COVID-19 has affected the world and has had a significant impact on the healthcare system. The COVID-19 outbreak has resulted in many changes in European healthcare practice, especially ophthalmology drugs and devices in Europe majorly impacted. The elective operations/therapies and non-emergency medical procedures had nearly halted in most medical centers, and these services witnessed a significant decline, including cataract and vitreoretinal surgeries. An article by the European Journal of Ophthalmology published in March 2021 reported that the epidemic severely struck ophthalmic surgical procedures in Italy and other European countries. The article also reported that eye surgical procedures were limited to urgent procedures and intravitreal injections in all centers due to government rules. Thus, although an overall reduction in elective, urgent, and intravitreal injection procedures was observed during the lockdown period in the European countries, however after a post-pandemic, the market witnessed significant growth as these services got resumed.

The growth of the market is driven by the factors such as the growing prevalence of eye disease, technological advancements in the field of ophthalmology, and the rising geriatric population. The growing prevalence of eye disease in Europe is driving the market. For instance, according to a study published in the European Journal of Opthalmology in March 2021, an article reported that myopia is predicted to become the most common cause of irreversible vision impairment and blindness in Europe. Similarly, as per the article published in the Journal of Glaucoma in August 2022 reported that primary open-angle glaucoma is a neurodegenerative disease highly prevalent in the European adult population, with cases expected to increase over the aging population is expected to increase in European countries. Thus, a high incidence of eye disorders is increasing the demand for medicines and related surgeries, which is expected to boost market growth over the forecast period.

The technological advancement in ophthalmic devices in Europe is also driving the market. For instance, in September 2022, BVI received the certification for its intraocular lens (IOL) portfolio under the European Medical Device Regulation (MDR, (EU) 2017/745) from its notified body, the British Standards Institution (BSI). The new regulatory criteria came into effect in May 2021, replacing the prior Medical Device Directive (MDD). Additionally, in September 2022, SIFI launched Evolux, a novel extended monofocal intraocular lens (IOL) based on a hydrophobic material and a non-diffractive profile designed to provide better intermediate vision. Evolux was developed on a patented technology platform, pioneering the extension of the depth of focus through wavefront engineering. Thus, such product development and launches in Europe are expected to drive market growth.

Thus, all factors mentioned above, such as the rising prevalence of ophthalmic diseases and technological advancement in ophthalmology devices, are expected to boost the market over the forecast period. However, the high risk associated with eye surgery and stringent regulations may restrain the market growth over the forecast period.

Europe Ophthalmology Drug & Device Market Trends

Cataract Segment is Expected to Witness a Significant Growth Over the Forecast Period

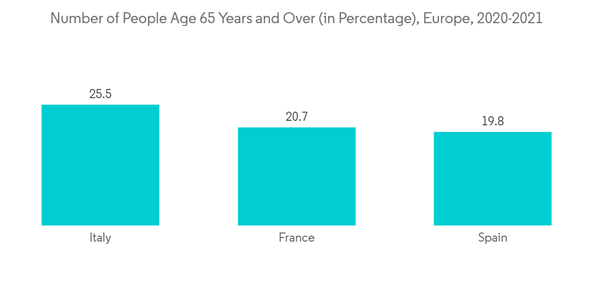

A cataract is an eye disease that causes clouding of the eye lens, resulting in irreversible vision loss, and surgery is performed to remove the clouded natural lens and implant an intraocular lens. The cataract segment is expected to witness significant growth due to the increasing cataract treatment market driven by an increase in the geriatric population and a rise in the prevalence of cataract diseases. In addition, the rising awareness among individuals about the benefits of early diagnosis and treatment of cataracts is catalyzing the demand for cataract surgical devices. As per the United Nations Population Fund's World Population Dashboard Statistics 2021, about 21.1% of individuals in France are 65 or older. Since vision loss and cataracts are more common among the elderly driving the growth of the segment.Technological advancements and rising strategic collaborations are some of the other factors anticipated to propel the growth of the segment. For instance, in June 2022 PromTime and the European Society of Cataract and Refractive Surgeons (ESCRS) entered into a partnership that enable France to join the European Registry of Quality Outcomes for Cataract and Refractive Surgery (Eurequo). This partnership aims to standardize a digital tool that compares real-life patient-reported outcomes measures (PROMs) which have been adjusted to severity profiles.

Also, in April 2022, the European Society of Cataract and Refractive Surgery reported, that 219,736 cataract extraction was reported to the European Registry of Quality Outcomes for Cataract and Refractive Surgery (EUREQUO) database in the year 2021, while in the year 2020 it was 193,082. The cataract extraction number got increased by 13.8% in 2021 as comapred to the previous year. Thus, high cataract surgery in the europe is expected to drive the demand for ophthalmology devices and treatment, thereby boosting the growth of the segment over the forecast period.

Thus, due to the above-mentioned reasons such as rising number of cataract surgery, the segment is expected to witness significant growth over the forecast period, thereby driving the studied market in the European countries.

Germany is Expected to Witness a Significant Growth Over the Forecast Period

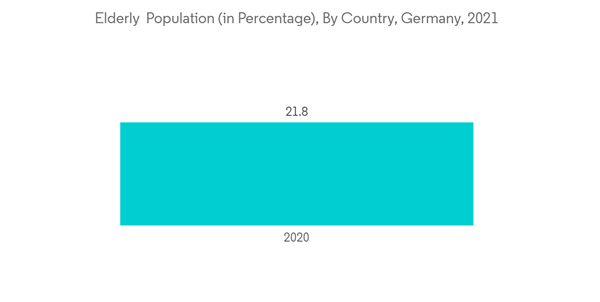

Germany is expected to witness significant growth over the forecast period due to the increasing incidence and prevalence of eye-related disorders such as presbyopia, macular degeneration, and diabetic retinopathy among the aging population. Also, due to the technological advancement of ophthalmic devices equipped with sophisticated technologies, people are increasingly opting for ophthalmic surgeries to correct their eye-related disorders in the country, thereby contributing to the market.As per the January 2022 estimates by the Federal Statistical Office (Destatis), 16.2 million people over the age of 67 years old lived in Germany at the end of the year 2021. The same source projected that the number would rise to 21.6 by the year 2060. The rising geriatric population is likely to propel the segment's growth in the nation over the forecast period as this population is more vulnerable to eye-related disorders. Furthermore, the elderly population is more prone to illness and poor vision. In addition, as this population grows, the demand for vision correction surgeries and drugs is likely to increase, in turn boosting the demand for ophthalmic drug and devices market.

Technological advancement due to the presence of key market players is significantly contributing to the market growth. For instance, in December 2021, Novaliq, a company that focuses on first- and best-in-class ocular therapeutics based on the unique EyeSol water-free technology reported the key results of the second pivotal Phase 3 trial (ESSENCE-2) for evaluating the investigational drug CyclASol for the treatment of dry eye disease (DED).

Thus, due to the aforesaid mentioned factors such as rising geriatric population, Germany is expected to witness significant growth thereby driving the Europe ophthalmology drug and devices market.

Europe Ophthalmology Drug & Device Market Competitor Analysis

The Europe ophthalmology drug and devices market is fragmented due to the presence of fewer companies at the global and regional levels. The competitive landscape includes an analysis of a few international as well as local companies which hold the market shares and are well known as Alcon Inc., Bausch Health Companies Inc., Carl Zeiss Meditec AG, Essilor International SA, Haag-Streit Group, Johnson & Johnson, Nidek Co. Ltd, Topcon Corporation, Ziemer Group AG, Staar Surgical, Inc., Novartis International AG, Pfizer Inc, and Roche Holding Ltd.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alcon Inc.

- Bausch Health Companies Inc.

- Carl Zeiss Meditec AG

- Essilor International SA

- Haag-Streit Group

- Johnson & Johnson

- Nidek Co. Ltd

- Topcon Corporation

- Ziemer Group AG

- Staar Surgical

- Novartis International AG

- Pfizer Inc

- Roche Holding Ltd