Global Automotive Brakes and Clutches Market - Key Trends & Drivers Summarized

Automotive brakes and clutches are critical components in vehicle systems, playing essential roles in safety and performance. Brakes are responsible for decelerating or stopping the vehicle by converting kinetic energy into thermal energy through friction. There are various types of braking systems, including disc brakes, drum brakes, and regenerative brakes. Disc brakes are widely used due to their efficiency and cooling capabilities, while drum brakes are commonly found in older or more budget-friendly models. Regenerative braking, primarily utilized in electric and hybrid vehicles, recaptures energy during braking to enhance efficiency. Clutches, on the other hand, connect and disconnect the engine from the transmission, allowing for smooth gear changes. They are vital in manual transmission vehicles, providing control over the engagement and disengagement of power. Modern vehicles often use single-plate dry clutches, but advancements have led to dual-clutch systems offering faster shifts and improved fuel efficiency.The growth in the automotive brakes and clutches market is driven by several factors. Technological advancements, such as the integration of advanced driver-assistance systems (ADAS) and autonomous driving technologies, have increased the demand for sophisticated braking systems capable of precise control and rapid response. The rise of electric and hybrid vehicles has also spurred innovation in regenerative braking systems, as manufacturers seek to maximize energy efficiency and range. Additionally, increasing consumer awareness of safety and regulatory mandates for safer vehicles have pushed manufacturers to incorporate advanced braking technologies, such as ABS and ESC, as standard features. Urbanization and the expanding middle class in emerging markets have led to a surge in vehicle ownership, further driving demand. Finally, the trend towards lightweight vehicles for improved fuel efficiency has necessitated the development of advanced materials for brakes and clutches, balancing performance with weight reduction. These factors collectively underscore the dynamic and evolving nature of the automotive brakes and clutches market.

The development of automotive brakes and clutches has been marked by continuous innovation aimed at improving performance, durability, and user experience. Anti-lock braking systems (ABS) and electronic stability control (ESC) have become standard features, enhancing safety by preventing wheel lock-up and maintaining vehicle control during emergencies. In the realm of clutches, the advent of automated manual transmissions (AMTs) and continuously variable transmissions (CVTs) has reduced the reliance on traditional clutch systems, integrating automated clutches for seamless operation. Furthermore, advancements in materials science have introduced ceramics and carbon composites in high-performance and racing applications, providing superior heat resistance and longevity compared to conventional materials. These innovations have not only enhanced the functionality of brakes and clutches but also contributed to the overall efficiency and safety of modern vehicles.

Report Scope

The report analyzes the Automotive Brakes and Clutches market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Distribution Channel (OEM, Aftermarket); End-Use (Passenger Cars, Commercial Vehicles).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the OEM Distribution Channel segment, which is expected to reach US$25.6 Billion by 2030 with a CAGR of 4.5%. The Aftermarket Distribution Channel segment is also set to grow at 3.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $8.5 Billion in 2024, and China, forecasted to grow at an impressive 6.3% CAGR to reach $5.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Brakes and Clutches Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Brakes and Clutches Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Brakes and Clutches Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Advics Co. Ltd., Aisin Seiki Co. Ltd., Akebono Brake Industry Co. Ltd., Bendix Commercial Vehicle Systems, BorgWarner Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 69 companies featured in this Automotive Brakes and Clutches market report include:

- Advics Co. Ltd.

- Aisin Seiki Co. Ltd.

- Akebono Brake Industry Co. Ltd.

- Bendix Commercial Vehicle Systems

- BorgWarner Inc.

- Brembo S.P.A

- Continental Automotive Systems (CAS)

- Dana Incorporated

- Exedy Corporation

- F.C.C. Co., Ltd.

- Knorr-Bremse AG

- Nisshinbo Brake Inc.

- Robert Bosch GmbH

- Schaeffler Technologies AG & Co. KG

- TRW Automotive

- Valeo SA

- ZF Japan Co. Ltd.

- ZF Sachs AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advics Co. Ltd.

- Aisin Seiki Co. Ltd.

- Akebono Brake Industry Co. Ltd.

- Bendix Commercial Vehicle Systems

- BorgWarner Inc.

- Brembo S.P.A

- Continental Automotive Systems (CAS)

- Dana Incorporated

- Exedy Corporation

- F.C.C. Co., Ltd.

- Knorr-Bremse AG

- Nisshinbo Brake Inc.

- Robert Bosch GmbH

- Schaeffler Technologies AG & Co. KG

- TRW Automotive

- Valeo SA

- ZF Japan Co. Ltd.

- ZF Sachs AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 393 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

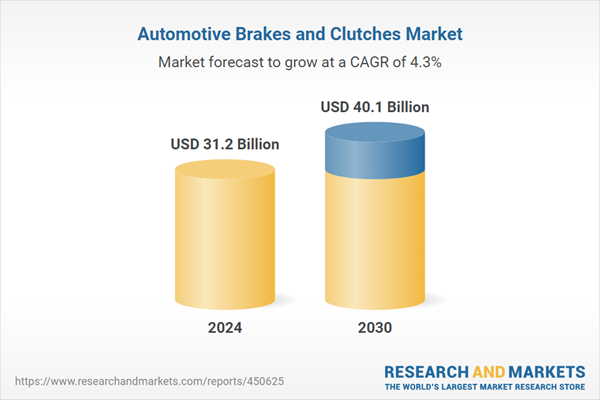

| Estimated Market Value ( USD | $ 31.2 Billion |

| Forecasted Market Value ( USD | $ 40.1 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |