The industry has also seen the advancement of high power Insulated Gate Bipolar Transistors (IGBT), which has reduced the size of the HVDC power supply system and generated significant financial gains. The only feasible option now on the market that can be used with renewable energy sources is the HVDC power supply, which increases the dependability of an electrical system. These products’ effective bulk power transmission over long distances has greatly aided the development of direct-drive wind turbines, which promotes the long-term sustainability of the current energy infrastructure. The introduction of 4G and 5G networks causes constant growth in the industry as the need for power for telecom base station equipment rises.

Another factor driving the industry growth is 5G deployment, which will have modest growth between 2020 and 2022 as 5G investment steadily picks up worldwide, with major growth most likely to occur around 2025. Electric systems are also growing more complex as a result of a rise in feed-in nodes brought on by the increased grid expansion demand. As a result, there is a higher chance that there will be partial or complete blackouts, which happen when power flow exceeds design parameters. It is anticipated that the PGCIL, Global Wind Energy Council, and EUROPA would create advantageous public policies that will considerably aid the expansion of the offshore wind industry, thus supporting the industry

In India, transmission corridor requests from grid operators are increasing, especially in light of the advancement of renewable energies. Regeneration has been given priority by the government in this situation, and PGCIL was awarded the contract to construct an eco-friendly source for producing electricity from wind and solar power projects. Due to substantial investments made by industry players like Siemens and ABB, offshore HVDC power supply power transmission systems have been established in countries like Italy, Norway, and the Netherlands. Such initiatives undertaken for industry growth are expected to support the OEMs in expanding their overall share.

High Voltage Direct Current Power Supply Market Report Highlights

- The industrial segment accounted for the largest revenue share in 2022 and will expand further at a steady CAGR from 2023 to 2030

- This is mainly due to the rapid industrialization in developing nations like China & India and the high demand for reliable electricity supply

- The telecommunication application segment is anticipated to witness a healthy CAGR from 2023 to 2030

- The growth is attributable to the dependable and long-distance transmission with little loss provided by these items

- The extensive use of the internet has accelerated infrastructure construction, which could have a significant impact on the segment's as well as overall industry growth

- The >4,000 V segment accounted for the largest revenue share in 2022 due to the various characteristics offered by these products, such as reduced output noise, development of an automated high-voltage test system, and improved sourcing precision, and measurement sensitivity

Table of Contents

Chapter 1. Methodology and Scope1.1. Methodology Segmentation & Scope

1.2. Information Procurement

1.2.1. Purchased database

1.2.2. internal database

1.2.3. Secondary sources & third-party perspectives

1.2.4. Primary research

1.3. Information Analysis

1.3.1. Data analysis models

1.4. Market Formulation & Data Visualization

1.5. Data Validation & Publishing

Chapter 2. Executive Summary

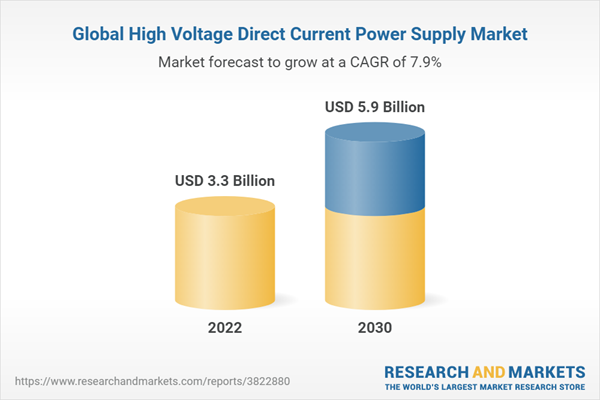

2.1. High Voltage Direct Current Power Supply Market - Industry Snapshot, 2018 - 2030

Chapter 3. High Voltage Direct Current Power Supply Market Variables, Trends & Scope

