Global Up-Regulated Protein Market - Key Trends and Drivers Summarized

Why Is Research on Up-Regulated Proteins Gaining Momentum?

The study of up-regulated proteins is gaining significant momentum in scientific and medical research due to their critical role in various cellular processes, disease progression, and therapeutic applications. Up-regulated proteins refer to those whose expression levels increase in response to specific stimuli, such as stress, infection, or cellular signaling pathways. This up-regulation often signals a reaction to internal or external changes in the body, making these proteins vital markers in understanding disease mechanisms, particularly in cancer, neurodegenerative disorders, and autoimmune diseases. For example, in cancer, certain proteins become up-regulated to support tumor growth, cell proliferation, and metastasis. These proteins can be linked to drug resistance, making them crucial targets for the development of new therapies. Similarly, in the context of inflammation and infection, proteins such as cytokines and chemokines are often up-regulated, mediating the body's immune response. As researchers continue to unravel the complexities of cellular biology, the study of up-regulated proteins is offering valuable insights into how diseases develop and progress, thus shaping new approaches to diagnosis, prognosis, and treatment.How Do Up-Regulated Proteins Influence Disease Progression?

Up-regulated proteins play a central role in disease progression by influencing various cellular pathways that either promote or inhibit disease processes. In cancer, for instance, the up-regulation of specific oncogenes and growth factors can lead to uncontrolled cell division, allowing tumors to grow rapidly and evade normal cellular checkpoints. Proteins like vascular endothelial growth factor (VEGF) may be up-regulated to promote angiogenesis, the process by which tumors develop new blood vessels to support their growth and metastasis. This makes VEGF and similar proteins prime targets for anti-cancer drugs designed to inhibit tumor vascularization. Beyond cancer, up-regulated proteins are also key players in neurodegenerative diseases like Alzheimer's, where proteins such as tau and amyloid-beta become overexpressed and contribute to the formation of plaques and tangles, leading to neuronal death. In autoimmune diseases, proteins that regulate the immune system, such as interleukins, can become up-regulated, triggering an overactive immune response that attacks the body's own tissues. The ability to identify which proteins are up-regulated in a particular disease state offers crucial insight into how the disease develops, progresses, and ultimately, how it can be treated or managed. Understanding these proteins not only aids in disease diagnosis but also in creating targeted therapies that can modulate their expression to achieve better clinical outcomes.What Technological Advancements Are Accelerating the Study of Up-Regulated Proteins?

Technological advancements in genomics, proteomics, and bioinformatics are dramatically accelerating the study of up-regulated proteins, making it easier for scientists to identify, quantify, and analyze these proteins in both normal and disease states. Proteomic technologies, such as mass spectrometry, have advanced significantly, allowing for the detailed analysis of protein expression levels, modifications, and interactions on a large scale. This has been particularly useful in identifying which proteins are up-regulated in response to specific disease conditions or environmental factors. Genomic technologies, like RNA sequencing, enable researchers to measure gene expression patterns that lead to the production of up-regulated proteins, thus linking genetic changes to protein-level outcomes. Additionally, CRISPR and other gene-editing tools have made it possible to experimentally manipulate protein expression levels, providing insights into the functional roles of specific up-regulated proteins in disease models. The integration of bioinformatics and machine learning has also played a critical role in the analysis of large datasets generated from proteomic and genomic studies. These computational tools allow researchers to identify patterns of protein up-regulation across different diseases, helping to discover new biomarkers for diagnosis or potential therapeutic targets. Moreover, advancements in imaging technologies, such as fluorescent tagging and real-time molecular imaging, enable the visualization of up-regulated proteins within live cells or tissues, offering dynamic insights into their behavior and interactions. These technological developments have transformed the way scientists study up-regulated proteins, enabling more precise and comprehensive analysis, which is critical for advancing personalized medicine and targeted therapies.What Factors Are Driving the Growth of Research on Up-Regulated Proteins?

The growth in research on up-regulated proteins is driven by several key factors, most notably the increasing recognition of their role in disease mechanisms and the demand for more targeted therapeutic approaches. One of the primary drivers is the rising prevalence of chronic diseases such as cancer, neurodegenerative disorders, and autoimmune conditions, where up-regulated proteins play a critical role in disease onset and progression. As researchers seek to develop more effective treatments, up-regulated proteins have become prime targets for drug development, particularly in creating therapies that can either inhibit or modulate their expression. Personalized medicine is another significant factor, as the ability to tailor treatments based on an individual's specific protein expression patterns is becoming a key objective in modern healthcare. Advances in biomarker discovery are also contributing to the increased focus on up-regulated proteins, as these proteins serve as valuable indicators for diagnosing diseases earlier and monitoring treatment efficacy. Moreover, the growing use of omics technologies, including genomics, proteomics, and metabolomics, has generated a wealth of data on protein expression, further fueling research into how these proteins can be leveraged for therapeutic purposes. The pharmaceutical industry's push to develop more precise and less toxic treatments has led to a surge in research on targeted therapies, where up-regulated proteins are often the focal point. Finally, government funding and investment in biomedical research, alongside the rapid pace of technological innovation, have provided the resources necessary to explore the vast potential of up-regulated proteins in transforming the way we understand and treat disease. These combined factors are not only expanding our knowledge of cellular biology but also paving the way for breakthroughs in the diagnosis and treatment of complex diseases.Report Scope

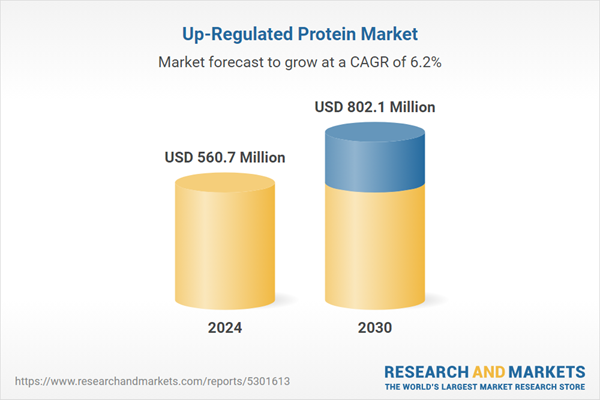

The report analyzes the Up-Regulated Protein market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Diagnostic Labs, Outpatient Clinics, Hospitals, Research Centers).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Diagnostic Labs End-Use segment, which is expected to reach US$300.9 Million by 2030 with a CAGR of a 7%. The Outpatient Clinics End-Use segment is also set to grow at 6.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $143.9 Million in 2024, and China, forecasted to grow at an impressive 9.8% CAGR to reach $196.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Up-Regulated Protein Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Up-Regulated Protein Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Up-Regulated Protein Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alpavit, Arla Foods, Carbery Group, Davisco Foods International, Inc., Fonterra Co-operative Group Ltd and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Up-Regulated Protein market report include:

- Alpavit

- Arla Foods

- Carbery Group

- Davisco Foods International, Inc.

- Fonterra Co-operative Group Ltd

- Glanbia plc

- Hilmar Cheese Company, Inc.

- LACTALIS Ingredients

- Leprino Foods Company

- Maple Island Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alpavit

- Arla Foods

- Carbery Group

- Davisco Foods International, Inc.

- Fonterra Co-operative Group Ltd

- Glanbia plc

- Hilmar Cheese Company, Inc.

- LACTALIS Ingredients

- Leprino Foods Company

- Maple Island Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 177 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 560.7 Million |

| Forecasted Market Value ( USD | $ 802.1 Million |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |