Global Construction Equipment Market - Key Trends & Drivers Summarized

What Is Construction Equipment and How Is It Manufactured?

Construction equipment comprises a wide range of heavy machinery designed to perform various tasks on construction sites, such as excavation, earthmoving, lifting, paving, and material handling. This equipment is essential in large-scale projects like infrastructure development, residential construction, and commercial buildings. It encompasses machines like excavators, bulldozers, cranes, loaders, and concrete mixers. These machines enhance the speed, efficiency, and safety of construction operations, making them indispensable in the construction industry.The manufacturing of construction equipment involves multiple stages, including design, component fabrication, assembly, and quality control. The process begins with the design phase, where engineers determine the machine's purpose, capacity, and operational requirements. Core components like engines, hydraulic systems, and tracks or wheels are then fabricated using high-strength materials to ensure durability and performance under harsh conditions. During the assembly phase, these components are integrated into a complete machine, followed by rigorous testing to ensure optimal functionality, safety, and reliability. Quality control measures are implemented throughout the manufacturing process to ensure that the equipment meets industry standards and regulatory requirements.

Recent advancements in the production of construction equipment focus on improving fuel efficiency, automation, and operator safety. Innovations in engine design, hybrid technologies, and electric powertrains are leading to the development of machines with lower emissions and better energy efficiency. Additionally, advancements in automation and IoT integration are making construction equipment smarter, allowing for features such as remote control, predictive maintenance, and real-time performance monitoring.

What Are the Primary Applications of Construction Equipment Across Industries?

Construction equipment has a wide range of applications across several sectors, with its primary uses in infrastructure development, residential and commercial construction, mining, and material handling. In infrastructure development, construction equipment is employed for projects such as roads, bridges, highways, and railways. Excavators, graders, and asphalt pavers are essential for earthmoving, leveling, and paving tasks, ensuring efficient and timely project completion. The speed and precision of construction equipment make it indispensable for large-scale infrastructure projects that require substantial earthwork and material handling.In residential and commercial construction, equipment like cranes, backhoe loaders, and concrete mixers play a vital role in building foundations, structures, and facilities. Cranes are used for lifting and placing heavy materials like steel beams and prefabricated elements, while loaders and backhoes handle digging, loading, and transporting soil and aggregates. Construction equipment enhances productivity by reducing manual labor and increasing the speed of construction, helping contractors meet tight deadlines and maintain project schedules.

The mining industry also relies heavily on construction equipment for excavation, drilling, and material transport. Machines such as hydraulic shovels, dump trucks, and wheel loaders are used to extract and transport minerals and ores from mines. The rugged design and high capacity of these machines allow for efficient handling of heavy loads in challenging terrains. The ability of construction equipment to operate in harsh conditions and perform heavy-duty tasks makes it essential in mining operations.

Moreover, construction equipment is widely used in material handling and logistics, particularly in sectors like warehousing, shipping, and manufacturing. Forklifts, telehandlers, and conveyor systems are employed for lifting, moving, and stacking materials, facilitating efficient operations in distribution centers and factories. The versatility of construction equipment in material handling makes it a valuable asset in optimizing logistics and supply chain processes.

Why Is Consumer Demand for Construction Equipment Increasing?

The demand for construction equipment is increasing due to several key factors, including rapid urbanization, growing infrastructure development, advancements in equipment technologies, and the rising emphasis on sustainability. One of the primary drivers of demand is the increasing pace of urbanization, particularly in emerging economies. As cities expand to accommodate growing populations, there is a surge in demand for housing, transportation, and public infrastructure, driving the need for construction equipment to build these essential facilities. Construction equipment enables faster and more efficient construction processes, making it a critical component of urban development.The growing focus on infrastructure development is another significant factor contributing to the rising demand for construction equipment. Governments worldwide are investing heavily in building and upgrading infrastructure, such as roads, bridges, airports, and utilities, to stimulate economic growth. Construction equipment is essential for executing these large-scale projects, leading to greater adoption across various regions. The need for high-performance machines that can handle extensive workloads and ensure timely project completion is boosting demand in the market.

Advancements in equipment technologies are also influencing consumer demand for construction equipment. Innovations such as autonomous machinery, telematics, and IoT integration are enhancing the functionality and efficiency of construction equipment. Smart machines that offer real-time data analysis, predictive maintenance, and remote operation capabilities are becoming increasingly popular among contractors looking to optimize operations and reduce downtime. As the construction industry becomes more digitized, the demand for technologically advanced equipment is expected to grow.

Additionally, the rising emphasis on sustainability in construction is driving demand for eco-friendly equipment. Manufacturers are developing electric and hybrid construction machines that offer lower emissions, improved fuel efficiency, and reduced environmental impact. As governments and regulatory bodies enforce stricter emissions standards and green construction initiatives, contractors are seeking equipment that aligns with sustainability goals. This trend is prompting increased investments in green technologies and contributing to the demand for sustainable construction equipment.

What Factors Are Driving the Growth of the Construction Equipment Market?

The growth of the construction equipment market is driven by several key factors, including the expanding construction and infrastructure sectors, technological advancements, and increasing investments in automation and sustainability. One of the most significant factors influencing market growth is the ongoing expansion of the global construction sector. As demand for new buildings, infrastructure, and industrial facilities continues to rise, construction companies are investing in modern equipment to improve efficiency and meet project deadlines. This growth is particularly pronounced in emerging economies, where rapid urbanization and industrialization are driving large-scale construction activities.Technological advancements are also playing a crucial role in driving the growth of the construction equipment market. Innovations such as autonomous machinery, GPS-based guidance systems, and telematics are enhancing the performance, safety, and efficiency of construction equipment. Autonomous construction equipment, for example, can perform repetitive tasks without human intervention, improving productivity and reducing labor costs. The integration of telematics and real-time monitoring systems allows for better fleet management, predictive maintenance, and data-driven decision-making. As these technologies become more widely adopted, the demand for advanced construction equipment is expected to increase.

Increasing investments in automation and sustainability are another important factor contributing to market growth. Companies are recognizing the benefits of automating construction processes, which include faster project completion, reduced labor costs, and improved safety. Additionally, the focus on sustainable construction is prompting the adoption of green equipment, such as electric excavators, hybrid loaders, and low-emission machinery. Manufacturers are actively developing eco-friendly construction equipment to meet evolving regulatory standards and consumer preferences, further driving market growth.

Moreover, government initiatives to promote infrastructure development and economic recovery post-pandemic are influencing the growth of the construction equipment market. Large-scale infrastructure projects, such as roads, bridges, railways, and public utilities, are receiving significant government funding, creating demand for construction equipment. The emphasis on infrastructure as a driver of economic growth is expected to sustain demand for construction machinery in the coming years.

In conclusion, the global construction equipment market is poised for significant growth, driven by the expanding construction and infrastructure sectors, technological advancements, and increasing investments in automation and sustainability. As the demand for efficient, reliable, and eco-friendly equipment continues to rise, construction machinery will play a vital role in shaping modern construction practices. With ongoing innovations and a commitment to addressing industry challenges, the market for construction equipment is expected to experience sustained expansion in the coming years.

Report Scope

The report analyzes the Construction Equipment market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Equipment Type (Earthmoving Equipment, Material Handling Equipment, Concrete & Road Construction Equipment, Other Equipment Types); End-Use (Commercial End-Use, Infrastructure End-Use, Residential End-Use).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Earthmoving Equipment segment, which is expected to reach US$99.4 Billion by 2030 with a CAGR of 4%. The Material Handling Equipment segment is also set to grow at 5.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $34.1 Billion in 2024, and China, forecasted to grow at an impressive 5.9% CAGR to reach $51.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Construction Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Construction Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Construction Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AB Volvo, Caterpillar Inc., CNH Industrial NV, Deere & Company, Hitachi Construction Machinery Co. Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 283 companies featured in this Construction Equipment market report include:

- AB Volvo

- Caterpillar Inc.

- CNH Industrial NV

- Deere & Company

- Hitachi Construction Machinery Co. Ltd.

- Hyundai Doosan Infracore Co., Ltd.

- J C Bamford Excavators Ltd.

- Kobelco Construction Machinery Co. Ltd.

- Komatsu Ltd.

- Liebherr-International AG

- Manitou Group

- Sany Heavy Industry Co. Ltd.

- Terex Corporation

- Xuzhou Construction Machinery Group Co., Ltd. (XCMG)

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AB Volvo

- Caterpillar Inc.

- CNH Industrial NV

- Deere & Company

- Hitachi Construction Machinery Co. Ltd.

- Hyundai Doosan Infracore Co., Ltd.

- J C Bamford Excavators Ltd.

- Kobelco Construction Machinery Co. Ltd.

- Komatsu Ltd.

- Liebherr-International AG

- Manitou Group

- Sany Heavy Industry Co. Ltd.

- Terex Corporation

- Xuzhou Construction Machinery Group Co., Ltd. (XCMG)

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 523 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

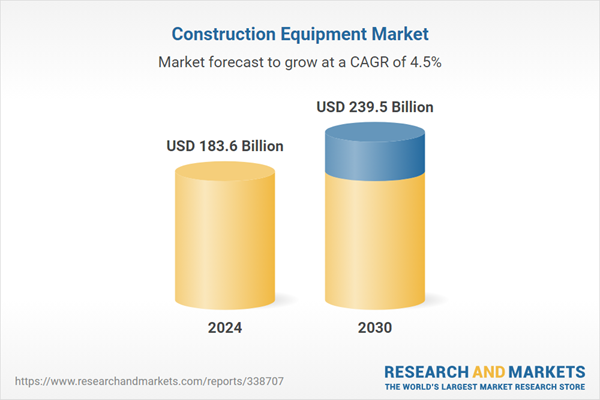

| Estimated Market Value ( USD | $ 183.6 Billion |

| Forecasted Market Value ( USD | $ 239.5 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |