Speak directly to the analyst to clarify any post sales queries you may have.

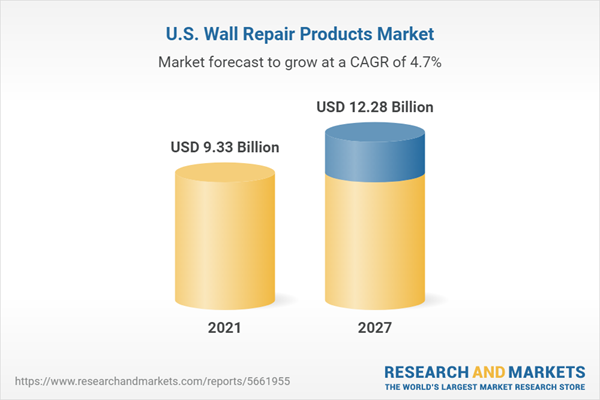

The U.S. wall repair products market is expected to reach USD 12.28 billion by 2027 from USD 9.33 billion in 2022, growing at a CAGR of 4.69% during the forecast period.

Rapid industrialization and increasing applications in the household and commercial sectors are primarily driving the wall repair products market. These repair products are mainly used in the residential sector since the construction of housing units in the U.S. is drywall. Drywall is rigid, however, not indestructible. Over time, gypsum-board walls can withstand ugly cracks or holes. Fortunately, drywalls can be easily fixable. Therefore, the construction of drywall housing is expected to surge the demand for wall repair products in the U.S.

Key Winning Imperatives in the U.S. Wall Repair Products Market:

- The DIY culture is one of the significant drivers for wall repair products. Vendors are also committed to more innovations and product development in the market.

- Mergers and acquisitions can be a common market strategy in the industry.

- The growing urban population coupled with the rising demand for aesthetically improved materials in the building architecture is likely to support the growth of drywall in the region.

MARKET TRENDS

Growing DIY Activities for Repair & Restoration

- The demand for DIY wall repair for home modifications projects is growing, such as patching big or small wall holes, repairing damp walls, and many more in the U.S. due to better living standards of the middle-class population seeking improved home spaces boosting the wall repair products in the U.S.

Consumers in the residential sector often take up repair and enhancing activities that improve their skills and prove cost-efficient. Furthermore, hyper stores, supermarkets, and other specialty stores such as Home Depot offer more DIY projects and drive the DIY wall repair products market, eventually increasing the industry for wall repair products.

Growing Home Renovation Industry in the U.S.

- The home renovation industry is growing in the U.S., resulting in rising sales of building materials, appliances, and other home improvement elements. In addition, rental housing is witnessing a rising trend in the U.S., creating opportunities for home remodeling and renovation. Walls are the backbone of a building; any damage to walls can cause further structural damage. The demand to renovate them is high, which increases the need for wall repair products. As the industry for existing residential spaces has matured, new constructions in the housing sector are still struggling in the U.S., which has increased the demand for the maintenance and improvement of existing properties and further increased the U.S. wall repair products market share.

MARKET CHALLENGES

Labor & Material Shortages

- On the outbreak of the COVID-19 pandemic, a shift in demand for goods from services kept Americans at home and stressed the supply chains. The virus also disrupted manufacturers' and suppliers' labor, leading to raw material shortages across industries. Presently, construction projects in the U.S. are short-staffed, and this is becoming challenging day by day. The labor mismatch in the U.S. construction industry is likely to endure owing to the structural shifts in the labor industry. The association between job openings and unemployment has disappeared from historical trends. Increasing labor and material shortages; lack of skilled labor is expected to hamper the target industry since repairing a wall require skilled labor.

SEGMENT ANALYSIS

- The drywalls type segment held the largest U.S. Wall Repair Products market share of 83.02% in 2021 and is expected to grow at a CAGR of 4.53% during the forecast period. One of the most common drywall is the gypsum panel. In North America, the tradition of drywall was started in the mid-20s to save labor costs and time for the plaster and lath. A drywall is installed at the interior sides of walls and ceilings.

- The wet products segment is expected to be the largest in theU.S.S Wall Repair Products market. Further wet products are categorized into spackle, joint compound, caulk, and others, and dry products include patches, tapes, and others. The spackle segment expects to grow at a CAGR of 3.89% during the forecast period. Spackle is ideal for minor drywall repairs and usually comes in small containers. Spackle is a little more expensive than joint compound.

