Global Sulfur (Sulphur) Market - Key Trends and Drivers Summarized

What Is Sulfur and Why Is It Vital to Various Industries?

Sulfur, a non-metallic chemical element with the atomic number 16, is one of the most abundant elements on Earth. Known for its bright yellow color in its elemental form, sulfur is a versatile substance integral to numerous industrial processes. It is most commonly found in nature as sulfide and sulfate minerals or as elemental sulfur deposits. Sulfur's chemical properties make it essential in producing sulfuric acid, one of the most widely used chemicals globally. Sulfuric acid plays a critical role in the manufacture of fertilizers, which are fundamental for modern agriculture. Additionally, sulfur is a key component in the vulcanization of rubber, enhancing the durability and elasticity of rubber products. Its importance extends to other sectors, including petroleum refining, where it helps in removing impurities, and the production of chemicals, explosives, and pharmaceuticals.How Is Sulfur Extracted and What Are Its Primary Applications?

The extraction of sulfur typically involves mining from natural deposits or recovering it as a by-product of refining crude oil and natural gas. One of the most prevalent methods is the Frasch process, which involves pumping superheated water into underground sulfur deposits to melt the sulfur, which is then brought to the surface. Another significant source is the Claus process, which recovers sulfur from hydrogen sulfide in natural gas processing. The primary applications of sulfur are diverse. In agriculture, sulfur is critical for producing phosphate fertilizers, which support global food production. In the chemical industry, sulfuric acid derived from sulfur is indispensable in manufacturing a wide array of chemicals. The petroleum industry relies on sulfur compounds for refining processes to produce cleaner fuels. Furthermore, sulfur is used in producing lead-acid batteries, essential for automotive and backup power applications, and in the creation of various construction materials.What Are the Environmental and Economic Impacts of Sulfur?

Sulfur production and utilization have notable environmental and economic impacts. Environmentally, the extraction and processing of sulfur must be managed carefully to minimize emissions of sulfur dioxide, which can contribute to acid rain and respiratory problems. The industry has made strides in implementing cleaner technologies and stringent regulations to reduce environmental footprints. Economically, sulfur is a critical commodity with a robust market, driven by its extensive applications across multiple industries. The cost and availability of sulfur are influenced by factors such as global demand for fertilizers, fluctuations in oil and gas production, and advancements in extraction technologies. Countries rich in sulfur deposits or with significant refining capacities, such as the United States, Canada, and Middle Eastern nations, play a pivotal role in the global sulfur market, contributing to their economic stability and growth.What Drives the Growth in the Sulfur Market?

The growth in the sulfur market is driven by several factors. Technological advancements in sulfur recovery and processing have enhanced efficiency and sustainability, boosting production capabilities. The increasing global population and the consequent rise in food demand have significantly propelled the need for sulfur-based fertilizers, ensuring agricultural productivity. The expanding petroleum refining sector, driven by the rising demand for cleaner fuels, also fuels sulfur market growth, as sulfur compounds are essential in refining processes. Moreover, the growth of the automotive industry, with its reliance on lead-acid batteries, further stimulates demand for sulfur. Environmental regulations requiring reduced sulfur emissions have led to innovations in cleaner extraction and processing methods, thereby supporting market expansion. Additionally, the rising need for construction materials and pharmaceuticals, where sulfur plays a crucial role, continues to drive the market. These multifaceted factors collectively ensure the sustained growth and importance of sulfur in the global industrial landscape.Report Scope

The report analyzes the Sulfur (Sulphur) market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Agrochemicals, Petroleum Refining, Metal Mining, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Agrochemicals End-Use segment, which is expected to reach 54.9 Million Metric Tons by 2030 with a CAGR of a 4.7%. The Petroleum Refining End-Use segment is also set to grow at 3.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at 18.4 Million Metric Tons in 2024, and China, forecasted to grow at an impressive 7.5% CAGR to reach 19 MillionMetric Tons by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Sulfur (Sulphur) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Sulfur (Sulphur) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Sulfur (Sulphur) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abu Dhabi National Oil Company (ADNOC), China Petroleum & Chemical Corporation (SINOPEC), Chinese Petroleum Corporation (CPC), Galp Energia, SGPS, SA, Husky Energy, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 53 companies featured in this Sulfur (Sulphur) market report include:

- Abu Dhabi National Oil Company (ADNOC)

- China Petroleum & Chemical Corporation (SINOPEC)

- Chinese Petroleum Corporation (CPC)

- Galp Energia, SGPS, SA

- Husky Energy, Inc.

- Kharg Petrochemical Co.

- Petrobras

- Petroleos de Venezuela SA

- PVS Chemicals, Inc.

- Valero Energy Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abu Dhabi National Oil Company (ADNOC)

- China Petroleum & Chemical Corporation (SINOPEC)

- Chinese Petroleum Corporation (CPC)

- Galp Energia, SGPS, SA

- Husky Energy, Inc.

- Kharg Petrochemical Co.

- Petrobras

- Petroleos de Venezuela SA

- PVS Chemicals, Inc.

- Valero Energy Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | February 2026 |

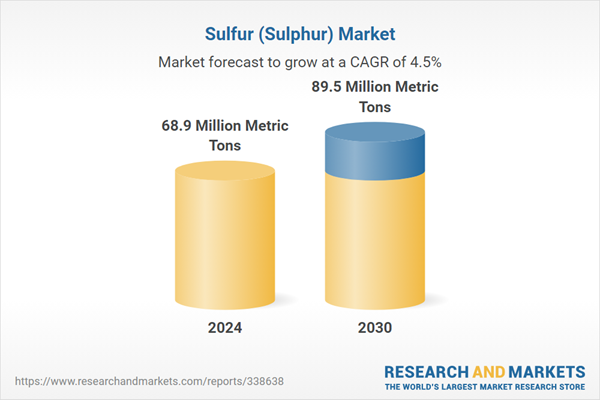

| Forecast Period | 2024 - 2030 |

| Estimated Market Value in 2024 | 68.9 Million Metric Tons |

| Forecasted Market Value by 2030 | 89.5 Million Metric Tons |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |