Technological advancements in sterilization methods have spurred market growth by introducing more efficient and effective solutions. These innovations include low-temperature plasma sterilization, advanced chemical sterilants, and ethylene oxide gas methods that are more effective and less harmful to sensitive medical instruments.

Regulatory bodies such as the FDA and the Occupational Safety and Health Administration (OSHA) impose strict guidelines regarding sterilization practices in healthcare settings. For instance, in November 2023, STERIS’ applied sterilization technologies were accepted into the FDA’s radiation sterilization master file pilot program, marking a significant advancement in their sterilization processes.

U.S. Sterilization Services Market Report Highlights

- Based on service type, the contract sterilization services segment dominated the market with the largest revenue share of 70.6% in 2024. As healthcare providers and manufacturers seek to ensure the safety and efficacy of medical devices and pharmaceuticals without the burden of maintaining in-house sterilization capabilities, thus contract sterilization services have become an attractive option.

- Based on delivery mode, the offsite segment dominated the market in 2024, accounting for 67.69% of revenue in 2024, driven by factors such as the increasing demand for cost-effective sterilization solutions, the rising adoption of contract sterilization services, and advancements in sterilization technologies.

- Onsite sterilization services are projected to grow significantly at a CAGR of 8.9% over the forecast period. On-site sterilization enables facilities to rapidly process equipment, minimizing downtime and ensuring instruments are readily available for procedures.

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This Report Addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- STERIS

- ASP (Fortive)

- Andersen Sterilizers

- Prince Sterilization Services, LLC

- Midwest Sterilization Corporation

- E-BEAM Services, Inc

- Sterigenics U.S., LLC - A Sotera Health company

- VPT Rad, Inc.

- Infinity Laboratorie

Table Information

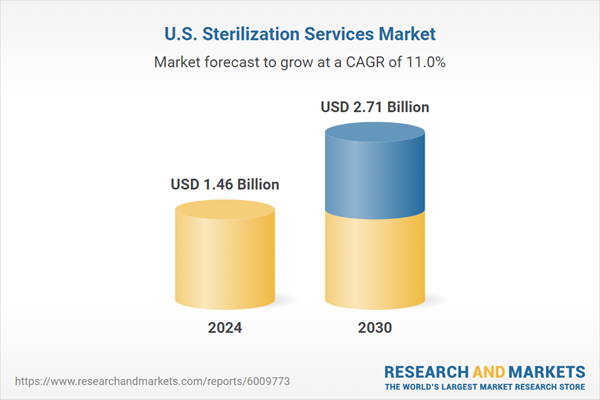

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | March 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.46 Billion |

| Forecasted Market Value ( USD | $ 2.71 Billion |

| Compound Annual Growth Rate | 11.0% |

| Regions Covered | United States |

| No. of Companies Mentioned | 9 |