The COVID-19 pandemic in 2021 negatively affected the market due to lockdowns and the temporary shutdown of manufacturing plants. Moreover, renewable ethanol producers were actively involved in an effort to contain the pandemic across the European Union. Even as they continue to deliver the necessary volumes of fuel ethanol, refineries are shifting parts of their production from biofuels to ethyl alcohol for use as disinfectants and hand sanitizers, and producers are working with national EU governments to ensure increased production and maintain supply chains.

Key Highlights

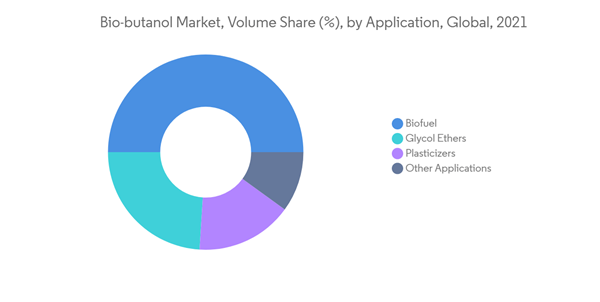

- Major factors driving the market studied are the reduction of carbon emissions to a great extent and gaining prominence as a building block for chemical manufacturing. Technological challenges in production are expected to hinder the growth of the market studied.

- The acrylates segment dominated the market, and it is expected to grow at a significant rate during the forecast period due to the increasing production of butyl acrylates.

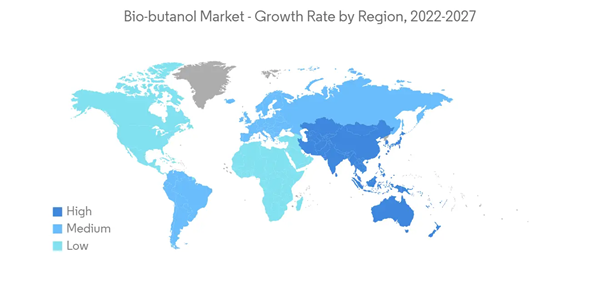

- The Asia-Pacific region was the largest consumer of bio-butanol. Growing production of coatings, adhesives, resins, and textiles in countries such as China, India, and Japan are driving the market growth.

Bio-butanol Market Trends

Acrylates to Dominate the Market

- Biobutanol is used as an intermediate for the production of butyl acrylates, which are used in the production of paints and coatings, adhesives, and textiles, among others.

- The Asia-Pacific region is the major consumer of butyl acrylates, majorly dominated by Japan, followed by North America and Europe. The demand for butyl acrylate is expected to be the highest in the Asia-Pacific region, owing to the increasing production of adhesives, textiles, and coatings, followed by the Middle-East and African region.

- Arkema Group, BASF SE, BASF Petronas Chemicals Sdn Bhd, CNPC, and Dow are some of the major manufacturers of butyl acrylates. Few of the above-mentioned companies are focusing on increasing the production capacity of butyl acrylate due to the increasing demand.

- In August 2021, BASF SE and SINOPEC planned to expand their Verbund site operated by a 50-50 joint venture, namely, BASF-YPC Co. Ltd (BASF-YPC), in Nanjing, China. It includes the capacity expansion of various downstream chemical plants, including a new tert-butyl acrylate plant, to cater to the growing Chinese market. The expanded and new plants are planned to come on stream in 2023.

- Thus, acrylates are excepted to dominate the market during the forecast period.

The Asia-Pacific Region to Dominate the Market

- In the Asia-Pacific region, China accounts for the largest market share in bio-butanol consumption. The country is the largest producer of paints and coatings in the Asia-Pacific region, with an estimated coating production of more than 15 million metric ton, which is expected to increase significantly in the near future.

- China is the world's largest plastic producer, accounting for nearly one-third of the global plastic production at present. Moreover, the country averaged 6.5 million ton to 7.5 million ton of plastics product production from August 2020 to August 2021.

- In May 2021, PPG announced the completion of its USD 13 million investment in its Jiading, China, paints and coatings facility, including eight new powder coating production lines and an expanded powder coatings technology center that is expected to enhance PPG’s R&D capabilities. The expansion is likely to increase the plant’s capacity by more than 8,000 metric ton per year.

- The Indian chemical industry produces 80,000 different chemical products, covering bulk chemicals, specialty chemicals, agrochemicals, petrochemicals, polymers, and fertilizers. According to the India Brand Equity Foundation (IBEF), the domestic chemicals sector's small and medium enterprises are expected to showcase an 18%-23% revenue growth in FY22, owing to an improvement in domestic demand.

- Such aforementioned factors are expected to drive the market growth over the forecast period.

Bio-butanol Market Competitor Analysis

The bio-butanol market is in the nascent stage and is apparently a consolidated one. The key players include Cathay Industrial Biotech, Gevo Inc., GranBio, Eastman Chemical Company, and Abengoa.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions

1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Drivers

4.1.1 Growing Emphasis on Reduction in Carbon Emissions

4.1.2 Gaining Prominence as a Building Block for Chemical Manufacturing

4.2 Restraints

4.2.1 Technological Challenges in Production

4.2.2 High Production Cost

4.2.3 Unfavorable Conditions Due to the COVID-19 Outbreak

4.3 Industry Value Chain Analysis

4.4 Porter's Five Forces Analysis

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Power of Consumers

4.4.3 Threat of New Entrants

4.4.4 Threat of Substitute Products and Services

4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

5.1 Application

5.1.1 Acrylates

5.1.2 Acetates

5.1.3 Glycol ethers

5.1.4 Plasticizers

5.1.5 Biofuel

5.1.6 Other Applications

5.2 Geography

5.2.1 Asia-Pacific

5.2.1.1 China

5.2.1.2 India

5.2.1.3 Japan

5.2.1.4 South Korea

5.2.1.5 Rest of Asia-Pacific

5.2.2 North America

5.2.2.1 United States

5.2.2.2 Canada

5.2.2.3 Mexico

5.2.3 Europe

5.2.3.1 Germany

5.2.3.2 United Kingdom

5.2.3.3 Italy

5.2.3.4 France

5.2.3.5 Rest of Europe

5.2.4 South America

5.2.4.1 Brazil

5.2.4.2 Argentina

5.2.4.3 Rest of South America

5.2.5 Middle-East and Africa

5.2.5.1 Saudi Arabia

5.2.5.2 South Africa

5.2.5.3 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Ranking Analysis

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles

6.4.1 Abengoa

6.4.2 Celtic Renewables

6.4.3 Cathay Industrial Biotech

6.4.4 Eastman Chemical Company

6.4.5 Gevo Inc

6.4.6 Green Biologics

6.4.7 GranBio

6.4.8 Metabolic Explorer

6.4.9 Phytonix

6.4.10 Working Bugs LLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

7.1 Alternative to Ethanol

7.2 Increasing Consumption of Biofuels in the Aviation Industry

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abengoa

- Celtic Renewables

- Cathay Industrial Biotech

- Eastman Chemical Company

- Gevo Inc

- Green Biologics

- GranBio

- Phytonix

- Metabolic Explorer

- Working Bugs LLC