The automotive industry is an ever-evolving, multifaceted field that requires a variety of industrial tools in the production of a vehicle. Industrial hoses are essential in the production facility of vehicles. These industrial hoses are primarily used in a broad range of manufacturing procedures, including transportation of fuel and lubricants.

The continuous introduction of new vehicle models and the need for advanced manufacturing procedures are likely to continue to propel the demand for industrial hoses over the forecast period. The US is the largest manufacturer of automobiles. The burgeoning demand for automotive vehicles results in frequent investments in the automotive sector in the country.

For instance, in February 2024, Schaeffler announced the expansion of its operations in the US with the addition of a new manufacturing facility concentrating on fabricating automotive electric mobility solutions. The company planned an investment of over US$ 230 million for the establishment of an advanced manufacturing facility in Ohio, US, along with its future expansion until 2032.

The assembly plant of the Mazda-Toyota joint venture for manufacturing automotive parts in Huntsville, General Motors Company's Detroit/Hamtramck Assembly, Flint Truck Assembly, Lansing Delta Township Assembly, and Orion Assembly. Ford Motor Company's Flat Rock Assembly Plant, Dearborn Truck, and Michigan Assembly Plant are a few of the major automotive manufacturing plants in the US. The extensive applications of industrial hoses in the flourishing automotive industry fuel the US industrial hose market growth.

A poorly maintained sewage infrastructure could negatively impact individuals' quality of health and wellness. Additionally, the lack of competent waste management and drain cleaning services could lead to several infections, diseases, and harmful components affecting individuals and compromising public safety. Thus, the US government and private agencies are educating the masses about the importance of competent management of waste and maintenance of sewer and drain infrastructure across commercial and residential units. In January 2023, the EPA announced a US$ 500 million loan to improve wastewater and drinking water infrastructure in New Jersey.

In January 2024, The Michigan Department of Environment, Great Lakes, and Energy announced grants worth US$ 67.1 million for the MI Clean Water Plan to help Michigan communities in upgrading water infrastructure. The main object of the project is to reduce sewage overflows into Lake St. Clair and maintain drinking water service lines in several communities properly.

The existing water systems across the US are grappling with the challenges posed by aging pipelines, treatment plants, and distribution networks, boosting the demand for sewer and drain cleaning services and the application of industrial hoses across the US. The increase in government investments in drainage and sewage projects is likely to boost the US industrial hose market.

Novaflex Inc., Parker Hannifin Corp, Kuriyama of America Inc., Gates Corporation, Norres, Kanaflex Corporation, Danfoss AS, Flexaust Inc., Jason Industrial Inc., and Polyhose Inc. are among the key players profiled in the US industrial hose market report. Companies operating in the US industrial hose market mainly focus on product and service enhancements by integrating advanced features and technologies into their offerings.

Reasons to buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the US sewer and drain cleaning services market .

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the US sewer and drain cleaning services market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth global market trends and outlook coupled with the factors driving the market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution

Table of Contents

Companies Mentioned

Some of the leading companies in the US Industrial Hose Market include:- Eaton Corp Plc

- Novaflex Inc

- Parker Hannifin Corp

- Kuriyama of America Inc.

- Gates Corporation

- Norres

- Kanaflex Corporation

- Polyhose Germany GmbH

- Jason Industrial

- Flexaust Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 73 |

| Published | October 2024 |

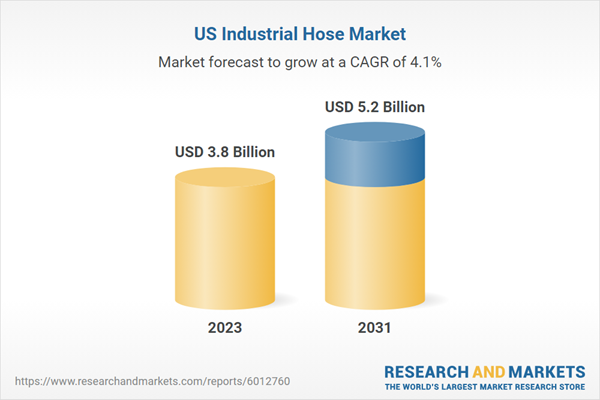

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 3.8 Billion |

| Forecasted Market Value ( USD | $ 5.2 Billion |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | United States |

| No. of Companies Mentioned | 11 |