Medical Foods Market Growth & Trends

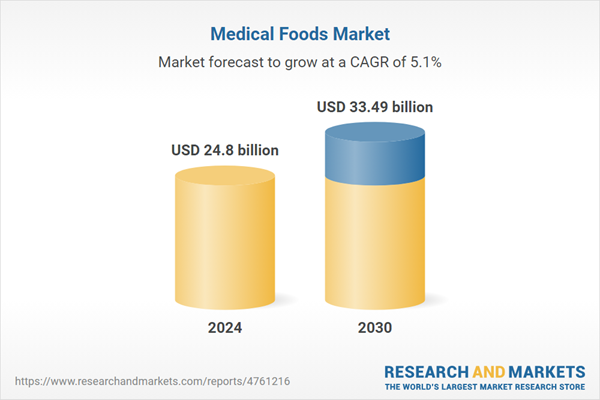

The global medical foods market size is estimated to reach USD 33.49 billion by 2030, registering to grow at a CAGR of 5.13% from 2025 to 2030 . Rising geriatric population, prevalence of chronic diseases, a shift toward consuming disease-specific formulas, and a growing demand for neonatal and preterm enteral feeding are some of the factors driving this growth.The oral route of the administration segment dominated the market in 2024. The major factors contributing to this growth include a high preference for oral medical foods owing to the ease of consumption and high commercial viability of products administered orally. In addition, these foods are available in a variety of forms such as pills, powder, puddings, and pre-thickened products, thereby fueling the segment’s growth.

In 2024, the powder product segment accounted for the largest revenue share. Factors contributing to the growth include the rising application areas of powdered medical foods, ease of administration, and higher commercial viability. The liquid segment is anticipated to grow at the fastest CAGR from 2025 to 2030, owing to the ease of consumption of liquid-based foods for special medical purposes by the pediatric and geriatric population.

The chemotherapy-induced diarrhea emerged as the largest application segment in 2024.. Diarrhea caused by chemotherapy treatment is one of the common problems among cancer patients and the rising prevalence of cancer is one of the major reasons for this increasing the revenue share. For instance, according to the National Cancer Institute statistics, about half of the patients develop diarrhea when treated with chemotherapy agents and the rate can reach 80% with respect to certain chemotherapy agents.

The institutional sales channel segment dominated the market in 2024. Higher penetration and adoption of oral and enteral medical foods in the healthcare institutions such as clinics, hospitals, and care centers and the rising consumption of these products are some of the major factors contributing to the large revenue share. In addition, the rising demand for such products in inpatient facilities and increasing adoption for such products are boosting the market growth.

North America dominated the market with a revenue share of approximately 30% in 2023.. The presence of major players and high revenue generated by them in the region are the key factors contributing to this growth. In addition, strategic developments, the growing prevalence of chronic conditions, and the increasing adoption of medical foods by patients and healthcare professionals are the other factors supporting the growth.

Medical Foods Market Report Highlights

- Based on route of administration, the oral segment led the market with the largest revenue share of 72.86% in 2024.

- The powder segment led the market with the largest revenue share of 35.53% in 2024. Medical foods are most widely available in powder form, which can be administered through the oral route or enteral route by mixing milk or water, as advised by the physician.

- Based on application, the cancer segment led the market with the largest revenue share of 12.11% in 2024.

- Based on module, the protein modules segment led the market with the largest revenue share of 12.72% in 2024.

- Based on sales channel, the DTC segment led the market with the largest revenue share of 59.07% in 2024. DTC sales in the medical foods sector allow companies to bypass traditional retail channels and establish a direct relationship with end users.

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

Table of Contents

Chapter. 1 Methodology and Scope

1.1 Market Segmentation and Scope

1.2 Market Definition

1.3 Research Methodology

1.3.1 Information procurement

1.3.2 Purchased database

1.3.3 internal database

1.3.4 Primary research

1.3.5 Research methodology

1.3.5.1 Country-level Assumptions

1.3.5.2 Segment-Level Calculations

1.3.6 Research scope and assumptions

1.3.7 List of secondary sources

1.3.8 List of primary sources

1.2 Market Definition

1.3 Research Methodology

1.3.1 Information procurement

1.3.2 Purchased database

1.3.3 internal database

1.3.4 Primary research

1.3.5 Research methodology

1.3.5.1 Country-level Assumptions

1.3.5.2 Segment-Level Calculations

1.3.6 Research scope and assumptions

1.3.7 List of secondary sources

1.3.8 List of primary sources

Chapter. 2 Executive Summary

2.1 Medical foods market snapshot

2.2 Medical foods market: Segment snapshot (Part 1)

2.3 Medical foods market: Segment snapshot (Part 2)

2.4 Medical foods market: Segment snapshot (Part 3)

2.5 Medical foods market: Market dynamics

2.2 Medical foods market: Segment snapshot (Part 1)

2.3 Medical foods market: Segment snapshot (Part 2)

2.4 Medical foods market: Segment snapshot (Part 3)

2.5 Medical foods market: Market dynamics

Chapter. 3 Medical Foods Market Variables, Trends & Scope

3.1 Market lineage outlook

3.1.1 Parent market outlook

3.1.1.1 Nutritional supplements market

3.1.2 Ancillary market outlook

3.1.2.1 Parenteral nutrition market:

3.1.2.2 Enteral feeding devices market

3.2 Pricing analysis

3.3 Industry analysis

3.3.1 User perspective analysis

3.3.1.1 Consumer behavior analysis

3.3.1.2 Market influencer analysis

3.3.2 Key end users

3.4 Technology Outlook

3.4.1 Technology timeline

3.4.2 Emerging Trends in Medical Foods Industry

3.4.2.1 Growth in Disease-Specific Products

3.4.2.2 Regulatory Evolution and Challenges

3.4.2.3 Functional Ingredients and Therapeutic Nutrients

3.4.2.4 Rise of Plant-Based Medical Foods

3.5 Regulatory & Reimbursement Framework

3.5.1 North America

3.5.1.1 U.S.

3.5.1.2 Canada

3.5.2 Europe

3.5.2.1 UK

3.5.2.2 Germany

3.5.2.3 Netherlands

3.5.2.4 Italy

3.5.3 Asia Pacific

3.5.3.1 China

3.5.3.2 Japan

3.5.3.3 Australia & New zealand

3.5.3.4 Vietnam

3.5.3.5 Malaysia

3.5.4 Latin America

3.5.4.1 Brazil

3.5.5 Middle East & Africa

3.5.5.1 South Africa

3.6 Standards, Compliance & Safety

3.7 Market Dynamics

3.7.1 Market Driver Analysis

3.7.1.1 Rising geriatric population

3.7.1.2 Growing prevalence of chronic diseases

3.7.1.3 Shifting trend toward the consumption of disease-specific formulas

3.7.1.4 Growing demand for neonatal and preterm enteral feeding

3.7.1.5 Rising organizational strategic initiatives to bolster market presence

3.7.2 Market Restraint Analysis

3.7.2.1 Lack of awareness in the medical community

3.7.2.2 Improper categorization of medical foods

3.7.3 Industry Challenges

3.7.3.1 Complications associated with small-bore connectors

3.7.3.2 Risks associated with enteral feeding

3.7.4 Industry Opportunity Overview

3.7.4.1 Strategic Growth Opportunities in Medical Nutrition and Personalized Care

3.8 Medical Foods Market Analysis Tools

3.8.1 Medical Foods Market - PESTLE Analysis

3.8.2 Industry Analysis - Porter’s

3.9 Major Deals & Strategic Alliances Analysis

3.9.1 Mergers & Acquisitions

3.9.2 Market Entry Strategies

3.9.3 Product Recalls

3.10 Impact of COVID-19 on Medical Foods Market

3.1.1 Parent market outlook

3.1.1.1 Nutritional supplements market

3.1.2 Ancillary market outlook

3.1.2.1 Parenteral nutrition market:

3.1.2.2 Enteral feeding devices market

3.2 Pricing analysis

3.3 Industry analysis

3.3.1 User perspective analysis

3.3.1.1 Consumer behavior analysis

3.3.1.2 Market influencer analysis

3.3.2 Key end users

3.4 Technology Outlook

3.4.1 Technology timeline

3.4.2 Emerging Trends in Medical Foods Industry

3.4.2.1 Growth in Disease-Specific Products

3.4.2.2 Regulatory Evolution and Challenges

3.4.2.3 Functional Ingredients and Therapeutic Nutrients

3.4.2.4 Rise of Plant-Based Medical Foods

3.5 Regulatory & Reimbursement Framework

3.5.1 North America

3.5.1.1 U.S.

3.5.1.2 Canada

3.5.2 Europe

3.5.2.1 UK

3.5.2.2 Germany

3.5.2.3 Netherlands

3.5.2.4 Italy

3.5.3 Asia Pacific

3.5.3.1 China

3.5.3.2 Japan

3.5.3.3 Australia & New zealand

3.5.3.4 Vietnam

3.5.3.5 Malaysia

3.5.4 Latin America

3.5.4.1 Brazil

3.5.5 Middle East & Africa

3.5.5.1 South Africa

3.6 Standards, Compliance & Safety

3.7 Market Dynamics

3.7.1 Market Driver Analysis

3.7.1.1 Rising geriatric population

3.7.1.2 Growing prevalence of chronic diseases

3.7.1.3 Shifting trend toward the consumption of disease-specific formulas

3.7.1.4 Growing demand for neonatal and preterm enteral feeding

3.7.1.5 Rising organizational strategic initiatives to bolster market presence

3.7.2 Market Restraint Analysis

3.7.2.1 Lack of awareness in the medical community

3.7.2.2 Improper categorization of medical foods

3.7.3 Industry Challenges

3.7.3.1 Complications associated with small-bore connectors

3.7.3.2 Risks associated with enteral feeding

3.7.4 Industry Opportunity Overview

3.7.4.1 Strategic Growth Opportunities in Medical Nutrition and Personalized Care

3.8 Medical Foods Market Analysis Tools

3.8.1 Medical Foods Market - PESTLE Analysis

3.8.2 Industry Analysis - Porter’s

3.9 Major Deals & Strategic Alliances Analysis

3.9.1 Mergers & Acquisitions

3.9.2 Market Entry Strategies

3.9.3 Product Recalls

3.10 Impact of COVID-19 on Medical Foods Market

Chapter. 4 Medical Foods Market: Route of Administration Estimates & Trend Analysis

4.1 Medical Foods Market: Route of Administration Movement Analysis, 2023 & 2030, USD Million

4.2 Global Medical Foods Market, Market Estimates & Forecast, by Route of Administration

4.3 Oral

4.3.1 Oral Medical foods market estimates and Forecasts, 2018-2030, (USD Million)

4.4 Enteral

4.4.1 Enteral Medical foods market estimates and Forecasts, 2018-2030, (USD Million)

4.2 Global Medical Foods Market, Market Estimates & Forecast, by Route of Administration

4.3 Oral

4.3.1 Oral Medical foods market estimates and Forecasts, 2018-2030, (USD Million)

4.4 Enteral

4.4.1 Enteral Medical foods market estimates and Forecasts, 2018-2030, (USD Million)

Chapter. 5 Medical Foods Market: Product Type Estimates & Trend Analysis

5.1 Medical Foods Market: Product Type Movement Analysis, 2023 & 2030, USD Million

5.2 Global Medical Foods Market, Market Estimates & Forecast, by Product Type

5.3 Pills

5.3.1 Medical foods market estimates and forecasts for pills formulation, 2018-2030, (USD Million)

5.4 Powder

5.4.1 Medical foods market estimates and forecasts for powder formulation, 2018-2030, (USD Million)

5.5 Liquid

5.5.1 Medical foods market estimates and forecasts for liquid formulation, 2018-2030, (USD Million)

5.6 Others

5.6.1 Medical foods market estimates and forecasts for other formulations, 2018-2030, (USD Million)

5.2 Global Medical Foods Market, Market Estimates & Forecast, by Product Type

5.3 Pills

5.3.1 Medical foods market estimates and forecasts for pills formulation, 2018-2030, (USD Million)

5.4 Powder

5.4.1 Medical foods market estimates and forecasts for powder formulation, 2018-2030, (USD Million)

5.5 Liquid

5.5.1 Medical foods market estimates and forecasts for liquid formulation, 2018-2030, (USD Million)

5.6 Others

5.6.1 Medical foods market estimates and forecasts for other formulations, 2018-2030, (USD Million)

Chapter. 6 Medical Foods Market: Application Estimates & Trend Analysis

6.1 Medical Foods Market: Application Movement Analysis, 2023 & 2030, USD Million

6.2 Global Medical Foods Market, Market Estimates & Forecast, by Application

6.3 Chronic Kidney Diseases

6.3.1 Medical foods market estimates and forecasts for chronic kidney diseases, 2018-2030, (USD Million)

6.4 Minimal Hepatic Encephalopathy

6.4.1 Medical foods market estimates and forecasts for minimal hepatic encephalopathy, 2018-2030, (USD Million)

6.5 Chemotherapy Induced Diarrhea

6.5.1 Medical foods market estimates and forecasts for chemotherapy induced diarrhea, 2018-2030, (USD Million)

6.6 Pathogen-Related Infection

6.6.1 Medical foods market estimates and forecasts for pathogen related infections, 2018-2030, (USD Million)

6.7 Diabetic Neuropathy

6.7.1 Medical foods market estimates and forecasts for diabetic neuropathy, 2018-2030, (USD Million)

6.8 ADHD

6.8.1 Medical foods market estimates and forecasts for ADHD, 2018-2030, (USD Million)

6.9 Depression

6.9.1 Medical foods market estimates and forecasts for depression, 2018-2030, (USD Million)

6.10 Alzheimer's Disease

6.10.1 Medical foods market estimates and forecasts for Alzheimer's disease, 2018 - 2030, (USD Million)

6.11 Nutritional Deficiency

6.11.1 Medical Foods Market Estimates and Forecasts for nutritional deficiency, 2018 - 2030 (USD Million)

6.12 Orphan Diseases

6.12.1 Medical Foods Market Estimates and Forecasts for orphan diseases, 2018 - 2030 (USD Million)

6.12.1.1 Tyrosinemia

6.12.1.1.1 Medical foods market estimates and forecasts for tyrosinemia, 2018 - 2030 (USD Million)

6.12.1.2 Eosinophilic Esophagitis

6.12.1.2.1 Medical foods market estimates and forecasts for eosinophilic esophagitis, 2018 - 2030 (USD Million)

6.12.1.3 Food protein-induced enterocolitis syndrome

6.12.1.3.1 Medical foods market estimates and forecasts for FPIES, 2018 - 2030 (USD Million)

6.12.1.4 Phenylketonuria

6.12.1.4.1 Medical foods market estimates and forecasts for phenylketonuria, 2018 - 2030 (USD Million)

6.12.1.5 Maple Syrup Urine Disease

6.12.1.5.1 Medical foods market estimates and forecasts for MSUD, 2018 - 2030 (USD Million)

6.12.1.6 Homocystinuria

6.12.1.6.1 Medical foods market estimates and forecasts for homocystinuria, 2018 - 2030 (USD Million)

6.12.1.7 Other Orphan Diseases

6.12.1.7.1 Medical foods market estimates and forecasts for other orphan diseases, 2018 - 2030 (USD Million)

6.12.2 Dysphagia

6.12.2.1 Medical foods market estimates and forecasts for dysphagia, 2018 - 2030 (USD Million)

6.12.3 Wound Healing

6.12.3.1 Medical foods market estimates and forecasts for wound healing, 2018 - 2030 (USD Million)

6.12.4 Chronic Diarrhea

6.12.4.1 Medical foods market estimates and forecasts for chronic diarrhea, 2018 - 2030 (USD Million)

6.12.5 Constipation Relief

6.12.5.1 Medical foods market estimates and forecasts for constipation relief, 2018 - 2030 (USD Million)

6.12.6 Protein Booster

6.12.6.1 Medical foods market estimates and forecasts for protein booster, 2018 - 2030 (USD Million)

6.12.7 Pain Management

6.12.7.1 Medical foods market estimates and forecasts for pain management, 2018 - 2030 (USD MILLION)

6.12.8 Parkinson's Disease

6.12.8.1 Medical foods market estimates and forecasts for Parkinson's disease, 2018 - 2030 (USD Million)

6.12.9 Epilepsy

6.12.9.1 Medical foods market estimates and forecasts for epilepsy, 2018 - 2030 (USD Million)

6.12.10 Other Cancer-Related Treatments

6.12.10.1 Medical foods market estimates and forecasts for other cancer-related treatments, 2018 - 2030 (USD Million)

6.12.11 Severe Protein Allergy

6.12.11.1 Medical foods market estimates and forecasts for severe protein allergy, 2018 - 2030 (USD Million)

6.12.12 Cancer

6.12.12.1 Medical foods market estimates and forecasts for cancer, 2018 - 2030 (USD Million)

6.12.13 Cachexia

6.12.13.1 Medical foods market estimates and forecasts for Cachexia, 2018 - 2030 (USD Million)

6.12.14 Other Diseases

6.12.14.1 Medical foods market estimates and forecasts for other diseases, 2018 - 2030 (USD Million)

6.2 Global Medical Foods Market, Market Estimates & Forecast, by Application

6.3 Chronic Kidney Diseases

6.3.1 Medical foods market estimates and forecasts for chronic kidney diseases, 2018-2030, (USD Million)

6.4 Minimal Hepatic Encephalopathy

6.4.1 Medical foods market estimates and forecasts for minimal hepatic encephalopathy, 2018-2030, (USD Million)

6.5 Chemotherapy Induced Diarrhea

6.5.1 Medical foods market estimates and forecasts for chemotherapy induced diarrhea, 2018-2030, (USD Million)

6.6 Pathogen-Related Infection

6.6.1 Medical foods market estimates and forecasts for pathogen related infections, 2018-2030, (USD Million)

6.7 Diabetic Neuropathy

6.7.1 Medical foods market estimates and forecasts for diabetic neuropathy, 2018-2030, (USD Million)

6.8 ADHD

6.8.1 Medical foods market estimates and forecasts for ADHD, 2018-2030, (USD Million)

6.9 Depression

6.9.1 Medical foods market estimates and forecasts for depression, 2018-2030, (USD Million)

6.10 Alzheimer's Disease

6.10.1 Medical foods market estimates and forecasts for Alzheimer's disease, 2018 - 2030, (USD Million)

6.11 Nutritional Deficiency

6.11.1 Medical Foods Market Estimates and Forecasts for nutritional deficiency, 2018 - 2030 (USD Million)

6.12 Orphan Diseases

6.12.1 Medical Foods Market Estimates and Forecasts for orphan diseases, 2018 - 2030 (USD Million)

6.12.1.1 Tyrosinemia

6.12.1.1.1 Medical foods market estimates and forecasts for tyrosinemia, 2018 - 2030 (USD Million)

6.12.1.2 Eosinophilic Esophagitis

6.12.1.2.1 Medical foods market estimates and forecasts for eosinophilic esophagitis, 2018 - 2030 (USD Million)

6.12.1.3 Food protein-induced enterocolitis syndrome

6.12.1.3.1 Medical foods market estimates and forecasts for FPIES, 2018 - 2030 (USD Million)

6.12.1.4 Phenylketonuria

6.12.1.4.1 Medical foods market estimates and forecasts for phenylketonuria, 2018 - 2030 (USD Million)

6.12.1.5 Maple Syrup Urine Disease

6.12.1.5.1 Medical foods market estimates and forecasts for MSUD, 2018 - 2030 (USD Million)

6.12.1.6 Homocystinuria

6.12.1.6.1 Medical foods market estimates and forecasts for homocystinuria, 2018 - 2030 (USD Million)

6.12.1.7 Other Orphan Diseases

6.12.1.7.1 Medical foods market estimates and forecasts for other orphan diseases, 2018 - 2030 (USD Million)

6.12.2 Dysphagia

6.12.2.1 Medical foods market estimates and forecasts for dysphagia, 2018 - 2030 (USD Million)

6.12.3 Wound Healing

6.12.3.1 Medical foods market estimates and forecasts for wound healing, 2018 - 2030 (USD Million)

6.12.4 Chronic Diarrhea

6.12.4.1 Medical foods market estimates and forecasts for chronic diarrhea, 2018 - 2030 (USD Million)

6.12.5 Constipation Relief

6.12.5.1 Medical foods market estimates and forecasts for constipation relief, 2018 - 2030 (USD Million)

6.12.6 Protein Booster

6.12.6.1 Medical foods market estimates and forecasts for protein booster, 2018 - 2030 (USD Million)

6.12.7 Pain Management

6.12.7.1 Medical foods market estimates and forecasts for pain management, 2018 - 2030 (USD MILLION)

6.12.8 Parkinson's Disease

6.12.8.1 Medical foods market estimates and forecasts for Parkinson's disease, 2018 - 2030 (USD Million)

6.12.9 Epilepsy

6.12.9.1 Medical foods market estimates and forecasts for epilepsy, 2018 - 2030 (USD Million)

6.12.10 Other Cancer-Related Treatments

6.12.10.1 Medical foods market estimates and forecasts for other cancer-related treatments, 2018 - 2030 (USD Million)

6.12.11 Severe Protein Allergy

6.12.11.1 Medical foods market estimates and forecasts for severe protein allergy, 2018 - 2030 (USD Million)

6.12.12 Cancer

6.12.12.1 Medical foods market estimates and forecasts for cancer, 2018 - 2030 (USD Million)

6.12.13 Cachexia

6.12.13.1 Medical foods market estimates and forecasts for Cachexia, 2018 - 2030 (USD Million)

6.12.14 Other Diseases

6.12.14.1 Medical foods market estimates and forecasts for other diseases, 2018 - 2030 (USD Million)

Chapter. 7 Medical Foods Market: Sales Channel Estimates & Trend Analysis

7.1 Medical Foods Market: Sales Channel Movement Analysis, 2023 & 2030, USD Million

7.2 Global Medical Foods Market, Market Estimates & Forecast, by Sales Channel

7.2.1 Institutional Sales

7.2.1.1 Medical foods market estimates and forecasts for institutional sales channel, 2018 - 2030 (USD Million)

7.2.1.2 Hospitals

7.2.1.2.1 Medical foods market estimates and forecasts for hospital sales channel, 2018 - 2030 (USD Million)

7.2.1.3 Others

7.2.1.3.1 Medical foods market estimates and forecasts for Other sales channels, 2018 - 2030 (USD Million)

7.2.2 DTC Sales

7.2.2.1 Medical foods market estimates and forecasts for DTC sales channel, 2018 - 2030 (USD Million)

7.2.2.2 Online Sales

7.2.2.2.1 Medical foods market estimates and forecasts for online sales channel, 2018 - 2030 (USD Million)

7.2.2.3 Retail Sales

7.2.2.3.1 Medical foods market estimates and forecasts for retail sales channel, 2018 - 2030 (USD Million)

7.2 Global Medical Foods Market, Market Estimates & Forecast, by Sales Channel

7.2.1 Institutional Sales

7.2.1.1 Medical foods market estimates and forecasts for institutional sales channel, 2018 - 2030 (USD Million)

7.2.1.2 Hospitals

7.2.1.2.1 Medical foods market estimates and forecasts for hospital sales channel, 2018 - 2030 (USD Million)

7.2.1.3 Others

7.2.1.3.1 Medical foods market estimates and forecasts for Other sales channels, 2018 - 2030 (USD Million)

7.2.2 DTC Sales

7.2.2.1 Medical foods market estimates and forecasts for DTC sales channel, 2018 - 2030 (USD Million)

7.2.2.2 Online Sales

7.2.2.2.1 Medical foods market estimates and forecasts for online sales channel, 2018 - 2030 (USD Million)

7.2.2.3 Retail Sales

7.2.2.3.1 Medical foods market estimates and forecasts for retail sales channel, 2018 - 2030 (USD Million)

Chapter. 8 Medical Foods Market: Modules Estimates & Trend Analysis

8.1 Medical Foods Market: Modules Movement Analysis, 2023 & 2030, USD Million

8.2 Global Medical Foods Market, Market Estimates & Forecast, by Module

8.3 Amino Acid based Module

8.3.1 Amino Acid based Module market estimates and Forecasts, 2018-2030, (USD Million)

8.4 Protein Module

8.4.1 Protein Module Medical foods market estimates and Forecasts, 2018-2030, (USD Million)

8.5 Vitamin & Mineral Module

8.5.1 Vitamin & Mineral Module market estimates and forecasts for powder formulation, 2018-2030, (USD Million)

8.6 Fatty Acid based Module

8.6.1 Medical foods market estimates and forecasts for liquid formulation, 2018-2030, (USD Million)

8.7 Carbohydrate Module

8.7.1 Carbohydrate Module market estimates and forecasts for other formulations, 2018-2030, (USD Million)

8.8 Fiber Module

8.8.1 Fiber Module market estimates and forecasts for chronic kidney diseases, 2018-2030, (USD Million)

8.9 Ketogenic Module

8.9.1 Ketogenic Module market estimates and forecasts for minimal hepatic encephalopathy, 2018-2030, (USD Million)

8.10 Peptide-Based Module

8.10.1 Peptide-Based Module market estimates and forecasts for chemotherapy induced diarrhea, 2018-2030, (USD Million)

8.11 Hypoallergenic Module

8.11.1 Hypoallergenic Module market estimates and forecasts for diabetic neuropathy, 2018-2030, (USD Million)

8.12 Others

8.12.1 Others market estimates and forecasts for ADHD, 2018-2030, (USD Million)

8.2 Global Medical Foods Market, Market Estimates & Forecast, by Module

8.3 Amino Acid based Module

8.3.1 Amino Acid based Module market estimates and Forecasts, 2018-2030, (USD Million)

8.4 Protein Module

8.4.1 Protein Module Medical foods market estimates and Forecasts, 2018-2030, (USD Million)

8.5 Vitamin & Mineral Module

8.5.1 Vitamin & Mineral Module market estimates and forecasts for powder formulation, 2018-2030, (USD Million)

8.6 Fatty Acid based Module

8.6.1 Medical foods market estimates and forecasts for liquid formulation, 2018-2030, (USD Million)

8.7 Carbohydrate Module

8.7.1 Carbohydrate Module market estimates and forecasts for other formulations, 2018-2030, (USD Million)

8.8 Fiber Module

8.8.1 Fiber Module market estimates and forecasts for chronic kidney diseases, 2018-2030, (USD Million)

8.9 Ketogenic Module

8.9.1 Ketogenic Module market estimates and forecasts for minimal hepatic encephalopathy, 2018-2030, (USD Million)

8.10 Peptide-Based Module

8.10.1 Peptide-Based Module market estimates and forecasts for chemotherapy induced diarrhea, 2018-2030, (USD Million)

8.11 Hypoallergenic Module

8.11.1 Hypoallergenic Module market estimates and forecasts for diabetic neuropathy, 2018-2030, (USD Million)

8.12 Others

8.12.1 Others market estimates and forecasts for ADHD, 2018-2030, (USD Million)

Chapter. 9 Medical Foods Market: Regional Estimates and Trend Analysis, by Route of Administration, Product, Application, & Sales Channel

9.1 Medical Foods Market: Regional Movement Analysis, 2023 & 2030, USD Million

9.2 North America

9.2.1 North America Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.2.2 U.S.

9.2.2.1 Regulatory Scenario

9.2.2.2 Country Dynamics

9.2.2.3 U.S. Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.2.3 Canada

9.2.3.1 Regulatory Scenario

9.2.3.2 Country Dynamics

9.2.3.3 Canada Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3 Europe

9.3.1 Regulatory Framework

9.3.2 Europe Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.3 UK

9.3.3.1 Regulatory Scenario

9.3.3.2 Country Dynamics

9.3.3.3 UK Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.4 Germany

9.3.4.1 Regulatory Scenario

9.3.4.2 Country Dynamics

9.3.4.3 Germany Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.5 France

9.3.5.1 Regulatory Scenario

9.3.5.2 Country Dynamics

9.3.5.3 France Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.6 Spain

9.3.6.1 Regulatory Scenario

9.3.6.2 Country Dynamics

9.3.6.3 Spain Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.7 Italy

9.3.7.1 Regulatory Scenario

9.3.7.2 Country Dynamics

9.3.7.3 Italy Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.8 Sweden

9.3.8.1 Regulatory Scenario

9.3.8.2 Country Dynamics

9.3.8.3 Sweden Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.9 Denmark

9.3.9.1 Regulatory Scenario

9.3.9.2 Country Dynamics

9.3.9.3 Denmark Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.10 Norway

9.3.10.1 Regulatory Scenario

9.3.10.2 Country Dynamics

9.3.10.3 Norway Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.11 Poland

9.3.11.1 Regulatory Scenario

9.3.11.2 Country Dynamics

9.3.11.3 Poland Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.12 Belgium

9.3.12.1 Regulatory Scenario

9.3.12.2 Country Dynamics

9.3.12.3 Belgium Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.13 Netherlands

9.3.13.1 Regulatory Scenario

9.3.13.2 Country Dynamics

9.3.13.3 Netherlands Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.14 Portugal

9.3.14.1 Regulatory Scenario

9.3.14.2 Country Dynamics

9.3.14.3 Portugal Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.15 Slovakia

9.3.15.1 Regulatory Scenario

9.3.15.2 Country Dynamics

9.3.15.3 Slovakia Medical Foods Market Estimates and Forecasts, 2018 - 2030(USD Million)

9.3.16 Finland

9.3.16.1 Regulatory Scenario

9.3.16.2 Country Dynamics

9.3.16.3 Finland Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.17 Czech Republic

9.3.17.1 Regulatory Scenario

9.3.17.2 Country Dynamics

9.3.17.3 Czech Republic Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.18 Hungary

9.3.18.1 Regulatory Scenario

9.3.18.2 Country Dynamics

9.3.18.3 Hungary Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4 Asia Pacific

9.4.1 Asia Pacific Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.2 Japan

9.4.2.1 Regulatory Scenario

9.4.2.2 Country Dynamics

9.4.2.3 Japan Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.3 China

9.4.3.1 Regulatory Scenario

9.4.3.2 Country Dynamics

9.4.3.3 China Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.4 Australia

9.4.4.1 Regulatory Scenario

9.4.4.2 Country Dynamics

9.4.4.3 Australia Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.5 India

9.4.5.1 Regulatory Scenario

9.4.5.2 Country Dynamics

9.4.5.3 India Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.6 South Korea

9.4.6.1 Regulatory Scenario

9.4.6.2 Country Dynamics

9.4.6.3 South Korea Medical Foods Market Estimates and Forecasts, 2018 - 2030(USD Million)

9.4.7 Thailand

9.4.7.1 Regulatory Scenario

9.4.7.2 Country Dynamics

9.4.7.3 Thailand Medical Foods Market Estimates and Forecasts, 2018 - 2030(USD Million)

9.4.8 Vietnam

9.4.8.1 Regulatory Scenario

9.4.8.2 Country Dynamics

9.4.8.3 Vietnam Medical Foods Market Estimates and Forecasts, 2018 - 2030(USD Million)

9.5 Latin America

9.5.1 Latin America Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.5.2 Brazil

9.5.2.1 Regulatory Scenario

9.5.2.2 Country Dynamics

9.5.2.3 Brazil Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.5.3 Mexico

9.5.3.1 Regulatory Scenario

9.5.3.2 Country Dynamics

9.5.3.3 Mexico Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.5.4 Argentina

9.5.4.1 Regulatory Scenario

9.5.4.2 Country Dynamics

9.5.4.3 Argentina Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.6 Middle East & Africa (MEA)

9.6.1 MEA Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.6.2 South Africa

9.6.2.1 Regulatory Scenario

9.6.2.2 Country Dynamics

9.6.2.3 South Africa Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.6.3 Saudi Arabia

9.6.3.1 Country Dynamics

9.6.3.2 Saudi Arabia Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.6.4 UAE

9.6.4.1 Country Dynamics

9.6.4.2 UAE Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.6.5 Kuwait

9.6.5.1 Country Dynamics

9.6.5.2 Kuwait Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.2 North America

9.2.1 North America Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.2.2 U.S.

9.2.2.1 Regulatory Scenario

9.2.2.2 Country Dynamics

9.2.2.3 U.S. Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.2.3 Canada

9.2.3.1 Regulatory Scenario

9.2.3.2 Country Dynamics

9.2.3.3 Canada Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3 Europe

9.3.1 Regulatory Framework

9.3.2 Europe Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.3 UK

9.3.3.1 Regulatory Scenario

9.3.3.2 Country Dynamics

9.3.3.3 UK Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.4 Germany

9.3.4.1 Regulatory Scenario

9.3.4.2 Country Dynamics

9.3.4.3 Germany Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.5 France

9.3.5.1 Regulatory Scenario

9.3.5.2 Country Dynamics

9.3.5.3 France Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.6 Spain

9.3.6.1 Regulatory Scenario

9.3.6.2 Country Dynamics

9.3.6.3 Spain Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.7 Italy

9.3.7.1 Regulatory Scenario

9.3.7.2 Country Dynamics

9.3.7.3 Italy Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.8 Sweden

9.3.8.1 Regulatory Scenario

9.3.8.2 Country Dynamics

9.3.8.3 Sweden Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.9 Denmark

9.3.9.1 Regulatory Scenario

9.3.9.2 Country Dynamics

9.3.9.3 Denmark Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.10 Norway

9.3.10.1 Regulatory Scenario

9.3.10.2 Country Dynamics

9.3.10.3 Norway Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.11 Poland

9.3.11.1 Regulatory Scenario

9.3.11.2 Country Dynamics

9.3.11.3 Poland Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.12 Belgium

9.3.12.1 Regulatory Scenario

9.3.12.2 Country Dynamics

9.3.12.3 Belgium Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.13 Netherlands

9.3.13.1 Regulatory Scenario

9.3.13.2 Country Dynamics

9.3.13.3 Netherlands Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.14 Portugal

9.3.14.1 Regulatory Scenario

9.3.14.2 Country Dynamics

9.3.14.3 Portugal Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.15 Slovakia

9.3.15.1 Regulatory Scenario

9.3.15.2 Country Dynamics

9.3.15.3 Slovakia Medical Foods Market Estimates and Forecasts, 2018 - 2030(USD Million)

9.3.16 Finland

9.3.16.1 Regulatory Scenario

9.3.16.2 Country Dynamics

9.3.16.3 Finland Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.17 Czech Republic

9.3.17.1 Regulatory Scenario

9.3.17.2 Country Dynamics

9.3.17.3 Czech Republic Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.18 Hungary

9.3.18.1 Regulatory Scenario

9.3.18.2 Country Dynamics

9.3.18.3 Hungary Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4 Asia Pacific

9.4.1 Asia Pacific Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.2 Japan

9.4.2.1 Regulatory Scenario

9.4.2.2 Country Dynamics

9.4.2.3 Japan Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.3 China

9.4.3.1 Regulatory Scenario

9.4.3.2 Country Dynamics

9.4.3.3 China Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.4 Australia

9.4.4.1 Regulatory Scenario

9.4.4.2 Country Dynamics

9.4.4.3 Australia Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.5 India

9.4.5.1 Regulatory Scenario

9.4.5.2 Country Dynamics

9.4.5.3 India Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.6 South Korea

9.4.6.1 Regulatory Scenario

9.4.6.2 Country Dynamics

9.4.6.3 South Korea Medical Foods Market Estimates and Forecasts, 2018 - 2030(USD Million)

9.4.7 Thailand

9.4.7.1 Regulatory Scenario

9.4.7.2 Country Dynamics

9.4.7.3 Thailand Medical Foods Market Estimates and Forecasts, 2018 - 2030(USD Million)

9.4.8 Vietnam

9.4.8.1 Regulatory Scenario

9.4.8.2 Country Dynamics

9.4.8.3 Vietnam Medical Foods Market Estimates and Forecasts, 2018 - 2030(USD Million)

9.5 Latin America

9.5.1 Latin America Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.5.2 Brazil

9.5.2.1 Regulatory Scenario

9.5.2.2 Country Dynamics

9.5.2.3 Brazil Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.5.3 Mexico

9.5.3.1 Regulatory Scenario

9.5.3.2 Country Dynamics

9.5.3.3 Mexico Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.5.4 Argentina

9.5.4.1 Regulatory Scenario

9.5.4.2 Country Dynamics

9.5.4.3 Argentina Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.6 Middle East & Africa (MEA)

9.6.1 MEA Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.6.2 South Africa

9.6.2.1 Regulatory Scenario

9.6.2.2 Country Dynamics

9.6.2.3 South Africa Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.6.3 Saudi Arabia

9.6.3.1 Country Dynamics

9.6.3.2 Saudi Arabia Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.6.4 UAE

9.6.4.1 Country Dynamics

9.6.4.2 UAE Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.6.5 Kuwait

9.6.5.1 Country Dynamics

9.6.5.2 Kuwait Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter. 10 Competitive Analysis

10.1 Recent Developments & Impact Analysis, by Key Market Participants

10.2 Company/Competition Categorization (Key Innovators, Market Leaders, Emerging Players)

10.3 Vendor Landscape

10.3.1 Key Customers

10.3.2 List Of Key Distributors and Channel Partners

10.3.3 Key Company Market Share Analysis, 2023

10.4 Public Companies

10.4.1 Company Market Position Analysis

10.4.2 Company Market Ranking By Region

10.5 Company Profiles

10.5.1 Participants’ Overview

10.5.1.1 Danone S.A.

10.5.1.1.1 Participant’s Overview

10.5.1.1.2 Financial Performance

10.5.1.1.3 Product Benchmarking

10.5.1.1.4 Recent Developments

10.5.1.2 Nestlé S.A.

10.5.1.2.1 Participant’s Overview

10.5.1.2.2 Financial Performance

10.5.1.2.3 Product Benchmarking

10.5.1.2.4 Recent Developments

10.5.1.3 Abbott

10.5.1.3.1 Participant’s Overview

10.5.1.3.2 Financial Performance

10.5.1.3.3 Product Benchmarking

10.5.1.3.4 Recent Developments

10.5.1.4 Targeted Medical Pharma Inc. (Physician Therapeutics LLC, a division of the company)

10.5.1.4.1 Participant’s Overview

10.5.1.4.2 Financial Performance

10.5.1.4.3 Product Benchmarking

10.5.1.4.4 Recent Developments

10.5.1.5 Primus Pharmaceuticals Inc.

10.5.1.5.1 Participant’s Overview

10.5.1.5.2 Financial Performance

10.5.1.5.3 Product Benchmarking

10.5.1.5.4 Recent Developments

10.5.1.6 Fresenius Kabi AG

10.5.1.6.1 Participant’s Overview

10.5.1.6.2 Financial Performance

10.5.1.6.3 Product Benchmarking

10.5.1.6.4 Recent Developments

10.5.1.7 Mead Johnson & Company, LLC

10.5.1.7.1 Participant’s Overview

10.5.1.7.2 Financial Performance

10.5.1.7.3 Product Benchmarking

10.5.1.7.4 Recent Developments

10.5.2 Financial Performance

10.1.2.1 Public Market Players

10.1.2.2 Private Market Players

10.6 Product Benchmarking

10.7 Strategy Mapping

10.7.1 Acquisition

10.7.2 Collaboration

10.7.3 Expansions

10.7.4 Partnership

10.7.5 Product Launch

10.7.6 Others

10.8 List of Other Companies Providing Medical Foods

10.9 Sales Revenue by Online Sales Channel and Retail Sales Channel for Key Companies

10.9.1 Nestlé S.A

10.9.1.1 Online Sales Channel Insights

10.9.1.2 Retail Sales Channel Insights

10.9.2 Danone S.A.

10.9.2.1 Online Sales Channel Insights

10.9.2.2 Retail Sales Channel Insights

10.9.3 Abbott

10.9.3.1 Online Sales Channel Insights

10.9.3.2 Retail Sales Channel Insights

10.2 Company/Competition Categorization (Key Innovators, Market Leaders, Emerging Players)

10.3 Vendor Landscape

10.3.1 Key Customers

10.3.2 List Of Key Distributors and Channel Partners

10.3.3 Key Company Market Share Analysis, 2023

10.4 Public Companies

10.4.1 Company Market Position Analysis

10.4.2 Company Market Ranking By Region

10.5 Company Profiles

10.5.1 Participants’ Overview

10.5.1.1 Danone S.A.

10.5.1.1.1 Participant’s Overview

10.5.1.1.2 Financial Performance

10.5.1.1.3 Product Benchmarking

10.5.1.1.4 Recent Developments

10.5.1.2 Nestlé S.A.

10.5.1.2.1 Participant’s Overview

10.5.1.2.2 Financial Performance

10.5.1.2.3 Product Benchmarking

10.5.1.2.4 Recent Developments

10.5.1.3 Abbott

10.5.1.3.1 Participant’s Overview

10.5.1.3.2 Financial Performance

10.5.1.3.3 Product Benchmarking

10.5.1.3.4 Recent Developments

10.5.1.4 Targeted Medical Pharma Inc. (Physician Therapeutics LLC, a division of the company)

10.5.1.4.1 Participant’s Overview

10.5.1.4.2 Financial Performance

10.5.1.4.3 Product Benchmarking

10.5.1.4.4 Recent Developments

10.5.1.5 Primus Pharmaceuticals Inc.

10.5.1.5.1 Participant’s Overview

10.5.1.5.2 Financial Performance

10.5.1.5.3 Product Benchmarking

10.5.1.5.4 Recent Developments

10.5.1.6 Fresenius Kabi AG

10.5.1.6.1 Participant’s Overview

10.5.1.6.2 Financial Performance

10.5.1.6.3 Product Benchmarking

10.5.1.6.4 Recent Developments

10.5.1.7 Mead Johnson & Company, LLC

10.5.1.7.1 Participant’s Overview

10.5.1.7.2 Financial Performance