- Residential end-user is the largest segment amongst others in theU.S.S Wall Repair Products market. The residential segment is expected to witness a significant increase in the wall repair products segment owing to the rise in the construction of new homes and buildings. A significant trend that has led to the substantial demand for wall repair products is the growth in DIY activities.

Segmentation by Wall Type

- Drywall

- Brick

- Wood

- Others

Segmentation by Product Type

- Wet Products

- Spackle

- Joint Compound

- Caulk

- Others

- Dry Products

- Patch

- Tapes

- Others

Segmentation by End-Users

- Residential

- Commercial & Industrial

GEOGRAPHICAL ANALYSIS

- The rising economic development, growth in residential, commercial & industrial sectors, and demand for innovative wall repair products have contributed to the growth of the U.S. wall repair products market.

- The Southern US region was the largest industry for wall repair products in 2021. The region is expected to maintain its position during the forecast period. The Southern US holds a significant share in theU.S.. wall repair products market due to the presence of the most extensive population base, which has resulted in a higher number of housing units and growth in the real estate, tourism, and hospitality sectors.

- The number of construction activities in both residential and commercial sectors has increased significantly across several growing cities in the United States, of which more than 40% were single-family apartments. Many single-family dwellings indicate the construction of a more significant number of homes with more requirements for repair products from both the industrial and residential sectors.

- Texas is the country's second-largest state in population and area. The total population is estimated at 29 million household units, which is expected to support the demand for wall repair products in theU.SS.

- The Western region accounts for a significant share of the U.S. wall repair products market due to growing disposable income, excellent growth potential in multiple end-user industries, and an increasing number of DIY projects. The Western region consists of developed and fast-growing states such as Colorado, Wyoming, Montana, and more which are primary hubs for several end-user industries.

Segmentation by Regions

- Southern US

- Western US

- Midwest US

- Northeastern US

COMPETITIVE LANDSCAPE

The U.S. wall repair products market is characterized by a high level of competition due to several multinational companies. The present scenario drives vendors to alter and refine their unique value propositions to achieve a strong industry presence. The major vendors also continually compete for the leading position in the industry, with occasional competition coming from other local vendors. The industry is characterized by the presence of diversified global and regional vendors. As international players increase their footprint in the industry, regional vendors will likely find it increasingly difficult to compete with these global players. The competition will be based solely on durability, technology, services, price, and customization. 3M, Red Devil, PPG Industries, and Saint Gobain are the leading player in the market.

Key Vendors

- 3M

- DAP

- Red Devil

- PPG Industries

- Saint Gobain

Other Prominent Vendors

- Henkel

- Erase-A-Hole

- Magicezy

- ClarkDietrich

- Knauf

- Scapa

- ProForm Finishing Products

- Sika

- Abatron

- Hyde Tools

- Rust-Oleum

- USG

- Allway Tools

- MARSHALLTOWN

- ToolPro

- Capital Industries

- Clearlake Capital Group

- Champion Tape

- Kraft Tool

- Freeman Products

KEY QUESTIONS ANSWERED

1. How big is the U.S. wall repair products market?

2. What is the growth rate of the U.S. wall repair products market?

3. Who are the key players in the U.S. wall repair products market?

4. What are the industry trends impacting the U.S. wall repair products market?

4. Which region in the U.S. contributes the largest wall repair products market share?

Table of Contents

Companies Mentioned

- 3M

- DAP

- Red Devil

- PPG Industries

- Saint Gobain

- Henkel

- Erase-A-Hole

- Magicezy

- ClarkDietrich

- Knauf

- Scapa

- ProForm Finishing Products

- Sika

- Abatron

- Hyde Tools

- Rust-Oleum

- USG

- Allway Tools

- MARSHALLTOWN

- ToolPro

- Capital Industries

- Clearlake Capital Group

- Champion Tape

- Kraft Tool

- Freeman Products

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 217 |

| Published | October 2022 |

| Forecast Period | 2021 - 2027 |

| Estimated Market Value ( USD | $ 9.33 Billion |

| Forecasted Market Value ( USD | $ 12.28 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | United States |

| No. of Companies Mentioned | 25 |