Speak directly to the analyst to clarify any post sales queries you may have.

MARKET DRIVERS

Rising Prevalence of Sleep Disorders: A study by the American Sleep Apnea Association found substantial increases in sleep disorders over the study period, including a 41% rise in obstructive sleep apnea. Other disorders also surged: narcolepsy by 14%, hypersomnia by 32%, periodic limb movement disorder by 30%, and REM sleep behavior disorder by 64%. The data suggests a potential rise in other disorders. Approximately 50-70 million Americans have sleep disorders, and around 84 million don't get the recommended uninterrupted sleep for health protection.Rising Healthcare Collaborations: Different organizations form 'collaborative working' partnerships, which can take various forms, from informal networks to complete mergers. With 50-70 million Americans experiencing sleep disorders, this poses a burgeoning opportunity for the medical and dental communities. As public awareness of sleep's crucial role in health grows, physicians and dentists can anticipate a rise in patients seeking remedies. The demand for clear standards and best practices in diagnosing and treating sleep disorders has become more evident.

Rising Elderly Population: Younger adults (18-44) face fewer sleep issues (13.8%) than those aged 45-64 (21.8%) and 65+ (20.3%). The U.S. older population, at 55.8 million or 16.8% in 2020, is rapidly growing due to aging baby boomers. As seniors require assistance, there's a rising concern for diabetes incidence, providing senior living facilities a chance to tap into the fastest-growing U.S. market.

U.S. SLEEP DISORDER CLINICS MARKET HIGHLIGHTS

- According to the National Council on Aging (NCOA), approximately 39 million U.S. adults have obstructive sleep apnea (OSA), and 936 million adults around the world are estimated to have mild to severe OSA.

- The U.S. sleep disorder clinics market by ownership is segmented into affiliated and independent clinics. Independent clinics are the fastest-growing segment, with a CAGR of 6.05% during the forecast period. This segment's growth is due to flexibility in providing services and personalized care, resulting in patients' shift from hospitals to independent clinics.

- The sleep testing application segment accounted for the largest U.S. sleep disorder clinics market share. With the need to diagnose sleep apnea in the comfort of their own homes, patients are increasingly using home sleep testing equipment, thus resulting in the growth of the segment.

- The private health insurance segment by payor dominated the U.S. sleep disorder clinics market share with over 50%. U.S. medical care is expensive, so most people appreciate health insurance, and private health insurance coverage continues to be more prevalent, making most Americans use private health insurance to cover their medical expenses.

REGIONAL ANALYSIS

The east region held the most significant share of the U.S. sleep disorder clinics market, accounting for over 33% in 2023. This region consists of states including Connecticut, Delaware, Maine, Maryland, Massachusetts, New York, New Jersey, New Hampshire, Pennsylvania, Rhode Island, and Vermont. New York and Pennsylvania are among the top 10 sleep-deprived states in the U.S. and provide significant opportunities for vendors to explore. In 2020, the age-adjusted prevalence of adults not getting enough sleep was 34.8% in the U.S., meaning 1 in 3 adults got fewer than seven hours in an average 24-hour period.VENDOR LANDSCAPE

The U.S. sleep disorder clinics market report contains exclusive data on 29 vendors. Star Sleep & Wellness Center, SleepWorks, and Comprehensive Sleep Care are some leading players currently dominating the U.S. sleep disorder clinics market. The U.S. sleep disorder clinic market is characterized by rapid technological changes, a surge in the prevalence of sleep disorders, a rise in awareness of sleep disorders, and insurance coverage standards. Most vendors in the market have been focusing on initiatives to enhance their solutions with new technologies and develop new services to broaden their consumer base.SEGMENTATION & FORECAST

By Ownership

- Affiliated Clinics

- Independent Clinics

By Application

- Sleep Testing

- Therapy

- Consultations

- Others

By Payor

- Private Health Insurance

- Public Health Insurance

- Out-Of-Pocket

By Region

- East

- South

- West

- Mid-West

VENDORS LIST

Key Vendors

- Comprehensive Sleep Care Center

- Star Sleep & Wellness

- SleepWorks

Other Prominent Vendors

- Anchorage Sleep Center

- Wellstar

- Butler Health System

- Mayo Clinic

- Koala Center for Sleep & TMJ Disorders

- Advantage Sleep Centers

- Norton Healthcare

- Clayton Sleep Institute

- Englewood Health

- Grand View Health

- Hunterdon Health

- Intermountain Health

- Jupiter Medical Center

- Nationwide Children's Hospital

- Penn Medicine

- The Sleep Center of Nevada

- Cleveland Clinic's

- Somerset Pulmonary and Sleep Medicine Center

- Stanford Health Care

- The Center for Sleep Medicine

- Thomas Jefferson University Hospitals

- UCLA Health

- University of Illinois Hospital & Health Sciences System

- USA Sleep Diagnostic Services

- Valley Health Systems

- Weill Cornell Medicine

KEY QUESTIONS ANSWERED

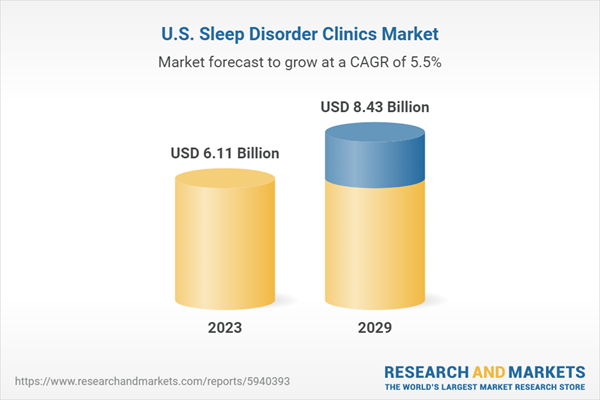

1. How big is the U.S. sleep disorder clinics market?2. What is the projected growth rate of the U.S. sleep disorder clinics market?

3. What are the rising U.S. sleep disorder clinic market trends?

4. Who are the key U.S. sleep disorder clinic market players?

Table of Contents

Companies Mentioned

- Comprehensive Sleep Care Center

- Star Sleep & Wellness

- SleepWorks

- Anchorage Sleep Center

- Wellstar

- Butler Health System

- Mayo Clinic

- Koala Center for Sleep & TMJ Disorders

- Advantage Sleep Centers

- Norton Healthcare

- Clayton Sleep Institute

- Englewood Health

- Grand View Health

- Hunterdon Health

- Intermountain Health

- Jupiter Medical Center

- Nationwide Children's Hospital

- Penn Medicine

- The Sleep Center of Nevada

- Cleveland Clinic's

- Somerset Pulmonary and Sleep Medicine Center

- Stanford Health Care

- The Center for Sleep Medicine

- Thomas Jefferson University Hospitals

- UCLA Health

- University of Illinois Hospital & Health Sciences System

- USA Sleep Diagnostic Services

- Valley Health Systems

- Weill Cornell Medicine

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 86 |

| Published | February 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 6.11 Billion |

| Forecasted Market Value ( USD | $ 8.43 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | United States |

| No. of Companies Mentioned | 29 |