Global Home Water Filtration Unit Market - Key Trends & Drivers Summarized

Is Safe Drinking Water Becoming a Personal Responsibility at Home?

The global home water filtration unit market is witnessing rapid evolution as consumers become increasingly proactive in safeguarding their access to clean and safe drinking water. Heightened concerns about municipal water quality, contamination risks, and aging infrastructure have driven a fundamental shift in consumer behavior - prompting more households to adopt in-home water purification systems as a first line of defense. Incidents of lead, microplastic, pesticide, and chemical contamination in tap water supplies across cities worldwide have eroded public trust in centralized treatment systems. As a result, water filtration is no longer viewed as a luxury or niche wellness product but as a basic necessity - especially in regions facing inconsistent supply quality or infrastructure gaps.This shift in perception is being reinforced by growing health awareness and the link between water quality and long-term wellness outcomes. Consumers are paying closer attention to the content of what they drink, not just to avoid pathogens but to reduce exposure to heavy metals, chlorine byproducts, and emerging contaminants like PFAS (forever chemicals). In many households, installing a filtration unit is part of a broader lifestyle choice that includes organic food, eco-friendly living, and preventive health measures. Additionally, the rising popularity of home-cooked meals, infant-safe water preparation, and even filtered water for pets is expanding usage scenarios. In this new context, home water filtration units are not just appliances - they are peace-of-mind purchases that empower consumers to reclaim control over an essential resource.

Can Technology and Design Bridge the Gap Between Health, Convenience, and Style?

Modern home water filtration units are rapidly evolving to meet the dual expectations of high-performance filtration and user-centric design. Manufacturers are investing in smarter, more compact, and aesthetically refined products that integrate effortlessly into kitchens, bathrooms, and other home settings. Innovations in filtration media - such as activated carbon, ion exchange, hollow fiber membranes, and advanced reverse osmosis (RO) membranes - are enhancing removal efficiency across a wider range of contaminants while preserving essential minerals. At the same time, smart sensors and digital displays are being embedded into units to provide real-time monitoring of water quality, filter life, and usage metrics.The rise of connected appliances has enabled mobile app control, automatic reordering of filters, and remote diagnostics - all aimed at simplifying maintenance and increasing user confidence. Tankless RO systems, multi-stage filtration units, and countertop purifiers with plug-and-play installation are gaining popularity, especially among urban renters and homeowners with modern kitchen layouts. Portable and under-the-sink systems are also becoming sleeker, quieter, and more space-efficient, ensuring compatibility with diverse living environments. Additionally, the emphasis on sustainable design is growing, with brands offering reusable filter cartridges, recyclable components, and BPA-free materials. By combining health benefits with smart functionality and clean aesthetics, new-age filtration units are capturing the attention of design-savvy, health-conscious consumers.

Are Shifting Consumer Lifestyles and Environmental Awareness Reshaping Market Priorities?

Changing lifestyles and heightened environmental consciousness are playing a central role in redefining how and why people invest in home water filtration units. With increasing time spent at home - whether due to remote work, family caregiving, or personal wellness pursuits - households are becoming more intentional about improving their daily living environment. Water consumption has become a focal point within this wellness transformation, as consumers shift away from single-use bottled water and adopt in-home purification systems as both a sustainable and cost-effective alternative. The reduced dependency on plastic bottles also aligns with global efforts to cut down on environmental waste, a priority especially important to Gen Z and millennial consumers.These shifts are accompanied by growing interest in personalized water experiences, such as pH-balanced, mineralized, or flavored filtered water - creating demand for advanced units with custom settings or add-ons. Families with children, seniors, or individuals with compromised immunity are particularly attentive to the safety and purity of drinking water, further broadening the market. Likewise, the rise of DIY home improvement culture has encouraged many consumers to seek easy-to-install filtration units, accelerating online sales and driving innovation in modular, tool-free systems. As environmental responsibility merges with lifestyle optimization, home water filtration units are being embraced not just for what they remove from water - but for the holistic, future-facing values they represent in the modern household.

What’ s Fueling the Growth of the Global Home Water Filtration Unit Market?

The growth in the home water filtration unit market is driven by a combination of health-driven consumer behavior, product innovation, and shifting environmental priorities. One of the most important growth drivers is the increasing awareness of water contamination risks - whether due to outdated plumbing infrastructure, agricultural runoff, or industrial pollutants - prompting consumers to seek at-home control over their water quality. Rising chronic health concerns, particularly among aging populations and families with young children, are also propelling demand for filtration systems that support immunity and minimize chemical exposure. Technological innovations are a key enabler, with the development of compact, multi-stage, and digitally integrated units making high-performance filtration more accessible and easier to maintain.Consumer preference for sustainable living is another powerful catalyst, as filtration units offer an attractive alternative to bottled water, reducing plastic waste and long-term costs. Convenience-focused design - ranging from DIY installation and mobile monitoring to auto-refill subscription filters - is lowering adoption barriers across income and age groups. Expanding urbanization, particularly in developing economies, is fueling demand in both premium and entry-level segments, while e-commerce and D2C channels are improving market reach. Regulatory scrutiny of water quality standards, combined with government awareness programs in regions like the U.S., India, and the EU, is further driving household adoption. Finally, increased product availability through retail partnerships, appliance bundling, and influencer-driven marketing is making home filtration more mainstream than ever before - solidifying it as a high-growth category in the global consumer health ecosystem.

Report Scope

The report analyzes the Home Water Filtration Unit market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Reverse Osmosis-based Home Water Filtration Unit, Ultraviolet-based Home Water Filtration Unit, Gravity-based Home Water Filtration Unit, Other Home Water Filtration Units).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Reverse Osmosis-based Unit segment, which is expected to reach US$10.0 Billion by 2030 with a CAGR of a 7.5%. The Ultraviolet-based Unit segment is also set to grow at 11.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.9 Billion in 2024, and China, forecasted to grow at an impressive 12.7% CAGR to reach $4.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Home Water Filtration Unit Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Home Water Filtration Unit Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Home Water Filtration Unit Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

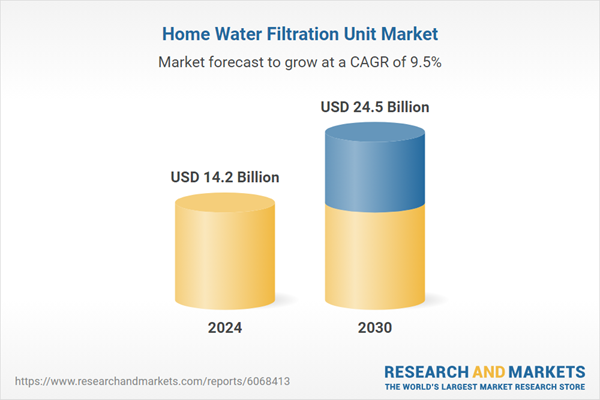

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as American Textile Company, Boll & Branch, Création Baumann, Etro Home Collection, F. Schumacher & Co. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Home Water Filtration Unit market report include:

- 3M Company

- A.O. Smith Corporation

- Amway Corporation

- Aquasana, Inc.

- Brita GmbH

- Coway Co., Ltd.

- Culligan International Company

- EcoWater Systems LLC

- Eureka Forbes Ltd.

- General Electric Company

- Kent RO Systems Ltd.

- Kinetico Incorporated

- LG Electronics Inc.

- LifeSource Water Systems, Inc.

- Panasonic Corporation

- Pentair plc

- Samsung Electronics Co., Ltd.

- Tata Chemicals Limited

- Unilever PLC

- Whirlpool Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- A.O. Smith Corporation

- Amway Corporation

- Aquasana, Inc.

- Brita GmbH

- Coway Co., Ltd.

- Culligan International Company

- EcoWater Systems LLC

- Eureka Forbes Ltd.

- General Electric Company

- Kent RO Systems Ltd.

- Kinetico Incorporated

- LG Electronics Inc.

- LifeSource Water Systems, Inc.

- Panasonic Corporation

- Pentair plc

- Samsung Electronics Co., Ltd.

- Tata Chemicals Limited

- Unilever PLC

- Whirlpool Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 176 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 14.2 Billion |

| Forecasted Market Value ( USD | $ 24.5 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | Global |