North America Flame Retardant Thermoplastics Market Growth & Trends

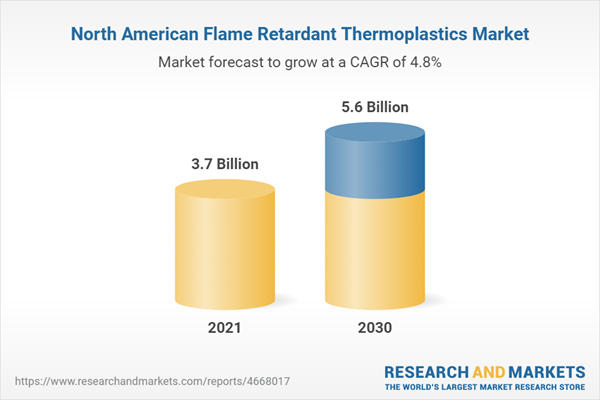

The North America flame retardant thermoplastics market size is expected to reach USD 5.6 billion by 2030, registering a CAGR of 4.8%, during the forecast period, according to a new report. Developments in the electrical & electronics and automotive & transportation industry is likely to drive the demand for thermoplastics in these application segments. Increasing use of environment-friendly and energy-saving products is also expected to influence the market, positively.

Building & construction industry in Canada is witnessing lucrative growth opportunities. Low cost involved in facility set up and availability of labor at low cost in comparison with that of the U.S. are the factors that are attracting the attention of manufacturers to set up their plants in Canada. In addition, investments by the government of Canada in infrastructure development are also anticipated to boost the growth of the construction industry in the country, thereby, creating a high demand during the forecast period.

Flame retardant thermoplastics are finding increased utilization in the building & construction industry for commercial & industrial applications. The construction industry in the U.S. is expected to observe growth owing to new import tariffs, changing trade deals, a strong economy, proliferation of mega projects, focus on smart cities, and increasing household construction. The electrical & electronics industry in the U.S. is growing on account of increasing demand for electronics equipment from the gaming industry, which is expected to drive the market.

North America Flame Retardant Thermoplastics Market Report Highlights

- The North America flame retardant thermoplastics market was valued at USD 3.7 billion in 2021 and is expected to expand at a CAGR of 4.8% from 2022 to 2030

- Acrylonitrile Butadiene Styrene product segment occupied the largest revenue share on account rising trend of its high strength, rigidity, and dimensional stability.

- ABS is a tough flame-retardant thermoplastic material and is resistant to physical impact, corrosive chemicals, and heat

- Rising demand for environment-friendly and energy-saving products & solutions is expected to drive this market

- The automotive & transportation application segment accounted for more than17.0% in North America in 2021 and is projected to expand at a CAGR of 4.6% during forecast period

- Stringent environmental rules & regulations and focus on indoor air quality is expected to drive the polystyrene based products

- Increasing investment from government & private institutions in the automotive & transportation and building & construction sector is projected to contribute to the demand for these flame-retardant thermoplastics

Table of Contents

Chapter 1. Methodology and Scope1.1 Research Methodology

1.2 Research Scope and Assumptions

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 Internal database

1.3.3 Secondary Sources

1.3.4 Third-Party Perspective

1.3.5 Primary Research

1.4 Information Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation and Data Visualization

1.6 Data Validation and Publishing

1.7 List of Abbreviations

Chapter 2. Executive Summary

2.1 Market Snapshot

2.2 Segmental Outlook

Chapter 3. North America Flame Retardant Thermoplastics Market Variables, Trends, & Scope

3.1 Market Lineage Outlook

3.1.1 Global Flame Retardant Thermoplastics Market

3.2 Penetration & Growth Prospects Mapping

3.3 Industry Value Chain Analysis

3.3.1 Raw Material Trends

3.4 Technology Overview

3.4.1 Vapor-Phase Inhibition Mechanism

3.4.2 Solid-Phase Char-Formation Mechanism

3.4.3 Quench and Cool Mechanism

3.5 Regulatory Framework

3.5.1 Standards

3.6 Market Dynamics

3.6.1 Market Driver Analysis

3.6.1.1 Rising Awareness for Halogen-Free Flame-Retardants

3.6.1.2 Growth in Automotive Industry

3.6.1.3 Growing Demand from Electrical & Electronics Industry

3.6.2 Market Restraint Analysis

3.6.2.1 Fluctuating Raw Material Prices

3.6.2.2 Stringent Government Regulations in the Region in Line to the Chemicals Used

3.7 Business Environment Analysis:

3.7.1 Industry Analysis - Porter’S Five Forces Analysis

3.7.2 Industrial Plastics Market - PESTEL Analysis

Chapter 4. North America Flame Retardant Thermoplastics Market: Product Estimates & Analysis

4.1 North America Flame Retardant Thermoplastics Market: Product Movement Analysis

4.2 Acrylonitrile Butadiene Styrene (Abs)

4.2.1 North America Flame Retardant Thermoplastics Market Estimates and Forecasts, by Acrylonitrile Butadiene Styrene (Abs), 2019 - 2030 (Tons) (Usd Million)

4.2.2 North America Flame Retardant Thermoplastics Market Estimates and Forecasts, by Application, 2019 - 2030 (Tons) (Usd Million)

4.3 Polycarbonate (Pc)

4.3.1 North America Flame Retardant Thermoplastics Market Estimates and Forecasts, by Polycarbonate (Pc), 2019 - 2030 (Tons) (Usd Million)

4.3.2 North America Flame Retardant Thermoplastics Market Estimates and Forecasts, by Application, 2019 - 2030 (Tons) (Usd Million)

4.4 Polypropylene (Pp)

4.4.1 North America Flame Retardant Thermoplastics Market Estimates and Forecasts, by Polypropylene (Pp), 2019 - 2030 (Tons) (Usd Million)

4.4.2 North America Flame Retardant Thermoplastics Market Estimates and Forecasts, by Application, 2019 - 2030 (Tons) (Usd Million)

4.5 Polystyrene (Ps)

4.5.1 North America Flame Retardant Thermoplastics Market Estimates and Forecasts, by Polystyrene (Ps), 2019 - 2030 (Tons) (Usd Million)

4.5.2 North America Flame Retardant Thermoplastics Market Estimates and Forecasts, by Application, 2019 - 2030 (Tons) (Usd Million)

Chapter 5. North America Flame Retardant Thermoplastics Market: Country Estimates & Analysis

5.1 North America Flame Retardant Thermoplastics Market: Region Movement Analysis

5.2 U.S.

5.2.1 U.S. Flame Retardant Thermoplastics Market Estimates and Forecasts, 2019 - 2030 (Tons) (Usd Million)

5.2.2 U.S. Flame Retardant Thermoplastics Market Estimates and Forecasts, by Acrylonitrile Butadiene Styrene, 2019 - 2030 (Tons) (Usd Million)

5.2.3 U.S. Flame Retardant Thermoplastics Market Estimates and Forecasts, by Polycarbonate, 2019 - 2030 (Tons) (Usd Million)

5.2.4 U.S. Flame Retardant Thermoplastics Market Estimates and Forecasts, by Polypropylene, 2019 - 2030 (Tons) (Usd Million)

5.2.5 U.S. Flame Retardant Thermoplastics Market Estimates and Forecasts, by Polystyrene, 2019 - 2030 (Tons) (Usd Million)

5.3 Canada

5.3.1 Canada Flame Retardant Thermoplastics Market Estimates and Forecasts, 2019 - 2030 (Tons) (Usd Million)

5.3.2 Canada Flame Retardant Thermoplastics Market Estimates and Forecasts, by Acrylonitrile Butadiene Styrene, 2019 - 2030 (Tons) (Usd Million)

5.3.3 Canada Flame Retardant Thermoplastics Market Estimates and Forecasts, by Polycarbonate, 2019 - 2030 (Tons) (Usd Million)

5.3.4 Canada Flame Retardant Thermoplastics Market Estimates and Forecasts, by Polypropylene, 2019 - 2030 (Tons) (Usd Million)

5.3.5 Canada Flame Retardant Thermoplastics Market Estimates and Forecasts, by Polystyrene, 2019 - 2030 (Tons) (Usd Million)

5.4 Mexico

5.4.1 Mexico Flame Retardant Thermoplastics Market Estimates and Forecasts, 2019 - 2030 (Tons) (Usd Million)

5.4.2 Mexico Flame Retardant Thermoplastics Market Estimates and Forecasts, by Acrylonitrile Butadiene Styrene, 2019 - 2030 (Tons) (Usd Million)

5.4.3 Mexico Flame Retardant Thermoplastics Market Estimates and Forecasts, by Polycarbonate, 2019 - 2030 (Tons) (Usd Million)

5.4.4 Mexico Flame Retardant Thermoplastics Market Estimates and Forecasts, by Polypropylene, 2019 - 2030 (Tons) (Usd Million)

5.4.5 Mexico Flame Retardant Thermoplastics Market Estimates and Forecasts, by Polystyrene, 2019 - 2030 (Tons) (Usd Million)

Chapter 6. Competitive Landscape

6.1 Key Global Players, Recent Developments, & Their Impact on Industry

6.2 Key Company/Competition Categorization

6.3 Vendor Landscape

6.3.1 List of Key Distributors & Channel Partners

6.4 Public Companies

6.4.1 Company Market Position Analysis

6.4.2 Competitive Dashboard Analysis

6.5 List of Companies (For Flame Retardant Thermoplastics)

6.5.1 Acrylonitrile Butadiene Styrene (Abs)

6.5.2 Polycarbonate (Pc)

6.5.3 Polypropylene (Pp)

6.5.4 Polystyrene (Ps)

Chapter 7. Company Profiles

7.1 Basf Se

7.1.1 Company Overview

7.1.2 Financial Performance

7.1.3 Product Benchmarking

7.1.4 Strategic Initiatives

7.2 Lanxess

7.2.1 Company Overview

7.2.2 Financial Performance

7.2.3 Product Benchmarking

7.3 Dow Inc.

7.3.1 Company Overview

7.3.2 Financial Performance

7.3.3 Product Benchmarking

7.4 Icl

7.4.1 Company Overview

7.4.2 Financial Performance

7.4.3 Product Benchmarking

7.5 Rtp Company

7.5.1 Company Overview

7.5.2 Product Benchmarking

7.5.3 Strategic Initiatives

7.6 Huber Engineered Materials

7.6.1 Company Overview

7.6.2 Product Benchmarking

7.7 Clariant AG

7.7.1 Company Overview

7.7.2 Financial Performance

7.7.3 Product Benchmarking

7.7.4 Strategic Initiatives

7.8 Plastics Color Corporation

7.8.1 Company Overview

7.8.2 Product Benchmarking

7.9 Albemarle Corporation

7.9.1 Company Overview

7.9.2 Financial Performance

7.9.3 Product Benchmarking

7.10 Polyone Corporation

7.10.1 Company Overview

7.10.2 Financial Performance

7.10.3 Product Benchmarking

7.10.4 Strategic Initiatives

7.11 Sabic

7.11.1 Company Overview

7.11.2 Financial Performance

7.11.3 Product Benchmarking

7.11.4 Strategic Initiatives

7.12 Asahi Kasei Corporation

7.12.1 Company Overview

7.12.2 Financial Performance

7.12.3 Product Benchmarking

7.13 Washington Penn Plastic Co. Inc.

7.13.1 Company Overview

7.13.2 Product Benchmarking

7.14 Koninklijke Dsm N.V.

7.14.1 Company Overview

7.14.2 Financial Performance

7.14.3 Product Benchmarking

7.14.4 Strategic Initiatives

7.15 Teknor Apex

7.15.1 Company Overview

7.15.2 Product BenchmarkingList of Tables

List of Tables

Table 1 List of Abbreviations

Table 2 North America flame retardant thermoplastics market estimates and forecasts, by acrylonitrile butadiene styrene (ABS), 2019 - 2030 (Tons) (USD Million)

Table 3 North America flame retardant thermoplastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 4 North America flame retardant thermoplastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 5 North America flame retardant thermoplastics market estimates and forecasts, by polycarbonate (PC), 2019 - 2030 (Tons) (USD Million)

Table 6 North America flame retardant thermoplastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 7 North America flame retardant thermoplastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 8 North America flame retardant thermoplastics market estimates and forecasts, by polypropylene (PP), 2019 - 2030 (Tons) (USD Million)

Table 9 North America flame retardant thermoplastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 10 North America flame retardant thermoplastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 11 North America flame retardant thermoplastics market estimates and forecasts, by polystyrene (PS), 2019 - 2030 (Tons) (USD Million)

Table 12 North America flame retardant thermoplastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 13 North America flame retardant thermoplastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 14 U.S. flame retardant thermoplastics marketestimates and forecasts, 2019 - 2030 (Tons) (USD Million)

Table 15 U.S. flame retardant thermoplastics market revenue estimates and forecasts, by Acrylonitrile butadiene styrene, 2019 - 2030 (Tons)

Table 16 U.S. flame retardant thermoplastics market revenue estimates and forecasts, by Acrylonitrile butadiene styrene, 2019 - 2030 (USD Million)

Table 17 U.S. flame retardant thermoplastics market revenue estimates and forecasts, by Polycarbonate, 2019 - 2030 (Tons)

Table 18 U.S. flame retardant thermoplastics market revenue estimates and forecasts, by Polycarbonate, 2019 - 2030 (USD Million)

Table 19 U.S. flame retardant thermoplastics market revenue estimates and forecasts, by Polypropylene, 2019 - 2030 (Tons)

Table 20 U.S. flame retardant thermoplastics market revenue estimates and forecasts, by Polypropylene, 2019 - 2030 (USD Million)

Table 21 U.S. flame retardant thermoplastics market revenue estimates and forecasts, by Polystyrene, 2019 - 2030 (Tons)

