Construction represents close to a 13% share of the global GDP. Thus, a short impact on the sector affects the materials demand, thereby reducing the growth of the market. Most of the construction sites during the first half of 2020 faced numerous challenges associated with operations and supply chains. However, the market started recovering in 2021. Construction spending on infrastructure projects is likely to rise in 2022, on account of the passage of public and private investments.

Focus on sustainable construction and infrastructure projects is anticipated to assist the market growth during the coming years. Governments may provide stimulation to the economy by encouraging carbon reduction targets. These incentives might come in the form of direct public funds and policy changes. Companies expect demand for sustainable buildings and communities that promote healthier lifestyles, which is anticipated to drive the demand for construction adhesives.

The adoption of digitization and emerging technologies is another key factor, which is likely to provide a boost to the building & construction sector and associated materials over the long term. Contractors are likely to use remote collaboration at various stages of projects using digital models. Distributors of adhesives and other building materials are focusing on minimal physical interactions, especially with e-commerce sites for which sales teams can handle customers and orders with digital tools.

Investments in construction and infrastructure projects are anticipated to drive market growth in the long run. For instance, the Indian government has plans to double its infrastructure investments in sectors such as communication, commercial infrastructure, energy, and water & sanitation over the next five years, as of 2021. Also, as per the National Infrastructure Pipeline, there are over 6,800 identified projects worth USD 15 million in the country. Projects such as airport development in smart cities and Pradhan Mantri Sadak Yojna Project are likely to offer new opportunities for market players.

Construction Adhesives Market Report Highlights

- Polyvinyl acetate resins witnessed the fastest growth rate with a CAGR of nearly 5.9%. These adhesives do not contain solvents and are therefore useful to consolidate porous construction materials such as sandstone

- Reactive & other technology witnessed the fastest growth rate with a CAGR of nearly 5.2%. These technologies exhibit long-term durability and high bond strength under severe environmental conditions

- Commercial applications witnessed the fastest growth rate with a CAGR of nearly 5.4% from 2024 to 2030. The segment growth over the anticipated period is anticipated to profit from the rising number of commercial buildings, such as pharmacies, grocery stores, and large box stores that have been constructed over the past few years

- The Asia Pacific region dominated the market with the highest revenue share of 39.39% in 2023. The market is growing due to factors such as strong economic development coupled with population expansion in countries such as China and India is expected to increase construction spending in Asia Pacific over the forecasted period

- Henkel AG & Co. KGaA, Dow, 3M, Arkema, and H.B. Fuller companies dominated the market with their continuous involvement in acquisitions, partnerships, and manufacturing facility expansions

Table of Contents

Companies Profiled

- H.B. Fuller Company

- 3M

- Sika AG

- Dow Inc.

- Bostik (Arkema Group)

- Henkel AG & Co. KGaA

- Franklin International, Inc.

- Avery Dennison Corporation

- Illinois Tool Works Incorporation

- DAP Products Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | November 2023 |

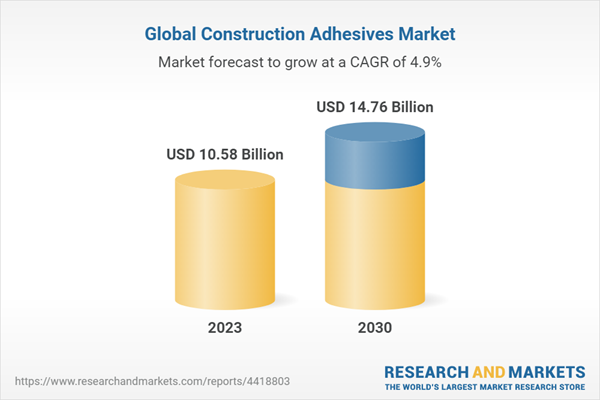

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 10.58 Billion |

| Forecasted Market Value ( USD | $ 14.76 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |