Wireless charging, also known as inductive charging, is a technology that allows devices to charge without the need for physical cables or connectors. It uses electromagnetic fields to transfer energy between a charging pad or station and a compatible device, such as a smartphone, smartwatch, or even electric vehicle. The process of wireless charging involves two main components: a transmitter (charging pad) and a receiver (device being charged). The charging pad contains a coil that generates an alternating current, creating a magnetic field. The device being charged has a coil receiver that converts the magnetic field back into an electrical current, which is then used to charge the device's battery. When the device is placed on the charging pad, the coils in both the pad and the device align, allowing the energy transfer to occur. This eliminates the need for physical connections and provides a convenient and clutter-free way of charging devices.

Wireless charging offers a convenient and hassle-free charging experience. Users no longer need to fumble with cables or connectors, making it easier to charge their devices. The simplicity and ease of use contribute to the increasing demand for wireless charging solutions. Additionally, the expanding range of devices that support wireless charging, such as smartphones, smartwatches, tablets, and earbuds, is a significant driver for the market. As more manufacturers integrate wireless charging capabilities into their products, consumers have greater options to choose from, leading to increased adoption. Other than this, wireless charging is increasingly being integrated into public spaces like airports, coffee shops, and restaurants, allowing users to charge their devices conveniently. Additionally, many automobile manufacturers are incorporating wireless charging pads into their vehicles, enabling users to charge their devices on the go. These developments have expanded the accessibility and availability of wireless charging, further fueling its market growth. Besides this, the establishment of wireless charging standards, such as Qi, has played a crucial role in driving market growth. These standards ensure compatibility between charging pads and devices from different manufacturers. The widespread adoption of common standards has increased consumer confidence, encouraging them to invest in wireless charging solutions.

Wireless Charging Market Trends/Drivers

Convenience and user experience

Traditional charging methods require users to locate and plug in charging cables, which can be inconvenient, especially in low-light conditions or when dealing with multiple devices. Wireless charging eliminates the need for physical connections, allowing users to simply place their devices on a charging pad or station. This simplicity and ease of use enhance the overall charging experience and save time and effort for users.Integration in public spaces and automobiles

Airports, coffee shops, restaurants, and other public venues are increasingly offering wireless charging pads or stations, enabling users to conveniently charge their devices while on the go. This integration has become a value-added service, attracting customers and enhancing customer satisfaction. Similarly, several automobile manufacturers are incorporating wireless charging pads in their vehicles, allowing drivers and passengers to charge their devices without the need for cables. This integration in public spaces and automobiles expands the accessibility and availability of wireless charging, driving its adoption.Technological advancements

Improvements in charging speed, efficiency, and compatibility have made wireless charging more appealing to consumers. Faster wireless charging solutions, supporting higher wattage and fast-charging standards, have been developed, addressing previous limitations and reducing charging times. Enhanced efficiency has minimized energy loss during the charging process, making wireless charging more energy-efficient. Furthermore, technological advancements have improved compatibility, allowing wireless charging to be compatible with a wider range of devices. These technological advancements have improved the performance and reliability of wireless charging, leading to increased consumer adoption.Wireless Charging Industry Segmentation

This report provides an analysis of the key trends in each segment of the global wireless charging market report, along with forecasts at the global and regional levels from 2025-2033. The report has categorized the market based on technology, transmission range and application.Breakup by Technology

- Inductive Charging

- Resonant Charging

- Radio Frequency Based Charging

- Others

The report has provided a detailed breakup and analysis of the market based on technology. This includes inductive charging, resonant charging, radio frequency-based charging, and others. According to the report, inductive charging represented the largest segment.

Inductive charging technology, particularly the Qi standard, has gained widespread adoption and support from major device manufacturers. Many smartphones, wearables, and other electronic devices are built with Qi-compatible inductive charging receivers. This compatibility has created a strong ecosystem of devices and charging pads that work seamlessly together, contributing to the dominance of inductive charging. It has been available for a relatively longer time compared to other wireless charging technologies. It has undergone years of development and refinement, resulting in mature and reliable solutions. The Qi standard, introduced by the Wireless Power Consortium, has provided a widely accepted and standardized approach to inductive charging, further solidifying its position as the dominant technology. Moreover, inductive charging offers a good balance between cost-effectiveness and convenience. The technology is relatively affordable to implement, making it accessible for a wide range of consumer devices. Additionally, it provides a convenient user experience, with charging pads widely available in various public spaces and integrated into furniture, vehicles, and other environments. This convenience factor has driven consumer preference toward inductive charging.

Breakup by Transmission Range

- Short Range

- Medium Range

- Long Range

A detailed breakup and analysis of the market based on the transmission range has also been provided in the report. This includes short range, medium range, and long range. According to the report, short range accounted for the largest market share.

Short range wireless charging offers a practical and efficient solution for charging personal electronic devices such as smartphones, smartwatches, and earbuds. These devices typically have small form factors and are designed for close proximity use. Short-range technology, such as inductive charging, is well-suited for charging these devices when they are placed directly on a charging pad or station. Additionally, short-range wireless charging provides a more focused and controlled energy transfer. It minimizes power loss over shorter distances, resulting in higher efficiency and faster charging times compared to long-range alternatives. This makes short-range charging more appealing to consumers who value quick and reliable charging. Besides this, short-range wireless charging aligns with the concept of personalization and user-centric charging. It enables individuals to have dedicated charging stations in their homes, offices, and public spaces, ensuring their devices are always charged and readily available.

Breakup by Application

- Consumer Electronics

- Automotive

- Healthcare

- Industrial

- Defense

- Others

The report has provided a detailed breakup and analysis of the market based on application This includes consumer electronics, automotive, healthcare, industrial, defense, and others. According to the report, consumer electronics represented the largest segment.

Consumer electronics devices such as smartphones, smartwatches, tablets, and wireless earbuds have become an integral part of our daily lives. These devices heavily rely on battery power, and the demand for convenient and efficient charging solutions is high. Wireless charging provides a convenient and hassle-free way to charge these devices without the need for cables or connectors. Additionally, consumer electronics companies have played a crucial role in driving the adoption of wireless charging. Major smartphone manufacturers, for instance, have widely adopted wireless charging capabilities in their flagship models. This has created a ripple effect, with consumers expecting and seeking wireless charging compatibility in their devices. The prevalence and availability of wireless charging options for consumer electronics have further fueled its dominance in the market. Besides this, the consumer electronics segment benefits from the continuous innovation and advancements in wireless charging technology. Efforts to improve charging speeds, efficiency, and compatibility have been primarily driven by the demand from consumer electronics applications. This ongoing development has made wireless charging increasingly attractive to both manufacturers and consumers in the consumer electronics market.

Breakup by Region

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

The report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, North America, Europe, Middle East and Africa, Latin America. According to the report, Asia Pacific was the leading market.

The Asia Pacific region is home to some of the world's largest consumer electronics manufacturing hubs, including China, South Korea, and Japan. These countries are major producers of smartphones, smartwatches, and other electronic devices that are increasingly adopting wireless charging technology. The strong presence of consumer electronics manufacturers in the region has contributed to the rapid integration of wireless charging capabilities into their products, driving market growth. Additionally, the Asia Pacific region has a large and tech-savvy population. The rising disposable incomes, urbanization, and a high demand for the latest technological advancements have created a favorable market environment for wireless charging. Consumers in this region are quick to adopt new technologies and embrace the convenience and ease of use offered by wireless charging solutions. Furthermore, governments and regulatory bodies in the Asia Pacific region have shown support for wireless charging initiatives. Incentives, subsidies, and favorable policies have encouraged the adoption of wireless charging technology across industries. This support has created a conducive environment for market growth and development.

Competitive Landscape

Major players in the market are continuously investing in research and development to innovate and improve wireless charging technologies. They focus on developing faster charging solutions, improving efficiency, and expanding compatibility across a wide range of devices. For example, advancements in fast-charging technologies like Qualcomm's Quick Charge and Apple's MagSafe have accelerated the adoption of wireless charging. Additionally, key players have formed strategic partnerships and collaborations to expand the ecosystem of wireless charging. Collaborations between device manufacturers and wireless charging technology providers ensure seamless integration and compatibility. Moreover, partnerships with public spaces, automobile manufacturers, and furniture companies have led to the integration of wireless charging infrastructure in various environments, making it more accessible to consumers. Other than this, wireless charging standards like Qi have been instrumental in driving market growth. Key players have also actively participated in standardization organizations to ensure interoperability and compatibility across devices and charging pads. By adopting and promoting common standards, they have built consumer confidence and accelerated the adoption of wireless charging technology.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Convenient Power HK Limited

- Energizer Holdings Inc.

- Integrated Device Technology

- Leggett & Platt Incorporated

- Murata Manufacturing Co. Ltd.

- Powermatic Technologies

- Qualcomm Incorporated

- Texas Instruments Incorporated

- Witricity Corporation

- Samsung

Key Questions Answered in This Report

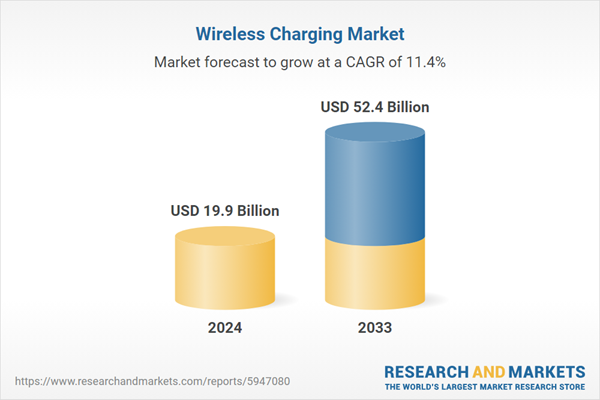

1. What was the size of the global wireless charging market in 2024?2. What is the expected growth rate of the global wireless charging market during 2025-2033?

3. What are the key factors driving the global wireless charging market?

4. What has been the impact of COVID-19 on the global wireless charging market?

5. What is the breakup of the global wireless charging market based on the technology?

6. What is the breakup of the global wireless charging market based on the transmission range?

7. What is the breakup of the global wireless charging market based on the application?

8. What are the key regions in the global wireless charging market?

9. Who are the key players/companies in the global wireless charging market?

Table of Contents

Companies Mentioned

- Convenient Power HK Limited

- Energizer Holdings Inc.

- Integrated Device Technology

- Leggett & Platt Incorporated

- Murata Manufacturing Co. Ltd

- Powermatic Technologies Ltd.

- Qualcomm Incorporated

- Texas Instruments Incorporated

- Witricity Corporation

- Samsung

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | February 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 19.9 Billion |

| Forecasted Market Value ( USD | $ 52.4 Billion |

| Compound Annual Growth Rate | 11.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |