The expansion of structural heart imaging in the U.S. is primarily driven by the growing prevalence of heart diseases and an increasing emphasis on preventive health checkups. Structural heart diseases, such as aortic stenosis, mitral regurgitation, and congenital heart defects, are becoming more common, particularly among the aging population, which is more vulnerable to these conditions. Early detection and accurate diagnosis are essential for managing these diseases effectively, fueling the demand for advanced imaging technologies. Simultaneously, patients are increasingly aware of the importance of preventive healthcare. People are increasingly opting for regular health screenings to detect potential cardiovascular issues before they become severe, which has led to a greater reliance on structural heart imaging solutions.

The presence of major manufacturers, such as Siemens Healthineers, GE Healthcare, and Koninklijke Philips N.V., is significantly driving market growth in the U.S. These industry leaders are consistently innovating and introducing advanced imaging products to meet the growing demand for accurate and efficient diagnostic solutions. For instance, in August 2024, Siemens Healthineers received FDA clearance for the ACUSON Origin, an advanced cardiovascular ultrasound system integrated with artificial intelligence (AI) capabilities. This advanced system is designed to enhance diagnostic accuracy and streamline workflows, demonstrating the industry's focus on leveraging AI to improve imaging outcomes. The continuous efforts of these key players to develop and commercialize new technologies not only cater to the rising prevalence of structural heart diseases but also strengthen the market's growth by offering healthcare providers state-of-the-art tools for patient care.

U.S. Structural Heart Imaging Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 - 2030. For the purpose of this study, the analyst has segmented the U.S. structural heart imaging market report on the basis of modality, procedure, application, and end-use:Modality Outlook (Revenue, USD Million, 2018 - 2030)

- Echocardiogram

- Angiogram

- CT

- MRI

- Nuclear Imaging

- Other Modalities

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

- Transcatheter Aortic Valve Replacement (TAVR)

- Surgical Aortic Valve Replacement (SAVR)

- Transcatheter Mitral Valve Repair (TMVR)

- Left Atrial Appendage Closure (LAAC)

- Tricuspid Valve Replacement and Repair

- Paravalvular Leak Detection and Repair

- Annuloplasty

- Valvuloplasty

- Other Structural Heart Procedures

Application Outlook (Revenue, USD Million, 2018 - 2030)

- Diagnostic Imaging

- Interventional Cardiology

End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Diagnostic Imaging Centers

- Other End Use

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Siemens Healthineers

- GE Healthcare

- Koninklijke Philips N.V.

- Canon Medical Systems

- Fujifilm Holdings Corporation

- Shanghai United Imaging Healthcare Co., LTD

- Abbott

- Terumo Corporation

- Samsung Medison Co., Ltd.

- Lepu Medical Technology

Table Information

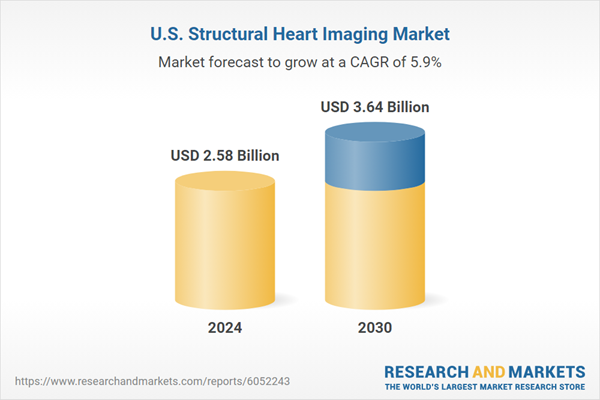

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | January 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.58 Billion |

| Forecasted Market Value ( USD | $ 3.64 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |