Global Photonic Sensors and Detectors Market - Key Trends and Drivers Summarized

Photonic sensors and detectors have become integral in advancing numerous industries by offering highly precise and sensitive detection of physical and chemical changes in materials. These sensors operate on the principle of light interaction with materials, detecting variances that signify changes in conditions or composition. The broad spectrum of photonic sensor technologies includes photonic crystals, surface plasmon resonance, optical fibers, optical waveguides, and wearable sensors, each tailored for specific applications such as biochemical sensing, medical diagnostics, infrastructure monitoring, and environmental tracking. For instance, photonic crystal-based sensors manipulate light within their structures to provide high sensitivity, ideal for precise applications like disease detection or pollutant measurement. Similarly, surface plasmon resonance sensors use the oscillation of electrons on metal surfaces to detect chemical and biological entities, providing critical data for non-invasive medical tests and environmental assessments.The utility of photonic sensors spans across critical areas such as medical diagnostics, environmental monitoring, and industrial manufacturing, highlighting their versatility and adaptability. In healthcare, these sensors are pivotal for non-invasive diagnostics and continuous patient monitoring, enhancing disease management and patient care. Environmental applications are equally significant, with photonic sensors playing a crucial role in monitoring air and water quality, thus aiding in pollution control and conservation efforts. Additionally, their application in agriculture helps optimize crop health and soil conditions, promoting sustainable agricultural practices. Photonic sensors also ensure safety and efficiency in industrial settings by enabling precise process control. Furthermore, in the realm of communications, these sensors maintain the integrity and efficiency of data transmission, ensuring robust digital connectivity.

The growth of the photonic sensor market is driven by several dynamic factors. Integration with the Internet of Things (IoT) is pivotal, enhancing real-time data collection and analysis, crucial for developing smart cities and automated industrial processes. Advances in material science, like the use of graphene, improve sensor performance, making them more sensitive and compact. Miniaturization technologies facilitate the incorporation of photonic sensors into personal and portable devices, expanding their use in mobile healthcare and wearable technologies. Additionally, the demand for precision agriculture and stringent regulatory and safety standards across industries necessitates advanced monitoring capabilities that photonic sensors provide. Enhanced computational power allows for sophisticated data processing, enabling complex applications such as dynamic environmental monitoring and intricate medical diagnostics. The growing trend towards non-invasive medical technologies and the increasing emphasis on energy efficiency also spur the development of photonic sensors, reflecting their broadening application spectrum and the technological evolution catering to modern needs.

Report Scope

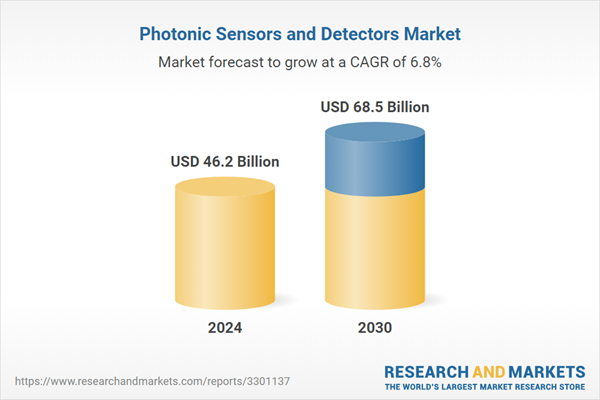

The report analyzes the Photonic Sensors and Detectors market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Medical & Healthcare, Defense & Security, Industrial Manufacturing, Consumer Electronics & Entertainment, Aviation, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Medical & Healthcare End-Use segment, which is expected to reach US$23.5 Billion by 2030 with a CAGR of a 7.7%. The Defense & Security End-Use segment is also set to grow at 6.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $12.0 Billion in 2024, and China, forecasted to grow at an impressive 10.2% CAGR to reach $16.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Photonic Sensors and Detectors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Photonic Sensors and Detectors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Photonic Sensors and Detectors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Akzo Nobel NV, Carboline Company, Hempel A/S, Jotun Group, Kansai Paint Co. Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 96 companies featured in this Photonic Sensors and Detectors market report include:

- Banpil Photonics, Inc.

- Hamamatsu Photonics KK

- KEYENCE Corporation of America

- NP Photonics, Inc.

- Omron Corporation

- ON Semiconductor Corporation

- Pepperl+Fuchs GmbH

- Prime Photonics

- Samsung Electronics Co., Ltd.

- Sony Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Banpil Photonics, Inc.

- Hamamatsu Photonics KK

- KEYENCE Corporation of America

- NP Photonics, Inc.

- Omron Corporation

- ON Semiconductor Corporation

- Pepperl+Fuchs GmbH

- Prime Photonics

- Samsung Electronics Co., Ltd.

- Sony Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 246 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 46.2 Billion |

| Forecasted Market Value ( USD | $ 68.5 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |