Speak directly to the analyst to clarify any post sales queries you may have.

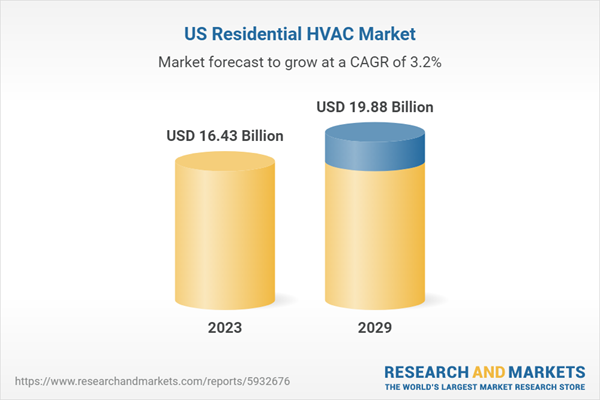

The U.S. residential HVAC market was valued at USD 16.43 billion in 2023 and is expected to grow at a CAGR of 3.23% during the forecast period. This report provides complete information regarding consumer purchasing behavior and the adoption of HVAC in the residential sector in the U.S. Increasing applications among sectors with a high expectancy of standards and manufacturing in the HVAC market must meet regulatory standards and provide robust solutions.

The demand for HVAC systems is due to different climatic conditions necessitating several types of equipment. Furthermore, major players focus on strategic agreements, acquisitions, and collaboration with emerging players to enter the U.S. residential HVAC market to access commercially launched products.

The future of the U.S. residential HVAC market thrives with the growth of energy-efficient solutions in construction, driven by smart home trends. Government initiatives and the popularity of Variable Refrigerant Flow (VRF) systems underscore a shift towards advanced, environmentally friendly HVAC solutions in the residential sector.

KEY HIGHLIGHTS:

- Air conditioning is a critical aspect of residential HVAC, especially in regions with warm climates. The market sees a demand for efficient and environmentally friendly cooling solutions. Innovations in ductless mini-split systems and smart thermostats contribute to the overall efficiency of cooling systems.

- Technological advancements, a focus on energy efficiency, and a growing emphasis on indoor air quality characterize the U.S. residential HVAC market. Given new developments in market conditions and the evolution of the HVAC industry, the future will likely remain positive, with innovation and strategic planning guiding the way.

- Growing awareness of indoor air quality has influenced product development in the residential HVAC market. Air purifiers, advanced filtration systems, and ventilation solutions are integral parts of HVAC systems to address concerns about allergens, pollutants, and indoor air quality.

- Companies are focusing on sustainable production processes and facilities. Most vendors in the market are developing new innovative products to gain attention. With the rise in SMART home technology and sustainability trends, the HVAC industry is on the path of innovation.

- The heating equipment in the equipment segment leads the segmental market share by having over 40% share. Furthermore, the heating equipment market in the U.S. is likely to gain higher traction than in other countries, owing to the extremely cold weather conditions that prevail in most parts of the country throughout the year.

- The furnace heating equipment segment is projected to witness the highest segmental CAGR of approximately 4.3% during the forecast period due to the increasing popularity of furnaces in residential segments, which has significantly overtaken the demand for heat pumps and boilers.

- By equipment, the HVAC air conditioning market is growing at a CAGR of 4.08%, in which residential air conditioners (RAC) have acquired a major market compared to commercial air conditioners (CAC) and chillers.

- The HVAC ventilation market is seeing steady growth, and adding value to its growth are air filter products, which are projected to reach a market size of over USD 1 billion in the forecast period.

- The Southern region held the largest U.S. residential HVAC market share. It has the highest number of households with rising annual household incomes. New construction in the South is anticipated to stimulate the adoption of HVAC systems. Furthermore, as consumers become more environmentally conscious and seek comfort and efficiency, the residential HVAC market will likely witness continued innovation and evolution during the forecast period.

- Regarding the competitive landscape, a few major players dominate the market: Carrier, Daikin, Johnson Controls, Rheem Manufacturing, and Lennox International.

SEGMENTATION & FORECAST

Equipment (Revenue)

- Heating

- Heat Pumps

- Boiler Units

- Furnaces

- Others

- Air Conditioning

- RACs

- CACs

- Chillers

- Heat Exchangers

- Others

- Ventilation

- Air Handling Units

- Air Filters

- Humidifiers & Dehumidifiers

- Fan Coil Units

- Others

Region (Revenue)

- South

- West

- Midwest

- Northeast

MARKET STRUCTURE

- Market Dynamics

- Competitive Landscape of U.S. Residential HVAC

- Key Vendors

- Other Prominent Vendors

LIST OF VENDORS

Key Vendors

- Carrier

- Daikin

- Johnson Controls

- Lennox International

- Rheem Manufacturing

Other Prominent Vendors

- Alfa Laval

- Backer Springfield

- Bosch Thermotechnology

- Copeland

- Danfoss

- Dunham Bush

- Fujitsu

- G.E. Appliances

- Glen Dimplex Americas

- Gree Electric Appliances

- Hitachi

- LG Electronics

- Midea Group

- Mitsubishi Electric

- Panasonic Corporation

- S&P

- Samsung HVAC

- TCL Electronics

- Watts

- Whirlpool Corporation

KEY QUESTIONS ANSWERED:

- How big is the U.S. residential HVAC market?

- Which region dominates the U.S. residential HVAC market?

- Who are the key players in the U.S. residential HVAC market?

- What are the growth drivers of the U.S. residential HVAC market?

Table of Contents

Companies Mentioned

- Carrier

- Daikin

- Johnson Controls

- Lennox International

- Rheem Manufacturing

- Alfa Laval

- Backer Springfield

- Bosch Thermotechnology

- Copeland

- Danfoss

- Dunham Bush

- Fujitsu

- G.E. Appliances

- Glen Dimplex Americas

- Gree Electric Appliances

- Hitachi

- LG Electronics

- Midea Group

- Mitsubishi Electric

- Panasonic Corporation

- S&P

- Samsung HVAC

- TCL Electronics

- Watts

- Whirlpool Corporation

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 79 |

| Published | February 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 16.43 Billion |

| Forecasted Market Value ( USD | $ 19.88 Billion |

| Compound Annual Growth Rate | 3.2% |

| Regions Covered | United States |

| No. of Companies Mentioned | 25 |