The adoption of new technologies among providers is constantly growing. This includes bringing services to rural areas and demonstrating how technology is transforming the approach to care. Many service providers have begun to deploy technology such as telemedicine, predictive analytics, virtual reality, and artificial intelligence. For instance, in March 2023, WorldView partnered with care co-ordinations to design a solution to transform home health & hospice care delivery by integrating automation and patient engagement.

The COVID-19 pandemic negatively impacted the market by affecting long-term projections and operational goals of the industry in the U.S. providers reported the lowest share of Medicare decedents enrolled for care since 2013, owing to the death rate outpacing the increase in enrollment rate. According to NHPCO data, in 2020, around 47.8% of Medicare decedents received hospice care in the U.S., much lower than around 51.6% in 2019. Currently, these centers are adopting advanced technologies due to patients refusing in-person visits during the COVID-19 pandemic. This is expected to drive market growth post-pandemic.

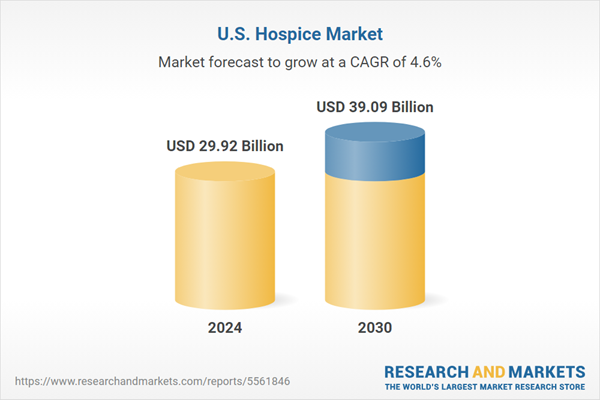

U.S. Hospice Market Report Highlights

- Based on type, Routine Homecare (RHC) segment dominated the market in 2024 and accounted for the largest revenue share of 92.98%.

- The hospice center segment held the largest market share of 86.32% in 2024, owing to the various benefits offered by these facilities.

- The dementia segment held the largest market share of 25.17% in 2024, owing to the dependency and disability among the elderly, with significant physical and psychological effects on individuals, their families, and caregivers.

This report addresses:

- Market intelligence to enable effective decision-making.

- Market estimates and forecasts from 2018 to 2030.

- Growth opportunities and trend analyses.

- Segment and regional revenue forecasts for market assessment.

- Competition strategy and market share analysis.

- Product innovation listings for you to stay ahead of the curve.

- COVID-19's impact and how to sustain in this fast-evolving market.

Why Should You Buy This Report?

- Comprehensive Market Analysis: Gain detailed insights into the market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned

The major companies profiled in this U.S. Hospice market report include:- Chemed Corporation (VITAS Healthcare)

- LHC Group, Inc. (UnitedHealth Group)

- Amedisys

- Gentiva

- Brookdale Senior Living, Inc

- Crossroads Hospice (Agape Care Group)

- Seasons Hospice

- Oklahoma Palliative & Hospice Care

- Compassus

- Chapters Health System

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | February 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 29.92 Billion |

| Forecasted Market Value ( USD | $ 39.09 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | United States |

| No. of Companies Mentioned | 11 |