Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Component

1.2.2. Function

1.2.3. Application

1.2.4. End-use

1.2.5. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. Internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Volume price analysis (Model 2)

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Executive Summary

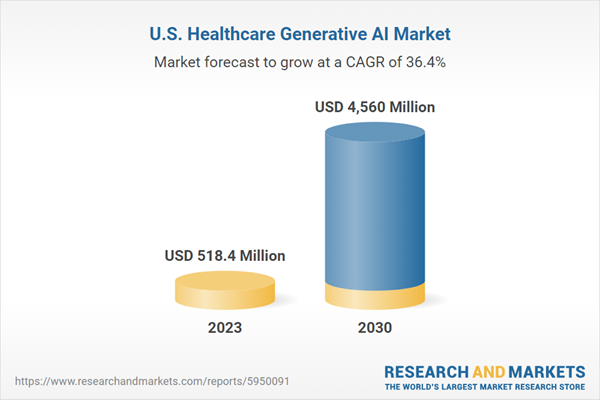

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Component outlook

2.2.2. Function outlook

2.2.3. Application outlook

2.2.4. End-use outlook

2.3. Competitive Insights

Chapter 3. U.S. Healthcare Generative AI Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.2. Market restraint analysis

3.3. U.S. Healthcare Generative AI Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Supplier power

3.3.1.2. Buyer power

3.3.1.3. Substitution threat

3.3.1.4. Threat of new entrant

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Technological landscape

3.3.2.3. Economic landscape

Chapter 4. U.S. Healthcare Generative AI Market: Component Estimates & Trend Analysis

4.1. Component Market Share, 2023 & 2030

4.2. Segment Dashboard

4.3. U.S. Healthcare Generative AI Market by Component Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.4.1. Solutions

4.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2. Services

4.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 5. U.S. Healthcare Generative AI Market: Function Estimates & Trend Analysis

5.1. Function Market Share, 2023 & 2030

5.2. Segment Dashboard

5.3. U.S. Healthcare Generative AI Market by Function Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.4.1. Virtual Nursing Assistance

5.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.2. Robot-Assisted AI Surgery

5.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.3. Administrative Process Optimization

5.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.4. Medical imaging Analysis

5.4.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 6. U.S. Healthcare Generative AI Market: End-use Estimates & Trend Analysis

6.1. End-use Market Share, 2023 & 2030

6.2. Segment Dashboard

6.3. U.S. Healthcare Generative AI Market by End-use Outlook

6.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

6.4.1. Clinical Research

6.4.1.1. Market estimates and forecasts 2018 to 2030 (USD million)

6.4.2. Medical Centers

6.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

6.4.3. Diagnostic Centers

6.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

6.4.4. Others

6.4.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 7. U.S. Healthcare Generative AI Market: Application Estimates & Trend Analysis

7.1. Application Market Share, 2023 & 2030

7.2. Segment Dashboard

7.3. U.S. Healthcare Generative AI Market by Application Outlook

7.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

7.4.1. Clinics

7.4.1.1. Market estimates and forecasts 2018 to 2030 (USD million)

7.4.1.2. Cardiovascular

7.4.1.2.1. Market estimates and forecasts 2018 to 2030 (USD million)

7.4.1.3. Dermatology

7.4.1.3.1. Market estimates and forecasts 2018 to 2030 (USD million)

7.4.1.4. Infectious Disease

7.4.1.4.1. Market estimates and forecasts 2018 to 2030 (USD million)

7.4.1.5. Oncology

7.4.1.5.1. Market estimates and forecasts 2018 to 2030 (USD million)

7.4.2. System

7.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

7.4.2.2. Disease Diagnosis

7.4.2.2.1. Market estimates and forecasts 2018 to 2030 (USD million)

7.4.2.3. Telemedicine

7.4.2.3.1. Market estimates and forecasts 2018 to 2030 (USD million)

7.4.2.4. Electronic Health Records

7.4.2.4.1. Market estimates and forecasts 2018 to 2030 (USD million)

7.4.2.5. Drug Interaction

7.4.2.5.1. Market estimates and forecasts 2018 to 2030 (USD million)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company/Competition Categorization

8.3. Vendor Landscape

8.3.1. List of key distributors and channel partners

8.3.2. Key customers

8.3.3. Key company heat map analysis, 2023

8.4. Company Profiles

8.4.1. Medtronic

8.4.1.1. Company overview

8.4.1.2. Financial performance

8.4.1.3. Product benchmarking

8.4.1.4. Strategic initiatives

8.4.2. HCA Healthcare

8.4.2.1. Company overview

8.4.2.2. Financial performance

8.4.2.3. Product benchmarking

8.4.2.4. Strategic initiatives

8.4.3. Neuralink Corporation

8.4.3.1. Company overview

8.4.3.2. Financial performance

8.4.3.3. Product benchmarking

8.4.3.4. Strategic initiatives

8.4.4. Google LLC

8.4.4.1. Company overview

8.4.4.2. Financial performance

8.4.4.3. Product benchmarking

8.4.4.4. Strategic initiatives

8.4.5. Microsoft Corporation

8.4.5.1. Company overview

8.4.5.2. Financial performance

8.4.5.3. Product benchmarking

8.4.5.4. Strategic initiatives

8.4.6. IBM Watson

8.4.6.1. Company overview

8.4.6.2. Financial performance

8.4.6.3. Product benchmarking

8.4.6.4. Strategic initiatives

8.4.7. Amazon Web Services, Inc.

8.4.7.1. Company overview

8.4.7.2. Financial performance

8.4.7.3. Product benchmarking

8.4.7.4. Strategic initiatives

8.4.8. NioyaTech

8.4.8.1. Company overview

8.4.8.2. Financial performance

8.4.8.3. Product benchmarking

8.4.8.4. Strategic initiatives

8.4.9. Oracle

8.4.9.1. Company overview

8.4.9.2. Financial performance

8.4.9.3. Product benchmarking

8.4.9.4. Strategic initiatives

8.4.10. OpenAI

8.4.10.1. Company overview

8.4.10.2. Financial performance

8.4.10.3. Product benchmarking

8.4.10.4. Strategic initiatives

List of Tables

Table 1 List of abbreviations

Table 2 U.S. healthcare generative AI market, by component, 2018 - 2030 (USD Million)

Table 3 U.S. healthcare generative AI market, by function, 2018 - 2030 (USD Million)

Table 4 U.S. healthcare generative AI market, by application, 2018 - 2030 (USD Million)

Table 5 U.S. healthcare generative AI market, by end-use, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value-chain-based sizing & forecasting

Fig. 6 QFD modeling for market share assessment

Fig. 7 Market formulation & validation

Fig. 8 U.S. healthcare generative AI market: market outlook

Fig. 9 U.S. healthcare generative AI competitive insights

Fig. 10 Parent market outlook

Fig. 11 Related/ancillary market outlook

Fig. 12 Penetration and growth prospect mapping

Fig. 13 Industry value chain analysis

Fig. 14 U.S. healthcare generative AI market driver impact

Fig. 15 U.S. healthcare generative AI market restraint impact

Fig. 16 U.S. healthcare generative AI market: Component movement analysis

Fig. 17 U.S. healthcare generative AI market: Component outlook and key takeaways

Fig. 18 Solutions market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 19 Services estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 20 U.S. healthcare generative AI market: Function movement analysis

Fig. 21 U.S. healthcare generative AI market: Function outlook and key takeaways

Fig. 22 Virtual nursing assistants market estimates and forecasts, 2018 - 2030

Fig. 23 Robot-assisted AI surgery market estimates and forecasts,2018 - 2030

Fig. 24 Administrative process optimization market estimates and forecasts,2018 - 2030

Fig. 25 Medical imaging analysis market estimates and forecasts,2018 - 2030

Fig. 26 U.S. healthcare generative AI market: End-use movement analysis

Fig. 27 U.S. healthcare generative AI market: End-use outlook and key takeaways

Fig. 28 Clinical research market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 29 Medical centers market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 30 Diagnostic center market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 31 Others market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 32 U.S. healthcare generative AI market: Application movement analysis

Fig. 33 U.S. healthcare generative AI market: Application outlook and key takeaways

Fig. 34 Clinical market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 35 Cardiovascular market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 36 Dermatology market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 37 Infectious disease market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 38 Oncology market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 39 System market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 40 Disease diagnosis market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 41 Telemedicine market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 42 Electronic health market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 43 Drug interaction market estimates and forecasts, 2018 - 2030 (USD Million)