In response to COVID-19, health systems and government agencies around the world heavily relied on emergency department information systems (EDIS). Rapid case identification and appropriate triage were aided by technology-based screening tools. The use of the electronic health record (EHR) to onboard frontline providers with new protocols, provide clinical decision support and improve diagnostic testing systems aided clinical care. For instance, according to the study titled " Impact of the COVID-19 pandemic on emergency department attendance and acute medical admissions" published in the BMC Emergency Medicine in November 2021, emergency department (ED) attendance dropped by 37%, medical admissions dropped by 30%, and medical bed occupancy dropped by 27% during the first wave of the pandemic. ED visits and medical admissions decreased in all age groups, with the youngest adults experiencing the greatest reductions in ED visits. Thus, the decrease in ED admissions significantly affected the adoption of emergency department information systems during the COVID-19 pandemic, hampering the market's growth rate in its initial phase.

The market for emergency department information systems is expected to grow rapidly due to the aging population, increased use of data-driven technologies, and an increase in the number of insured people. According to the World Health Organization's key facts on aging and health published in October 2021, around 1 in 6 people in the world are projected to be over the age of 60 by 2030. The number of people over the age of 60 in the world in 2020 was 1 billion, and it is projected to rise to 1.4 billion by 2030 and 2.1 billion by 2050. Increased incidences of chronic and life-threatening diseases among the elderly population will eventually lead to hospitalization. Cardiovascular disease, neurodegenerative disease, and other diseases are found to be more common in the elderly. Emergency department information systems play a critical role in hospitals as emergency departments are frequently the hospital's front door to patients. Thus, the demand for such information systems for effectively managing data and processes across ED departments of hospitals is likely to increase with the growing geriatric population and a surge in hospital admissions.

Additionally, the strategic initiatives and the launches of products are also driving the growth of the market. For instance, in December 2021, Shannon Health deployed PeraHealth's Latest Clinical Decision Support Platform and launched the "RI Triage" health system, migrating to a state-of-the-art cloud-based predictive analytics system for emergency department use. Likewise, in September 2021, Vital, an Atlanta-based artificial intelligence (AI)-powered solution company that improves patient experience and loyalty in hospital emergency departments (EDs) and inpatient stays, raised USD 15 million in Series A funding led by Transformation Capital, with existing investors First Round Capital and Threshold Ventures joining the round.

Thus, owing to the abovementioned factors, the market is expected to grow over the forecast period. However, the adverse quality and safety implications of EDIS and the lack of skilled healthcare IT professionals may hinder the growth of the market.

Emergency Department Information System Market Trends

Best of Breed (B.O.B.) Solutions are Anticipated to be the Dominant Segment in Software Type During the Forecast Period

The Best of Breed (B.O.B.) Solutions segment is expected to garner the major share of the market by software type over the analysis period as these best-of-breed solutions provide improvements in physician productivity, diagnostic enhancements, and enhanced interoperability.Furthermore, the presence of existing information systems such as electronic health records in most healthcare facilities is causing a paradigm shift toward best-of-breed emergency department information system software as these solutions allow for seamless integration with existing systems. Best-of-Breed solutions require minimal training, making them an excellent choice for teams that do not spend much of their time in the implementation of these solutions. They are specific to particular applications across ED departments. This is expected to drive segment growth over the forecast period.

In addition, several key market players are engaged in strategic initiatives that are significantly boosting the growth of the segment. For instance, in May 2022, Inflectra, a provider of IT Software Lifecycle Management solutions, partnered with Checkpoint Technologies, which offers best-of-breed software solutions. With SpiraPlan, Inflectra's enterprise programs, portfolio and risk management platforms, and Checkpoint's expertise in quality assurance and software testing, the partnership optimizes customer technology and solves business challenges with a commitment to software quality. Such activities by market players are expected to aid the growth of the segment.

Thus, owing to the aforesaid factors, the best-of-breed segment is expected to grow over the forecast period.

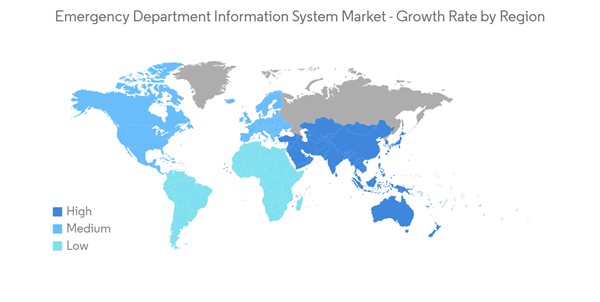

North America Region Holds the Large Market Share of Emergency Department Information System Market

North America is found to be one of the biggest markets as emergency department information systems are widely used in countries such as the United States and Canada.The COVID-19 pandemic bolstered the use of healthcare IT services in emergency departments across the region. The outbreak heightened the need for mHealth technologies and electronic medical records to become a reality in the healthcare industry, as linked patient records, correct patient data, cybersecurity, and interoperability were prioritized. Besides, an increase in the geriatric population, who are more susceptible to chronic diseases, will lead to an increase in hospital admissions and, as a result, an increase in the demand for emergency department information systems. According to the Administration for Community Living's 2020 Profile of Older Americans, the number of people over the age of 65 years in the United States is expected to reach 80.58 million by 2040 and 94.7 million by 2060.

Furthermore, favorable government support is also contributing to the market's growth. For instance, in June 2021, the United States Office of Information and Technology revised the Emergency Department Integration Software (EDIS) program services installation in hospitals for tracking and managing the delivery of care to patients in an emergency department (ED). Such regulations helping the ease of access to the emergency department information system in hospitals and healthcare settings are likely to propel the growth of the market over the forecast period.

Thus, due to the rise in the adoption of healthcare IT in North America, the market is anticipated to grow over the coming years.

Emergency Department Information System Industry Overview

The Emergency Department Information System market is competitive and consists of a few major players. The major players in the emergency department information system market are Allscripts Healthcare Solutions Inc., Cerner Corporation, T-Systems Inc., MEDHOST, Inc., EPOWERdoc, and Medsphere Systems Corporation, among others, which provide their products across the globe.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allscripts Healthcare Solutions, Inc.

- Cerner Corporation

- EPOWERdoc, Inc.

- MEDHOST, Inc.

- Medical Information Technology, Inc.

- T-Systems, Inc.

- Unitedhealth Group, Inc.

- Medsphere Systems Corporation

- Epic Systems

- Mckesson Corporation

- Evident

- Logibec Canada