Table 22 U.S. flame retardant thermoplastics market revenue estimates and forecasts, by Polystyrene, 2019 - 2030 (USD Million)

Table 23 Canada flame retardant thermoplastics marketestimates and forecasts, 2019 - 2030 (Tons) (USD Million)

Table 24 Canada flame retardant thermoplastics market revenue estimates and forecasts, by Acrylonitrile butadiene styrene, 2019 - 2030 (Tons)

Table 25 Canada flame retardant thermoplastics market revenue estimates and forecasts, by Acrylonitrile butadiene styrene, 2019 - 2030 (USD Million)

Table 26 Canada flame retardant thermoplastics market revenue estimates and forecasts, by Polycarbonate, 2019 - 2030 (Tons)

Table 27 Canada flame retardant thermoplastics market revenue estimates and forecasts, by Polycarbonate, 2019 - 2030 (USD Million)

Table 28 Canada flame retardant thermoplastics market revenue estimates and forecasts, by Polypropylene, 2019 - 2030 (Tons)

Table 29 Canada flame retardant thermoplastics market revenue estimates and forecasts, by Polypropylene, 2019 - 2030 (USD Million)

Table 30 Canada flame retardant thermoplastics market revenue estimates and forecasts, by Polystyrene, 2019 - 2030 (Tons)

Table 31 Canada flame retardant thermoplastics market revenue estimates and forecasts, by Polystyrene, 2019 - 2030 (USD Million)

Table 32 Mexico flame retardant thermoplastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

Table 33 Mexico flame retardant thermoplastics market revenue estimates and forecasts, by Acrylonitrile butadiene styrene, 2019 - 2030 (Tons)

Table 34 Mexico flame retardant thermoplastics market revenue estimates and forecasts, by Acrylonitrile butadiene styrene, 2019 - 2030 (USD Million)

Table 35 Mexico flame retardant thermoplastics market revenue estimates and forecasts, by Polycarbonate, 2019 - 2030 (Tons)

Table 36 Mexico flame retardant thermoplastics market revenue estimates and forecasts, by Polycarbonate, 2019 - 2030 (USD Million)

Table 37 Mexico flame retardant thermoplastics market revenue estimates and forecasts, by Polypropylene, 2019 - 2030 (Tons)

Table 38 Mexico flame retardant thermoplastics market revenue estimates and forecasts, by Polypropylene, 2019 - 2030 (USD Million)

Table 39 Mexico flame retardant thermoplastics market revenue estimates and forecasts, by Polystyrene, 2019 - 2030 (Tons)

Table 40 Mexico flame retardant thermoplastics market revenue estimates and forecasts, by Polystyrene, 2019 - 2030 (USD Million)

List of Charts

Fig. 1 Information procurement

Fig. 2 Primary research pattern

Fig. 3 Primary Research Process

Fig. 4 Market research approaches - Bottom-Up Approach

Fig. 5 Market research approaches - Top-Down Approach

Fig. 6 Market research approaches - Combined Approach

Fig. 7 North America Flame Retardant Thermoplastics Market Snapshot

Fig. 8 North America Flame Retardant Thermoplastics Market Segmentation

Fig. 9 North America Flame Retardant Thermoplastics: Penetration & Growth Prospects Mapping

Fig. 10 North America Flame Retardant Thermoplastics Market: Value chain analysis

Fig. 11 The U.S. multifamily residential building fire loss, 2008 - 2017 (USD Million)

Fig. 12 North America commercial vehicle production, 2014 - 2018 (Million Units)

Fig. 13 Porter’s Five Forces Analysis:North America Flame Retardant Thermoplastics Market

Fig. 14 PESTEL Analysis: North America Flame Retardant Thermoplastics Market

Fig. 15 North America flame retardant thermoplastics market: Product movement analysis, 2021 & 2030

Fig. 16 North America flame retardant thermoplastics market: Region movement analysis, 2021 & 2030

Fig. 17 Competitive dashboard analysis

Companies Mentioned

- BASF SE

- LANXESS

- Dow Inc.

- ICL

- RTP Company

- Huber Engineered Materials

- Clariant AG

- Plastics Color Corporation

- Albemarle Corporation

- PolyOne Corporation

- SABIC

- Asahi Kasei Corporation

- WASHINGTON PENN PLASTIC CO., INC.

- Koninklijke DSM N.V.

- Teknor Apex

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 86 |

| Published | May 2022 |

| Forecast Period | 2021 - 2030 |

| Estimated Market Value in 2021 | 3.7 Billion |

| Forecasted Market Value by 2030 | 5.6 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | North America |

| No. of Companies Mentioned | 15 |