The increased demand for alcoholic beverages, especially among millennials, as well as the rising global consumer desire for premium/super-premium goods, are the main drivers of the premium alcoholic beverage market. The public demand for premium alcoholic beverages is also rising due to the rising preference for low-alcohol beers. It is attributed to consumers' increased willingness to explore new drinks and advanced knowledge of alcohol unit intake. Additionally, the premium alcoholic beverages market growth rate is positively impacted by rising disposable income, a growing young adult population around the world, and rising consumer demand for a premium or super-premium products. It is due to the appealing packaging of these beverages in various sizes and containers (bottles and cans). For instance, according to the World Bank, in 2021, about 67.45% of the Indian population fell into the 15-64 age group. It increased from 67.27% in 2020 and accounted for the largest share in the country.

In most mature and emerging markets, consumers are starting to drink 'le's-but-better' alcohol, generally with higher barley and malt contents. Moreover, the shifting inclination toward online sales channels is also providing a way into the premium beverage and is supporting its growth. Owing to this trend, players in the market are also making product launches accordingly. For instance, in October 2022, Square 6 High-Rye Rye Whiskey was released by Heaven Hill Distillery, which claimed it was the latest cutting-edge offering from the Evan Williams Bourbon Experience. They stated that the Square 6 High-Rye Rye Whiskey mash bill, a new recipe under the Heaven Hill portfolio, contains 63% rye, 24% corn, and 13% malted barley. Hence, such developments in the market are expected to attract and increase the demand for premium alcoholic beverages, thus boosting the market's growth during the forecast period.

Premium Alcoholic Beverages Market Trends

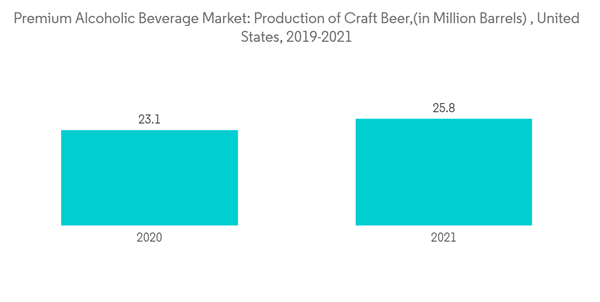

Craft Beer Gaining Importance

The rising health awareness among people and the promoted inclusion of functional and natural ingredients offer more excellent opportunities for craft beer in the premium alcoholic beverage market as it is less expensive than its high-alcohol counterparts, with 2.8% ABV. The demand for craft beer is growing faster in emerging countries like India, China, Indonesia, and Singapore. The growing demand for premium alcoholic beverages is considered one of this market's primary drivers. Additionally, due to the socializing trends, the rising popularity of brewpubs and taprooms among millennial consumers is expected to support the speedy expansion of craft beers globally. New breweries are popping up worldwide, and significant players are keen on developments, offering innovative craft brew and lager varieties to differentiate themselves from competitors to meet the growing consumer demand, causing the sector to grow. For instance, in 2021, Coca-Cola FEMSA announced the acquisition of The Rezopolis, a Brazilian beer brand, to obtain access to the market of Brazilian Craft Beer.Craft beers contain a CBD invention, a non-psychoactive component of the cannabis plant. Breweries like The Long Trail Brewing Company in Vermont have begun producing IPAs and APAs in limited quantities that are brewed using hemp oil. Customers are gravitating to CBD-infused beers because they are relatively low in calories, and the CBD lessens the bitterness of the beer's hops, enhanced by terpenes' citrus flavors. Efforts by alcoholic beverage manufacturers to strengthen distribution channels and extension of purchase channels, such as online stores, and convenience stores, are also contributing substantially to the growth of the premium alcoholic beverages market.

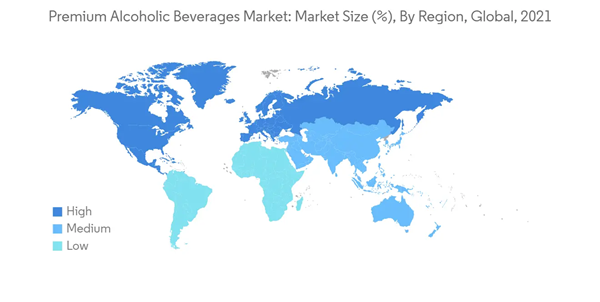

Asia-Pacific to Witness Fastest Growth in the Market

Asia-Pacific is witnessing significant growth in market share in the premium alcoholic beverages market globally. The region includes a sizeable millennial consumer base. It encourages vital players to expand their geographical presence and increase their consumer base, supporting the premium alcoholic beverages market growth in the region. The variety of flavors used in spirits, beer, cider, and wine with a tint of fruits, botanicals, herbs, chocolates, and spices, fabricate a unique texture and taste in alcoholic beverages to fulfill Asian customers' requirements as they prefer variation in premium alcoholic beverages. China holds a significant share of the premium alcoholic beverage market in Asia owing to its augmented exposure to western culture and lifestyle and rising suspicion of domestic liquor. It is increasing the trend of consuming premium alcoholic beverages in the region. For instance, beer is the most consumed alcoholic beverage. According to the National Bureau of Statistics of China, in August 2022, beer production in China was about 3.93 million KL. The number increased by about 12% compared to the same period of the previous year, which amounted to around 4.22 million KL.In addition, the major players operating in the market are expanding their product portfolios, with strategic acquisitions of breweries, to spread their footprints across the world and tap the premium alcoholic beverage market. For instance, in November 2022, the third-largest Indian IMFL (Indian-made Foreign Liquor) company in India, Allied Blenders and Distillers (ABD), solidified plans to acquire three brands in the semi-premium and premium whisky segment. It launched an aggressive growth strategy to expand its reach in the rapidly growing Indian alcohol market. Such factors are expected to attract consumers and raise the consumption of alcoholic beverages in the region.

Premium Alcoholic Beverages Market Competitor Analysis

The premium alcoholic beverage market is highly competitive and comprises regional and international competitors. The market is dominated by players like The Brown-Forman Corporation, Pernod Ricard SA, Gruppo Campari, Diageo plc Brands Inc., and Bacardi Limited. Advanced distribution networks and manufacturing expertise give an upper edge to the manufacturers to expand their range of products. Most market players in the flavonoid industry are focusing on R&D for innovation which is expected to raise sales during the forecast period. Leading producers of the premium alcoholic beverage market are concentrating on leveraging opportunities posed by emerging markets. It includes markets like the United States, Brazil, China, and India, to expand their revenue base, owing to the increasing income levels and changing preference for different types of innovative alcoholic beverage product type.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Pernod Ricard SA

- Diageo plc

- Bacardi Limited

- The Brown-Forman Corporation

- Gruppo Campari

- Constellation Brands

- Carlsberg Group

- Heineken Holding NV

- Treasury Wine Estates

- Anheuser-Busch InBev