The Automotive pressure sensors market was valued at USD 10.10 billion in 2021 and is expected to reach USD 14.60 billion by 2027 registering a CAGR of above 7% during the Forecasts period (2022 - 2027).

The COVID-19 pandemic has severely impacted the many automotive sensors companies owing to restrictions imposed by government. Many automotive sensors manufacturers have experienced significant resource bottlenecks in the global supply and logistics chains in the year that had a perceptibly negative effect on their businesses. However, post-pandemic as restrictions eased market expected to gain momentum during the Forecasts period.

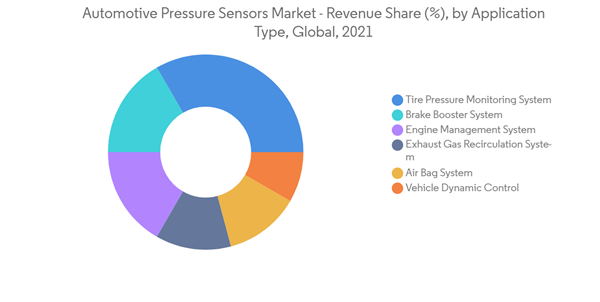

Modern vehicle restraint systems utilize side airbag pressure sensors to satisfy passenger car safety requirements. Furthermore, the air pressure sensor improves engine efficiency by effectively controlling spark advances in gasoline and diesel engines.

Hence, the market is expected to develop due to the rising use of pressure sensors in the engine and the vehicle's safety system.Increasing demand for advanced technologies, comfort and safety expected to further set positive trend for market growth. However, high Cost and limitations under bad weather conditions to act as restraints during the Forecasts period.

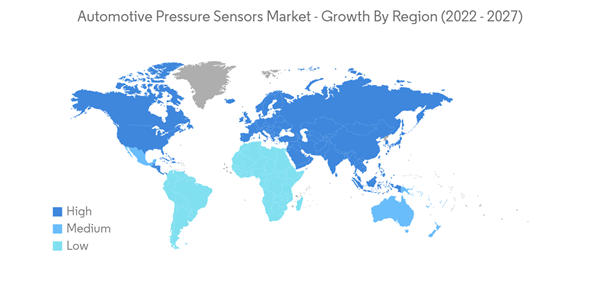

Low automotive production costs and the availability of low-cost labour characterise the Asia Pacific market, which is characterised by rising middle-class disposable income and cost benefits for OEMs. However, the number of people killed in car accidents has climbed in recent years, forcing regulators to enact more strict safety and pollution standards.

Further, key market drivers in North America and Europe that impact the automotive sensors market growth are growing demand for safety and comfort characteristics, new energy vehicles, connected vehicles, body electronics and upcoming autonomous vehicles, the rigorous regulatory framework.

TPMS utilizes pressure monitoring sensors within each tire that monitor specific pressure levels and send the data to the centralized control module. TPMS usually finds major applications in the passenger vehicle segment, where tire pressure management is considered to be a critical safety system. The automotive industry has been stepping up on introducing features that aid in minimizing the impact of collisions, reduce fatalities, and improve overall vehicle safety. This, in turn, is fueling the growth of the automotive TPMS market during the Forecasts period.

Several manufacturers are manufacturing TPMS sensors for capturing the growing market share and are focused on designing various growth strategies to stablize their position in the market. For instance,

The Asia-Pacific region has been home to the manufacturers that provide sensors, with China, India, Japan, and Taiwan being the major contributors. The growth in Asia-Pacific is attributed to the development of the automotive industry in countries, such as China and India. The growing economy and advancements in the regulatory framework in the region have also helped the passenger car sensors market boom in the region.

The major trend driving the Asia-Pacific automotive sensor market is miniaturization and improved communication capabilities, which, in turn, enable their integration into vehicles without interfering with the basic functionalities of the vehicle. Increasing automotive light vehicle production is also driving the pressure sensor market in Asia-Pacific. Other factors, such as low cost, compact size, ecofriendly nature, and bulk manufacturing capability, are the key factors helping the automotive sensors market grow.

Recently, with the advent of connected cars and automated driverless vehicles, the demand for technologically-advanced sensors, which have better efficiency and reliability in terms of functioning, has increased substantially. Also, rise in government grants to improve industrial infrastructure, along with the availability of cheap labor and raw materials, has been an additional key factor to substantially increase the production of automotive sensors.

Increased research and development in the sensor industry is creating opportunities for technological advancements that open up new prospects for sensor applications. On basis of aforementioned factors, the Asia-Pacific region expected to hold significant share in the market.

The Automotive pressure sensors market is consolidated, with few major players holding the majority of the share in the market. Although, it can be assumed that almost all pressure sensor manufacturers serve as automotive suppliers, the barrier to entry for prospective automotive suppliers is quite high.

Organizations, like Robert Bosch, have aggregated production volume of automotive, as well as consumer markets, to reduce cost and further increase its competitive advantage. Other players, like Infineon, Sensata, DENSO, and Melexis, are mainly focused on the automotive sector, with vertical integration being a common trend in the sector.

This product will be delivered within 2 business days.

The COVID-19 pandemic has severely impacted the many automotive sensors companies owing to restrictions imposed by government. Many automotive sensors manufacturers have experienced significant resource bottlenecks in the global supply and logistics chains in the year that had a perceptibly negative effect on their businesses. However, post-pandemic as restrictions eased market expected to gain momentum during the Forecasts period.

Modern vehicle restraint systems utilize side airbag pressure sensors to satisfy passenger car safety requirements. Furthermore, the air pressure sensor improves engine efficiency by effectively controlling spark advances in gasoline and diesel engines.

Hence, the market is expected to develop due to the rising use of pressure sensors in the engine and the vehicle's safety system.Increasing demand for advanced technologies, comfort and safety expected to further set positive trend for market growth. However, high Cost and limitations under bad weather conditions to act as restraints during the Forecasts period.

Low automotive production costs and the availability of low-cost labour characterise the Asia Pacific market, which is characterised by rising middle-class disposable income and cost benefits for OEMs. However, the number of people killed in car accidents has climbed in recent years, forcing regulators to enact more strict safety and pollution standards.

Further, key market drivers in North America and Europe that impact the automotive sensors market growth are growing demand for safety and comfort characteristics, new energy vehicles, connected vehicles, body electronics and upcoming autonomous vehicles, the rigorous regulatory framework.

Key Market Trends

Tire Pressure Monitoring Systems (TPMS) Expected to Play Key Role in the Market

TPMS utilizes pressure monitoring sensors within each tire that monitor specific pressure levels and send the data to the centralized control module. TPMS usually finds major applications in the passenger vehicle segment, where tire pressure management is considered to be a critical safety system. The automotive industry has been stepping up on introducing features that aid in minimizing the impact of collisions, reduce fatalities, and improve overall vehicle safety. This, in turn, is fueling the growth of the automotive TPMS market during the Forecasts period.

Several manufacturers are manufacturing TPMS sensors for capturing the growing market share and are focused on designing various growth strategies to stablize their position in the market. For instance,

- In July 2021, Goodyear launched the DrivePoint-Tyre Pressure Monitoring System for trucks and trailers. This new solution does not require demounting of the tyre as the sensors can be quickly installed on the valves reducing installation complexity and associated downtime

- In 2019, JK Tyre & Industries launched sensors for monitoring and maintenance of tyres. Treel sensors (from the recently-acquired Treel Mobility Solutions) for strengthening the company’s position in the domestic market. The company has introduced tyre pressure monitoring systems (TPMS) via Treel sensors that help in monitoring the tyres’ vital statistics, including pressure and temperature.

Asia-Pacific Expected to Hold the Largest Market Share in the Market

The Asia-Pacific region has been home to the manufacturers that provide sensors, with China, India, Japan, and Taiwan being the major contributors. The growth in Asia-Pacific is attributed to the development of the automotive industry in countries, such as China and India. The growing economy and advancements in the regulatory framework in the region have also helped the passenger car sensors market boom in the region.

The major trend driving the Asia-Pacific automotive sensor market is miniaturization and improved communication capabilities, which, in turn, enable their integration into vehicles without interfering with the basic functionalities of the vehicle. Increasing automotive light vehicle production is also driving the pressure sensor market in Asia-Pacific. Other factors, such as low cost, compact size, ecofriendly nature, and bulk manufacturing capability, are the key factors helping the automotive sensors market grow.

Recently, with the advent of connected cars and automated driverless vehicles, the demand for technologically-advanced sensors, which have better efficiency and reliability in terms of functioning, has increased substantially. Also, rise in government grants to improve industrial infrastructure, along with the availability of cheap labor and raw materials, has been an additional key factor to substantially increase the production of automotive sensors.

Increased research and development in the sensor industry is creating opportunities for technological advancements that open up new prospects for sensor applications. On basis of aforementioned factors, the Asia-Pacific region expected to hold significant share in the market.

Competitive Landscape

The Automotive pressure sensors market is consolidated, with few major players holding the majority of the share in the market. Although, it can be assumed that almost all pressure sensor manufacturers serve as automotive suppliers, the barrier to entry for prospective automotive suppliers is quite high.

Organizations, like Robert Bosch, have aggregated production volume of automotive, as well as consumer markets, to reduce cost and further increase its competitive advantage. Other players, like Infineon, Sensata, DENSO, and Melexis, are mainly focused on the automotive sector, with vertical integration being a common trend in the sector.

- In October 2020, Borg Warner completed the acquisition of one of the founding automotive MEMS sensor companies, Delphi Technologies. The company plans to get more balance results across light vehicles, commercial vehicles and the aftermarket.

- In April 2019, DENSO, the world’s second-largest mobility supplier, announced an investment of USD 1.6 billion to strengthen development and production of Automotive Electrification Products and Systems. This has been done to support its aggressive development and production of electrified automotive products, systems, and technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET DYNAMICS

5 MARKET SEGMENTATION

6 COMPETITIVE LANDSCAPE

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AUTOLIV INC

- DENSO Corporation

- Robert Bosch GmbH

- Continental AG

- ST Microelectronics NV

- Infineon Technologies AG

- Sensata Technologies Inc.

- NXP Semiconductor NV

- Allegro Microsystems, LLC

- Texas Instruments Incorporated