Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

These vehicles are crucial for hauling bulk materials such as sand, gravel, and debris, which are essential components in various civil and infrastructure works. Evolving construction standards are also influencing truck configurations and load-bearing capacities. According to the Ministry of Road Transport and Highways (MoRTH), India’s total goods vehicle registrations rose from 6.16 lakh units in FY 2020-21 to 8.53 lakh units in FY 2022-23, indicating recovering commercial vehicle demand. Since tippers form a significant share of medium and heavy goods vehicles, this broader rebound signals rising opportunities in the tipper segment for mining, infrastructure, and construction projects.

Evolving emission norms and environmental concerns are shaping product designs and specifications. Manufacturers and buyers are aligning with Bharat Stage VI standards, driving innovation in powertrain technologies and fuel efficiency. The market is also seeing the emergence of electric and hybrid tipper trucks, although their adoption remains in the early stages. Moreover, digital integration in vehicle systems is improving monitoring, diagnostics, and fleet management capabilities, which contributes to operational efficiency and reduced downtime.

The market faces hurdles such as rising input costs, delayed payments in construction contracts, and the need for skilled drivers and maintenance personnel. However, long-term opportunities lie in the increasing focus on smart logistics and infrastructure automation. As more sectors incorporate data-driven and sustainable operations, tipper trucks equipped with advanced telematics, safety enhancements, and customizable features are expected to gain preference, helping the industry align with broader industrial goals.

Market Drivers

Government Infrastructure Push

Massive investments under national programs like Bharatmala and smart city missions are spurring road construction, tunneling, and bridge-building activities. These projects require a consistent supply of aggregates and other materials, positioning tipper trucks as essential assets in transportation chains. The growing scale and complexity of infrastructure development projects demand a robust fleet of trucks capable of operating in high-stress, time-bound environments.Tipper trucks with high durability and load-handling capacity are being preferred, as timelines and cost-efficiency are critical to project execution. As per the Society of Indian Automobile Manufacturers (SIAM), The overall Commercial Vehicles sales increased from 9.62 Lakh to 9.68 Lakh units. Sales of Medium and Heavy Commercial Vehicles increased from 3.59 Lakh to 3.73 Lakh units in 2024. Tippers constitute a major portion of M&HCVs used in infrastructure and mining. This surge reflects momentum from road-building, urban development, and logistics expansion across the country.

Key Market Challenges

High Operational and Maintenance Costs

Tipper trucks, particularly those used in mining and heavy construction, face significant wear and tear. Frequent breakdowns and expensive maintenance increase the total cost of ownership. Fuel consumption is also high in heavy-duty operations, further straining operational budgets. Small and medium contractors find it challenging to balance recurring expenditures against project earnings, limiting fleet upgrades and capacity expansion.Key Market Trends

Shift Toward Electrification and Green Vehicles

There is growing interest in electric tipper trucks as the industry moves towards sustainability. Though still in the nascent phase, electric models are being tested for short-haul and urban applications. Battery advancements and supportive policy frameworks may accelerate adoption in the coming years. These vehicles offer reduced emissions and lower operating costs, appealing to eco-conscious operators and large contractors seeking to align with ESG goals.Key Market Players

- Ashok Leyland Limited

- Asia Motor Works Limited

- Caterpillar India Pvt Ltd

- Daimler India Commercial Vehicles

- Mahindra & Mahindra Limited

- MAN Truck & Bus Pvt Ltd.

- Sany Heavy Industry India Pvt. Ltd.

- Scania CV Ind Pvt Ltd.

- Tata Motors Limited

- VE Commercial Vehicles

Report Scope:

In this report, the India Tipper Truck Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Tipper Truck Market, By Truck Type:

- Light

- Medium

- Large

India Tipper Truck Market, By Tonnage Capacity:

- 2-16 tons

- 16-31 tons

- 31-45 tons

India Tipper Truck Market, By Application:

- Construction

- Mining

- Others

India Tipper Truck Market, By Region:

- West

- East

- North

- South

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Tipper Truck Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Ashok Leyland Limited

- Asia Motor Works Limited

- Caterpillar India Pvt Ltd

- Daimler India Commercial Vehicles

- Mahindra & Mahindra Limited

- MAN Truck & Bus Pvt Ltd.

- Sany Heavy Industry India Pvt. Ltd.

- Scania CV Ind Pvt Ltd.

- Tata Motors Limited

- VE Commercial Vehicles

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | August 2025 |

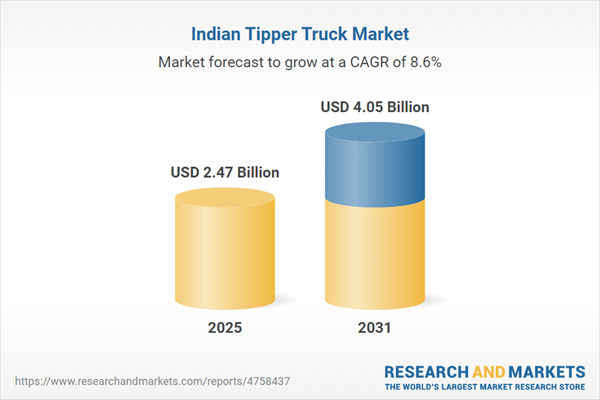

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 2.47 Billion |

| Forecasted Market Value ( USD | $ 4.05 Billion |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |