Global Cooling Towers Market - Key Trends & Drivers Summarized

Cooling towers are critical components in industrial and commercial HVAC systems, designed to dissipate excess heat into the atmosphere through the cooling of water. These towers are prevalent in various industries, including power generation, manufacturing, and chemical processing, where they facilitate the efficient operation of machinery and processes by maintaining optimal temperatures. Cooling towers function by transferring heat from the water to the air, usually through evaporation. As hot water from the system is sprayed inside the cooling tower, it flows over fill media to increase the surface area for air contact. The cooling effect is achieved as air is drawn through the tower, either by natural convection or mechanical fans, causing a portion of the water to evaporate and thereby reducing the temperature of the remaining water, which is then recirculated back into the system.Technological advancements have significantly enhanced the efficiency and environmental impact of cooling towers. Modern designs incorporate high-efficiency drift eliminators, which minimize water loss, and advanced fill media that improve heat transfer efficiency. Additionally, innovations in materials and construction techniques have led to more durable and corrosion-resistant towers, extending their operational life and reducing maintenance costs. The integration of smart controls and IoT technology has further revolutionized cooling tower management, allowing for real-time monitoring and optimization of performance. These systems can adjust fan speeds, water flow rates, and chemical treatments based on current operating conditions, ensuring efficient and sustainable operation. Furthermore, the development of hybrid cooling towers, which combine wet and dry cooling methods, has provided a versatile solution for regions with water scarcity, offering substantial water savings while maintaining effective cooling.

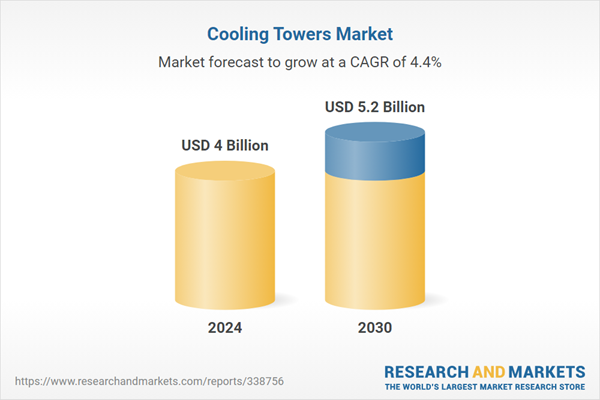

The growth in the cooling towers market is driven by several factors, reflecting the increasing industrialization and urbanization worldwide. One significant driver is the rising demand for energy-efficient cooling solutions in power plants and industrial facilities, prompted by stringent environmental regulations and the need to reduce operational costs. The expansion of the HVAC sector, fueled by growing commercial construction activities and the need for enhanced indoor climate control, also boosts the demand for cooling towers. Technological advancements, such as the adoption of smart cooling systems and the development of hybrid cooling towers, are further propelling market growth by providing more efficient and sustainable solutions. Additionally, the push towards green building standards and certifications encourages the incorporation of advanced cooling technologies that align with sustainability goals. The ongoing modernization of aging infrastructure in developed economies and the rapid industrial growth in emerging markets ensure a steady demand for new and upgraded cooling tower installations, driving the continuous expansion of the market.

Report Scope

The report analyzes the Cooling Towers market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Wet Cooling Towers, Dry Cooling Towers, Hybrid Cooling Towers); End-Use (Power Generation, HVAC, Chemicals, Oil & Gas and Petrochemicals, Food & Beverages, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Wet Towers segment, which is expected to reach US$3.3 Billion by 2030 with a CAGR of 5%. The Dry Towers segment is also set to grow at 3.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 6.4% CAGR to reach $453.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cooling Towers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cooling Towers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cooling Towers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Artech Cooling Towers Pvt. Ltd., Babcock & Wilcox Enterprises, Inc., Baltimore Aircoil Company Inc., Bell Cooling Tower, BERG Chilling Systems, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 118 companies featured in this Cooling Towers market report include:

- Artech Cooling Towers Pvt. Ltd.

- Babcock & Wilcox Enterprises, Inc.

- Baltimore Aircoil Company Inc.

- Bell Cooling Tower

- BERG Chilling Systems, Inc.

- Brentwood Industries, Inc.

- Composite Cooling Solutions L.P

- Cooling Tower Depot, Inc.

- Cooling Tower Systems, Inc.

- Delta Cooling Towers, Inc.

- ENEXIO Management GmbH

- EVAPCO, Inc.

- EWK Equipos de Refrigeracion, S.A.

- FANS a.s.

- ILMED IMPIANTI SRL

- JACIR - GOHL

- JAEGGI Hybridtechnologie AG

- Johnson Controls Inc.

- Kelvion Holding GmbH

- Krones AG

- Liang Chi Industry (THAILAND) Co., Ltd.

- Mastertech Services Inc.

- MESAN Group

- MITA Cooling Technologies Srl

- Paharpur Cooling Tower Limited

- REYMSA COOLING TOWERS, INC.

- Ryowo Holding Co., Ltd.

- S.A. HAMON

- SPX Cooling Technologies, Inc.

- Star Cooling Tower Pvt. Ltd.

- Superchill Australia Pty Ltd.

- Thermal Care Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Artech Cooling Towers Pvt. Ltd.

- Babcock & Wilcox Enterprises, Inc.

- Baltimore Aircoil Company Inc.

- Bell Cooling Tower

- BERG Chilling Systems, Inc.

- Brentwood Industries, Inc.

- Composite Cooling Solutions L.P

- Cooling Tower Depot, Inc.

- Cooling Tower Systems, Inc.

- Delta Cooling Towers, Inc.

- ENEXIO Management GmbH

- EVAPCO, Inc.

- EWK Equipos de Refrigeracion, S.A.

- FANS a.s.

- ILMED IMPIANTI SRL

- JACIR - GOHL

- JAEGGI Hybridtechnologie AG

- Johnson Controls Inc.

- Kelvion Holding GmbH

- Krones AG

- Liang Chi Industry (THAILAND) Co., Ltd.

- Mastertech Services Inc.

- MESAN Group

- MITA Cooling Technologies Srl

- Paharpur Cooling Tower Limited

- REYMSA COOLING TOWERS, INC.

- Ryowo Holding Co., Ltd.

- S.A. HAMON

- SPX Cooling Technologies, Inc.

- Star Cooling Tower Pvt. Ltd.

- Superchill Australia Pty Ltd.

- Thermal Care Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 298 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4 Billion |

| Forecasted Market Value ( USD | $ 5.2 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |