Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Infrastructure Investment and Jobs Act has allocated over USD 100 billion through 2025 for road and bridge improvements, boosting demand for commercial vehicle tires as freight transport increases. The Canadian government is also investing heavily in highway upgrades, supporting tire consumption in logistics sectors. Technological upgrades such as run-flat tires and low rolling resistance designs are receiving increased traction due to performance and environmental benefits. Evolving mobility trends, including ride-sharing and fleet expansion, further reinforce tire consumption patterns in urban and intercity routes.

North America continues to see steady growth in vehicle registrations. According to the U.S. Department of Transportation, light vehicle registrations in the U.S. reached approximately 280 million units in 2024, marking a 1.5% increase from the previous year. This steady rise is supported by strong economic recovery, growing consumer confidence, and favorable financing options, which encourage both new vehicle purchases and vehicle replacement cycles.

The increase is not limited to passenger cars but includes SUVs, trucks, and commercial vehicles, all contributing to heightened demand for tires across various segments. Aging vehicle fleets are also driving replacement tire sales as owners opt to maintain rather than replace older vehicles, especially amid supply chain delays impacting new car availability. This growth in vehicle ownership directly boosts demand for original equipment manufacturer (OEM) tires and aftermarket replacement tires, sustaining the tire market’s expansion.

Market Drivers

Growth in E-commerce and Last-Mile Delivery

E-commerce sales in North America surpassed USD 1 trillion in 2024, significantly increasing demand for light commercial vehicle (LCV) tires used in last-mile delivery. This sector’s growth, reported by the U.S. Census Bureau, is encouraging fleets to upgrade tires to durable, fuel-efficient models that can withstand frequent stops, variable loads, and urban driving conditions. The rise of same-day and next-day delivery services has further intensified the need for reliable tire performance to minimize downtime and maintenance costs.Additionally, the adoption of advanced telematics and fleet management systems is optimizing tire usage and replacement schedules, contributing to better overall tire lifecycle management. Increasing investments in urban logistics infrastructure and sustainable delivery solutions, such as electric delivery vans, also support demand for specialized tires designed for low rolling resistance and reduced environmental impact. This trend is expected to continue accelerating as consumer preference for online shopping grows and retailers expand their delivery networks across both metropolitan and suburban areas.

Key Market Challenges

Supply Chain Disruptions and Logistics Costs

Complex global supply chains are vulnerable to delays and increased shipping costs due to port congestion, trade barriers, and geopolitical conflicts. These disruptions affect the timely availability of raw materials and finished products, impacting OEM and aftermarket operations alike. The pandemic’s lingering effects and recent geopolitical tensions continue to cause unpredictable supply fluctuations. Rising fuel prices and labor shortages in the logistics sector further increase transportation costs. Manufacturers are increasingly adopting localized sourcing and inventory diversification strategies to mitigate these risks and improve supply chain resilience.Key Market Trends

Rising Demand for Sustainable and Green Tires

Regulatory pressures and consumer demand are pushing tire manufacturers to develop sustainable products. According to the Environmental Protection Agency (EPA), tire manufacturers are adopting more eco-friendly materials, recycling programs, and producing tires with up to 20% improved fuel efficiency through low rolling resistance technology. These innovations help reduce carbon footprints and comply with increasingly strict environmental regulations. Growing consumer awareness about climate change also drives market preference for green tires. Collaboration between tire makers and automotive companies is accelerating to integrate sustainability throughout the vehicle lifecycle.Key Market Players

- The Goodyear Tire & Rubber Company

- Michelin North America, Inc.

- Bridgestone Americas, Inc.

- Continental Tire the Americas, LLC

- Pirelli Tire LLC

- Hankook Tire America Corp.

- Yokohama Tire Corporation

- Toyo Tire U.S.A. Corp.

- Kumho Tire U.S.A., Inc.

- Sumitomo Rubber North America, Inc.

Report Scope:

In this report, the North America Tire Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:North America Tire Market, By Vehicle Type:

- Passenger Car

- Light Commercial Vehicle (LCV)

- Medium & Heavy Commercial Vehicles (M&HCV)

- Off-the-Road Vehicles (OTR)

- Two-Wheeler

North America Tire Market, By Tire Construction:

- Radial

- Bias

North America Tire Market, By Demand Category:

- OEM

- Aftermarket

North America Tire Market, By Country:

- United States

- Mexico

- Canada

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the North America Tire Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.:Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- The Goodyear Tire & Rubber Company

- Michelin North America, Inc.

- Bridgestone Americas, Inc.

- Continental Tire the Americas, LLC

- Pirelli Tire LLC

- Hankook Tire America Corp.

- Yokohama Tire Corporation

- Toyo Tire U.S.A. Corp.

- Kumho Tire U.S.A., Inc.

- Sumitomo Rubber North America, Inc.

Table Information

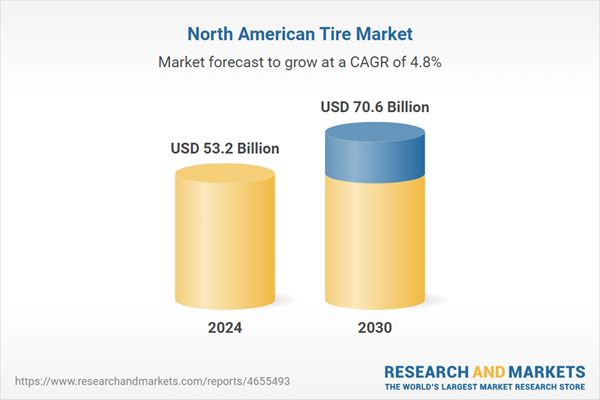

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 53.2 Billion |

| Forecasted Market Value ( USD | $ 70.6 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | North America |

| No. of Companies Mentioned | 10 |