3.1. Market Size and Growth Prospects, 2018 - 2030

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Driver Analysis

3.3.2. Market Restraint/Challenge Analysis

3.3.3. Market Opportunity Analysis

3.4. Penetration & Growth Prospect Mapping (Key Opportunities Prioritized)

3.5. Business Environment Analysis Tools

3.5.1. Industry Analysis - Porter's Five Forces Analysis

3.5.2. PEST Analysis

3.5.3. COVID-19 Impact Analysis

Chapter 4. HVDC Power Supply Voltage Outlook

4.1. < 1000V

4.1.1. Market estimates and forecasts by region, 2018 - 2030 (USD Billion)

4.2. 1000-4000V

4.2.1. Market estimates and forecasts by region, 2018 - 2030 (USD Billion)

4.3. >4000V

4.3.1. Market estimates and forecasts by region, 2018 - 2030 (USD Billion)

Chapter 5. HVDC Power Supply Application Outlook

5.1. Telecommunication

5.1.1. Market estimates and forecasts by region, 2018 - 2030 (USD Billion)

5.2. Medical

5.2.1. Market estimates and forecasts by region, 2018 - 2030 (USD Billion)

5.3. Industrial

5.3.1. Market estimates and forecasts by region, 2018 - 2030 (USD Billion)

5.4. Oil & Gas

5.4.1. Market estimates and forecasts by region, 2018 - 2030 (USD Billion)

5.5. Others

5.5.1. Market estimates and forecasts by region, 2018 - 2030 (USD Billion)

Chapter 6. HVDC Power Supply Regional Outlook

6.1. North America

6.1.1. North America market by voltage, 2018 - 2030 (USD Billion)

6.1.2. North America market by application, 2018 - 2030 (USD Billion)

6.1.3. The U.S.

6.1.3.1. The U.S. market by voltage, 2018 - 2030 (USD Billion)

6.1.3.2. The U.S. market by application, 2018 - 2030 (USD Billion)

6.1.4. Canada

6.1.4.1. Canada market by voltage, 2018 - 2030 (USD Billion)

6.1.4.2. Canada market by application, 2018 - 2030 (USD Billion)

6.2. Europe

6.2.1. Europe market by voltage, 2018 - 2030 (USD Billion)

6.2.2. Europe market by application, 2018 - 2030 (USD Billion)

6.2.3. Germany

6.2.3.1. Germany market by voltage, 2018 - 2030 (USD Billion)

6.2.3.2. Germany market by application, 2018 - 2030 (USD Billion)

6.2.4. U.K.

6.2.4.1. The U.K. market by voltage, 2018 - 2030 (USD Billion)

6.2.4.2. The U.K. market by application, 2018 - 2030 (USD Billion)

6.2.5. France

6.2.5.1. France market by voltage, 2018 - 2030 (USD Billion)

6.2.5.2. France market by application, 2018 - 2030 (USD Billion)

6.2.6. Rest of Europe

6.2.6.1. Rest of Europe market by voltage, 2018 - 2030 (USD Billion)

6.2.6.2. Rest of Europe market by application, 2018 - 2030 (USD Billion)

6.3. Asia Pacific

6.3.1. Asia Pacific market by voltage, 2018 - 2030 (USD Billion)

6.3.2. Asia Pacific market by application, 2018 - 2030 (USD Billion)

6.3.3. China

6.3.3.1. China market by voltage, 2018 - 2030 (USD Billion)

6.3.3.2. China market by application, 2018 - 2030 (USD Billion)

6.3.4. India

6.3.4.1. India market by voltage, 2018 - 2030 (USD Billion)

6.3.4.2. India market by application, 2018 - 2030 (USD Billion)

6.3.5. Japan

6.3.5.1. Japan market by voltage, 2018 - 2030 (USD Billion)

6.3.5.2. Japan market by application, 2018 - 2030 (USD Billion)

6.3.6. Rest of Asia Pacific

6.3.6.1. Rest of Asia Pacific market by voltage, 2018 - 2030 (USD Billion)

6.3.6.2. Rest of Asia Pacific market by application, 2018 - 2030 (USD Billion)

6.4. Latin America

6.4.1. Latin America market by voltage, 2018 - 2030 (USD Billion)

6.4.2. Latin America market by application, 2018 - 2030 (USD Billion)

6.4.3. Brazil

6.4.3.1. Brazil market by voltage, 2018 - 2030 (USD Billion)

6.4.3.2. Brazil market by application, 2018 - 2030 (USD Billion)

6.4. Mexico

6.4.4.1. Brazil market by voltage, 2018 - 2030 (USD Billion)

6.4.4.2. Brazil market by application, 2018 - 2030 (USD Billion)

6.4.5. Rest of Latin America

6.4.5.1. Rest of Latin America market by voltage, 2018 - 2030 (USD Billion)

6.4.5.2. Rest of Latin America market by application, 2018 - 2030 (USD Billion)

6.5. Middle East & Africa

6.5.1. Middle East & Africa market by voltage, 2018 - 2030 (USD Billion)

6.5.2. Middle East & Africa market by application, 2018 - 2030 (USD Billion)

Chapter 7. Competitive Landscape

7.1. ABB

7.1.1. Revenue Analysis

7.1.2. Product Benchmarking

7.1.3. Strategic Development

7.2. AHV

7.2.1. Revenue Analysis

7.2.2. Product Benchmarking

7.2.3. Strategic Development

7.3. American Power Design (APD)

7.3.1. Revenue Analysis

7.3.2. Product Benchmarking

7.3.3. Strategic Development

7.4. Applied Kilovolts (Exelis)

7.4.1. Revenue Analysis

7.4.2. Product Benchmarking

7.4.3. Strategic Development

7.5. Excelitas Technologies Corp.

7.5.1. Revenue Analysis

7.5.2. Product Benchmarking

7.5.3. Strategic Development

7.6. General Electric

7.6.1. Revenue Analysis

7.6.2. Product Benchmarking

7.6.3. Strategic Development

7.7. Glassman Europe Ltd.

7.7.1. Revenue Analysis

7.7.2. Product Benchmarking

7.7.3. Strategic Development

7.8. Hamamatsu

7.8.1. Revenue Analysis

7.8.2. Product Benchmarking

7.8.3. Strategic Development

7.9. Siemens AG

7.9.1. Revenue Analysis

7.9.2. Product Benchmarking

7.9.3. Strategic Development

7.10. Toshiba Corp.

7.10.1. Revenue Analysis

7.10.2. Product Benchmarking

7.10.3. Strategic Development

7.11. XP Power (EMCO high voltage)

7.11.1. Revenue Analysis

7.11.2. Product Benchmarking

7.11.3. Strategic Development

List of Tables

Table 1 HVDC power supply - Industry snapshot & key buying criteria

TABLE 2 HVDC power supply market, 2018 - 2030 (USD Million)

TABLE 3 HVDC power supply market by region, 2018 - 2030 (USD Million)

TABLE 4 HVDC power supply market by voltage, 2018 - 2030 (USD Million)

TABLE 5 HVDC power supply market by application, 2018 - 2030 (USD Million)

TABLE 6 HVDC power supply - Key market driver impact

TABLE 7 HVDC power supply - Key market restraint impact

TABLE 8 < 1000V demand in HVDC power supply market, 2018 - 2030 (USD Million)

TABLE 9 < 1000V demand in HVDC power supply market by region, 2018 - 2030 (USD Million)

TABLE 10 1000-4000V demand in HVDC power supply market, 2018 - 2030 (USD Million)

TABLE 11 1000-4000V demand in HVDC power supply market by region, 2018 - 2030 (USD Million)

TABLE 12 >4000V demand in HVDC power supply market, 2018 - 2030 (USD Million)

TABLE 13 >4000V demand in HVDC power supply market by region, 2018 - 2030 (USD Million)

TABLE 14 Telecommunication demand in HVDC power supply market, 2018 - 2030 (USD Million)

TABLE 15 Telecommunication demand in HVDC power supply market by region, 2018 - 2030 (USD Million)

TABLE 16 Medical demand in HVDC power supply market, 2018 - 2030 (USD Million)

TABLE 17 Medical demand in HVDC power supply market by region, 2018 - 2030 (USD Million)

TABLE 18 Industrial demand in HVDC power supply market, 2018 - 2030 (USD Million)

TABLE 19 Industrial demand in HVDC power supply market by region, 2018 - 2030 (USD Million)

TABLE 20 Oil & gas demand in HVDC power supply market, 2018 - 2030 (USD Million)

TABLE 21 Oil & gas demand in HVDC power supply market by region, 2018 - 2030 (USD Million)

TABLE 22 Others demand in HVDC power supply market, 2018 - 2030 (USD Million)

TABLE 23 Others demand in HVDC power supply market by region, 2018 - 2030 (USD Million)

TABLE 24 North America market by voltage, 2018 - 2030 (USD Million)

TABLE 25 North America market by application, 2018 - 2030 (USD Million)

TABLE 26 U.S. market by voltage, 2018 - 2030 (USD Million)

TABLE 27 U.S. market by application, 2018 - 2030 (USD Million)

TABLE 28 Canada market by voltage, 2018 - 2030 (USD Million)

TABLE 29 Canada market by application, 2018 - 2030 (USD Million)

TABLE 30 Europe market by voltage, 2018 - 2030 (USD Million)

TABLE 31 Europe market by application, 2018 - 2030 (USD Million)

TABLE 32 Germany market by voltage, 2018 - 2030 (USD Million)

TABLE 33 Germany market by application, 2018 - 2030 (USD Million)

TABLE 34 U.K. market by voltage, 2018 - 2030 (USD Million)

TABLE 35 U.K. market by application, 2018 - 2030 (USD Million)

TABLE 36 France market by voltage, 2018 - 2030 (USD Million)

TABLE 37 France market by application, 2018 - 2030 (USD Million)

TABLE 38 Rest of Europe market by voltage, 2018 - 2030 (USD Million)

TABLE 39 Rest of Europe market by application, 2018 - 2030 (USD Million)

TABLE 40 Asia Pacific market by voltage, 2018 - 2030 (USD Million)

TABLE 41 Asia Pacific market by application, 2018 - 2030 (USD Million)

TABLE 42 China market by voltage, 2018 - 2030 (USD Million)

TABLE 43 China market by application, 2018 - 2030 (USD Million)

TABLE 44 India market by voltage, 2018 - 2030 (USD Million)

TABLE 45 India market by application, 2018 - 2030 (USD Million)

TABLE 46 Japan market by voltage, 2018 - 2030 (USD Million)

TABLE 47 Japan market by application, 2018 - 2030 (USD Million)

TABLE 48 Rest of Asia Pacific market by voltage, 2018 - 2030 (USD Million)

TABLE 49 Rest of Asia Pacific market by application, 2018 - 2030 (USD Million)

TABLE 50 Latin America market by voltage, 2018 - 2030 (USD Million)

TABLE 51 Latin America market by application, 2018 - 2030 (USD Million)

TABLE 52 Brazil market by voltage, 2018 - 2030 (USD Million)

TABLE 53 Brazil market by application, 2018 - 2030 (USD Million)

TABLE 54 Mexico market by voltage, 2018 - 2030 (USD Million)

TABLE 55 Mexico market by application, 2018 - 2030 (USD Million)

TABLE 56 Rest of Latin America market by voltage, 2018 - 2030 (USD Million)

TABLE 57 Rest of Latin America market by application, 2018 - 2030 (USD Million)

TABLE 58 Middle East & Africa market by voltage, 2018 - 2030 (USD Million)

TABLE 59 Middle East & Africa market by application, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 HVDC power supply market segmentation

FIG. 2 HVDC power supply market, 2018 - 2030 (USD Billion)

FIG. 3 HVDC power supply value chain analysis

FIG. 4 HVDC power supply market dynamics

FIG. 5 Energy consumption across countries (in TWh)

FIG. 6 Key opportunities prioritized

FIG. 7 HVDC power supply - Porter’s Five Forces analysis

FIG. 8 HVDC power supply - PESTEL analysis

FIG. 9 HVDC power supply market share by voltage, 2022 & 2030

FIG. 10 HVDC power supply market share by application, 2022 & 2030

FIG. 11 HVDC power supply market share by region, 2022 & 2030

Companies Mentioned

- ABB

- AHV

- American Power Design (APD)

- Applied Kilovolts (Exelis)

- Excelitas Technologies Corp.

- General Electric

- Glassman Europe Ltd.

- Hamamatsu

- Siemens AG

- Toshiba Corp.

- XP Power (EMCO high voltage)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | February 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 3.3 Billion |

| Forecasted Market Value ( USD | $ 5.9 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |