The U.S. single-use bioprocessing industry experienced a positive impact from the COVID-19 pandemic, particularly due to the increased demand for single-use products driven by the heightened need for vaccines, treatments, and assays. These products played an important role in facilitating the rapid scaling up of production by biopharmaceutical companies to meet the unprecedented global demand for vaccines. The pandemic underscored the importance of maintaining sterility and minimizing contamination risks in pharmaceutical and biologics production, highlighting the significance of single-use products in such scenarios.

Furthermore, the benefits of using SUT, such as significant cost reduction in capital, decreased time in operation & construction of a facility, and environmental sustainability, have supported the implementation of single-use systems in the bioprocessing market. The current industry trend of perfusion and continuous cell culture in bioprocessing has greatly enabled the use of single-use equipment. Single-use technologies offer enhanced mobility, ease of sampling, higher productivity, and faster product changeovers, further boosting their implementation in the biopharmaceutical industry. The following figure represents the usage of single-use disposables in biopharmaceutical manufacturing.

In addition, membrane adsorbers and columns for downstream chromatography have provided faster product output with decreased processing time and are now the single-use alternative to resins. For instance, drug product-filling operations can be carried out in single-use systems. For instance, in August 2023, Trelleborg Healthcare and Medical launched the BioPharmaPro family of advanced products and services for fluid path single-use equipment to boost the development of advanced therapies. Similarly, in February 2021, Cytiva acquired Varnx Pharmasystems, a Canadian aseptic filling innovator, and brought single-use flow paths for drug product filling. Due to the growth in single-use trends, the single-use workstation for filling and sterile operations will pose a great opportunity for the players in this market.

With the continued demand for biopharmaceuticals, CMOs have adopted these single-use systems for highly dynamic and frequent changes in product portfolios. Some of the major factors for the adoption of this technology by the CMOs are ease of use, flexibility, energy & capital cost reduction features, and decreased turnaround time for product changeover. Due to the benefits above and process advantages like performance efficiency, SUS has allowed CMOs to transition between product campaigns quickly. The adoption of SUS has resulted in CMOs building multiproduct facilities and providing enhanced services for faster market penetration of commercial products. For instance, in October 2024, Lonza acquired Roche’s Genentech facility in Vacaville for USD 1.2 billion. This strategic move significantly expanded its large-scale biological manufacturing capacity, catering to the growing demand for mammalian therapies.

U.S. Single-use Bioprocessing Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, the analyst has segmented the U.S. Single-use bioprocessing market report based on product, workflow, and end use.Product Outlook (Revenue, USD Million, 2018 - 2030)

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes, Sensors, & Flow Meters

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Meters & Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Work Equipment

- Cell Culture System

- Syringes

- Others

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

- Upstream

- Fermentation

- Downstream

End Use Outlook (Revenue, USD Million, 2018 - 2030)

- Biopharmaceutical Manufacturer

- CMOs & CROs

- In-house Manufacturer

- Academic & Clinical Research Institutes

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

Table of Contents

Companies Mentioned

- Sartorius AG

- Danaher

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Avantor, Inc.

- Eppendorf SE

- Corning Incorporated

- Meissner Filtration Products, Inc.

- Lonza

- PBS Biotech, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | November 2024 |

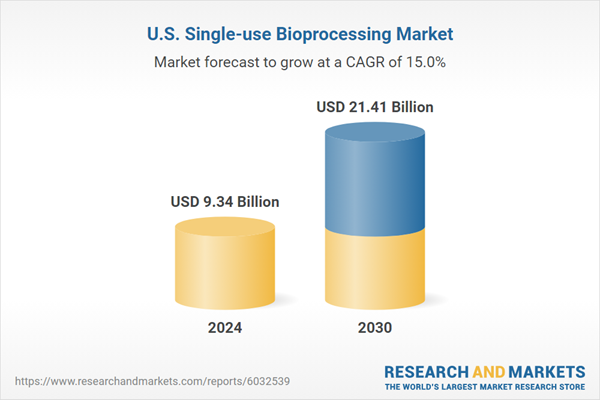

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9.34 Billion |

| Forecasted Market Value ( USD | $ 21.41 Billion |

| Compound Annual Growth Rate | 15.0% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |

![Single-use Bioprocessing Market by Product (Equipment [Bioreactors, Filtration, Chromatography], Consumables [Filters, Bags, Assemblies, Sensors]), Application (Storage, Mixing), Workflow (Upstream), Molecule Type (mAbs, Vaccines) - Global Forecast to 2030 - Product Image](http://www.researchandmarkets.com/product_images/12020/12020910_60px_jpg/singleuse_bioprocessing_market.jpg)