Global Watches and Clocks Market - Key Trends & Drivers Summarized

Why Are Watches And Clocks Timeless Instruments?

Watches and clocks have been indispensable tools for tracking time for centuries, evolving from simple mechanical devices to sophisticated digital instruments. Their ability to measure and display the passage of time accurately has made them essential in various aspects of daily life, from coordinating schedules to managing time efficiently. Historically, watches and clocks were primarily valued for their practicality, but over time, they have also become symbols of craftsmanship and luxury. The intricate designs and precision engineering found in high-end timepieces reflect a blend of art and science, making them coveted items for collectors and enthusiasts. Moreover, in an age where digital devices are ubiquitous, traditional watches and clocks retain a unique charm and authenticity, bridging the gap between the past and the present.How Have Technological Advancements Transformed Watches And Clocks?

Technological advancements have significantly transformed the watches and clocks industry, introducing new functionalities and enhancing performance. The advent of quartz technology in the 1960s revolutionized timekeeping, offering unprecedented accuracy and reliability compared to mechanical movements. Digital watches and clocks further expanded the possibilities, integrating features such as alarms, timers, and backlit displays. In recent years, smartwatches have emerged as a major innovation, combining traditional timekeeping with advanced technology. These devices can track fitness metrics, monitor health parameters, and connect to smartphones, providing users with a comprehensive suite of tools on their wrists. Additionally, atomic clocks represent the pinnacle of precision, utilizing the vibrations of atoms to maintain time with incredible accuracy. These technological advancements have not only enhanced the functionality of watches and clocks but have also diversified their applications in various fields, from personal use to scientific research.What Are The Current Trends In The Watches And Clocks Industry?

The watches and clocks industry is currently experiencing several trends that reflect changing consumer preferences and technological progress. One significant trend is the resurgence of vintage and mechanical watches, driven by a growing appreciation for traditional craftsmanship and heritage. Collectors and enthusiasts are increasingly valuing the artistry and history behind these timepieces, leading to a thriving market for both new and pre-owned mechanical watches. Another trend is the rise of smartwatches, which continue to gain popularity due to their multifunctionality and connectivity. Brands are investing in developing sleek, stylish smartwatches that cater to the tech-savvy consumer while maintaining a sense of elegance and luxury. Sustainability is also becoming a key focus, with manufacturers exploring eco-friendly materials and ethical production practices. Furthermore, the integration of augmented reality (AR) and virtual reality (VR) in the retail experience is enhancing customer engagement, allowing buyers to virtually try on watches and clocks before making a purchase.What Are The Key Drivers Of Growth In The Watches And Clocks Market?

The growth in the watches and clocks market is driven by several factors that underscore the dynamic nature of this industry. Firstly, the increasing disposable income and changing lifestyles in emerging economies are boosting the demand for luxury and premium timepieces, as consumers seek to express their status and personal style. Secondly, the continuous technological advancements, particularly in smartwatches, are attracting a younger demographic that values connectivity and multifunctionality. The rising health and fitness awareness is also propelling the adoption of smartwatches with integrated health monitoring features. Additionally, the growing trend of customization and personalization is driving the demand for bespoke and unique timepieces, as consumers seek products that reflect their individuality. The expansion of online retail platforms has further facilitated market growth by making watches and clocks more accessible to a global audience. Lastly, the focus on sustainability and ethical practices is resonating with environmentally conscious consumers, prompting brands to innovate and adopt greener practices, thereby attracting a broader customer base. These factors collectively contribute to the robust growth and continued evolution of the watches and clocks market.Report Scope

The report analyzes the Watches and Clocks market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Category [Mass (Under $50), Middle ($50-$299), Upper ($300-$999), Luxury ($1000 & Above)]; and Type (Quartz, and Mechanical).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Quartz Watches & Clocks segment, which is expected to reach US$52.5 Billion by 2030 with a CAGR of 3.2%. The Mechanical Watches & Clocks segment is also set to grow at 5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $13 Billion in 2024, and China, forecasted to grow at an impressive 5.1% CAGR to reach $9.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Watches and Clocks Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Watches and Clocks Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Watches and Clocks Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alpina Watch International SA, Audemars Piguet, Casio Computer Co., Ltd., Timex Group USA, Tissot SA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 329 companies featured in this Watches and Clocks market report include:

- Alpina Watch International SA

- Audemars Piguet

- Casio Computer Co., Ltd.

- Timex Group USA

- Tissot SA

- Zodiac Watches

- Tiffany & Company

- Tag Heuer International SA

- Rolex SA

- Rhythm Watch Co.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alpina Watch International SA

- Audemars Piguet

- Casio Computer Co., Ltd.

- Timex Group USA

- Tissot SA

- Zodiac Watches

- Tiffany & Company

- Tag Heuer International SA

- Rolex SA

- Rhythm Watch Co.

Table Information

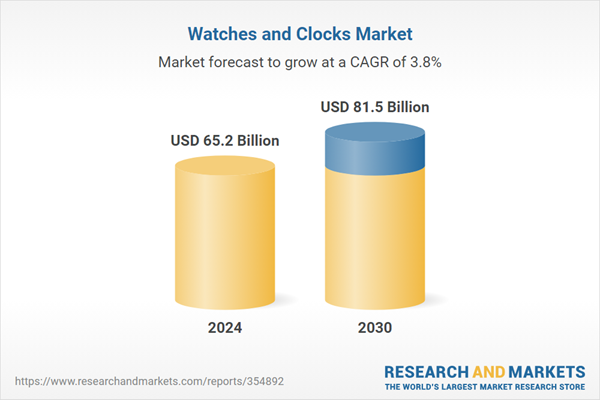

| Report Attribute | Details |

|---|---|

| No. of Pages | 467 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 65.2 Billion |

| Forecasted Market Value ( USD | $ 81.5 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |