Freeze Drying Equipment - Key Trends and Drivers

Freeze drying, also known as lyophilization, is a dehydration process used extensively in the pharmaceutical and biotechnology industries to preserve perishable materials and improve the shelf life of products. This process involves freezing the material, then reducing the surrounding pressure and adding heat to allow the frozen water in the material to sublimate directly from ice to vapor. This technique is favored for its ability to maintain the stability and activity of products, including active ingredients, without causing damage or degradation. This makes freeze drying particularly advantageous for preparing pharmaceuticals for distribution by stabilizing them, making them lighter, more compact, and extending their shelf life. The pharmaceutical and biotechnology sectors are primary users of freeze drying equipment. As these industries expand, driven by increasing healthcare needs and investment in drug development, the demand for reliable lyophilization equipment to ensure the stability and long-term storage of biologics, vaccines, and other pharmaceuticals continues to rise.The market for freeze drying equipment continues to experience strong growth driven by pharmaceutical, biotechnology, and food industries' expanding needs. Companies invest in advanced, energy-efficient systems to produce high-quality, stable products. Technological advancements, including automation and improved energy efficiency, make freeze drying more accessible and cost-effective, ensuring precise control over the lyophilization process and higher-quality outcomes. Smaller, more versatile units are being developed to suit R&D and experimental uses, allowing researchers to pilot test freeze drying methods on a smaller scale before scaling up to commercial production. This trend supports innovation and development across various sectors by making lyophilization more accessible during the experimental phases.

Advancements in biologics, injectables, and personalized medicine highlight the critical role of freeze drying in stabilizing pharmaceutical products for global distribution. The rise in nutraceuticals and functional foods also drives adoption, preserving nutrients and extending product shelf life. Equipment manufacturers are focusing on developing scalable solutions that can grow with the user's needs. Modular systems that can be upgraded or expanded provide flexibility for businesses to adapt to changing production demands without the need for entirely new systems. The pharmaceutical industry's increasing reliance on freeze drying is underscored by advancements that have enabled the scalability of this technology. Modern freeze drying techniques allow for larger batches of products to be processed efficiently and cost-effectively, reducing errors and enhancing production throughput. This scalability is vital for meeting the growing demand for pharmaceutical products, especially in critical health sectors.

Freeze Drying Equipment - Key Trends and Drivers

Freeze drying, also known as lyophilization, is a dehydration process used extensively in the pharmaceutical and biotechnology industries to preserve perishable materials and improve the shelf life of products. This process involves freezing the material, then reducing the surrounding pressure and adding heat to allow the frozen water in the material to sublimate directly from ice to vapor. This technique is favored for its ability to maintain the stability and activity of products, including active ingredients, without causing damage or degradation. This makes freeze drying particularly advantageous for preparing pharmaceuticals for distribution by stabilizing them, making them lighter, more compact, and extending their shelf life. The pharmaceutical and biotechnology sectors are primary users of freeze drying equipment. As these industries expand, driven by increasing healthcare needs and investment in drug development, the demand for reliable lyophilization equipment to ensure the stability and long-term storage of biologics, vaccines, and other pharmaceuticals continues to rise.The market for freeze drying equipment continues to experience strong growth driven by pharmaceutical, biotechnology, and food industries' expanding needs. Companies invest in advanced, energy-efficient systems to produce high-quality, stable products. Technological advancements, including automation and improved energy efficiency, make freeze drying more accessible and cost-effective, ensuring precise control over the lyophilization process and higher-quality outcomes. Smaller, more versatile units are being developed to suit R&D and experimental uses, allowing researchers to pilot test freeze drying methods on a smaller scale before scaling up to commercial production. This trend supports innovation and development across various sectors by making lyophilization more accessible during the experimental phases.

Advancements in biologics, injectables, and personalized medicine highlight the critical role of freeze drying in stabilizing pharmaceutical products for global distribution. The rise in nutraceuticals and functional foods also drives adoption, preserving nutrients and extending product shelf life. Equipment manufacturers are focusing on developing scalable solutions that can grow with the user's needs. Modular systems that can be upgraded or expanded provide flexibility for businesses to adapt to changing production demands without the need for entirely new systems. The pharmaceutical industry's increasing reliance on freeze drying is underscored by advancements that have enabled the scalability of this technology. Modern freeze drying techniques allow for larger batches of products to be processed efficiently and cost-effectively, reducing errors and enhancing production throughput. This scalability is vital for meeting the growing demand for pharmaceutical products, especially in critical health sectors.

Report Scope

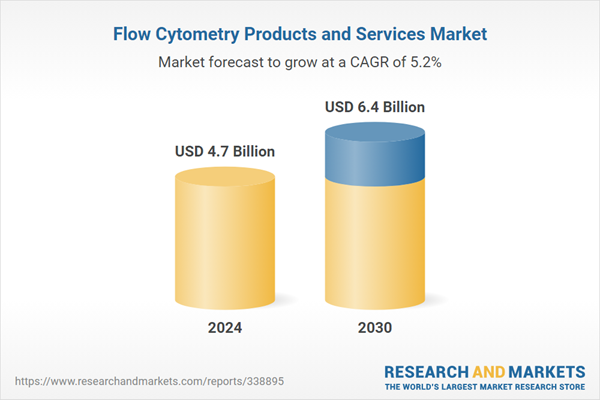

The report analyzes the Flow Cytometry Products and Services market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (Cell-Based Flow Cytometry, Bead-Based Flow Cytometry); Product & Service (Reagents & Consumables, Instruments, Services, Software); Application (Research, Clinical, Industrial).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cell-Based Flow Cytometry segment, which is expected to reach US$3.8 Billion by 2030 with a CAGR of a 5.1%. The Bead-Based Flow Cytometry segment is also set to grow at 5.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.3 Billion in 2024, and China, forecasted to grow at an impressive 8.6% CAGR to reach $1.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Flow Cytometry Products and Services Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Flow Cytometry Products and Services Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Flow Cytometry Products and Services Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Andreas Hettich GmbH & Co. KG, Beckman Coulter, Inc., Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., Drucker Diagnostics and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Flow Cytometry Products and Services market report include:

- Agilent Technologies, Inc.

- Apogee Flow Systems Ltd.

- Beckman Coulter, Inc.

- Becton, Dickinson and Company

- bioMerieux SA

- Bio-Rad Laboratories, Inc.

- Cytonome/ST, LLC

- Enzo Life Sciences, Inc.

- Luminex Corporation

- Merck KGaA

- Miltenyi Biotec GmbH

- Sony Biotechnology, Inc.

- Stratedigm, Inc.

- Sysmex Partec GmbH

- Thermo Fisher Scientific, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agilent Technologies, Inc.

- Apogee Flow Systems Ltd.

- Beckman Coulter, Inc.

- Becton, Dickinson and Company

- bioMerieux SA

- Bio-Rad Laboratories, Inc.

- Cytonome/ST, LLC

- Enzo Life Sciences, Inc.

- Luminex Corporation

- Merck KGaA

- Miltenyi Biotec GmbH

- Sony Biotechnology, Inc.

- Stratedigm, Inc.

- Sysmex Partec GmbH

- Thermo Fisher Scientific, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 375 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.7 Billion |

| Forecasted Market Value ( USD | $ 6.4 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |