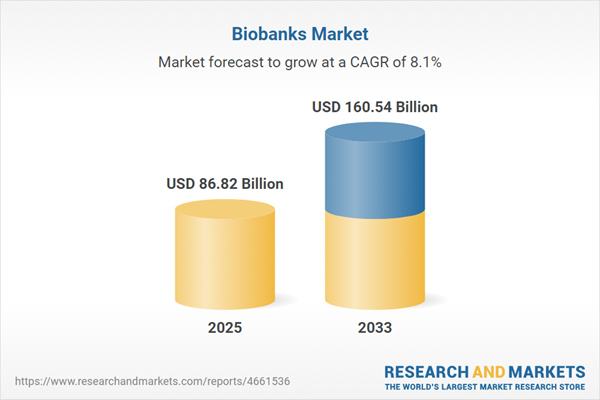

The global biobanks market size was estimated at USD 86.82 billion in 2025 and is anticipated to reach USD 160.54 billion by 2033, growing at a CAGR of 8.11% from 2026 to 2033. High investments in the R&D of advanced therapies, such as regenerative medicine, personalized medicine, and cancer genomic studies, are some of the driving factors.

This product will be delivered within 1-3 business days.

Global Biobanks Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. The report has segmented the global biobanks market report based on product & service, biospecimen type, biobank type, application, and region:Product & Services Outlook (Revenue, USD Million, 2021-2033)

- Product

- Services

Biospecimen Type Outlook (Revenue, USD Million, 2021-2033)

- Human Tissues

- Human Organs

- Stem Cells

- Other Biospecimens

Biobank Type Outlook (Revenue, USD Million, 2021-2033)

- Physical/Real Biobanks

- Virtual Biobanks

Application Type Outlook (Revenue, USD Million, 2021-2033)

- Therapeutics

- Drug Discovery & Clinical Research

- Clinical Diagnostics

- Other Applications

Regional Outlook (Revenue, USD Million, 2021-2033)

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa (MEA)

Why You Should Buy This Report

- Comprehensive Market Analysis: Gain detailed insights into the market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listings for you to stay ahead of the curve

This product will be delivered within 1-3 business days.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Product & Services

1.2.2. Biospecimen Type

1.2.3. Biobank Type

1.2.4. Application

1.3. Research Methodology

1.4. Information Procurement

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

1.2. Segment Definitions

1.2.1. Product & Services

1.2.2. Biospecimen Type

1.2.3. Biobank Type

1.2.4. Application

1.3. Research Methodology

1.4. Information Procurement

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Biobanks Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Increased focus on precision medicine and genetic testing

3.2.1.2. Changes in biobanking operations

3.2.1.3. Increase in the number of clinical trials globally

3.2.1.4. Growing industry and research collaborations

3.2.1.5. Technology advancement and automation

3.2.2. Market restraint analysis

3.2.2.1. Challenges in sharing biobanking data & limited access to biospecimens

3.2.2.2. Sustainability challenges for biobanks

3.2.2.3. Other challenges in biobanking specimens for research

3.3. Biobanks Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.2. PESTEL Analysis

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Increased focus on precision medicine and genetic testing

3.2.1.2. Changes in biobanking operations

3.2.1.3. Increase in the number of clinical trials globally

3.2.1.4. Growing industry and research collaborations

3.2.1.5. Technology advancement and automation

3.2.2. Market restraint analysis

3.2.2.1. Challenges in sharing biobanking data & limited access to biospecimens

3.2.2.2. Sustainability challenges for biobanks

3.2.2.3. Other challenges in biobanking specimens for research

3.3. Biobanks Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.2. PESTEL Analysis

Chapter 4. Biobanks Market: Product & Services Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Product & Services Market Share, 2025 & 2033

4.3. Product

4.4. Market Size & Forecasts and Trend Analyses, 2021 to 2033, for the following

4.4.1. Biobanking Equipment

4.4.1.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.1.2. Temperature Control Systems

4.4.1.2.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.1.2.2. Freezers & Refrigerators

4.4.1.2.2.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.1.2.3. Cryogenic Storage Systems

4.4.1.2.4. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.1.2.5. Thawing Equipment

4.4.1.2.6. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.1.3. Incubators & Centrifuges

4.4.1.3.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.1.4. Alarms & Monitoring Systems

4.4.1.4.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.1.5. Accessories & Other Equipment

4.4.1.5.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.2. Biobanking Consumables

4.4.2.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.3. Laboratory Information Management Systems

4.4.3.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.5. Services

4.6. Market Size & Forecasts and Trend Analyses, 2021 to 2033 for the following

4.6.1. Biobanking & repository

4.6.1.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.6.2. Lab processing

4.6.2.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.6.3. Qualification/ Validation

4.6.3.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.6.4. Cold Chain Logistics

4.6.4.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.6.5. Other Services

4.6.5.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.2. Product & Services Market Share, 2025 & 2033

4.3. Product

4.4. Market Size & Forecasts and Trend Analyses, 2021 to 2033, for the following

4.4.1. Biobanking Equipment

4.4.1.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.1.2. Temperature Control Systems

4.4.1.2.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.1.2.2. Freezers & Refrigerators

4.4.1.2.2.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.1.2.3. Cryogenic Storage Systems

4.4.1.2.4. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.1.2.5. Thawing Equipment

4.4.1.2.6. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.1.3. Incubators & Centrifuges

4.4.1.3.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.1.4. Alarms & Monitoring Systems

4.4.1.4.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.1.5. Accessories & Other Equipment

4.4.1.5.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.2. Biobanking Consumables

4.4.2.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.4.3. Laboratory Information Management Systems

4.4.3.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.5. Services

4.6. Market Size & Forecasts and Trend Analyses, 2021 to 2033 for the following

4.6.1. Biobanking & repository

4.6.1.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.6.2. Lab processing

4.6.2.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.6.3. Qualification/ Validation

4.6.3.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.6.4. Cold Chain Logistics

4.6.4.1. Market estimates and forecasts 2021 to 2033 (USD Million)

4.6.5. Other Services

4.6.5.1. Market estimates and forecasts 2021 to 2033 (USD Million)

Chapter 5. Biobanks Market: Biospecimen Type Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Biospecimen Type Market Share, 2025 & 2033

5.3. Market Size & Forecasts and Trend Analyses, 2021 to 2033, for the following

5.3.1. Human Tissues

5.3.1.1. Market estimates and forecasts 2021 to 2033 (USD Million)

5.3.2. Human Organs

5.3.2.1. Market estimates and forecasts 2021 to 2033 (USD Million)

5.3.3. Stem Cells

5.3.3.1. Market estimates and forecasts 2021 to 2033 (USD Million)

5.3.3.2. Adult Stem Cells

5.3.3.2.1. Market estimates and forecasts 2021 to 2033 (USD Million)

5.3.3.3. Embryonic Stem Cells

5.3.3.3.1. Market estimates and forecasts 2021 to 2033 (USD Million)

5.3.3.4. IPS Cells

5.3.3.4.1. Market estimates and forecasts 2021 to 2033 (USD Million)

5.3.3.5. Other Stem Cells

5.3.3.5.1. Market estimates and forecasts 2021 to 2033 (USD Million)

5.3.4. Other biospecimens

5.3.4.1. Market estimates and forecasts 2021 to 2033 (USD Million)

5.2. Biospecimen Type Market Share, 2025 & 2033

5.3. Market Size & Forecasts and Trend Analyses, 2021 to 2033, for the following

5.3.1. Human Tissues

5.3.1.1. Market estimates and forecasts 2021 to 2033 (USD Million)

5.3.2. Human Organs

5.3.2.1. Market estimates and forecasts 2021 to 2033 (USD Million)

5.3.3. Stem Cells

5.3.3.1. Market estimates and forecasts 2021 to 2033 (USD Million)

5.3.3.2. Adult Stem Cells

5.3.3.2.1. Market estimates and forecasts 2021 to 2033 (USD Million)

5.3.3.3. Embryonic Stem Cells

5.3.3.3.1. Market estimates and forecasts 2021 to 2033 (USD Million)

5.3.3.4. IPS Cells

5.3.3.4.1. Market estimates and forecasts 2021 to 2033 (USD Million)

5.3.3.5. Other Stem Cells

5.3.3.5.1. Market estimates and forecasts 2021 to 2033 (USD Million)

5.3.4. Other biospecimens

5.3.4.1. Market estimates and forecasts 2021 to 2033 (USD Million)

Chapter 6. Biobanks Market: Biobank Type Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Biobank Type Market Share, 2025 & 2033

6.3. Market Size & Forecasts and Trend Analyses, 2021 to 2033, for the following

6.3.1. Physical/Real biobanks

6.3.1.1. Market estimates and forecasts 2021 to 2033 (USD Million)

6.3.1.2. Tissue Biobanks

6.3.1.2.1. Market estimates and forecasts 2021 to 2033 (USD Million)

6.3.1.3. Population-based biobanks

6.3.1.3.1. Market estimates and forecasts 2021 to 2033 (USD Million)

6.3.1.4. Genetic (DNA/RNA)

6.3.1.4.1. Market estimates and forecasts 2021 to 2033 (USD Million)

6.3.1.5. Disease-Based biobanks

6.3.1.5.1. Market estimates and forecasts 2021 to 2033 (USD Million)

6.3.2. Virtual biobanks

6.3.2.1. Market estimates and forecasts 2021 to 2033 (USD Million)

6.2. Biobank Type Market Share, 2025 & 2033

6.3. Market Size & Forecasts and Trend Analyses, 2021 to 2033, for the following

6.3.1. Physical/Real biobanks

6.3.1.1. Market estimates and forecasts 2021 to 2033 (USD Million)

6.3.1.2. Tissue Biobanks

6.3.1.2.1. Market estimates and forecasts 2021 to 2033 (USD Million)

6.3.1.3. Population-based biobanks

6.3.1.3.1. Market estimates and forecasts 2021 to 2033 (USD Million)

6.3.1.4. Genetic (DNA/RNA)

6.3.1.4.1. Market estimates and forecasts 2021 to 2033 (USD Million)

6.3.1.5. Disease-Based biobanks

6.3.1.5.1. Market estimates and forecasts 2021 to 2033 (USD Million)

6.3.2. Virtual biobanks

6.3.2.1. Market estimates and forecasts 2021 to 2033 (USD Million)

Chapter 7. Biobanks Market: Application Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Application Market Share, 2025 & 2033

7.3. Market Size & Forecasts and Trend Analyses, 2021 to 2033, for the following

7.3.1. Therapeutics

7.3.1.1. Market estimates and forecasts 2021 to 2033 (USD Million)

7.3.2. Drug discovery & clinical research

7.3.2.1. Market estimates and forecasts 2021 to 2033 (USD Million)

7.3.3. Clinical Diagnostics

7.3.3.1. Market estimates and forecasts 2021 to 2033 (USD Million)

7.3.4. Other Applications

7.3.4.1. Market estimates and forecasts 2021 to 2033 (USD Million)

7.2. Application Market Share, 2025 & 2033

7.3. Market Size & Forecasts and Trend Analyses, 2021 to 2033, for the following

7.3.1. Therapeutics

7.3.1.1. Market estimates and forecasts 2021 to 2033 (USD Million)

7.3.2. Drug discovery & clinical research

7.3.2.1. Market estimates and forecasts 2021 to 2033 (USD Million)

7.3.3. Clinical Diagnostics

7.3.3.1. Market estimates and forecasts 2021 to 2033 (USD Million)

7.3.4. Other Applications

7.3.4.1. Market estimates and forecasts 2021 to 2033 (USD Million)

Chapter 8. Biobanks Market: Regional Estimates & Trend Analysis

8.1. Regional Market Dashboard

8.2. Regional Market Share Analysis, 2025 & 2033

8.3. Market Size, & Forecasts Trend Analysis, 2021 to 2033

8.4. North America

8.4.1. U.S.

8.4.1.1. Key country dynamics

8.4.1.2. Regulatory framework

8.4.1.3. Competitive scenario

8.4.1.4. U.S. market estimates and forecasts 2021 to 2033 (USD Million)

8.4.2. Canada

8.4.2.1. Key country dynamics

8.4.2.2. Regulatory framework

8.4.2.3. Competitive scenario

8.4.2.4. Canada market estimates and forecasts 2021 to 2033 (USD Million)

8.4.3. Mexico

8.4.3.1. Key country dynamics

8.4.3.2. Regulatory framework

8.4.3.3. Competitive scenario

8.4.3.4. Mexico market estimates and forecasts 2021 to 2033 (USD Million)

8.5. Europe

8.5.1. UK

8.5.1.1. Key country dynamics

8.5.1.2. Regulatory framework

8.5.1.3. Competitive scenario

8.5.1.4. UK market estimates and forecasts 2021 to 2033 (USD Million)

8.5.2. Germany

8.5.2.1. Key country dynamics

8.5.2.2. Regulatory framework

8.5.2.3. Competitive scenario

8.5.2.4. Germany market estimates and forecasts 2021 to 2033 (USD Million)

8.5.3. France

8.5.3.1. Key country dynamics

8.5.3.2. Regulatory framework

8.5.3.3. Competitive scenario

8.5.3.4. France market estimates and forecasts 2021 to 2033 (USD Million)

8.5.4. Italy

8.5.4.1. Key country dynamics

8.5.4.2. Regulatory framework

8.5.4.3. Competitive scenario

8.5.4.4. Italy market estimates and forecasts 2021 to 2033 (USD Million)

8.5.5. Spain

8.5.5.1. Key country dynamics

8.5.5.2. Regulatory framework

8.5.5.3. Competitive scenario

8.5.5.4. Spain market estimates and forecasts 2021 to 2033 (USD Million)

8.5.6. Norway

8.5.6.1. Key country dynamics

8.5.6.2. Regulatory framework

8.5.6.3. Competitive scenario

8.5.6.4. Norway market estimates and forecasts 2021 to 2033 (USD Million)

8.5.7. Sweden

8.5.7.1. Key country dynamics

8.5.7.2. Regulatory framework

8.5.7.3. Competitive scenario

8.5.7.4. Sweden market estimates and forecasts 2021 to 2033 (USD Million)

8.5.8. Denmark

8.5.8.1. Key country dynamics

8.5.8.2. Regulatory framework

8.5.8.3. Competitive scenario

8.5.8.4. Denmark market estimates and forecasts 2021 to 2033 (USD Million)

8.6. Asia-Pacific

8.6.1. Japan

8.6.1.1. Key country dynamics

8.6.1.2. Regulatory framework

8.6.1.3. Competitive scenario

8.6.1.4. Japan market estimates and forecasts 2021 to 2033 (USD Million)

8.6.2. China

8.6.2.1. Key country dynamics

8.6.2.2. Regulatory framework

8.6.2.3. Competitive scenario

8.6.2.4. China market estimates and forecasts 2021 to 2033 (USD Million)

8.6.3. India

8.6.3.1. Key country dynamics

8.6.3.2. Regulatory framework

8.6.3.3. Competitive scenario

8.6.3.4. India market estimates and forecasts 2021 to 2033 (USD Million)

8.6.4. Australia

8.6.4.1. Key country dynamics

8.6.4.2. Regulatory framework

8.6.4.3. Competitive scenario

8.6.4.4. Australia market estimates and forecasts 2021 to 2033 (USD Million)

8.6.5. South Korea

8.6.5.1. Key country dynamics

8.6.5.2. Regulatory framework

8.6.5.3. Competitive scenario

8.6.5.4. South Korea market estimates and forecasts 2021 to 2033 (USD Million)

8.6.6. Thailand

8.6.6.1. Key country dynamics

8.6.6.2. Regulatory framework

8.6.6.3. Competitive scenario

8.6.6.4. Thailand market estimates and forecasts 2021 to 2033 (USD Million)

8.7. Latin America

8.7.1. Brazil

8.7.1.1. Key country dynamics

8.7.1.2. Regulatory framework

8.7.1.3. Competitive scenario

8.7.1.4. Brazil market estimates and forecasts 2021 to 2033 (USD Million)

8.7.2. Argentina

8.7.2.1. Key country dynamics

8.7.2.2. Regulatory framework

8.7.2.3. Competitive scenario

8.7.2.4. Argentina market estimates and forecasts 2021 to 2033 (USD Million)

8.8. MEA

8.8.1. South Africa

8.8.1.1. Key country dynamics

8.8.1.2. Regulatory framework

8.8.1.3. Competitive scenario

8.8.1.4. South Africa market estimates and forecasts 2021 to 2033 (USD Million)

8.8.2. Saudi Arabia

8.8.2.1. Key country dynamics

8.8.2.2. Regulatory framework

8.8.2.3. Competitive scenario

8.8.2.4. Saudi Arabia market estimates and forecasts 2021 to 2033 (USD Million)

8.8.3. UAE

8.8.3.1. Key country dynamics

8.8.3.2. Regulatory framework

8.8.3.3. Competitive scenario

8.8.3.4. UAE market estimates and forecasts 2021 to 2033 (USD Million)

8.8.4. Kuwait

8.8.4.1. Key country dynamics

8.8.4.2. Regulatory framework

8.8.4.3. Competitive scenario

8.8.4.4. Kuwait market estimates and forecasts 2021 to 2033 (USD Million)

8.2. Regional Market Share Analysis, 2025 & 2033

8.3. Market Size, & Forecasts Trend Analysis, 2021 to 2033

8.4. North America

8.4.1. U.S.

8.4.1.1. Key country dynamics

8.4.1.2. Regulatory framework

8.4.1.3. Competitive scenario

8.4.1.4. U.S. market estimates and forecasts 2021 to 2033 (USD Million)

8.4.2. Canada

8.4.2.1. Key country dynamics

8.4.2.2. Regulatory framework

8.4.2.3. Competitive scenario

8.4.2.4. Canada market estimates and forecasts 2021 to 2033 (USD Million)

8.4.3. Mexico

8.4.3.1. Key country dynamics

8.4.3.2. Regulatory framework

8.4.3.3. Competitive scenario

8.4.3.4. Mexico market estimates and forecasts 2021 to 2033 (USD Million)

8.5. Europe

8.5.1. UK

8.5.1.1. Key country dynamics

8.5.1.2. Regulatory framework

8.5.1.3. Competitive scenario

8.5.1.4. UK market estimates and forecasts 2021 to 2033 (USD Million)

8.5.2. Germany

8.5.2.1. Key country dynamics

8.5.2.2. Regulatory framework

8.5.2.3. Competitive scenario

8.5.2.4. Germany market estimates and forecasts 2021 to 2033 (USD Million)

8.5.3. France

8.5.3.1. Key country dynamics

8.5.3.2. Regulatory framework

8.5.3.3. Competitive scenario

8.5.3.4. France market estimates and forecasts 2021 to 2033 (USD Million)

8.5.4. Italy

8.5.4.1. Key country dynamics

8.5.4.2. Regulatory framework

8.5.4.3. Competitive scenario

8.5.4.4. Italy market estimates and forecasts 2021 to 2033 (USD Million)

8.5.5. Spain

8.5.5.1. Key country dynamics

8.5.5.2. Regulatory framework

8.5.5.3. Competitive scenario

8.5.5.4. Spain market estimates and forecasts 2021 to 2033 (USD Million)

8.5.6. Norway

8.5.6.1. Key country dynamics

8.5.6.2. Regulatory framework

8.5.6.3. Competitive scenario

8.5.6.4. Norway market estimates and forecasts 2021 to 2033 (USD Million)

8.5.7. Sweden

8.5.7.1. Key country dynamics

8.5.7.2. Regulatory framework

8.5.7.3. Competitive scenario

8.5.7.4. Sweden market estimates and forecasts 2021 to 2033 (USD Million)

8.5.8. Denmark

8.5.8.1. Key country dynamics

8.5.8.2. Regulatory framework

8.5.8.3. Competitive scenario

8.5.8.4. Denmark market estimates and forecasts 2021 to 2033 (USD Million)

8.6. Asia-Pacific

8.6.1. Japan

8.6.1.1. Key country dynamics

8.6.1.2. Regulatory framework

8.6.1.3. Competitive scenario

8.6.1.4. Japan market estimates and forecasts 2021 to 2033 (USD Million)

8.6.2. China

8.6.2.1. Key country dynamics

8.6.2.2. Regulatory framework

8.6.2.3. Competitive scenario

8.6.2.4. China market estimates and forecasts 2021 to 2033 (USD Million)

8.6.3. India

8.6.3.1. Key country dynamics

8.6.3.2. Regulatory framework

8.6.3.3. Competitive scenario

8.6.3.4. India market estimates and forecasts 2021 to 2033 (USD Million)

8.6.4. Australia

8.6.4.1. Key country dynamics

8.6.4.2. Regulatory framework

8.6.4.3. Competitive scenario

8.6.4.4. Australia market estimates and forecasts 2021 to 2033 (USD Million)

8.6.5. South Korea

8.6.5.1. Key country dynamics

8.6.5.2. Regulatory framework

8.6.5.3. Competitive scenario

8.6.5.4. South Korea market estimates and forecasts 2021 to 2033 (USD Million)

8.6.6. Thailand

8.6.6.1. Key country dynamics

8.6.6.2. Regulatory framework

8.6.6.3. Competitive scenario

8.6.6.4. Thailand market estimates and forecasts 2021 to 2033 (USD Million)

8.7. Latin America

8.7.1. Brazil

8.7.1.1. Key country dynamics

8.7.1.2. Regulatory framework

8.7.1.3. Competitive scenario

8.7.1.4. Brazil market estimates and forecasts 2021 to 2033 (USD Million)

8.7.2. Argentina

8.7.2.1. Key country dynamics

8.7.2.2. Regulatory framework

8.7.2.3. Competitive scenario

8.7.2.4. Argentina market estimates and forecasts 2021 to 2033 (USD Million)

8.8. MEA

8.8.1. South Africa

8.8.1.1. Key country dynamics

8.8.1.2. Regulatory framework

8.8.1.3. Competitive scenario

8.8.1.4. South Africa market estimates and forecasts 2021 to 2033 (USD Million)

8.8.2. Saudi Arabia

8.8.2.1. Key country dynamics

8.8.2.2. Regulatory framework

8.8.2.3. Competitive scenario

8.8.2.4. Saudi Arabia market estimates and forecasts 2021 to 2033 (USD Million)

8.8.3. UAE

8.8.3.1. Key country dynamics

8.8.3.2. Regulatory framework

8.8.3.3. Competitive scenario

8.8.3.4. UAE market estimates and forecasts 2021 to 2033 (USD Million)

8.8.4. Kuwait

8.8.4.1. Key country dynamics

8.8.4.2. Regulatory framework

8.8.4.3. Competitive scenario

8.8.4.4. Kuwait market estimates and forecasts 2021 to 2033 (USD Million)

Chapter 9. Competitive Landscape

9.1. Company/Competition Categorization

9.2. Strategy Mapping

9.3. Company Market Position Analysis, 2025

9.4. Company Profiles/Listing

9.4.1. Thermo Fisher Scientific Inc.

9.4.1.1. Company overview

9.4.1.2. Financial performance

9.4.1.3. Product benchmarking

9.4.1.4. Strategic initiatives

9.4.2. Merck KGaA

9.4.2.1. Company overview

9.4.2.2. Financial performance

9.4.2.3. Product benchmarking

9.4.2.4. Strategic initiatives

9.4.3. Qiagen

9.4.3.1. Company overview

9.4.3.2. Financial performance

9.4.3.3. Product benchmarking

9.4.3.4. Strategic initiatives

9.4.4. Hamilton Company

9.4.4.1. Company overview

9.4.4.2. Financial performance

9.4.4.3. Product benchmarking

9.4.4.4. Strategic initiatives

9.4.5. Tecan Trading AG

9.4.5.1. Company overview

9.4.5.2. Financial performance

9.4.5.3. Product benchmarking

9.4.5.4. Strategic initiatives

9.4.6. Danaher Corporation

9.4.6.1. Company overview

9.4.6.2. Financial performance

9.4.6.3. Product benchmarking

9.4.6.4. Strategic initiatives

9.4.7. Becton, Dickinson, and Company (BD)

9.4.7.1. Company overview

9.4.7.2. Financial performance

9.4.7.3. Product benchmarking

9.4.7.4. Strategic initiatives

9.4.8. Biocision, LLC.

9.4.8.1. Company overview

9.4.8.2. Financial performance

9.4.8.3. Product benchmarking

9.4.8.4. Strategic initiatives

9.4.9. Taylor-Wharton

9.4.9.1. Company overview

9.4.9.2. Financial performance

9.4.9.3. Product benchmarking

9.4.9.4. Strategic initiatives

9.4.10. Charles River Laboratories

9.4.10.1. Company overview

9.4.10.2. Financial performance

9.4.10.3. Product benchmarking

9.4.10.4. Strategic initiatives

9.4.11. Lonza

9.4.11.1. Company overview

9.4.11.2. Financial performance

9.4.11.3. Product benchmarking

9.4.11.4. Strategic initiatives

9.4.12. Stemcell Technologies

9.4.12.1. Company overview

9.4.12.2. Financial performance

9.4.12.3. Product benchmarking

9.4.12.4. Strategic initiatives

9.4.13. Biovault Family

9.4.13.1. Company overview

9.4.13.2. Financial performance

9.4.13.3. Product benchmarking

9.4.13.4. Strategic initiatives

9.4.14. Promocell Gmbh

9.4.14.1. Company overview

9.4.14.2. Financial performance

9.4.14.3. Product benchmarking

9.4.14.4. Strategic initiatives

9.4.15. Precision Cellular Storage Ltd. (Virgin Health Bank)

9.4.15.1. Company overview

9.4.15.2. Financial performance

9.4.15.3. Product benchmarking

9.4.15.4. Strategic initiatives

9.2. Strategy Mapping

9.3. Company Market Position Analysis, 2025

9.4. Company Profiles/Listing

9.4.1. Thermo Fisher Scientific Inc.

9.4.1.1. Company overview

9.4.1.2. Financial performance

9.4.1.3. Product benchmarking

9.4.1.4. Strategic initiatives

9.4.2. Merck KGaA

9.4.2.1. Company overview

9.4.2.2. Financial performance

9.4.2.3. Product benchmarking

9.4.2.4. Strategic initiatives

9.4.3. Qiagen

9.4.3.1. Company overview

9.4.3.2. Financial performance

9.4.3.3. Product benchmarking

9.4.3.4. Strategic initiatives

9.4.4. Hamilton Company

9.4.4.1. Company overview

9.4.4.2. Financial performance

9.4.4.3. Product benchmarking

9.4.4.4. Strategic initiatives

9.4.5. Tecan Trading AG

9.4.5.1. Company overview

9.4.5.2. Financial performance

9.4.5.3. Product benchmarking

9.4.5.4. Strategic initiatives

9.4.6. Danaher Corporation

9.4.6.1. Company overview

9.4.6.2. Financial performance

9.4.6.3. Product benchmarking

9.4.6.4. Strategic initiatives

9.4.7. Becton, Dickinson, and Company (BD)

9.4.7.1. Company overview

9.4.7.2. Financial performance

9.4.7.3. Product benchmarking

9.4.7.4. Strategic initiatives

9.4.8. Biocision, LLC.

9.4.8.1. Company overview

9.4.8.2. Financial performance

9.4.8.3. Product benchmarking

9.4.8.4. Strategic initiatives

9.4.9. Taylor-Wharton

9.4.9.1. Company overview

9.4.9.2. Financial performance

9.4.9.3. Product benchmarking

9.4.9.4. Strategic initiatives

9.4.10. Charles River Laboratories

9.4.10.1. Company overview

9.4.10.2. Financial performance

9.4.10.3. Product benchmarking

9.4.10.4. Strategic initiatives

9.4.11. Lonza

9.4.11.1. Company overview

9.4.11.2. Financial performance

9.4.11.3. Product benchmarking

9.4.11.4. Strategic initiatives

9.4.12. Stemcell Technologies

9.4.12.1. Company overview

9.4.12.2. Financial performance

9.4.12.3. Product benchmarking

9.4.12.4. Strategic initiatives

9.4.13. Biovault Family

9.4.13.1. Company overview

9.4.13.2. Financial performance

9.4.13.3. Product benchmarking

9.4.13.4. Strategic initiatives

9.4.14. Promocell Gmbh

9.4.14.1. Company overview

9.4.14.2. Financial performance

9.4.14.3. Product benchmarking

9.4.14.4. Strategic initiatives

9.4.15. Precision Cellular Storage Ltd. (Virgin Health Bank)

9.4.15.1. Company overview

9.4.15.2. Financial performance

9.4.15.3. Product benchmarking

9.4.15.4. Strategic initiatives

List of Tables

Table 1 List of abbreviation

Table 2 North America biobanks market, by region, 2021-2033 (USD Million)

Table 3 North America biobanks market, by product & services, 2021-2033 (USD Million)

Table 4 North America biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 5 North America biobanks market, by biobank type, 2021-2033 (USD Million)

Table 6 North America biobanks market, by application, 2021-2033 (USD Million)

Table 7 U.S. biobanks market, by product & services, 2021-2033 (USD Million)

Table 8 U.S. biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 9 U.S. biobanks market, by biobank type, 2021-2033 (USD Million)

Table 10 U.S. biobanks market, by application, 2021-2033 (USD Million)

Table 11 Mexico biobanks market, by product & services, 2021-2033 (USD Million)

Table 12 Mexico biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 13 Mexico biobanks market, by biobank type, 2021-2033 (USD Million)

Table 14 Mexico biobanks market, by application, 2021-2033 (USD Million)

Table 15 Canada biobanks market, by product & services, 2021-2033 (USD Million)

Table 16 Canada biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 17 Canada biobanks market, by biobank type, 2021-2033 (USD Million)

Table 18 Canada biobanks market, by application, 2021-2033 (USD Million)

Table 19 Europe biobanks market, by region, 2021-2033 (USD Million)

Table 20 Europe biobanks market, by product & services, 2021-2033 (USD Million)

Table 21 Europe biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 22 Europe biobanks market, by biobank type, 2021-2033 (USD Million)

Table 23 Europe biobanks market, by application, 2021-2033 (USD Million)

Table 24 Germany biobanks market, by product & services, 2021-2033 (USD Million)

Table 25 Germany biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 26 Germany biobanks market, by biobank type, 2021-2033 (USD Million)

Table 27 Germany biobanks market, by application, 2021-2033 (USD Million)

Table 28 UK biobanks market, by product & services, 2021-2033 (USD Million)

Table 29 UK biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 30 UK biobanks market, by biobank type, 2021-2033 (USD Million)

Table 31 UK biobanks market, by application, 2021-2033 (USD Million)

Table 32 France biobanks market, by product & services, 2021-2033 (USD Million)

Table 33 France biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 34 France biobanks market, by biobank type, 2021-2033 (USD Million)

Table 35 France biobanks market, by application, 2021-2033 (USD Million)

Table 36 Italy biobanks market, by product & services, 2021-2033 (USD Million)

Table 37 Italy biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 38 Italy biobanks market, by biobank type, 2021-2033 (USD Million)

Table 39 Italy biobanks market, by application, 2021-2033 (USD Million)

Table 40 Spain biobanks market, by product & services, 2021-2033 (USD Million)

Table 41 Spain biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 42 Spain biobanks market, by biobank type, 2021-2033 (USD Million)

Table 43 Spain biobanks market, by application, 2021-2033 (USD Million)

Table 44 Denmark biobanks market, by product & services, 2021-2033 (USD Million)

Table 45 Denmark biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 46 Denmark biobanks market, by biobank type, 2021-2033 (USD Million)

Table 47 Denmark biobanks market, by application, 2021-2033 (USD Million)

Table 48 Sweden biobanks market, by product & services, 2021-2033 (USD Million)

Table 49 Sweden biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 50 Sweden biobanks market, by biobank type, 2021-2033 (USD Million)

Table 51 Sweden biobanks market, by application, 2021-2033 (USD Million)

Table 52 Norway biobanks market, by product & services, 2021-2033 (USD Million)

Table 53 Norway biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 54 Norway biobanks market, by biobank type, 2021-2033 (USD Million)

Table 55 Norway biobanks market, by application, 2021-2033 (USD Million)

Table 56 Asia-Pacific biobanks market, by region, 2021-2033 (USD Million)

Table 57 Asia-Pacific biobanks market, by product & services, 2021-2033 (USD Million)

Table 58 Asia-Pacific biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 59 Asia-Pacific biobanks market, by biobank type, 2021-2033 (USD Million)

Table 60 Asia-Pacific biobanks market, by application, 2021-2033 (USD Million)

Table 61 China biobanks market, by product & services, 2021-2033 (USD Million)

Table 62 China biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 63 China biobanks market, by biobank type, 2021-2033 (USD Million)

Table 64 China biobanks market, by application, 2021-2033 (USD Million)

Table 65 Japan biobanks market, by product & services, 2021-2033 (USD Million)

Table 66 Japan biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 67 Japan biobanks market, by biobank type, 2021-2033 (USD Million)

Table 68 Japan biobanks market, by application, 2021-2033 (USD Million)

Table 69 India biobanks market, by product & services, 2021-2033 (USD Million)

Table 70 India biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 71 India biobanks market, by biobank type, 2021-2033 (USD Million)

Table 72 India biobanks market, by application, 2021-2033 (USD Million)

Table 73 South Korea biobanks market, by product & services, 2021-2033 (USD Million)

Table 74 South Korea biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 75 South Korea biobanks market, by biobank type, 2021-2033 (USD Million)

Table 76 South Korea biobanks market, by application, 2021-2033 (USD Million)

Table 77 Australia biobanks market, by product & services, 2021-2033 (USD Million)

Table 78 Australia biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 79 Australia biobanks market, by biobank type, 2021-2033 (USD Million)

Table 80 Australia biobanks market, by application, 2021-2033 (USD Million)

Table 81 Thailand biobanks market, by product & services, 2021-2033 (USD Million)

Table 82 Thailand biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 83 Thailand biobanks market, by biobank type, 2021-2033 (USD Million)

Table 84 Thailand biobanks market, by application, 2021-2033 (USD Million)

Table 85 Latin America biobanks market, by product & services, 2021-2033 (USD Million)

Table 86 Latin America biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 87 Latin America biobanks market, by biobank type, 2021-2033 (USD Million)

Table 88 Latin America biobanks market, by application, 2021-2033 (USD Million)

Table 89 Brazil biobanks market, by product & services, 2021-2033 (USD Million)

Table 90 Brazil biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 91 Brazil biobanks market, by biobank type, 2021-2033 (USD Million)

Table 92 Brazil biobanks market, by application, 2021-2033 (USD Million)

Table 93 Argentina biobanks market, by product & services, 2021-2033 (USD Million)

Table 94 Argentina biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 95 Argentina biobanks market, by biobank type, 2021-2033 (USD Million)

Table 96 Argentina biobanks market, by application, 2021-2033 (USD Million)

Table 97 MEA biobanks market, by region, 2021-2033 (USD Million)

Table 98 MEA biobanks market, by product & services, 2021-2033 (USD Million)

Table 99 MEA biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 100 MEA biobanks market, by biobank type, 2021-2033 (USD Million)

Table 101 MEA biobanks market, by application, 2021-2033 (USD Million)

Table 102 South Africa biobanks market, by product & services, 2021-2033 (USD Million)

Table 103 South Africa biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 104 South Africa biobanks market, by biobank type, 2021-2033 (USD Million)

Table 105 South Africa biobanks market, by application, 2021-2033 (USD Million)

Table 106 Saudi Arabia biobanks market, by product & services, 2021-2033 (USD Million)

Table 107 Saudi Arabia biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 108 Saudi Arabia biobanks market, by biobank type, 2021-2033 (USD Million)

Table 109 Saudi Arabia biobanks market, by application, 2021-2033 (USD Million)

Table 110 UAE biobanks market, by product & services, 2021-2033 (USD Million)

Table 111 UAE biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 112 UAE biobanks market, by biobank type, 2021-2033 (USD Million)

Table 113 UAE biobanks market, by application, 2021-2033 (USD Million)

Table 114 Kuwait biobanks market, by product & services, 2021-2033 (USD Million)

Table 115 Kuwait biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 116 Kuwait biobanks market, by biobank type, 2021-2033 (USD Million)

