According to the Centers for Disease Control and Prevention (CDC), U.S., in 2019, some of the largest tobacco companies spent close to USD 8.2 billion on the marketing of cigarettes and smokeless tobacco in the U.S. This amount translates to about USD 22.5 million each day, or nearly USD 1 million every hour, which indicates the continued consumption of tobacco products across the country. Furthermore, the introduction of innovative tobacco products in varied taste options has become imperative, as consumers are gradually inclining toward smoking alternatives.

The cigarettes segment accounted for the largest revenue share of over 86.0% in 2021 as the American Indians/Alaska Natives (AI/ANs) have a higher prevalence of smoking compared to the other racial/ethnic groups present in the U.S. According to the CDC, in 2019, nearly 20.9% of AI/AN adults in the U.S. smoked cigarettes, compared with 14.0% of U.S. adults overall. Moreover, tobacco sold on tribal lands is typically not subject to state and national taxes, thus, reducing cost and supporting high smoking levels. Lower prices are connected to increased smoking rates, driving consumption.

The offline segment accounted for the largest revenue share in 2021 and is expected to maintain its dominance over the forecast period. Consumers buy tobacco products from offline stores owing to increased access to more retail distribution channels. The Food and Drugs Administration (FDA) has issued regulations regarding the promotion and marketing of tobacco products sold or distributed online or through non-face-to-face transactions to prevent the sale of tobacco to minors.

The U.S. market for tobacco is highly competitive and dominated by large multinational tobacco manufacturing companies. Some of the key manufacturers operating in the country include Pyxus International, Inc.; Swedish Match AB; Altria Group, Inc.; Korea Tobacco & Ginseng Corporation; Imperial Brands; Philip Morris International; Universal Corporation; Japan Tobacco Inc.; Scandinavian Tobacco Group; and Vector Group LTD. These players face intense competition, especially from the top market players, as they have a large consumer base, strong brand recognition, and vast distribution networks.

U.S. Tobacco Market Report Highlights

- The Southeast region is expected to register a CAGR of 2.2% during forecast years as major cities including West Virginia and Kentucky have the highest smoking rates and tobacco use.

- The new generation tobacco products segment is expected to register the fastest CAGR of around 10.3% from 2022 to 2030. Market players have introduced novel products such as e-cigarettes, and heated tobacco products, to reduce the risk of tobacco-related diseases and harm caused by them.

- The online segment is expected to register a CAGR of around 4.7% over the forecast period, due to the ease of buying, and benefits like doorstep delivery, additional discounts, and access to several brands.

Table of Contents

Companies Mentioned

- Pyxus International, Inc.

- Swedish Match Ab

- Altria Group, Inc.

- Korea Tobacco & Ginseng Corporation

- Imperial Brands

- Philip Morris International

- Universal Corporation

- Japan Tobacco Inc.

- Scandinavian Tobacco Group

- Vector Group Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | April 2022 |

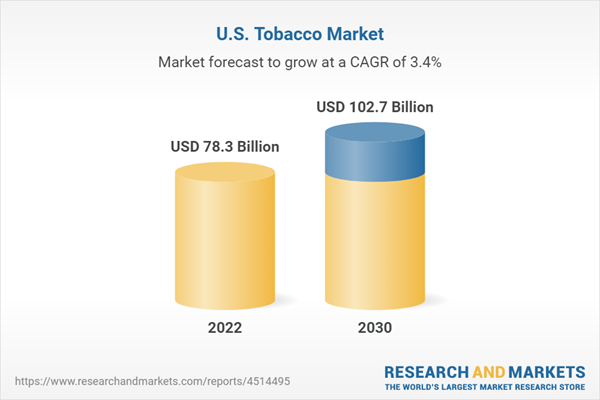

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 78.3 Billion |

| Forecasted Market Value ( USD | $ 102.7 Billion |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |