Global Zirconium Market - Key Trends & Drivers Summarized

Zirconium is a versatile and valuable element known for its remarkable resistance to corrosion, high melting point, and excellent strength-to-weight ratio. It is commonly found in the mineral zircon, from which it is extracted and refined. Zirconium's primary application is in the nuclear industry, where its ability to withstand extreme conditions and its low neutron absorption cross-section make it an ideal material for cladding fuel rods in nuclear reactors. Additionally, zirconium alloys are used in various industrial applications, including the manufacture of pipes, fittings, and heat exchangers that operate in corrosive environments. Its biocompatibility also makes it suitable for use in medical devices and implants, particularly in dental and orthopedic applications.Technological advancements have expanded the use of zirconium in other high-tech industries. In the aerospace and automotive sectors, zirconium is utilized for its lightweight properties and resistance to heat, contributing to the development of more efficient engines and components. The chemical industry relies on zirconium compounds for catalysis and as a protective lining in chemical reactors and storage tanks. Furthermore, zirconium dioxide (zirconia) is a crucial component in the production of ceramics, known for its hardness and thermal stability. This material is used in everything from dental crowns to cutting tools and electronic components. The growing demand for high-performance materials in various technological applications has driven innovation in zirconium processing and alloy development, enhancing its properties and expanding its market potential.

The growth in the zirconium market is driven by several factors. The increasing demand for nuclear energy as a clean and efficient power source has bolstered the need for zirconium in reactor construction and maintenance. The rise of advanced manufacturing and the push for more durable, lightweight materials in the aerospace and automotive industries have further stimulated market growth. Additionally, the expanding medical and dental sectors, seeking biocompatible materials for implants and devices, have contributed to the increased use of zirconium. The development of new zirconium-based materials and compounds, driven by continuous research and innovation, has opened up new applications and markets. Environmental regulations and the shift towards sustainable industrial practices also play a role, as zirconium's corrosion resistance and durability can extend the lifespan of equipment, reducing waste and maintenance costs. These factors collectively drive the robust growth of the zirconium market, highlighting its critical role in modern technology and industry.

Report Scope

The report analyzes the Zirconium market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Occurrence Type (Zircon, Zirconia, Other Occurrence Types); End-Use (Ceramics, Chemicals, Refractories, Foundries, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

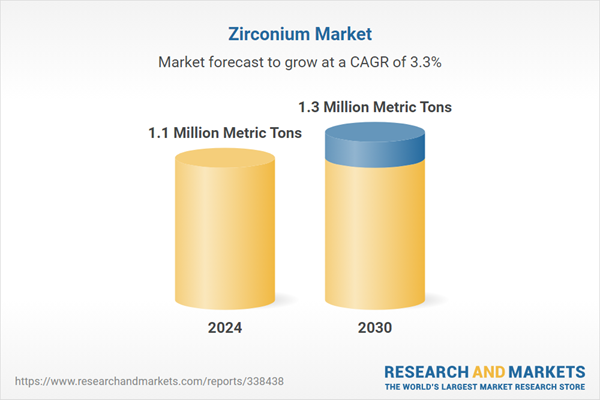

- Market Growth: Understand the significant growth trajectory of the Zircon Occurrence segment, which is expected to reach 949.4 Thousand Metric Tons by 2030 with a CAGR of 3.5%. The Zirconia Occurrence segment is also set to grow at 3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at 94.0 Thousand Metric Tons in 2024, and China, forecasted to grow at an impressive 2.9% CAGR to reach 579.1 Thousand Metric Tons by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Zirconium Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Zirconium Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Zirconium Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Compagnie de Saint-Gobain S.A., Eramet Group, Carborundum Universal Ltd., Glidewell Laboratories, Imperial Metal Industries Limited and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 89 companies featured in this Zirconium market report include:

- Compagnie de Saint-Gobain S.A.

- Eramet Group

- Carborundum Universal Ltd.

- Glidewell Laboratories

- Imperial Metal Industries Limited

- Iluka Resources Ltd.

- Japan New Metals Co., Ltd.

- KCM Corporation

- Alkane Resources Ltd.

- Luxfer Holdings PLC

- DuraTech Industries

- Foskor Pty., Ltd.

- China Metallurgical Information and Standardization Institute (CMISI)

- Matrix (Guangzhou) Metamaterials Co.,Ltd.

- Alliance Design and Development Group, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Compagnie de Saint-Gobain S.A.

- Eramet Group

- Carborundum Universal Ltd.

- Glidewell Laboratories

- Imperial Metal Industries Limited

- Iluka Resources Ltd.

- Japan New Metals Co., Ltd.

- KCM Corporation

- Alkane Resources Ltd.

- Luxfer Holdings PLC

- DuraTech Industries

- Foskor Pty., Ltd.

- China Metallurgical Information and Standardization Institute (CMISI)

- Matrix (Guangzhou) Metamaterials Co.,Ltd.

- Alliance Design and Development Group, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 420 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value in 2024 | 1.1 Million Metric Tons |

| Forecasted Market Value by 2030 | 1.3 Million Metric Tons |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Global |