Global Gene Amplification Technologies Market - Key Trends & Drivers Summarized

What Are Gene Amplification Technologies and How Are They Transforming Biomedical Research?

Gene amplification technologies constitute a suite of methods used to increase the number of copies of a specific DNA sequence, enhancing the ability to analyze genetic material in detail. These technologies are pivotal in molecular biology, genetics, and clinical diagnostics, facilitating advancements in disease diagnosis, genetic research, and the development of targeted therapies. The most renowned technique, Polymerase Chain Reaction (PCR), amplifies DNA sequences millions of times, enabling researchers to study genetic material from even very small samples. Innovations such as real-time PCR and digital PCR provide quantitative data on DNA, increasing the precision of genetic analysis. The capacity of these technologies to rapidly and accurately amplify genes is critical for identifying disease-causing mutations, understanding genetic diversity, and developing genetic interventions.How Technological Advancements Enhance the Capabilities of Gene Amplification

Recent technological advancements have significantly expanded the capabilities and applications of gene amplification technologies. Next-Generation Sequencing (NGS) integrates gene amplification to sequence millions of DNA fragments simultaneously, providing comprehensive insights into complex genetic landscapes. This has revolutionized genomics with its ability to decode entire genomes swiftly and more economically than ever before. Additionally, the advent of CRISPR-based amplification methods offers a novel approach to targeted gene editing and regulation, opening new avenues in genetic engineering and therapeutic development. These cutting-edge technologies are not only making gene analysis more robust and versatile but also improving the scalability and efficiency of genetic research and diagnostics.Emerging Trends and Applications of Gene Amplification in Industry and Medicine

The application of gene amplification technologies is witnessing expansive growth, driven by emerging trends in personalized medicine and genetic engineering. In clinical diagnostics, these technologies are increasingly used for early detection of pathogenic infections, cancer mutations, and genetic disorders, facilitating timely and precise treatment. In the pharmaceutical industry, gene amplification is integral to drug development processes, helping to identify drug targets and screen for potential drug efficacy and safety. The agricultural sector also benefits from these technologies, employing them in crop improvement programs to ensure food security and sustainability. Moreover, environmental applications are emerging, where gene amplification is used to assess biodiversity and monitor microbial populations in various ecosystems. These applications highlight the versatility and indispensability of gene amplification technologies across multiple fields.What Drives the Growth of the Gene Amplification Technologies Market?

The growth in the gene amplification technologies market is driven by several factors, including the rising demand for personalized medicine, the global increase in genetic research funding, and the continuous advancements in technology. The growing prevalence of genetic disorders and cancer is prompting extensive use of these technologies in diagnostics and therapeutic development, underscoring their role in modern medicine. Furthermore, the expansion of biotechnological applications and the pharmaceutical industry's reliance on precision medicine strategies are catalyzing market growth. Consumer behavior, increasingly informed and influenced by genetic insights into health and disease, also fosters greater demand for genetic testing and analysis, propelling the adoption of gene amplification technologies. Additionally, government and regulatory bodies are bolstering this growth through supportive policies, research funding, and incentives, especially in genomic projects and health initiatives. These factors, combined with technological innovation that ensures higher accuracy, accessibility, and cost-effectiveness, are crucial in driving the robust expansion of this market, making gene amplification technologies fundamental tools in the ongoing exploration and manipulation of genetic material.Report Scope

The report analyzes the Gene Amplification Technologies market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Medical & Pharma, Forensic & Identity Testing, Agricultural & Food Safety, Other Applications).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Medical & Pharma Application segment, which is expected to reach US$6.4 Billion by 2030 with a CAGR of 11.1%. The Forensic & Identity Testing Application segment is also set to grow at 8.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3 Billion in 2024, and China, forecasted to grow at an impressive 13.1% CAGR to reach $385.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Gene Amplification Technologies Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Gene Amplification Technologies Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Gene Amplification Technologies Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, Inc., Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., bioMerieux SA, Charles River Laboratories International, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 52 companies featured in this Gene Amplification Technologies market report include:

- Abbott Laboratories, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- bioMerieux SA

- Charles River Laboratories International, Inc.

- Cepheid

- Enzo Life Sciences, Inc.

- ELITech Group

- BioGenex

- BioCat GmbH

- Biotecon Diagnostics GmbH

- Eiken Chemical Co., Ltd.

- DiaCarta, Inc.

- Bio-Synthesis Inc.

- Diatech Pharmacogenetics Srl

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- bioMerieux SA

- Charles River Laboratories International, Inc.

- Cepheid

- Enzo Life Sciences, Inc.

- ELITech Group

- BioGenex

- BioCat GmbH

- Biotecon Diagnostics GmbH

- Eiken Chemical Co., Ltd.

- DiaCarta, Inc.

- Bio-Synthesis Inc.

- Diatech Pharmacogenetics Srl

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 293 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

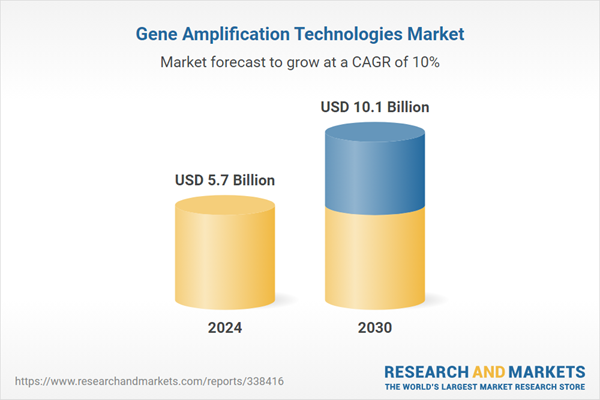

| Estimated Market Value ( USD | $ 5.7 Billion |

| Forecasted Market Value ( USD | $ 10.1 Billion |

| Compound Annual Growth Rate | 10.0% |

| Regions Covered | Global |