Type-III is the fastest growing segment, Asia-Pacific is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The globalization of trade and the increasing complexity of supply chains represent a fundamental impetus for the ISO modal container market. As businesses expand their reach across international borders, the demand for standardized, secure, and efficient transport units becomes paramount for handling diverse goods across vast distances. This interconnectedness fuels the necessity for containers that can seamlessly transition between maritime, rail, and road networks, enabling goods to move from manufacturing hubs to consumption markets worldwide. According to the World Trade Organization, in April 2024, their "2024 Global Trade Outlook" projected world merchandise trade volume to grow by 2.6% in 2024, demonstrating the continuous expansion of global commerce that directly underpins container demand.Key Market Challenges

The prevailing issue of overcapacity within the global ISO modal container fleet directly hampers market growth by creating an imbalance between available vessel supply and cargo demand. This surplus capacity exerts significant downward pressure on freight rates, reducing profitability for shipping lines and container owners. According to BIMCO, shipyards delivered 2.2 million TEU of new container ship capacity in 2023, with another 3.1 million TEU scheduled for delivery in 2024, representing a substantial increase in the global fleet. This rapid expansion of supply outpaces the growth in containerized trade volumes. BIMCO forecasts that the increase in container volumes will increase the demand for ship capacity by only 3-4% in 2024, while the fleet capacity is expected to grow by 10% in the same year. Such a disparity leads to lower vessel utilization rates and intensifies competition, ultimately affecting investment decisions in new container equipment and infrastructure.Key Market Trends

Digital transformation is fundamentally reshaping container logistics by integrating advanced technologies for enhanced operational visibility, efficiency, and data management across the supply chain. This trend utilizes IoT sensors for real-time tracking, blockchain for secure documentation, and artificial intelligence for predictive analytics. These digital tools empower owners and operators to monitor cargo conditions, optimize routes, and streamline customs procedures, thereby reducing delays and improving security. According to the Digital Container Shipping Association (DCSA), in September 2024, the adoption of electronic Bills of Lading (eBL) within the container shipping sector reached 5%, demonstrating a clear progression away from paper-based processes towards greater digital transparency. This transformation is vital for adapting to evolving customer expectations and addressing complex global trade demands.Key Market Players Profiled:

- China International Marine Containers (Group) Co., Ltd.

- Singamas Container Holdings Limited

- Mitsui O.S.K. Lines, Ltd.

- A.P. Moller - Maersk A/S

- Textainer Group Holdings Limited

- Triton International Limited

- COSCO Shipping Lines Co., Ltd.

- CAI International, Inc.

Report Scope:

In this report, the Global ISO Modal Container Market has been segmented into the following categories:By Type:

- Type-I

- Type-II

- Type-III

- Type-IV

By Application:

- LNG

- Industrial Gases

- Chemical & Petrochemicals

By Transport:

- Ship

- Road

- Rail

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global ISO Modal Container Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this ISO Modal Container market report include:- China International Marine Containers (Group) Co., Ltd.

- Singamas Container Holdings Limited

- Mitsui O.S.K. Lines, Ltd.

- A.P. Moller - Maersk A/S

- Textainer Group Holdings Limited

- Triton International Limited

- COSCO Shipping Lines Co., Ltd.

- CAI International, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | November 2025 |

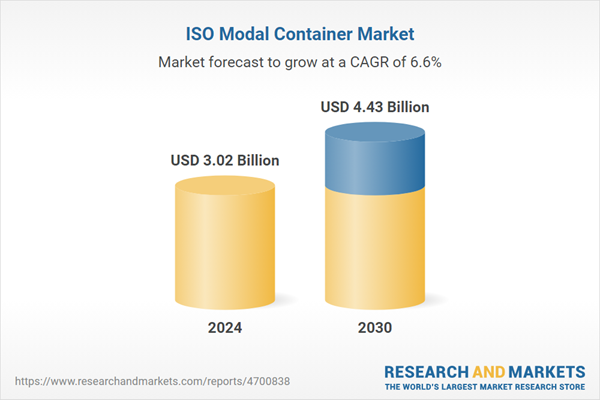

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.02 Billion |

| Forecasted Market Value ( USD | $ 4.43 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |