Rising expectations of customers in the past few decades have led to increased spending by the end-user industries to improve the quality of industrial pumps along with installing advanced process control. This has further led to increased spending by the industrial pump manufacturers in the region in an attempt to improve energy efficiency which is likely to benefit the market growth.

Key market players have undertaken various initiatives such as technology innovations, research and development, partnerships, and mergers and acquisitions for manufacturing cost-effective industrial pumps. Moreover, rising investments by major players on technological advancements that focus on ensuring higher productivity are projected to spur market growth.

The chemical industry is expected to be negatively impacted by the novel coronavirus outbreak on numerous fronts-operational and supply chain disruptions, lowered demand and productivity, and potentially tightening credit markets. As a result, the demand for chemicals is expected to fall drastically, which is further likely to hinder the industrial pump market growth.

U.S. Industrial Pump Market Report Highlights

- Centrifugal pump led the market and accounted for the largest revenue share of 67.6% in 2024. owing to their extensive use in various end-use industries, especially for high capacity and low-pressure pumping applications.

- The water and wastewater treatment dominated the market and accounted for the largest revenue share in 2024 owing to the population growth, urbanization, and rise in manufacturing activities across several states in the U.S.

- In April 2020, Flowserve Corporation introduced a new vacuum pumps series with the name of the SIHI Dry PD Mi series which is capable of improving the throughput times, process efficiency, and the time required to achieve the target vacuum levels.

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments

- Competitive Landscape: Explore the market presence of key players worldwide

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

The leading players in the U.S. Industrial Pump market include:

- Gardner Denver

- Grundfos

- Flowserve Corporation

- Xylem

- ITT INC.

- SPX Flow

- Sulzer Ltd.

- Saniflo

- EBARA International Corporation

- Iwaki America Inc.

- Franklin Electric

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned

- Gardner Denver

- Grundfos

- Flowserve Corporation

- Xylem

- ITT INC.

- SPX Flow

- Sulzer Ltd.

- Saniflo

- EBARA International Corporation

- Iwaki America Inc.

- Franklin Electric

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 100 |

| Published | October 2024 |

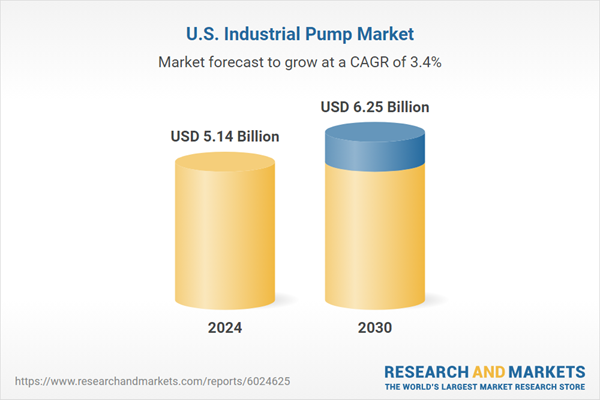

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.14 Billion |

| Forecasted Market Value ( USD | $ 6.25 Billion |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | United States |

| No. of Companies Mentioned | 11 |