COVID-19 had a significant impact on the market studied. Owing to the high burden of COVID-19, healthcare systems across the globe were implementing critical care centers for diagnosis as well as therapeutics. For instance, in November 2021, the Gujarat government in India initiated tele-ICU services to ease the pressure on government hospitals and health centers in rural and remote areas with a dearth of specialized doctors. Moreover, in July 2022, with the support of the European Union early in the COVID-19 pandemic, the European Society of Intensive Care Medicine (ESICM) developed the C19 Skills Preparation Course (C19_SPACE) to orientate and supplement clinical learning for nurses and doctors not regularly or newly engaged in intensive care units (ICUs). Thus, given the aforementioned factors, the pandemic considerably impacted the market studied. Currently, the market has reached its pre-pandemic nature in terms of demand for critical care diagnostics and is expected to witness healthy growth in the coming years.

The critical care diagnostics market is primarily driven by the increasing global prevalence of chronic and lifestyle-related disorders, an increase in data management and connectivity through interoperability to Electronic Health Records (EHR), and advancements in diagnostic technologies. According to the Centers for Disease Control and Prevention (CDC), data updated in July 2022, in the United States, 6 in 10 adults have a chronic disease, and 4 in 10 adults have two or more chronic diseases, which include heart disease, cancer, stroke, chronic obstructive pulmonary disease, and diabetes. Therefore, with the increasing chronic and lifestyle diseases worldwide, there is an increased demand for critical care diagnostics for these patients; thereby, the market is expected to see a surge over the forecast period.

Moreover, the data published in October 2021 by WHO reported that the pace of population aging is much faster than in the past, and 1 in 6 people in the world will be aged 60 years or over by 2030. WHO also stated that the share of the population aged 60 years and above will increase and nearly double from 12% to 22% by 2050. As the aging population creates an increase in health-related issues, especially cardiovascular and neurological diseases, the hospitalization of patients is also expected to rise. This hospitalization is likely to lead to the requirement for the diagnosis of critically ill patients, and this is expected to drive the critical care diagnostics market.

Therefore, owing to the factors mentioned above, the studied market is expected to grow over the forecast period. However, the high cost of the diagnostic test and the lack of skilled professionals in handling critical care diagnostics are likely to impede the market's growth.

Critical Care Diagnostics Market Trends

Intensive Care Unit Segment is Expected to Witness Considerable Growth Over the Forecast Period

Intensive care refers to the specialized treatment given to patients who are acutely unwell and require critical medical care. An Intensive Care Unit (ICU) provides critical care and life support for acutely ill and injured patients.Growth in the number of cases of neurological disorders, respiratory disorders, cardiovascular diseases, malignancy, and the increasing number of surgeries is expected to rise the demand for ICU settings in the market during the forecast period. For instance, as per the report published by the CDC in January 2022, about 0.6% of children aged 0-17 years suffered from active epilepsy in 2021. The same source also stated that around 470,000 children had active epilepsy, and about 3.0 million adults in the United States had active epilepsy in 2021. In addition, the incidence of epilepsy in the United States in seniors is up to 240 per 100,000 per year. Hence, with such a high prevalence of neurological diseases in the United States, the segment is expected to witness substantial growth in the coming years.

Moreover, in March 2022, Royal Philips's Collaboration Live received approval from FDA for remote diagnostic use on additional mobile platforms. Available on Philips Ultrasound Systems EPIQ and Affiniti, Collaboration Live allows clinicians to collaborate in real-time with colleagues to complete image acquisition and diagnosis regardless of location.

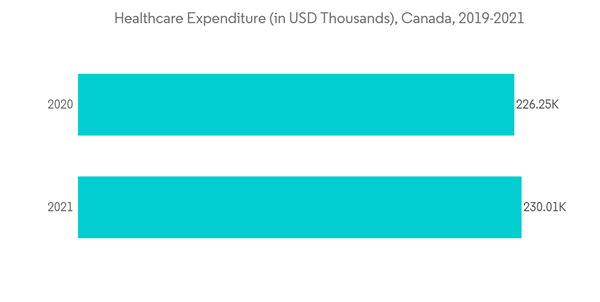

Additionally, health expenditure is rising across the globe, fueling the growth of the ICU segment. As health expenditure increases, the focus of hospitals on providing critical care also increases, resulting in a drastic rise in the number of ICUs. For instance, as per the data from Canadian Institute for Health Information published in November 2021, approximately USD 230,000 were spent on healthcare in Canada during the year 2021. With such expenditure, the implementation of ICU care can be achieved, which is believed to propel segment growth.

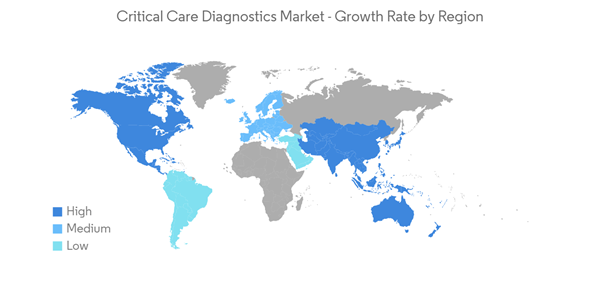

North America is Expected to Dominate the Critical Care Diagnostics Market

North America has been witnessing stable growth but with substantial regional variations. Hospitals in the United States have made substantial investments in the physical infrastructure of their operating rooms.The increasing number of injuries due to vehicle crashes in the United States resulted in the growing demand for critical care diagnostics, further boosting the market's growth. According to the data published in March 2022 by Association for Safe International Road Travel (ASIRT), annually, 4.4 million are injured seriously enough to require medical attention in the United States. Thus, these injuries require a quick diagnosis for quick treatment. Therefore, critical care diagnostics is expected to see a surge in the region.

Additionally, in August 2022, Oncocyte Corporation announced that the United States Department of Veterans Affairs (VA), the largest integrated healthcare system in the United States, was awarded a Federal Supply Schedule Contract for the Company's DetermaRx test. The contract is for five years. Such instances are expected to boost the growth of the studied market in the region over the forecast period.

The high healthcare expenditure, better infrastructure, and additional involvement by the government are expected to drive the growth of the market in North America.

Critical Care Diagnostics Industry Overview

The Critical Care Diagnostics Market is moderately competitive. In terms of market share, there is moderate consolidation in the market. The market players are involved with government initiations, through funding and collaboration, which can help the Critical Care Diagnostics market to garner significant growth. Top players are also engaged in new product launches, partnerships, collaborations, etc., to enhance their market presence. Key players in the market are Abbott, Beckman-Coulter, and Roche, among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott

- Bayer AG

- Becton, Dickinson & Company

- bioMerieux SA

- Bio-Rad Laboratories, Inc.

- Chembio Diagnostic Systems, Inc.

- Danaher Corporation

- F. Hoffmann-La Roche

- Siemens Healthineers

- Sysmex Corporation