Table 117 Kuwait biobanks market, by application, 2021-2033 (USD Million)

Table 2 North America biobanks market, by region, 2021-2033 (USD Million)

Table 3 North America biobanks market, by product & services, 2021-2033 (USD Million)

Table 4 North America biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 5 North America biobanks market, by biobank type, 2021-2033 (USD Million)

Table 6 North America biobanks market, by application, 2021-2033 (USD Million)

Table 7 U.S. biobanks market, by product & services, 2021-2033 (USD Million)

Table 8 U.S. biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 9 U.S. biobanks market, by biobank type, 2021-2033 (USD Million)

Table 10 U.S. biobanks market, by application, 2021-2033 (USD Million)

Table 11 Mexico biobanks market, by product & services, 2021-2033 (USD Million)

Table 12 Mexico biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 13 Mexico biobanks market, by biobank type, 2021-2033 (USD Million)

Table 14 Mexico biobanks market, by application, 2021-2033 (USD Million)

Table 15 Canada biobanks market, by product & services, 2021-2033 (USD Million)

Table 16 Canada biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 17 Canada biobanks market, by biobank type, 2021-2033 (USD Million)

Table 18 Canada biobanks market, by application, 2021-2033 (USD Million)

Table 19 Europe biobanks market, by region, 2021-2033 (USD Million)

Table 20 Europe biobanks market, by product & services, 2021-2033 (USD Million)

Table 21 Europe biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 22 Europe biobanks market, by biobank type, 2021-2033 (USD Million)

Table 23 Europe biobanks market, by application, 2021-2033 (USD Million)

Table 24 Germany biobanks market, by product & services, 2021-2033 (USD Million)

Table 25 Germany biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 26 Germany biobanks market, by biobank type, 2021-2033 (USD Million)

Table 27 Germany biobanks market, by application, 2021-2033 (USD Million)

Table 28 UK biobanks market, by product & services, 2021-2033 (USD Million)

Table 29 UK biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 30 UK biobanks market, by biobank type, 2021-2033 (USD Million)

Table 31 UK biobanks market, by application, 2021-2033 (USD Million)

Table 32 France biobanks market, by product & services, 2021-2033 (USD Million)

Table 33 France biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 34 France biobanks market, by biobank type, 2021-2033 (USD Million)

Table 35 France biobanks market, by application, 2021-2033 (USD Million)

Table 36 Italy biobanks market, by product & services, 2021-2033 (USD Million)

Table 37 Italy biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 38 Italy biobanks market, by biobank type, 2021-2033 (USD Million)

Table 39 Italy biobanks market, by application, 2021-2033 (USD Million)

Table 40 Spain biobanks market, by product & services, 2021-2033 (USD Million)

Table 41 Spain biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 42 Spain biobanks market, by biobank type, 2021-2033 (USD Million)

Table 43 Spain biobanks market, by application, 2021-2033 (USD Million)

Table 44 Denmark biobanks market, by product & services, 2021-2033 (USD Million)

Table 45 Denmark biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 46 Denmark biobanks market, by biobank type, 2021-2033 (USD Million)

Table 47 Denmark biobanks market, by application, 2021-2033 (USD Million)

Table 48 Sweden biobanks market, by product & services, 2021-2033 (USD Million)

Table 49 Sweden biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 50 Sweden biobanks market, by biobank type, 2021-2033 (USD Million)

Table 51 Sweden biobanks market, by application, 2021-2033 (USD Million)

Table 52 Norway biobanks market, by product & services, 2021-2033 (USD Million)

Table 53 Norway biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 54 Norway biobanks market, by biobank type, 2021-2033 (USD Million)

Table 55 Norway biobanks market, by application, 2021-2033 (USD Million)

Table 56 Asia-Pacific biobanks market, by region, 2021-2033 (USD Million)

Table 57 Asia-Pacific biobanks market, by product & services, 2021-2033 (USD Million)

Table 58 Asia-Pacific biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 59 Asia-Pacific biobanks market, by biobank type, 2021-2033 (USD Million)

Table 60 Asia-Pacific biobanks market, by application, 2021-2033 (USD Million)

Table 61 China biobanks market, by product & services, 2021-2033 (USD Million)

Table 62 China biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 63 China biobanks market, by biobank type, 2021-2033 (USD Million)

Table 64 China biobanks market, by application, 2021-2033 (USD Million)

Table 65 Japan biobanks market, by product & services, 2021-2033 (USD Million)

Table 66 Japan biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 67 Japan biobanks market, by biobank type, 2021-2033 (USD Million)

Table 68 Japan biobanks market, by application, 2021-2033 (USD Million)

Table 69 India biobanks market, by product & services, 2021-2033 (USD Million)

Table 70 India biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 71 India biobanks market, by biobank type, 2021-2033 (USD Million)

Table 72 India biobanks market, by application, 2021-2033 (USD Million)

Table 73 South Korea biobanks market, by product & services, 2021-2033 (USD Million)

Table 74 South Korea biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 75 South Korea biobanks market, by biobank type, 2021-2033 (USD Million)

Table 76 South Korea biobanks market, by application, 2021-2033 (USD Million)

Table 77 Australia biobanks market, by product & services, 2021-2033 (USD Million)

Table 78 Australia biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 79 Australia biobanks market, by biobank type, 2021-2033 (USD Million)

Table 80 Australia biobanks market, by application, 2021-2033 (USD Million)

Table 81 Thailand biobanks market, by product & services, 2021-2033 (USD Million)

Table 82 Thailand biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 83 Thailand biobanks market, by biobank type, 2021-2033 (USD Million)

Table 84 Thailand biobanks market, by application, 2021-2033 (USD Million)

Table 85 Latin America biobanks market, by product & services, 2021-2033 (USD Million)

Table 86 Latin America biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 87 Latin America biobanks market, by biobank type, 2021-2033 (USD Million)

Table 88 Latin America biobanks market, by application, 2021-2033 (USD Million)

Table 89 Brazil biobanks market, by product & services, 2021-2033 (USD Million)

Table 90 Brazil biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 91 Brazil biobanks market, by biobank type, 2021-2033 (USD Million)

Table 92 Brazil biobanks market, by application, 2021-2033 (USD Million)

Table 93 Argentina biobanks market, by product & services, 2021-2033 (USD Million)

Table 94 Argentina biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 95 Argentina biobanks market, by biobank type, 2021-2033 (USD Million)

Table 96 Argentina biobanks market, by application, 2021-2033 (USD Million)

Table 97 MEA biobanks market, by region, 2021-2033 (USD Million)

Table 98 MEA biobanks market, by product & services, 2021-2033 (USD Million)

Table 99 MEA biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 100 MEA biobanks market, by biobank type, 2021-2033 (USD Million)

Table 101 MEA biobanks market, by application, 2021-2033 (USD Million)

Table 102 South Africa biobanks market, by product & services, 2021-2033 (USD Million)

Table 103 South Africa biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 104 South Africa biobanks market, by biobank type, 2021-2033 (USD Million)

Table 105 South Africa biobanks market, by application, 2021-2033 (USD Million)

Table 106 Saudi Arabia biobanks market, by product & services, 2021-2033 (USD Million)

Table 107 Saudi Arabia biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 108 Saudi Arabia biobanks market, by biobank type, 2021-2033 (USD Million)

Table 109 Saudi Arabia biobanks market, by application, 2021-2033 (USD Million)

Table 110 UAE biobanks market, by product & services, 2021-2033 (USD Million)

Table 111 UAE biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 112 UAE biobanks market, by biobank type, 2021-2033 (USD Million)

Table 113 UAE biobanks market, by application, 2021-2033 (USD Million)

Table 114 Kuwait biobanks market, by product & services, 2021-2033 (USD Million)

Table 115 Kuwait biobanks market, by biospecimen type, 2021-2033 (USD Million)

Table 116 Kuwait biobanks market, by biobank type, 2021-2033 (USD Million)

Table 117 Kuwait biobanks market, by application, 2021-2033 (USD Million)

List of Figures

Figure 1 Market research process

Figure 2 Data triangulation techniques

Figure 3 Primary research pattern

Figure 4 Market research approaches

Figure 5 Value-chain-based sizing & forecasting

Figure 6 QFD modeling for market share assessment

Figure 7 Market formulation & validation

Figure 8 Biobanks market: market outlook

Figure 9 Biobanks competitive insights

Figure 10 Parent market outlook

Figure 11 Related/ancillary market outlook

Figure 12 Penetration and growth prospect mapping

Figure 13 Industry value chain analysis

Figure 14 Biobanks market driver impact

Figure 15 Biobanks market restraint impact

Figure 16 Biobanks market strategic initiatives analysis

Figure 17 Biobanks market: Product & services movement analysis

Figure 18 Biobanks market: Product & services outlook and key takeaways

Figure 19 Product market estimates and forecast, 2021-2033

Figure 20 Biobanking equipment market estimates and forecast, 2021-2033

Figure 21 Temperature control systems estimates and forecast, 2021-2033

Figure 22 Freezers & refrigerators market estimates and forecast, 2021-2033

Figure 23 Cryogenic storage systems market estimates and forecast, 2021-2033

Figure 24 Thawing equipment market estimates and forecast, 2021-2033

Figure 25 Incubators & centrifuges market estimates and forecast, 2021-2033

Figure 26 Alarms & monitoring systems market estimates and forecast, 2021-2033

Figure 27 Accessories & other equipment market estimates and forecast, 2021-2033

Figure 28 Biobanking consumables market estimates and forecast, 2021-2033

Figure 29 Laboratory information management systems market estimates and forecast, 2021-2033

Figure 30 Services market estimates and forecasts, 2021-2033

Figure 31 Biobanking & repository market estimates and forecasts, 2021-2033

Figure 32 Lab processing market estimates and forecasts, 2021-2033

Figure 33 Qualification/ Validation market estimates and forecasts, 2021-2033

Figure 34 Cold chain logistics market estimates and forecasts, 2021-2033

Figure 35 Other services market estimates and forecasts, 2021-2033

Figure 36 Biobanks market: Biospecimen type movement analysis

Figure 37 Biobanks market: Biospecimen type outlook and key takeaways

Figure 38 Human tissues market estimates and forecasts, 2021-2033

Figure 39 Human organs market estimates and forecasts, 2021-2033

Figure 40 Stem cells market estimates and forecasts, 2021-2033

Figure 41 Adult stem cells market estimates and forecasts, 2021-2033

Figure 42 Embryonic stem cells market estimates and forecasts, 2021-2033

Figure 43 IPS cells market estimates and forecasts, 2021-2033

Figure 44 Other stem cells market estimates and forecasts, 2021-2033

Figure 45 Other biospecimens market estimates and forecasts, 2021-2033

Figure 46 Biobanks market: Biobank type movement analysis

Figure 47 Biobanks market: Biobank type outlook and key takeaways

Figure 48 Physical/Real biobanks market estimates and forecasts, 2021-2033

Figure 49 Tissue biobanks market estimates and forecasts, 2021-2033

Figure 50 Population-based biobanks market estimates and forecasts, 2021-2033

Figure 51 Genetic (DNA/RNA) market estimates and forecasts, 2021-2033

Figure 52 Disease-Based biobanks market estimates and forecasts, 2021-2033

Figure 53 Virtual biobanks market estimates and forecasts, 2021-2033

Figure 54 Biobanks market: Application movement analysis

Figure 55 Biobanks market: Application outlook and key takeaways

Figure 56 Therapeutics market estimates and forecasts, 2021-2033

Figure 57 Drug discovery & clinical research market estimates and forecasts, 2021-2033

Figure 58 Clinical diagnostics market estimates and forecasts, 2021-2033

Figure 59 Other applications market estimates and forecasts, 2021-2033

Figure 60 Global Biobanks market: Regional movement analysis

Figure 61 Global Biobanks market: Regional outlook and key takeaways

Figure 62 North America, by country

Figure 63 North America

Figure 64 North America market estimates and forecasts, 2021-2033

Figure 65 U.S. country dynamics

Figure 66 U.S. market estimates and forecasts, 2021-2033

Figure 67 Canada country dynamics

Figure 68 Canada market estimates and forecasts, 2021-2033

Figure 69 Mexico country dynamics

Figure 70 Mexico market estimates and forecasts, 2021-2033

Figure 71 Europe market estimates and forecasts, 2021-2033

Figure 72 UK country dynamics

Figure 73 UK market estimates and forecasts, 2021-2033

Figure 74 Germany country dynamics

Figure 75 Germany market estimates and forecasts, 2021-2033

Figure 76 France country dynamics

Figure 77 France market estimates and forecasts, 2021-2033

Figure 78 Italy country dynamics

Figure 79 Italy market estimates and forecasts, 2021-2033

Figure 80 Spain country dynamics

Figure 81 Spain market estimates and forecasts, 2021-2033

Figure 82 Denmark country dynamics

Figure 83 Denmark market estimates and forecasts, 2021-2033

Figure 84 Sweden country dynamics

Figure 85 Sweden market estimates and forecasts, 2021-2033

Figure 86 Norway country dynamics

Figure 87 Norway market estimates and forecasts, 2021-2033

Figure 88 Asia-Pacific market estimates and forecasts, 2021-2033

Figure 89 China country dynamics

Figure 90 China market estimates and forecasts, 2021-2033

Figure 91 Japan country dynamics

Figure 92 Japan market estimates and forecasts, 2021-2033

Figure 93 India country dynamics

Figure 94 India market estimates and forecasts, 2021-2033

Figure 95 Thailand country dynamics

Figure 96 Thailand market estimates and forecasts, 2021-2033

Figure 97 South Korea country dynamics

Figure 98 South Korea market estimates and forecasts, 2021-2033

Figure 99 Australia country dynamics

Figure 100 Australia market estimates and forecasts, 2021-2033

Figure 101 Latin America market estimates and forecasts, 2021-2033

Figure 102 Brazil country dynamics

Figure 103 Brazil market estimates and forecasts, 2021-2033

Figure 104 Argentina country dynamics

Figure 105 Argentina market estimates and forecasts, 2021-2033

Figure 106 Middle East and Africa market estimates and forecasts, 2021-2033

Figure 107 South Africa country dynamics

Figure 108 South Africa market estimates and forecasts, 2021-2033

Figure 109 Saudi Arabia country dynamics

Figure 110 Saudi Arabia market estimates and forecasts, 2021-2033

Figure 111 UAE country dynamics

Figure 112 UAE market estimates and forecasts, 2021-2033

Figure 113 Kuwait country dynamics

Figure 114 Kuwait market estimates and forecasts, 2021-2033

Figure 115 Market position of key market players- Biobanks market

Figure 2 Data triangulation techniques

Figure 3 Primary research pattern

Figure 4 Market research approaches

Figure 5 Value-chain-based sizing & forecasting

Figure 6 QFD modeling for market share assessment

Figure 7 Market formulation & validation

Figure 8 Biobanks market: market outlook

Figure 9 Biobanks competitive insights

Figure 10 Parent market outlook

Figure 11 Related/ancillary market outlook

Figure 12 Penetration and growth prospect mapping

Figure 13 Industry value chain analysis

Figure 14 Biobanks market driver impact

Figure 15 Biobanks market restraint impact

Figure 16 Biobanks market strategic initiatives analysis

Figure 17 Biobanks market: Product & services movement analysis

Figure 18 Biobanks market: Product & services outlook and key takeaways

Figure 19 Product market estimates and forecast, 2021-2033

Figure 20 Biobanking equipment market estimates and forecast, 2021-2033

Figure 21 Temperature control systems estimates and forecast, 2021-2033

Figure 22 Freezers & refrigerators market estimates and forecast, 2021-2033

Figure 23 Cryogenic storage systems market estimates and forecast, 2021-2033

Figure 24 Thawing equipment market estimates and forecast, 2021-2033

Figure 25 Incubators & centrifuges market estimates and forecast, 2021-2033

Figure 26 Alarms & monitoring systems market estimates and forecast, 2021-2033

Figure 27 Accessories & other equipment market estimates and forecast, 2021-2033

Figure 28 Biobanking consumables market estimates and forecast, 2021-2033

Figure 29 Laboratory information management systems market estimates and forecast, 2021-2033

Figure 30 Services market estimates and forecasts, 2021-2033

Figure 31 Biobanking & repository market estimates and forecasts, 2021-2033

Figure 32 Lab processing market estimates and forecasts, 2021-2033

Figure 33 Qualification/ Validation market estimates and forecasts, 2021-2033

Figure 34 Cold chain logistics market estimates and forecasts, 2021-2033

Figure 35 Other services market estimates and forecasts, 2021-2033

Figure 36 Biobanks market: Biospecimen type movement analysis

Figure 37 Biobanks market: Biospecimen type outlook and key takeaways

Figure 38 Human tissues market estimates and forecasts, 2021-2033

Figure 39 Human organs market estimates and forecasts, 2021-2033

Figure 40 Stem cells market estimates and forecasts, 2021-2033

Figure 41 Adult stem cells market estimates and forecasts, 2021-2033

Figure 42 Embryonic stem cells market estimates and forecasts, 2021-2033

Figure 43 IPS cells market estimates and forecasts, 2021-2033

Figure 44 Other stem cells market estimates and forecasts, 2021-2033

Figure 45 Other biospecimens market estimates and forecasts, 2021-2033

Figure 46 Biobanks market: Biobank type movement analysis

Figure 47 Biobanks market: Biobank type outlook and key takeaways

Figure 48 Physical/Real biobanks market estimates and forecasts, 2021-2033

Figure 49 Tissue biobanks market estimates and forecasts, 2021-2033

Figure 50 Population-based biobanks market estimates and forecasts, 2021-2033

Figure 51 Genetic (DNA/RNA) market estimates and forecasts, 2021-2033

Figure 52 Disease-Based biobanks market estimates and forecasts, 2021-2033

Figure 53 Virtual biobanks market estimates and forecasts, 2021-2033

Figure 54 Biobanks market: Application movement analysis

Figure 55 Biobanks market: Application outlook and key takeaways

Figure 56 Therapeutics market estimates and forecasts, 2021-2033

Figure 57 Drug discovery & clinical research market estimates and forecasts, 2021-2033

Figure 58 Clinical diagnostics market estimates and forecasts, 2021-2033

Figure 59 Other applications market estimates and forecasts, 2021-2033

Figure 60 Global Biobanks market: Regional movement analysis

Figure 61 Global Biobanks market: Regional outlook and key takeaways

Figure 62 North America, by country

Figure 63 North America

Figure 64 North America market estimates and forecasts, 2021-2033

Figure 65 U.S. country dynamics

Figure 66 U.S. market estimates and forecasts, 2021-2033

Figure 67 Canada country dynamics

Figure 68 Canada market estimates and forecasts, 2021-2033

Figure 69 Mexico country dynamics

Figure 70 Mexico market estimates and forecasts, 2021-2033

Figure 71 Europe market estimates and forecasts, 2021-2033

Figure 72 UK country dynamics

Figure 73 UK market estimates and forecasts, 2021-2033

Figure 74 Germany country dynamics

Figure 75 Germany market estimates and forecasts, 2021-2033

Figure 76 France country dynamics

Figure 77 France market estimates and forecasts, 2021-2033

Figure 78 Italy country dynamics

Figure 79 Italy market estimates and forecasts, 2021-2033

Figure 80 Spain country dynamics

Figure 81 Spain market estimates and forecasts, 2021-2033

Figure 82 Denmark country dynamics

Figure 83 Denmark market estimates and forecasts, 2021-2033

Figure 84 Sweden country dynamics

Figure 85 Sweden market estimates and forecasts, 2021-2033

Figure 86 Norway country dynamics

Figure 87 Norway market estimates and forecasts, 2021-2033

Figure 88 Asia-Pacific market estimates and forecasts, 2021-2033

Figure 89 China country dynamics

Figure 90 China market estimates and forecasts, 2021-2033

Figure 91 Japan country dynamics

Figure 92 Japan market estimates and forecasts, 2021-2033

Figure 93 India country dynamics

Figure 94 India market estimates and forecasts, 2021-2033

Figure 95 Thailand country dynamics

Figure 96 Thailand market estimates and forecasts, 2021-2033

Figure 97 South Korea country dynamics

Figure 98 South Korea market estimates and forecasts, 2021-2033

Figure 99 Australia country dynamics

Figure 100 Australia market estimates and forecasts, 2021-2033

Figure 101 Latin America market estimates and forecasts, 2021-2033

Figure 102 Brazil country dynamics

Figure 103 Brazil market estimates and forecasts, 2021-2033

Figure 104 Argentina country dynamics

Figure 105 Argentina market estimates and forecasts, 2021-2033

Figure 106 Middle East and Africa market estimates and forecasts, 2021-2033

Figure 107 South Africa country dynamics

Figure 108 South Africa market estimates and forecasts, 2021-2033

Figure 109 Saudi Arabia country dynamics

Figure 110 Saudi Arabia market estimates and forecasts, 2021-2033

Figure 111 UAE country dynamics

Figure 112 UAE market estimates and forecasts, 2021-2033

Figure 113 Kuwait country dynamics

Figure 114 Kuwait market estimates and forecasts, 2021-2033

Figure 115 Market position of key market players- Biobanks market

Companies Mentioned

The companies profiled in this Biobanks market report include:- Thermo Fisher Scientific Inc.

- Merck KGaA

- Qiagen

- Hamilton Company

- Tecan Trading AG

- Danaher Corporation

- Becton, Dickinson, and Company (BD)

- Biocision, LLC.

- Taylor-Wharton

- Charles River Laboratories

- Lonza

- Stemcell Technologies

- Biovault Family

- Promocell GmbH

- Precision Cellular Storage Ltd. (Virgin Health Bank)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | December 2025 |

| Forecast Period | 2025 - 2033 |

| Estimated Market Value ( USD | $ 86.82 Billion |

| Forecasted Market Value ( USD | $ 160.54 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |