Global Carrier Ethernet Access Devices Market - Key Trends and Drivers Summarized

Carrier Ethernet represents a significant advancement in network services, meeting the high demands of both businesses and residential consumers for superior bandwidth and quality. Traditional Ethernet, primarily used in local area networks (LANs) for its cost-effectiveness and scalability, has been adapted into Carrier Ethernet to integrate the benefits of Ethernet with the high-quality, connection-oriented features of time-domain multiplexing (TDM) solutions. This adaptation is crucial for modern service landscapes that require stringent quality of service (QoS). Carrier Ethernet Access Devices (CEADs) play a pivotal role in enhancing transport infrastructures, expanding network reach to edge and metro areas efficiently. These devices include Ethernet switches, routers, gateways, and access points, all designed to meet the rigorous demands of carrier-grade deployments by incorporating advanced features such as QoS, traffic management, security protocols, and network administration capabilities.Carrier Ethernet utilizes various media types to support its functionalities. Copper remains widely used due to its existing infrastructure and cost-effectiveness, suitable for lower-rate traffic and incremental service expansions despite its susceptibility to electromagnetic interference. Microwave radio, primarily used in mobile backhaul, supports rising bandwidth demands at base stations and offers operational cost reductions. Fiber is preferred for high-speed traffic over long distances, providing reliable data transmission resistant to interference despite higher initial costs. Carrier Ethernet defines two primary service types: Ethernet Line (E-Line) for point-to-point connectivity and Ethernet LAN (E-LAN) for multipoint-to-multipoint connectivity, catering to specific networking needs with variations like Ethernet private lines and virtual private lines. These services enhance business operations by simplifying backhaul and reducing costs, meeting the increasing demands for data, voice, and video applications.

Several factors drive the growth of the Carrier Ethernet Access Devices market. The increasing demand for cloud services necessitates robust networking infrastructure, with CEADs providing the required bandwidth and support. The proliferation of IoT devices requires scalable, quality networks that Carrier Ethernet offers. Consumer demand for high-speed connectivity for activities like streaming and gaming drives adoption by service providers. The shift towards remote work and e-learning has heightened the need for reliable internet connections, which CEADs support. The evolution towards higher-resolution content, such as 4K and 8K streaming, necessitates ultra-high bandwidth and low latency that Carrier Ethernet provides. Smart city initiatives and the rise of edge computing require sophisticated networking solutions, with CEADs enabling real-time data collection and low-latency processing. Furthermore, the adoption of Software-Defined Networking (SDN) and Network Function Virtualization (NFV) marks a transformative phase for CEADs, enabling greater automation, flexibility, and reduced operational costs. Environmental sustainability is also a focus, with eco-friendly designs and renewable energy sources becoming integral to the development of Carrier Ethernet Access Devices. These factors highlight the technological, strategic, and consumer-driven changes that propel the adoption and growth of CEADs in the telecommunications sector.

Report Scope

The report analyzes the Carrier Ethernet Access Devices market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Switching Port (10GbE, 40 GbE, 100 GbE, 1GbE); Connectivity (Optical Devices, Electrical Devices).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the 10GbE Switching Port segment, which is expected to reach US$9.7 Billion by 2030 with a CAGR of a 3.3%. The 40 GbE Switching Port segment is also set to grow at 2.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.9 Billion in 2024, and China, forecasted to grow at an impressive 4.8% CAGR to reach $4.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Carrier Ethernet Access Devices Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Carrier Ethernet Access Devices Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Carrier Ethernet Access Devices Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Diagnostics, Inc. - Core Laboratory, Amgen, Inc., Biogen, Inc., Eli Lilly and Company, F. Hoffmann-La Roche AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Carrier Ethernet Access Devices market report include:

- Actelis Networks

- ADVA Optical Networking

- AIRLINX Communications, Inc.

- Antaira Technologies LLC

- Arista Networks, Inc.

- Asympto OU

- Broadcom, Inc.

- Cisco Systems, Inc.

- CTC Union Technologies Co., Ltd.

- Ekinops

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Actelis Networks

- ADVA Optical Networking

- AIRLINX Communications, Inc.

- Antaira Technologies LLC

- Arista Networks, Inc.

- Asympto OU

- Broadcom, Inc.

- Cisco Systems, Inc.

- CTC Union Technologies Co., Ltd.

- Ekinops

Table Information

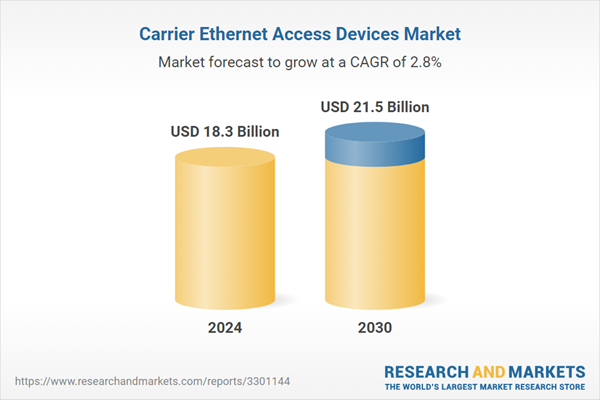

| Report Attribute | Details |

|---|---|

| No. of Pages | 272 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 18.3 Billion |

| Forecasted Market Value ( USD | $ 21.5 Billion |

| Compound Annual Growth Rate | 2.8% |

| Regions Covered | Global |