Global Gas Chromatography Systems Market - Key Trends & Drivers Summarized

Gas chromatography systems are essential analytical tools used in laboratories worldwide to separate, identify, and quantify compounds in complex mixtures. These systems operate by injecting a gaseous or vaporized sample into a chromatographic column, where it is carried by an inert gas (mobile phase) through a stationary phase. The interaction between the sample components and the stationary phase causes them to elute at different times, creating a unique chromatogram that can be analyzed to determine the composition and concentration of the sample. Gas chromatography is widely used in various fields, including environmental monitoring, pharmaceuticals, petrochemicals, food and beverage, and forensics, due to its high resolution, sensitivity, and versatility.Technological advancements have significantly enhanced the capabilities and applications of gas chromatography systems. Innovations such as capillary columns with higher efficiency, advanced detectors like mass spectrometry (GC-MS), and automated sample preparation techniques have improved the accuracy, speed, and reliability of analyses. Modern gas chromatography systems are equipped with sophisticated software for data acquisition and processing, allowing for more detailed and precise interpretation of results. These advancements have expanded the scope of gas chromatography, enabling its use in more complex and demanding applications, such as trace analysis of contaminants in environmental samples, quality control in pharmaceutical manufacturing, and detection of performance-enhancing drugs in sports.

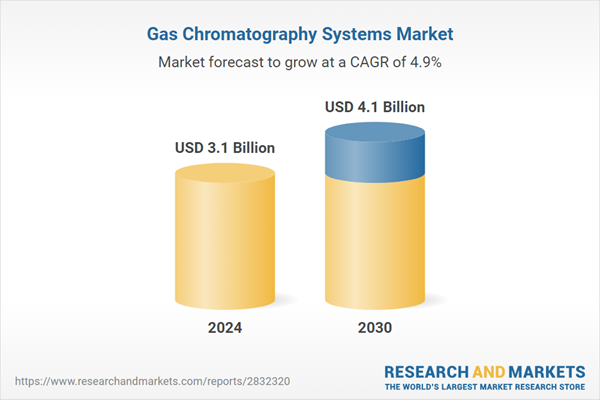

The growth in the gas chromatography systems market is driven by several factors including increasing investments in the pharmaceutical/biotechnology sector, rising funding from governments for research in various sectors, expansion in emerging markets The increasing demand for high-precision analytical techniques in various industries is a significant driver, as organizations seek to ensure product quality, comply with regulatory standards, and conduct research and development. Technological advancements in chromatography, such as improved column technologies and integration with mass spectrometry, are making these systems more powerful and versatile, encouraging their adoption. Additionally, the rising focus on environmental monitoring and food safety is boosting the demand for gas chromatography systems to detect and quantify pollutants and contaminants. The expanding pharmaceutical industry, with its stringent quality control requirements, is also a major contributor to market growth. Moreover, the trend towards automation and high-throughput analysis in laboratories is driving the demand for advanced gas chromatography systems that can handle large volumes of samples efficiently. Together, these factors are fostering a dynamic and expanding market for gas chromatography systems, presenting significant opportunities for innovation and development in analytical technologies.

Report Scope

The report analyzes the Gas Chromatography Systems market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Accessories & Consumables, Reagents, Instruments); End-Use (Oil & Gas, Pharma & Biotech, Environmental Labs, Food & Beverage, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Accessories & Consumables segment, which is expected to reach US$1.8 Billion by 2030 with a CAGR of 4.9%. The Reagents segment is also set to grow at 5.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.3 Billion in 2024, and China, forecasted to grow at an impressive 6.8% CAGR to reach $631.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Gas Chromatography Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Gas Chromatography Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Gas Chromatography Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Agilent Technologies, Inc., Emerson Electric Company, Elster Group GmbH, Ametek Process Instruments, Buck Scientific, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 89 companies featured in this Gas Chromatography Systems market report include:

- Agilent Technologies, Inc.

- Emerson Electric Company

- Elster Group GmbH

- Ametek Process Instruments

- Buck Scientific, Inc.

- Angstrom Advanced, Inc.

- Gibnik

- Defiant Technologies

- Electronic Sensor Technology, Inc.

- Focused Photonics, Inc.

- Galvanic Applied Sciences, Inc.

- COSA Xentaur

- Biobase Meihua

- Energy Support GmbH

- BET Interactive, LLC, a wholly owned subsidiary of Black Entertainment Television LLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agilent Technologies, Inc.

- Emerson Electric Company

- Elster Group GmbH

- Ametek Process Instruments

- Buck Scientific, Inc.

- Angstrom Advanced, Inc.

- Gibnik

- Defiant Technologies

- Electronic Sensor Technology, Inc.

- Focused Photonics, Inc.

- Galvanic Applied Sciences, Inc.

- COSA Xentaur

- Biobase Meihua

- Energy Support GmbH

- BET Interactive, LLC, a wholly owned subsidiary of Black Entertainment Television LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 332 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.1 Billion |

| Forecasted Market Value ( USD | $ 4.1 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |