers with a more comprehensive package of benefits and simplifies the administration of those benefits.

The COVID-19 pandemic had a positive impact on the regional market, and several changes such as changes in the underwriting and claim process, are likely to persist after the end of the pandemic. The COVID-19 pandemic has highlighted the need for more comprehensive coverage for dealing with the negative effects of the pandemic and other health crises. Disability insurance providers are developing policies offering more robust coverage for these occurrences.

U.S. Group Level Disability Insurance Market Report Highlights

- The long term disability insurance segment is expected to dominate the market over the forecast period. Long term disability insurance provides financial support for an extended period of time, usually spanning several years or until the policyholder reaches retirement age. This coverage is particularly beneficial for individuals with disabilities that prevent them from working for prolonged periods, as it offers a source of income to help defray their living expenses.

- The employer supplied disability insurance segment dominated the market in 2022. With an aging population and rising healthcare costs, there is a growing need for disability insurance. Many employers are recognizing this need and are providing disability insurance as part of their employee benefits package. This trend is expected to continue over the forecast period, driving growth in the employer supplied disability insurance segment.

- The tied agents and branches segment is expected to dominate the market over the forecast period. The tied agents and branches segment can access a broader range of disability insurance policies than other distribution channels. This allows companies to offer customers more comprehensive coverage options, which can be a key factor in attracting and retaining customers.

- The enterprise segment is expected to dominate the market over the forecast period. The dominance of the enterprise segment market is due to the more extensive customer base. The importance of disability insurance in attracting and retaining skilled workers, and the greater bargaining power of large organizations when negotiating insurance policies.

Table of Contents

Companies Mentioned

- The Hartford

- Unum Group

- Prudential Financial, Inc.

- MetLife

- StanCorp Financial Group, Inc.

- The Guardian Life Insurance Company of America

- Reliance Standard

- AFLAC INCORPORATED

- Mutual of Omaha Insurance Company

- Principle Financial Services, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | April 2023 |

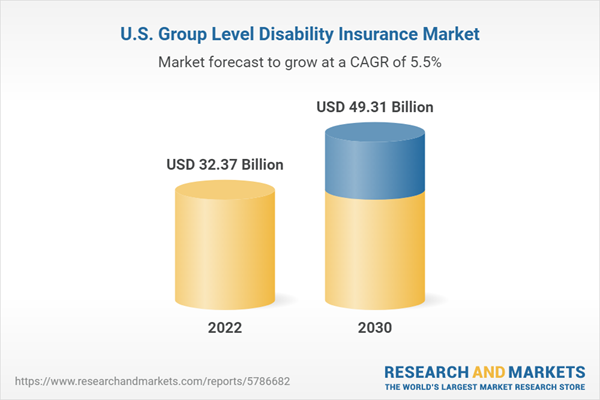

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 32.37 Billion |

| Forecasted Market Value ( USD | $ 49.31 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |