Global Electronics Recycling Market - Key Trends & Drivers Summarized

Electronics recycling is an increasingly crucial aspect of waste management and environmental sustainability, addressing the growing problem of electronic waste (e-waste). E-waste includes discarded electronic devices such as smartphones, computers, televisions, and household appliances, many of which contain hazardous materials like lead, mercury, and cadmium. Proper recycling of these items not only prevents these toxic substances from contaminating the environment but also recovers valuable materials like gold, silver, and copper. The recycling process involves several steps, including collection, sorting, dismantling, and extraction of materials. Advanced recycling facilities use techniques such as shredding, magnetic separation, and chemical processing to efficiently recover and purify these materials. By doing so, electronics recycling helps conserve natural resources, reduces greenhouse gas emissions, and minimizes the ecological footprint of electronic devices.The rise in electronic device usage has led to a significant increase in e-waste, prompting stricter regulations and more robust recycling initiatives worldwide. Governments and environmental organizations are advocating for extended producer responsibility (EPR), where manufacturers are required to manage the end-of-life disposal of their products. This has led to the establishment of take-back programs and recycling incentives. Additionally, public awareness campaigns aim to educate consumers on the importance of recycling electronics and the environmental impact of improper disposal. Technological advancements have also improved the efficiency of recycling processes. Innovations in automated sorting and material recovery technologies have made it possible to handle larger volumes of e-waste more effectively, enhancing the economic viability of recycling operations.

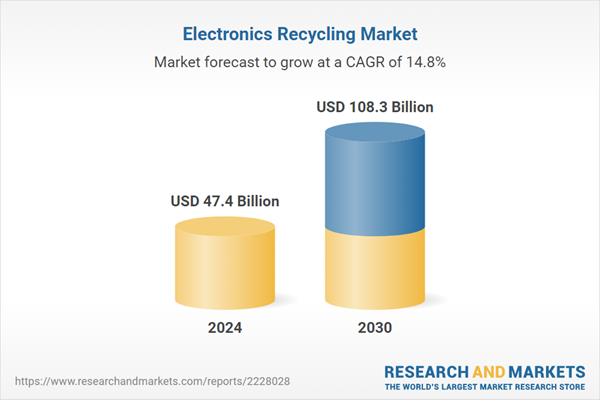

The growth in the electronics recycling market is driven by several factors, including increasing e-waste generation, stringent environmental regulations, and rising consumer awareness. The rapid pace of technological advancements and the frequent upgrading of electronic devices result in a steady increase in e-waste. Regulations mandating the proper disposal and recycling of electronic products, particularly in developed regions, have spurred the establishment of recycling infrastructure. Furthermore, growing consumer awareness about the environmental and health impacts of e-waste has led to higher participation in recycling programs. The market is also benefiting from the circular economy model, where the focus is on designing products with longer life cycles and better recyclability. Additionally, advancements in recycling technologies are improving the efficiency and profitability of e-waste recycling operations. As these factors converge, the electronics recycling market is poised for substantial growth, driven by the need to manage e-waste sustainably and the economic opportunities presented by material recovery.

Report Scope

The report analyzes the Electronics Recycling market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Material (Metals, Plastics, Other Materials); Equipment Type (Consumer Electronics, IT & Telecom, Other Equipment Types).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Metals Material segment, which is expected to reach US$61.2 Billion by 2030 with a CAGR of 16%. The Plastics Material segment is also set to grow at 14.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $8.5 Billion in 2024, and China, forecasted to grow at an impressive 17.8% CAGR to reach $21.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electronics Recycling Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electronics Recycling Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electronics Recycling Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aurubis AG, Boliden Group, Cerebra Integrated Technologies Ltd., Clean Earth, Inc., Exitcom Recycling GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 197 companies featured in this Electronics Recycling market report include:

- Aurubis AG

- Boliden Group

- Cerebra Integrated Technologies Ltd.

- Clean Earth, Inc.

- Exitcom Recycling GmbH

- Good Point Recycling

- MBA Polymers, Inc.

- Sims Metal Management Limited

- Stena Metall AB

- Umicore N.V.

- Universal Recycling Technologies(URT), LLC

- Zak Enterprises LLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aurubis AG

- Boliden Group

- Cerebra Integrated Technologies Ltd.

- Clean Earth, Inc.

- Exitcom Recycling GmbH

- Good Point Recycling

- MBA Polymers, Inc.

- Sims Metal Management Limited

- Stena Metall AB

- Umicore N.V.

- Universal Recycling Technologies(URT), LLC

- Zak Enterprises LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 604 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 47.4 Billion |

| Forecasted Market Value ( USD | $ 108.3 Billion |

| Compound Annual Growth Rate | 14.8% |

| Regions Covered | Global |