Global Biotechnology Instrumentation Market - Key Trends and Drivers Summarized

The biotechnology industry, at the forefront of scientific advancement, addresses global challenges from disease treatment to sustainable agriculture, spurring demand for sophisticated biotechnology instrumentation. Advancements in this field, driven by investments in R&D, revolutionize genetic, protein, and cellular analyses, impacting healthcare, agriculture, and environmental sciences profoundly. Key market growth drivers include advancements in genomics and proteomics, regulatory compliance, and the expansion of biopharmaceuticals.As the industry evolves, biotechnology instruments will continue to drive innovation in medical diagnostics and environmental biotechnology, with trends leaning towards automation, miniaturization, and integration with AI technologies. Genomics and proteomics advancements necessitate next-generation sequencing devices, mass spectrometers, and chromatography systems, while regulatory standards drive demand for precise instrumentation. The growth of biopharmaceuticals fuels demand for bio-manufacturing instruments, and technological integration enhances efficiency and decision-making processes.

Looking ahead, AI integration and sustainability practices will reshape biotechnology instrumentation, supporting high-throughput screening and expanding point-of-care testing capabilities. Miniaturization allows for flexible use, while AI and machine learning improve data analysis accuracy. With a focus on sustainability and the expansion of point-of-care testing, biotechnology instrumentation continues to evolve, meeting the diverse needs of scientific research and healthcare.

Report Scope

The report analyzes the Biotechnology Instrumentation market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product Segment (Immunoassay Systems, DNA Sequencing Systems, Mass Spectrometry, MicroArrays, Liquid Chromatography Systems, Laboratory Automation, Electrophoresis Systems, Other Product Segments).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Immunoassay Systems segment, which is expected to reach US$26.1 Billion by 2030 with a CAGR of a 4.4%. The DNA Sequencing Systems segment is also set to grow at 7.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $14.7 Billion in 2024, and China, forecasted to grow at an impressive 5.2% CAGR to reach $11.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Biotechnology Instrumentation Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Biotechnology Instrumentation Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Biotechnology Instrumentation Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A&D Company Ltd, Adam Equipment Co. Ltd, Avery Weigh-Tronix LLC, Bonso Electronics International Inc., CAS - USA Corp and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 147 companies featured in this Biotechnology Instrumentation market report include:

- Abbott Laboratories

- Agilent Technologies, Inc.

- Beckman Coulter Inc.

- Bio-Rad Laboratories Inc.

- Bruker Corporation

- GE HealthCare (UK)

- Gilson Inc.

- Harvard Bioscience Inc.

- Hitachi High-Technologies Corp.

- Illumina Inc.

- Lonza Group AG

- PerkinElmer Inc.

- Roche Diagnostics

- Shimadzu Corp.

- Siemens Healthineers

- Thermo Fischer Scientific Inc.

- Waters Corp.)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Agilent Technologies, Inc.

- Beckman Coulter Inc.

- Bio-Rad Laboratories Inc.

- Bruker Corporation

- GE HealthCare (UK)

- Gilson Inc.

- Harvard Bioscience Inc.

- Hitachi High-Technologies Corp.

- Illumina Inc.

- Lonza Group AG

- PerkinElmer Inc.

- Roche Diagnostics

- Shimadzu Corp.

- Siemens Healthineers

- Thermo Fischer Scientific Inc.

- Waters Corp.)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 249 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

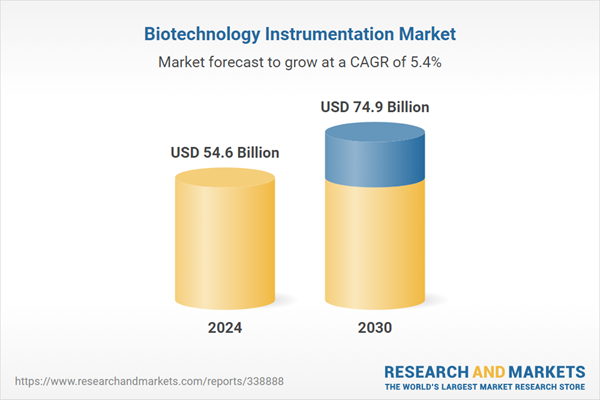

| Estimated Market Value ( USD | $ 54.6 Billion |

| Forecasted Market Value ( USD | $ 74.9 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |