Speak directly to the analyst to clarify any post sales queries you may have.

IMPACT OF TARIFF

A trade war is an economic conflict where countries place tariffs or other trade barriers on each other, usually in response to similar actions. A global trade war began when the U.S. started adding tariffs on more countries. On April 2, 2025, U.S. President Donald Trump announced new tariffs, called reciprocal tariffs, on imports from around 90 countries.The local manufacturing of tractors is also impacted by the implementation of tariffs on raw materials imported into the U.S. market from other countries. High tariffs imported raw materials such as iron, steel, rubber, aluminum, and glass. The U.S. government presently has 50% tariff rates on steel and aluminum imports from other countries.

US TRACTOR MARKET TRENDS & DRIVERS

Electric and Alternative Fuel Tractors

The need for cleaner alternatives to diesel-powered tractors has led to the development of tractors that run on CNG, hybrid fuels, and electricity. These alternative fuel tractors offer a more environmentally friendly option, lower operating costs, and improved productivity. The rising demand for sustainable farming is boosting interest in electric and alternative fuel tractors in the U.S. tractor market. Several tractor manufacturers are planning to launch new electric models to meet this growing need.New Holland is developing an electric T4 tractor with autonomous features for the U.S. market. John Deere is also working on an electric tractor prototype. Currently, the Case IH Farmall 75C electric tractor is available in the U.S. It was first showcased at the Farm Progress Show in Decatur, Illinois.

Autonomous & Semi-Autonomous Tractors

There is a rising demand for rapid innovation and the use of AI and robotics in agricultural equipment, driven by farmers' increasing focus on improving crop yields. Technology is expected to transform farming in the coming years. Automated systems can handle time-consuming and labor-intensive tasks more efficiently, boosting productivity. GPS receivers in autonomous agricultural equipment accurately determine positions up to two centimeters. This kind of accuracy is difficult to achieve with manual driving.John Deere is one of the leading tractor manufacturers in the U.S. tractor market. The company launched the 8R and 9R series autonomous tractors in the US market in 2024. These tractors are equipped with features like GPS guidance, machine learning & farm data analytics that improve farming efficiency.

Government Policy and Credit Support System

In the U.S., both federal and state governments offer various financial support programs to help farmers boost productivity, adopt modern technologies, and promote sustainable practices. These programs include direct subsidies, low-interest loans, grants, and crop insurance, all aimed at supporting farm income and encouraging investment in advanced equipment like tractors.In 2008, initiatives such as the Environmental Quality Incentives Program (EQIP) and the Conservation Stewardship Program (CSP) encouraged farmers to adopt sustainable farming practices and invest in modern equipment to increase efficiency and reduce environmental impact. Also, the U.S. government policies ensure that farmers have access to affordable credit and financial aid to invest in modern, efficient farming equipment.

Increased Farm Mechanization

Mechanization in the U.S. varies by region, based on farm income. The Southwest is the richest and most advanced farming area in the country. In this region, mechanization has moved from power-heavy tasks like land preparation, water pumping, and threshing to more precise tasks like harvesting, seeding, and weeding.Tractor makers are adding more technology, like data analytics, GPS, telematics, remote sensing, and mobile tools to make farming smarter and more accurate. These features help with mapping fields, auto-steering, and controlling tractor movement to reduce waste of fuel, fertilizer, and seeds. Moreover, the shortage of farm labor is a growing issue in key agricultural regions of the U.S., especially near major cities where many workers leave farming for higher-paying jobs. To cope with this challenge, farmers are increasingly turning to machinery like tractors to make up for labor gaps and maintain productivity. As a result, mechanization has become crucial for keeping farm operations efficient despite limited labor availability and has supported the U.S. tractor market growth.

INDUSTRY RESTRAINTS

Fluctuations in Agricultural Commodity Prices

In the U.S., agricultural commodity prices are strongly affected by weather and climate. Events such as droughts, floods, and hurricanes can greatly reduce crop yields, leading to lower supply and higher prices. In January 2025, the price of corn in the U.S. was around $214 per metric ton, down from the previous year. This drop is mainly due to higher domestic production and lower export demand, affected by global markets and trade policies. The lower prices have reduced farmers' profit margins, raising concerns about the long-term sustainability of corn farming. Moreover, fluctuating prices have wide-ranging impacts. Farmers face income uncertainty, which may influence their planting decisions and investment in future crops. Consumers can experience rising or falling food prices depending on commodity costs.Climate Variability on Agriculture

The agriculture industry depends heavily on weather for farming. Weather plays a big role in crop yields, and farmers rely on it for key activities like seeding, planting, and sowing. In the U.S., farming is facing more problems because of climate change, like droughts, floods, and higher temperatures. Crops such as corn, wheat, and soybeans are at risk due to less rain and extreme weather. Moreover, the economic impact could be serious. If global temperatures rise by 2°C, U.S. crop yields may drop, putting food security and farm profits at risk. This could lower farmers’ income and reduce their ability to buy tractors and other farm equipment.SEGMENTATION INSIGHTS

INSIGHTS BY HORSEPOWER

The segment of tractors below 50 HP has traditionally held the largest share of the U.S. tractor market. This is because most farmers operate on small landholdings, often less than 5 hectares. Farmers in regions like the Midwest prefer compact, affordable, and easy-to-maintain machines, which are ideal for tasks such as corn, soybeans, or wheat, transporting goods, and light tillage. Furthermore, the 50-100 HP tractor category has having CAGR of over 1.8% in the US tractor market. Medium-sized farms and progressive farmers looking to enhance operational efficiency are driving this trend. These tractors offer more power for varied tasks, including rotary tilling, sugarcane farming, orchard management, and even light construction work, without being too costly or complicated.INSIGHTS BY DRIVE TYPE

In 2024, the 2WD segment holds the largest share of the U.S. tractor market. In the U.S., the primary crops are corn, soybeans, and wheat. The relatively flat terrain favors the use of 2WD tractors. Farmers cultivating paddy fields, fruits, and engaging in dryland farming often prefer 2WD models because they are cost-effective and meet the operational demands without requiring heavy-duty capabilities. Another reason for the 2WD dominance in certain areas is the average farm size. In such settings, the flexibility and lower operating costs of 2WD tractors provide a clear advantage. Additionally, brands like Kubota and New Holland have traditionally offered a broad range of economical 2WD models, reinforcing their market popularity.GEOGRAPHICAL ANALYSIS

In regions such as the West, Southwest, Midwest, including Northeast and Southeast in the U.S., which are heavily reliant on agriculture (e.g., Corn, soybeans, wheat, cotton, fruits, dairy, etc.), large landholdings drive the demand for tractors. These regions use tractors to improve productivity and reduce labor costs, making mechanization a key to enhancing farm efficiency. In 2024, the western region accounted for a significant the U.S. tractor market share. The Western U.S. is an important farming region, especially known for growing fruits and specialty crops like almonds, grapes, and wine. These crops rely heavily on irrigation because of the area's low rainfall. While wheat and rice are also grown, their production is smaller compared to other regions due to limited water resources.The Southwest tractor market is expected to witness a CAGR of over 2% between 2025-2030. The region supports the growth of several important crops. Cotton is one of the leading crops, especially in Texas, Arizona, and New Mexico. The region is also famous for its chili peppers, particularly the Hatch green chiles from New Mexico. Furthermore, the Midwest region market accounted for a 27% share of the US tractor market in 2024. The Midwest U.S. is an important farming area, known for growing main crops like corn and soybeans. These crops grow well because of the region’s good soil and enough rainfall. Wheat is also grown, especially in Kansas.

Northeast U.S. is a key agricultural hub, famous for its prominent dairy industry, especially in states such as New York and Vermont, which are recognized for their premium milk and cheese production and drive significant market growth. Furthermore, the Southeast tractor market accounted for 19 thousand units in 2024. In Southeast U.S. states include Alabama, Florida, Georgia, Kentucky, Mississippi, North Carolina, South Carolina, and Tennessee. The Southeast U.S. is a significant agricultural region, known for producing a variety of crops due to its warm climate and fertile soil. Main crops grown in the Southeast include cotton, peanuts, tobacco, and soybeans.

U.S. TRACTOR MARKET VENDOR LANDSCAPE

The U.S. tractor market is competitive and dominated by both global and strong domestic manufacturers. Companies like John Deere, CNH Industrial, AGCO & Kubota hold a significant share of the U.S. tractor market. The industry features a mix of well-established global brands and regional players. As international companies continue to strengthen their presence, smaller regional manufacturers may face challenges competing with these larger, well-resourced companies. In early 2024, AGCO strengthened its U.S. presence by launching Fendt electric tractors and expanding its Fuse Smart Farming platform, which uses precision technology to boost farm efficiency.In 2023, Kubota released the L4802DTN narrow tractor in the U.S. tractor market. This 48-horsepower model is built for specialty farming like vineyards and orchards. With a width of just 39.4 inches, it easily moves through tight rows, making it ideal for tasks like spraying, mowing, and towing. It shows Kubota’s focus on compact, purpose-built machines for specific farming needs.

In February 2025, John Deere partnered with Drive TLV, giving it access to a wide network of startups. This helps the company improve in areas like autonomy, sensors, electrification, and connectivity, allowing it to offer more efficient and high-tech solutions to farmers. Furthermore, Deere & Company and CNH Industrial lead the U.S. tractor market, together holding over 45% of the market share. Both companies focus on innovation and are heavily investing in advanced technologies for precision farming and automation.

TRACTOR MARKET IN THE US NEWS

- In February 2025, KUBOTA Corporation introduced the FARMTRAC PROMAXX Tractor Series, with innovative features such as the Smart Pro Lift Switch, best-in-class hydraulics paired with helical gears & advanced lubrication technology, premium floor mat, ergonomic seating, and more. Through this, the company gains a competitive advantage and drives business growth.

- In 2024, AGCO purchased an 85% stake in Trimble Inc. for USD 2 billion, creating a joint venture focused on autonomous technologies and other advanced technologies for farm equipment.

- The U.S. government announced a National Strategy for reducing food loss and waste and recycling organics in 2024. The government strategy aims to reduce food loss and waste by 50% by 2030.

- In 2024, AGCO introduced the new S7 Series combines and updated 9RX tractors, designed to enhance customer value and address key agricultural challenges, such as time constraints caused by variable weather, labor shortages, and rising costs. The S7 Series combines advanced automation packages, and the 9RX tractors come with new engine options, to increase their sales and attract more consumers in the market.

- CNH Industrial has launched a satellite internet merger across North American markets, starting with pilot regions in the U.S. in 2024. This partnership allows farmers in rural locations to use connected, smart farming equipment in real time, boosting efficiency and advancing precision agriculture.

Key Company Profiles

- AGCO Corporation

- CNH Industrial N.V.

- Deere & Company

- KUBOTA Corporation

Other Prominent Company Profiles

- YANMAR HOLDINGS CO., LTD

- JCB

- Antonio Carraro

- Action Construction Equipment Ltd.

- CLAAS KGaA

- Deutz-Fahr

- ISEKI & CO.,LTD

- KIOTI

- Daedong-USA, Inc

- TAFE

- Jiangsu Yueda Intelligent Agricultural Equipment Co., Ltd.

- SOLIS

- LOVOL

- Sonalika

SEGMENTATION & FORECAST

Segmentation by Horsepower

- Less Than 50 HP

- 50-100 HP

- Above 100 HP

Segmentation by Drive Type

- 2-Wheel-Drive

- 4-Wheel-Drive

Segmentation by Geography

- The U.S.

- Northeast

- Midwest

- Southwest

- West

- Southeast

KEY QUESTIONS ANSWERED

1. What are the significant trends in the U.S. tractor market?2. Who are the key players in the U.S. tractor market?

3. What is the growth rate of the U.S. tractor market?

4. Which region dominates the U.S. tractor market share?

5. How big is the U.S. tractor market?

Table of Contents

Companies Mentioned

- AGCO Corporation

- CNH Industrial N.V.

- Deere & Company

- KUBOTA Corporation

- YANMAR HOLDINGS CO., LTD

- JCB

- Antonio Carraro

- Action Construction Equipment Ltd.

- CLAAS KGaA

- Deutz-Fahr

- ISEKI & CO.,LTD

- KIOTI

- Daedong-USA, Inc

- TAFE

- Jiangsu Yueda Intelligent Agricultural Equipment Co., Ltd.

- SOLIS

- LOVOL

- Sonalika

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 98 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

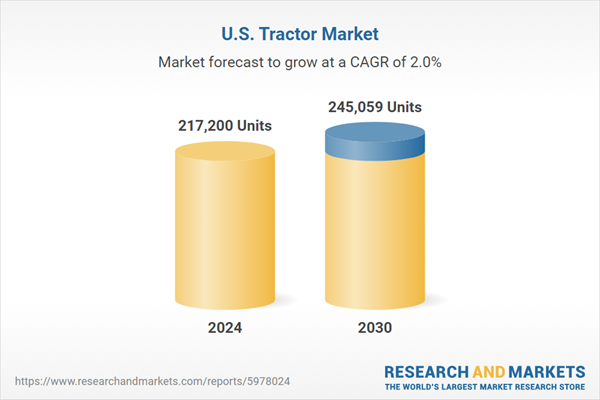

| Estimated Market Value in 2024 | 217200 Units |

| Forecasted Market Value by 2030 | 245059 Units |

| Compound Annual Growth Rate | 2.0% |

| Regions Covered | United States |

| No. of Companies Mentioned | 18 |