Global Copper Market - Key Trends and Drivers Summarized

Copper is a soft, malleable, and ductile metal with very high thermal and electrical conductivity. Its distinctive reddish-orange color is recognized widely and the metal is used extensively across a variety of industries. Primarily, copper is used in electrical wiring, plumbing, and the production of electronics due to its excellent conductive properties. Copper is increasingly recognized as a critical element in the global shift towards sustainable energy and electrification. It plays a central role in the construction of electric vehicles (EVs), efficient power grids, and renewable energy technologies such as wind and solar power systems. This wide array of applications underscores copper's indispensable role in modern infrastructure and technology advancements. As countries and corporations increasingly commit to reducing carbon emissions, the demand for renewable energy infrastructure - such as solar panels, wind turbines, and the related grid infrastructure - has surged. Copper is essential in these technologies due to its superior electrical conductivity, which is crucial for efficient energy transfer. Additionally, the growth of electric vehicles (EVs), which use approximately four times as much copper as gasoline-powered vehicles, further bolsters copper demand. As more nations adopt policies encouraging EV usage to combat climate change, the need for copper is expected to rise significantly.Another major factor influencing copper demand is the ongoing global expansion in construction and telecommunications. In developing countries, urbanization and industrial development drive the need for new residential and commercial buildings, all of which require extensive copper wiring and plumbing. In telecommunications, copper is a key element used in the infrastructure that supports high-speed internet and other communication technologies. As the digital economy expands, and with it the rollout of 5G networks, the demand for copper to facilitate these advancements continues to grow.

However, copper also faces challenges such as price volatility and supply constraints. The mining and extraction of copper can be significantly affected by geopolitical issues, environmental regulations, and the economic stability of producing countries, which occasionally leads to a tight supply market and price surges. Moreover, the push towards recycling and more sustainable mining practices reflects growing environmental awareness and the need to secure a stable copper supply for future technological developments. As such, the trends in the copper market are closely watched by industries and investors alike, given its critical role in both traditional infrastructure and modern technological applications.

Report Scope

The report analyzes the Copper market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Electrical & Electronics, Building & Construction, Transportation, Consumer & General Products, Industrial Machinery & Equipment).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Electrical & Electronics End-Use segment, which is expected to reach US$134.4 Billion by 2030 with a CAGR of a 6.9%. The Building & Construction End-Use segment is also set to grow at 4.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $55.2 Billion in 2024, and China, forecasted to grow at an impressive 8.9% CAGR to reach $68.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Copper Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Copper Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Copper Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Anglo American Plc, Antofagasta Plc, BHP Billiton Group, Codelco, First Quantum Minerals Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 122 companies featured in this Copper market report include:

- Anglo American Plc

- Antofagasta Plc

- BHP Billiton Group

- Codelco

- First Quantum Minerals Ltd.

- Grupo México S.A.B. DE C.V

- Jiangxi Copper Co. Ltd.

- JX Nippon Mining & Metals Corp.

- KGHM Polska MiedŸ S.A

- KME AG

- Mitsubishi Materials Corp.

- Mitsui Mining & Smelting Co. Ltd.

- Norilsk Nickel

- OM Group Inc.

- Rio Tinto Group

- Sumitomo Metal Mining Co., Ltd.

- Teck Resources Ltd.

- UMMC Holding Corp.

- Vale Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Anglo American Plc

- Antofagasta Plc

- BHP Billiton Group

- Codelco

- First Quantum Minerals Ltd.

- Grupo México S.A.B. DE C.V

- Jiangxi Copper Co. Ltd.

- JX Nippon Mining & Metals Corp.

- KGHM Polska MiedŸ S.A

- KME AG

- Mitsubishi Materials Corp.

- Mitsui Mining & Smelting Co. Ltd.

- Norilsk Nickel

- OM Group Inc.

- Rio Tinto Group

- Sumitomo Metal Mining Co., Ltd.

- Teck Resources Ltd.

- UMMC Holding Corp.

- Vale Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 269 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

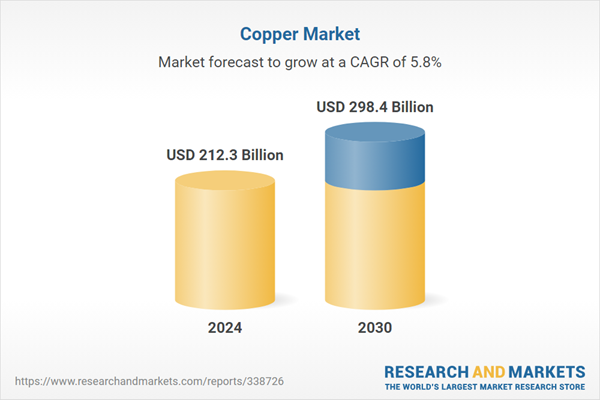

| Estimated Market Value ( USD | $ 212.3 Billion |

| Forecasted Market Value ( USD | $ 298.4 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |