The COVID-19 pandemic moderately impacted market growth. The high number of pregnant women suffering from COVID-19 during the pandemic has tremendously increased the demand for fetal and neonatal care equipment. For instance, according to the study published in NCBI in January 2022, in response to the increase in the number of pregnant women who tested positive for SARS-CoV-2 and who were referred to maternity hospitals for delivery as part of the COVID-19 pandemic in the spring of 2020, the United States hospitals rapidly created and implemented clinical guidelines about maternal and newborn peripartum care. Furthermore, the study also stated that interim guidelines from the American Academy of Pediatrics (AAP) dated April 2, 2020, and May 21, 2020 recommended temporary separation of mother and child as the safest practice to minimize the risk of mother-to-child transmission during the postpartum period. Therefore, the increased number of pregnant women with COVID-19 highly increased the demand for fetal and neonatal care equipment, as these items are necessary to maintain the health of the newborn baby when they are separated from their mothers. Thus, the market witnessed considerable growth during the pandemic and is expected to maintain an upward trend over the forecast period.

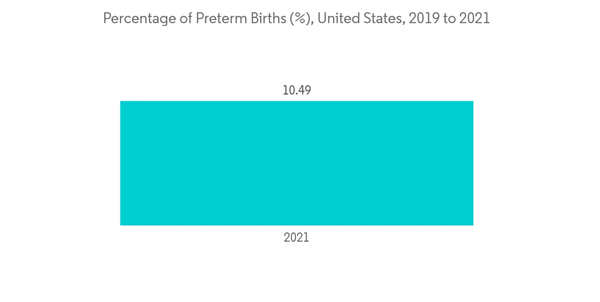

The increasing number of preterm and low-weight births, increased awareness for prenatal and neonatal care, and increasing technological advancement in infant and maternal care products are the major factors propelling the market growth. For instance, as per the study published in NCBI in March 2021, a search was conducted in Canada in 2020, which demonstrated that adolescent mothers witnessed a 56.0% increase in the prevalence of low birth weights, a 23.0% increase in preterm birth, and a 20.0% increase in stillbirth. Similarly, as per the report published by the CDC in November 2021, preterm birth affected 1 of every 10 infants born in the United States in 2020. It was also reported that the preterm birth rate among African American women (14.4%) was about 50.0% higher in 2020 than the preterm birth rate among white or Hispanic women (9.1% and 9.8%, respectively). Since fetal and neonatal care equipment is one of the essential requirements for managing preterm birth, such instances are expected to spur market growth and are likely to do the same over the forecast period.

The technological advancements related to fetal and neonatal care equipment in North America are also anticipated to drive market growth. For instance, in April 2021, the researchers at Nottingham Trent University developed a smart warming system that can provide enough heat to ensure premature babies are kept warm. Such active warming can avoid the need for more intensive intervention down the line and improve a baby’s early development. Similarly, Dräger's BabyLeo is equipped with new technology that is designed to meet the needs of the child and their family to ensure that the child receives the best possible treatment. The device is designed to keep the baby warm as an incubator, a radiant warmer, and during the transition between close and open care. Its connected heater, dual radiant heater, and heated mattress are synchronized to maintain a stable temperature at all times, regardless of which setting needs to be used. Therefore, such technological advancements are expected to positively impact the market, and considerable market growth is anticipated over the forecast period.

However, the high cost associated with neonatal care equipment and stringent regulatory policies for new device approval may hinder market growth over the forecast period.

North America Fetal & Neonatal Care Equipment Market Trends

Ultrasound Devices Segment is Expected to Witness Growth Over the Forecast Period

Ultrasound devices, also known as sonography, are imaging technique that uses high-frequency sound waves to produce images of the different structures inside the body. They are being utilized for the assessment of various conditions in newborn babies. They are also majorly used in chronic diseases, which include health conditions such as heart disease, asthma, cancer, and diabetes in newborn babies. Therefore, these devices are being utilized as both diagnostic imaging and therapeutic modalities and have a wide range of applications in the medical field.The launch of innovative ultrasound devices to detect preterm births and increasing pregnancy rates are the major drivers for the segment. For instance, in April 2022, Ultrasound AI Inc., a cloud-based artificial intelligence (AI) company that provides ultrasound imaging, and is headquartered in Highlands Ranch, Colorado, United States, announced that it had been awarded its first patent for its newest predictive diagnostic tool, Preterm AI (PAI). Preterm AI combines ultrasound technology with artificial intelligence to predict preterm birth, allowing for earlier interventions. Ultrasound can detect early changes in the cervix, such as shortening of the cervix, and predict preterm labor. When the short cervical length is identified, interventions can be used to prevent preterm birth. Therefore, increasing cases of preterm births may boost segment growth.

Furthermore, the report published by the Centers for Disease Control and Prevention in May 2022, the report shows a 1.0% increase in births from 2020, with 3,659,289 births recorded in 2021 in the United States. The general fertility rate in 2021 was 56.6 births per 1,000 women aged 15 to 44, an increase of 1.0% from 2020. Since ultrasound devices are one of the essential devices for the diagnosis of newborn babies, the increasing pregnancy rates in the United States are anticipated to propel the segment's growth.

Therefore, owing to the above-mentioned factors significant segment growth is anticipated over the forecast period,

The United States is Expected to Dominate the Market Over the Forecast Period

Over the forecast period, the United States is expected to dominate the overall North American fetal and neonatal care equipment market. The growth is due to factors such as the rising number of newborns with low birth weight and preterm births. For instance, as per the report published by the Centers for Disease Control and Prevention in May 2022, the percentage of newborn babies with low birth weight accounted for 8.24% in 2020, and the percentage of preterm births accounted for 10.09% in 2020.The technological advancements related to fetal and neonatal care equipment are also anticipated to propel market growth in the United States. For instance, in June 2021, Nuvo Group, the privately held company that commercializes Nuvo's INVU, an FDA-cleared, patent-protected, prescription-initiated remote pregnancy monitoring platform, announced that it had received clearance from the US Food and Drug Administration (FDA) to add a new module called 'uterine activity,' which provides the possibility of remote monitoring of uterine activity. With this clearance, INVU can provide a reliable passive alternative to existing UA measurement methods. INVU uses only external sensors, which allows it to be used without any invasive component or the need for hospitalization or clinical intervent.

Therefore, owing to the abovementioned factors, the market is anticipated to witness considerable growth in the United States over the forecast period.

North America Fetal & Neonatal Care Equipment Market Competitor Analysis

The market is highly competitive and fragmented, with many key and regional players. The competitive landscape includes an analysis of a few international and local companies that hold market shares and are well known, including Becton, Dickinson and Company, GE Healthcare, Koninklijke Philips NV, Masimo, and Medtronic PLC, among others.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Dragerwerk AG & Co. KGaA

- Koninklijke Philips N.V.

- GE Healthcare

- Siemens Healthineers AG

- Medtronic PLC

- Masimo

- Natus Medical Incorporated

- Atom Medical Corporation

- Becton, Dickinson and Company

- ICU Medical

- Hamilton Medical

- VYAIRE