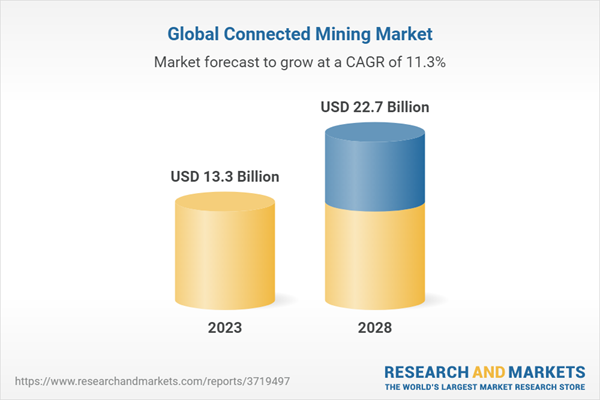

The global connected mining market is expected worth USD 13.3 billion in 2023 and USD 22.7 billion by 2028, growing at CAGR of 11.3% during the forecast period. The connected mining market is witnessing remarkable growth driven by technological advancements and the quest for operational excellence. The industry is realizing the potential of connected mining solutions in optimizing processes, ensuring worker safety, and improving overall efficiency. Connected mining empowers companies to leverage IoT, cloud computing, and data analytics to enable real-time monitoring, remote collaboration, and informed decision-making. This transformative approach reshapes the mining industry, driving productivity, sustainability, and cost-effectiveness. From exploration to resource management, connected mining solutions offer a seamless and integrated approach to enhance operational performance and maintain a competitive edge in the dynamic mining landscape.

The Solution segment to record the higher market share during the forecast period

During the forecast period, the Solution segment is expected to record a higher market share in the connected mining market. Connected mining solutions encompass a comprehensive range of technologies and software applications that enable mining companies to optimize their operations and enhance productivity. The demand for integrated and tailored solutions will surge as the industry continues prioritizing digital transformation and operational efficiency. The Solution segment is poised to dominate the market, providing mining companies the tools and capabilities to address their specific challenges and achieve sustainable growth in a highly competitive landscape.

The Asset tracking and optimization segment to record the higher market share during the forecast period

The Asset Tracking and Optimization segment is expected to record a higher market share during the forecast period in the connected mining market. This segment focuses on solutions that enable mining companies to track and optimize their assets, including vehicles, equipment, and machinery. By leveraging technologies like IoT, GPS, and advanced analytics, mining companies can gain real-time visibility into their assets, enhance operational efficiency, and maximize productivity. The ability to monitor asset location, performance, and utilization empowers mining companies to make data-driven decisions, improve maintenance planning, and optimize resource allocation. As mining companies increasingly recognize the importance of asset tracking and optimization for cost savings and operational excellence, the Asset Tracking and Optimization segment is poised to dominate the market, driving innovation, and reshaping how mining assets are managed.

Asia Pacific region to grow at a higher CAGR during the forecast period

During the forecast period, the Asia Pacific region is projected to experience a higher compound annual growth rate (CAGR) in the connected mining market. The Asia Pacific region boasts significant mineral reserves and is witnessing substantial growth in mining activities. The increasing adoption of advanced technologies, such as IoT, AI, and cloud computing, in the region’s mining industry is driving the demand for connected mining solutions. Moreover, rapid industrialization, urbanization, and infrastructure development fuel the need for efficient resource management and optimized mining operations. As a result, the Asia Pacific region presents lucrative opportunities for connected mining solution providers, positioning it as a key growth market during the forecast period.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The breakdown of the primaries is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level - 35%, Directors - 25%, and Others - 40%

- By Region: North America - 45%, Europe - 20%, APAC - 30%, ROW - 5%

The major players in the connected mining market are ABB (Switzerland), IBM (US), SAP (Germany), Cisco (US), Schneider Electric (France), Komatsu (Japan), Hexagon (Sweden), Caterpillar (US), Rockwell Automation (US), Trimble (US), Siemens (Germany), Howden (Scotland), Accenture (Ireland), PTC (US), Hitachi (Japan), Eurotech Communication (Israel), Wipro (India), MST Global (US), GE Digital (US), Symboticware (Canada), Getac (Taiwan), IntelliSense.io (UK), Zyfra (Finland), Axora (UK), GroundHog (US), SmartMining SpA (Chile), and Applied Vehicle Analysis (Africa). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, product launches and enhancements, and acquisitions to expand their footprint in the connected mining market.

Research Coverage

The market study covers the connected mining market across different segments. It aims at estimating the market size and the growth potential across different segments based on offerings, services, applications, end users, applications, and regions. The study also includes an in-depth competitive analysis of the key market players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the global connected mining market and its subsegments. This report will help stakeholders understand the competitive landscape and gain insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market’s pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- The connected mining market report identifies several key drivers for its growth, including the rising demand for operational efficiency, safety, and sustainability in the mining industry. Mining operations' increasing complexity and scale necessitate seamless communication and data-driven decision-making, driving the adoption of connected mining solutions. Additionally, advancements in technologies such as IoT, AI, and cloud computing enable real-time monitoring, automation, and optimization of mining processes. While the report acknowledges potential challenges like the need for skilled professionals and regulatory compliance, it highlights significant opportunities for growth, such as improved resource management, reduced downtime, and enhanced worker safety. With increasing adoption of connected mining solutions and the industry's focus on digital transformation, the report provides the outlook for the connected mining market during the forecast period.

- Product Development/Innovation: Detailed insights on coming technologies, R&D activities, and product & solution launches in the connected mining market

- Market Development: Comprehensive information about lucrative markets - the report analyses the connected mining market across varied regions

- Market Diversification: Exhaustive information about new products & solutions being developed, untapped geographies, recent developments, and investments in the connected mining market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like ABB (Switzerland), IBM (US), SAP (Germany), Cisco (US), Schneider Electric (France), Komatsu (Japan), Hexagon (Sweden), Caterpillar (US), Rockwell Automation (US), Trimble (US), Siemens (Germany), Howden (Scotland), Accenture (Ireland), PTC (US), Hitachi (Japan), Eurotech Communication (Israel), Wipro (India), MST Global (US), GE Digital (US), Symboticware (Canada), Getac (Taiwan), IntelliSense.io (UK), Zyfra (Finland) Axora (UK), GroundHog (US), SmartMining SpA (Chile), and Applied Vehicle Analysis (Africa).

Table of Contents

Companies Mentioned

- Abb Ltd.

- Accenture

- Applied Vehicle Analysis

- Axora

- Caterpillar Inc.

- Cisco

- Eurotech Communication

- GE Digital

- Getac

- Groundhog

- Hexagon Ab

- Hitachi Construction Machinery

- Howden

- Ibm

- Intellisense.Io

- Komatsu

- Mst Global

- Ptc

- Rockwell Automation, Inc.

- Sap

- Schneider Electric

- Siemens

- Smartmining

- Symboticware

- Trimble Inc.

- Wipro

- Zyfra

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 281 |

| Published | August 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 13.3 Billion |

| Forecasted Market Value ( USD | $ 22.7 Billion |

| Compound Annual Growth Rate | 11.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |