The COVID-19 pandemic negatively impacted the market. However, the market is reaching pre-pandemic levels and is expected to grow steadily during the forecast period.

Key Highlights

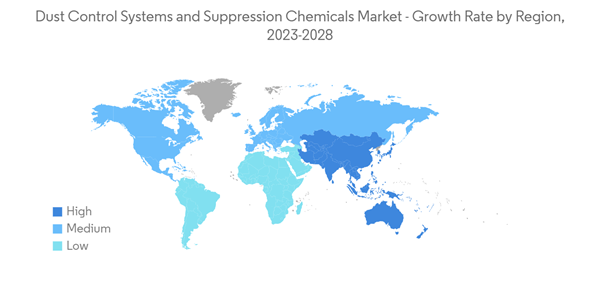

- Over the short term, the major factors driving the growth of the market are the growth in construction and infrastructure in Asia-Pacific and the increasing regulatory compliances.

- Dust collection problems in the food and pharmaceutical industry are expected to hinder the market's growth.

- Asia-Pacific dominated the market worldwide, with the largest consumption coming from China and India.

Dust Control Systems & Suppression Chemicals Market Trends

Construction Industry to Dominate the Market

- Dust control measures are applicable to any construction site with potential air and water pollution from dust traveling across the landscape or through the air.

- According to HSE statistics (the U.K. government's Health and Safety Executive statistics), every year, more than 500 construction workers die from exposure to silica dust worldwide. Hence, it became important to regulate hazardous dust emissions, creating a significant demand for dust control systems and suppression chemicals over the last few years.

- Compared to conventional processes, dust suppression solutions offer distinct advantages and lucrative benefits for construction applications, including easy application and long-life protection during extreme climatic conditions.

- Currently, there are state-of-the-art dust control solutions that can solve a range of dust control problems at construction sites and on all types of roads, from major highways and freeways to haulage, industrial, and rural roads, tarmacs, hardstand areas, and water-repellent pavements.

- Calcium chloride is the major dust control suppression chemical used in the construction industry. In addition, the construction industry uses polymer emulsions for stabilizing haul and access roads.

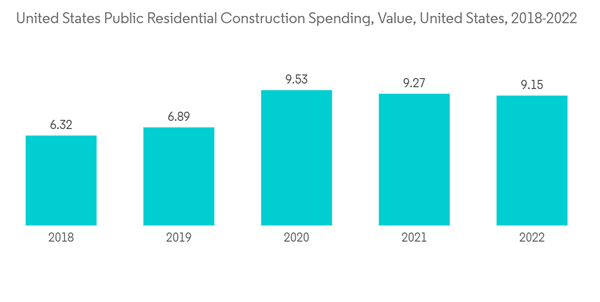

- The United States boasts a colossal construction sector that employs over 7.6 million employees. According to U.S. Census Bureau, in 2022, the value of construction was USD 1,792.9 billion, a 10.2% increase over the USD 1,626.4 billion spent in 2021.

- Further, as per further statistics generated by the U.S. Census Bureau, the annual value for new construction in the United States accounted for USD 1,657,590 million in 2022, compared to USD 1,499,822 million in 2021. Moreover, the annual residential construction in the United States was valued at USD 849,164 million in 2022, compared to USD 740,645 million in 2021. The annual value of non-residential construction put in place in the country was valued at USD 808,427 million in 2022, compared to USD 759,177 million in 2021, thereby decreasing the consumption of the market studied in the short term.

- Moreover, the increasing presence of foreign companies in the Asia-Pacific region has created a demand for new offices, buildings, production houses, etc., thereby driving the construction sector in the region.

- Such factors are likely to help the construction industry dominate the market.

China to Dominate the Asia-Pacific Market

- China's construction industry has been going through the Evergrande debt crisis, and it is expected to decline for a short while in the future.

- The country has been focusing on reducing coal consumption for the past few years, mainly due to environmental concerns and climate goals.

- The government took this step in accordance with the growing coal imports of the country due to the reduction in domestic production.

- The new coal mines approved in the country are located in the regions of Xinjiang, Inner Mongolia, Shanxi, and Shaanxi, supported by the national strategy toward consolidating the output at dedicated coal production bases.

- These new mines are planned for the expansion of the existing collieries. The country is expected to witness high demand for dust control systems and suppression chemicals for developing and operating such new mines.

- The country's demographics are expected to favor housing and commercial construction activities. The growing population has triggered investments in affordable residential colonies by the public and private sectors. China's government has taken the initiative to gift 40 key cities with 6.5 million government-subsidized rental homes that are supposed to accommodate around 13 million people.

- Additionally, the Chinese government has rolled out massive construction plans, which include making provisions for the movement of 250 million rural people to its new megacities over the next ten years, creating a major scope for construction materials used in the future in various applications during construction activities to enhance the building properties. The housing authorities of Hong Kong launched several measures to push start the construction of low-cost housing. The officials aim to provide 301,000 public housing units in 10 years till 2030. These factors are expected to raise the construction industry in the country and thereby are likely to support the demand for the market studied in the future.

- Thus, growth in various end-user industries is boosting the demand for dust control systems and suppression chemicals for various applications.

Dust Control Systems & Suppression Chemicals Industry Overview

The dust suppression chemicals market is partially consolidated among very few players. Some of the other prominent players in the dust suppression systems market include Cargill Incorporated, SUEZ, Ecolab, Camfil, and Donaldson Company Inc. (not in any particular order).Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Chemical Providers

- System Providers