The CBRNE defense market is estimated to register a CAGR of over 9% during the forecast period.

The COVID-19 situation forced governments to procure PPE equipment, disinfectants, and detection systems and caught most countries off-guard and underequipped to produce locally, and they were forced to procure huge quantities of PPE units from the international market. However, the increased demand for PPE equipment was expected to be short-term.

The CBRNE defense market is growing with an increase in the number of terrorist attacks worldwide, using CBRNE agents to carry out the attacks. The increase in the number of threats, as well as attacks carried out by making use of chemical, biological, and radioactive weapons, in recent years, led to various governments increasing their security measures globally.

Nowadays, the procurement of chemicals and materials for manufacturing the CBRNE weapons has become easier than ever before, and this raises concerns about the increasing threat from CBRNE weapons that are propelling the growth of the CBRNE defense market in the years to come.

Technological developments in unmanned systems, especially unmanned ground vehicles (UGVs) and unmanned aerial vehicles (UAVs), demonstrated the potential of remotely operated capabilities in alleviating the risks to humans in hostile environments resulting due to the CBRNEattacks. In terms of CBRNEdefense missions, unmanned systems can perform a wide variety of tasks that range from reconnaissance and surveillance to detection and decontamination.

Governments are also expected to learn from the current fiasco and invest in CBRNE defense equipment for the future, leading to a rise in both local production capacity as well as an increase in procurement quantity over the next few years. Ports across the world are expected to make international travel security checks stricter, mainly to identify, isolate, and prevent the transmission of communicable diseases.

CBRNE Defense Market Trends

The Military Segment Accounted for Largest Share in 2021

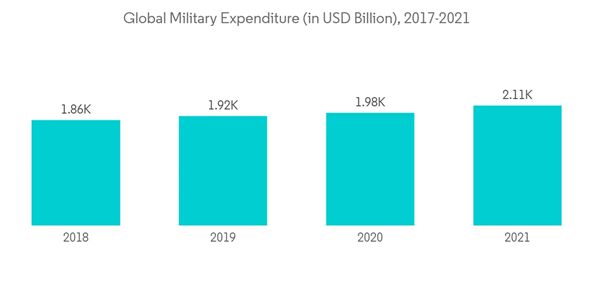

The military segment currently dominates the market and is expected to continue its dominance over the market during the forecast period. With growing threats from terrorists and a rise in political tensions, CBRNE weapons have emerged as a potential threat to several countries. Governments and defense departments of several nations are developing robust and effective countermeasures in order to protect the public and military personnel from CBRNE weapons. Governments, along with many militaries, are developing the necessary framework for tackling the threats caused by CBRNE incidents. The focus is on the protection of military personnel against any vulnerable attacks. For instance, South Korea's Defense Acquisition Program Administration (DAPA) announced that the Republic of Korea Armed Forces deployed upgraded reconnaissance vehicles with enhanced capabilities to counter chemical and biological security threats in December 2021. The vehicles are capable of monitoring hazardous airborne agents from a long distance and can transmit a CBRN warning through a military communications line. Moreover, many investments are being poured into the R&D of devices and equipment for countering CBRNE threats, which is expected to drive the segment during the forecast period.

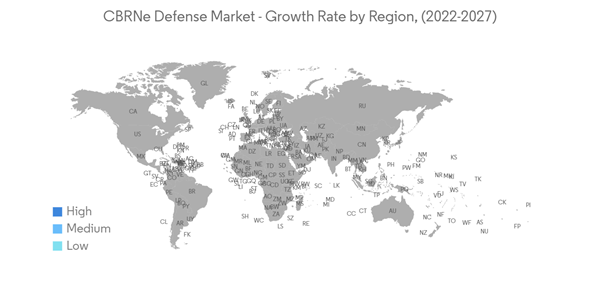

North America is Anticipated to Witness the Highest Growth During the Forecast Period

The North American region is expected to grow at a rapid pace during the forecast period. The majority of demand for CBRNE defense systems in North America is generated from the United States, which has formulated a National Strategy for CBRNEStandards, mainly for the coordination, prioritization, establishment, and implementation of CBRNE equipment standards by 2020. The country is also significantly investing in the development of the CBRNE defense systems. For instance, in June 2021, the US Department of Homeland Security (DHS) provided USD 2 million in funding under Small Business Innovation Research (SBIR) Program to two companies for the development of machine learning technologies for the detection of CBRNE threats. With machine learning technologies, the DHS plans to reduce time, redundancy, and cost, as well as enhance the accuracy in detecting threats, such as explosives, chemical agents, and narcotics. In addition, under the Man Transportable Robotic System Increment II (MTRS Inc II), the US Army is acquiring unmanned ground vehicles to support Engineers, Chemical, Biological, Radiological, and Nuclear (CBRN) Soldiers, and Special Operations Forces. The new UGVs are replacing the aging non-standard fleet of robots for locating, identifying, and clearing landmines, unexploded ordnance, and improvised explosive devices, which may enhance the maneuverability and survivability of military personnel. The MTRS Inc II has been acquiring Centaur unmanned ground vehicles since 2017. From March 2020 to May 2021, FLIR Systems received an order for more than 1,300 Centaur UGV (worth over USD 170 million) for the US armed forces. The investments in development and procurement plans of countries in North America are expected to propel the demand for advanced CBRNE defense equipment during the forecast period.

CBRNE Defense Market Competitor Analysis

The CBRNE Defense market is highly fragmented, with several players accounting for minor shares in the global market. The prominent players in the market include Smiths Group PLC, OSI Systems Inc., FLIR Systems, Inc., and Avon Rubber PLC. With the increasing global demand, several companies collaborated with research laboratories and institutions to develop advanced defense equipment or devices. For instance, in May 2022, RedWave Technology introduced the XplorIR, a gas-identification system specifically designed to meet the requirements of emergency response missions. The XplorIR system is a handheld FTIR identification tool that can identify more than 5,500 gases at low part per million (ppm) concentrations. The investments into advanced robotic technologies (integrated advanced sensors and payloads for conducting of CBRNE missions) and the strategies, such as focusing on building trust with the stakeholders, lowering product costs, and increasing product awareness, are expected to drive the growth of the players during the forecast period.

Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Argon Electronics

- Avon Rubber PLC

- Battelle Memorial Institute

- Leidos Holdings Inc.

- BLÜCHER GmbH

- FLIR Systems Inc.

- Nexter group KNDS

- Kärcher Futuretech GmbH

- Chemring Group PLC

- Smiths Group PLC

- QinetiQ Group PLC

- Saab AB

- OSI Systems Inc.

- National Technology and Engineering Solutions of Sandia LLC