10.5.1.7.3 Product Benchmarking

10.5.1.7.4 Recent Developments

10.5.2 Financial Performance

10.1.2.1 Public Market Players

10.1.2.2 Private Market Players

10.6 Product Benchmarking

10.7 Strategy Mapping

10.7.1 Acquisition

10.7.2 Collaboration

10.7.3 Expansions

10.7.4 Partnership

10.7.5 Product Launch

10.7.6 Others

10.8 List of Other Companies Providing Medical Foods

10.9 Sales Revenue by Online Sales Channel and Retail Sales Channel for Key Companies

10.9.1 Nestlé S.A

10.9.1.1 Online Sales Channel Insights

10.9.1.2 Retail Sales Channel Insights

10.9.2 Danone S.A.

10.9.2.1 Online Sales Channel Insights

10.9.2.2 Retail Sales Channel Insights

10.9.3 Abbott

10.9.3.1 Online Sales Channel Insights

10.9.3.2 Retail Sales Channel Insights

List of Tables

Table 1. List of abbreviation

Table 2. North America medical foods market, by region, 2018 - 2030 (USD Million)

Table 3. North America medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 4. North America medical foods market, by product type, 2018 - 2030 (USD Million)

Table 5. North America medical foods market, by application, 2018 - 2030 (USD Million)

Table 6. North America medical foods market, by module, 2018 - 2030 (USD Million)

Table 7. North America medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 8. U.S. medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 9. U.S. medical foods market, by product type, 2018 - 2030 (USD Million)

Table 10. U.S. medical foods market, by application, 2018 - 2030 (USD Million)

Table 11. U.S. medical foods market, by module, 2018 - 2030 (USD Million)

Table 12. U.S. medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 13. Canada medical foods market, by deployment model, 2018 - 2030 (USD Million)

Table 14. Canada medical foods market, by product type, 2018 - 2030 (USD Million)

Table 15. Canada medical foods market, by application, 2018 - 2030 (USD Million)

Table 16. Canada medical foods market, by module, 2018 - 2030 (USD Million)

Table 17. Canada medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 18. Mexico medical foods market, by product type, 2018 - 2030 (USD Million)

Table 19. Mexico medical foods market, by application, 2018 - 2030 (USD Million)

Table 20. Mexico medical foods market, by module, 2018 - 2030 (USD Million)

Table 21. Mexico medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 22. Europe medical foods market, by region, 2018 - 2030 (USD Million)

Table 23. Europe medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 24. Europe medical foods market, by product type, 2018 - 2030 (USD Million)

Table 25. Europe medical foods market, by application, 2018 - 2030 (USD Million)

Table 26. Europe medical foods market, by module, 2018 - 2030 (USD Million)

Table 27. Europe medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 28. Germany medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 29. Germany medical foods market, by product type, 2018 - 2030 (USD Million)

Table 30. Germany medical foods market, by application, 2018 - 2030 (USD Million)

Table 31. Germany medical foods market, by module, 2018 - 2030 (USD Million)

Table 32. Germany medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 33. UK medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 34. UK medical foods market, by product type, 2018 - 2030 (USD Million)

Table 35. UK medical foods market, by application, 2018 - 2030 (USD Million)

Table 36. UK medical foods market, by module, 2018 - 2030 (USD Million)

Table 37. UK medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 38. France medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 39. France medical foods market, by product type, 2018 - 2030 (USD Million)

Table 40. France medical foods market, by application, 2018 - 2030 (USD Million)

Table 41. France medical foods market, by module, 2018 - 2030 (USD Million)

Table 42. France medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 43. Italy medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 44. Italy medical foods market, by product type, 2018 - 2030 (USD Million)

Table 45. Italy medical foods market, by application, 2018 - 2030 (USD Million)

Table 46. Italy medical foods market, by module, 2018 - 2030 (USD Million)

Table 47. Italy medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 48. Spain medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 49. Spain medical foods market, by product type, 2018 - 2030 (USD Million)

Table 50. Spain medical foods market, by application, 2018 - 2030 (USD Million)

Table 51. Spain medical foods market, by module, 2018 - 2030 (USD Million)

Table 52. Spain medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 53. Denmark medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 54. Denmark medical foods market, by product type, 2018 - 2030 (USD Million)

Table 55. Denmark medical foods market, by application, 2018 - 2030 (USD Million)

Table 56. Denmark medical foods market, by module, 2018 - 2030 (USD Million)

Table 57. Denmark medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 58. Sweden medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 59. Sweden medical foods market, by product type, 2018 - 2030 (USD Million)

Table 60. Sweden medical foods market, by application, 2018 - 2030 (USD Million)

Table 61. Sweden medical foods market, by module, 2018 - 2030 (USD Million)

Table 62. Sweden medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 63. Norway medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 64. Norway medical foods market, by product type, 2018 - 2030 (USD Million)

Table 65. Norway medical foods market, by application, 2018 - 2030 (USD Million)

Table 66. Norway medical foods market, by module, 2018 - 2030 (USD Million)

Table 67. Norway medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 68. Asia Pacific medical foods market, by region, 2018 - 2030 (USD Million)

Table 69. Asia Pacific medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 70. Asia Pacific medical foods market, by product type, 2018 - 2030 (USD Million)

Table 71. Asia Pacific medical foods market, by application, 2018 - 2030 (USD Million)

Table 72. Asia Pacific medical foods market, by module, 2018 - 2030 (USD Million)

Table 73. Asia Pacific medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 74. China medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 75. China medical foods market, by product type, 2018 - 2030 (USD Million)

Table 76. China medical foods market, by application, 2018 - 2030 (USD Million)

Table 77. China medical foods market, by module, 2018 - 2030 (USD Million)

Table 78. China medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 79. Japan medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 80. Japan medical foods market, by product type, 2018 - 2030 (USD Million)

Table 81. Japan medical foods market, by application, 2018 - 2030 (USD Million)

Table 82. Japan medical foods market, by module, 2018 - 2030 (USD Million)

Table 83. Japan medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 84. India medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 85. India medical foods market, by product type, 2018 - 2030 (USD Million)

Table 86. India medical foods market, by application, 2018 - 2030 (USD Million)

Table 87. India medical foods market, by module, 2018 - 2030 (USD Million)

Table 88. India medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 89. South Korea medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 90. South Korea medical foods market, by product type, 2018 - 2030 (USD Million)

Table 91. South Korea medical foods market, by application, 2018 - 2030 (USD Million)

Table 92. South Korea medical foods market, by module, 2018 - 2030 (USD Million)

Table 93. South Korea medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 94. Australia medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 95. Australia medical foods market, by deployment model, 2018 - 2030 (USD Million)

Table 96. Australia medical foods market, by product type, 2018 - 2030 (USD Million)

Table 97. Australia medical foods market, by application, 2018 - 2030 (USD Million)

Table 98. Australia medical foods market, by module, 2018 - 2030 (USD Million)

Table 99. Australia medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 100. Thailand medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 101. Thailand medical foods market, by deployment model, 2018 - 2030 (USD Million)

Table 102. Thailand medical foods market, by product type, 2018 - 2030 (USD Million)

Table 103. Thailand medical foods market, by application, 2018 - 2030 (USD Million)

Table 104. Thailand medical foods market, by module, 2018 - 2030 (USD Million)

Table 105. Thailand medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 106. Latin America medical foods market, by region, 2018 - 2030 (USD Million)

Table 107. Latin America medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 108. Latin America medical foods market, by deployment model, 2018 - 2030 (USD Million)

Table 109. Latin America medical foods market, by product type, 2018 - 2030 (USD Million)

Table 110. Latin America medical foods market, by application, 2018 - 2030 (USD Million)

Table 111. Latin America medical foods market, by module, 2018 - 2030 (USD Million)

Table 112. Latin America medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 113. Brazil medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 114. Brazil medical foods market, by deployment model, 2018 - 2030 (USD Million)

Table 115. Brazil medical foods market, by product type, 2018 - 2030 (USD Million)

Table 116. Brazil medical foods market, by application, 2018 - 2030 (USD Million)

Table 117. Brazil medical foods market, by module, 2018 - 2030 (USD Million)

Table 118. Brazil medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 119. Argentina medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 120. Argentina medical foods market, by deployment model, 2018 - 2030 (USD Million)

Table 121. Argentina medical foods market, by product type, 2018 - 2030 (USD Million)

Table 122. Argentina medical foods market, by application, 2018 - 2030 (USD Million)

Table 123. Argentina medical foods market, by module, 2018 - 2030 (USD Million)

Table 124. Argentina medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 125. MEA medical foods market, by region, 2018 - 2030 (USD Million)

Table 126. MEA medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 127. MEA medical foods market, by deployment model, 2018 - 2030 (USD Million)

Table 128. MEA medical foods market, by product type, 2018 - 2030 (USD Million)

Table 129. MEA medical foods market, by application, 2018 - 2030 (USD Million)

Table 130. MEA medical foods market, by module, 2018 - 2030 (USD Million)

Table 131. MEA medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 132. South Africa medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 133. South Africa medical foods market, by deployment model, 2018 - 2030 (USD Million)

Table 134. South Africa medical foods market, by product type, 2018 - 2030 (USD Million)

Table 135. South Africa medical foods market, by application, 2018 - 2030 (USD Million)

Table 136. South Africa medical foods market, by module, 2018 - 2030 (USD Million)

Table 137. South Africa medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 138. Saudi Arabia medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 139. Saudi Arabia medical foods market, by deployment model, 2018 - 2030 (USD Million)

Table 140. Saudi Arabia medical foods market, by product type, 2018 - 2030 (USD Million)

Table 141. Saudi Arabia medical foods market, by application, 2018 - 2030 (USD Million)

Table 142. Saudi Arabia medical foods market, by module, 2018 - 2030 (USD Million)

Table 143. Saudi Arabia medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 144. UAE medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 145. UAE medical foods market, by deployment model, 2018 - 2030 (USD Million)

Table 146. UAE medical foods market, by product type, 2018 - 2030 (USD Million)

Table 147. UAE medical foods market, by application, 2018 - 2030 (USD Million)

Table 148. UAE medical foods market, by module, 2018 - 2030 (USD Million)

Table 149. UAE medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 150. Kuwait medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 151. Kuwait medical foods market, by deployment model, 2018 - 2030 (USD Million)

Table 152. Kuwait medical foods market, by product type, 2018 - 2030 (USD Million)

Table 153. Kuwait medical foods market, by application, 2018 - 2030 (USD Million)

Table 154. Kuwait medical foods market, by module, 2018 - 2030 (USD Million)

Table 155. North America medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 2. North America medical foods market, by region, 2018 - 2030 (USD Million)

Table 3. North America medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 4. North America medical foods market, by product type, 2018 - 2030 (USD Million)

Table 5. North America medical foods market, by application, 2018 - 2030 (USD Million)

Table 6. North America medical foods market, by module, 2018 - 2030 (USD Million)

Table 7. North America medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 8. U.S. medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 9. U.S. medical foods market, by product type, 2018 - 2030 (USD Million)

Table 10. U.S. medical foods market, by application, 2018 - 2030 (USD Million)

Table 11. U.S. medical foods market, by module, 2018 - 2030 (USD Million)

Table 12. U.S. medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 13. Canada medical foods market, by deployment model, 2018 - 2030 (USD Million)

Table 14. Canada medical foods market, by product type, 2018 - 2030 (USD Million)

Table 15. Canada medical foods market, by application, 2018 - 2030 (USD Million)

Table 16. Canada medical foods market, by module, 2018 - 2030 (USD Million)

Table 17. Canada medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 18. Mexico medical foods market, by product type, 2018 - 2030 (USD Million)

Table 19. Mexico medical foods market, by application, 2018 - 2030 (USD Million)

Table 20. Mexico medical foods market, by module, 2018 - 2030 (USD Million)

Table 21. Mexico medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 22. Europe medical foods market, by region, 2018 - 2030 (USD Million)

Table 23. Europe medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 24. Europe medical foods market, by product type, 2018 - 2030 (USD Million)

Table 25. Europe medical foods market, by application, 2018 - 2030 (USD Million)

Table 26. Europe medical foods market, by module, 2018 - 2030 (USD Million)

Table 27. Europe medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 28. Germany medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 29. Germany medical foods market, by product type, 2018 - 2030 (USD Million)

Table 30. Germany medical foods market, by application, 2018 - 2030 (USD Million)

Table 31. Germany medical foods market, by module, 2018 - 2030 (USD Million)

Table 32. Germany medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 33. UK medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 34. UK medical foods market, by product type, 2018 - 2030 (USD Million)

Table 35. UK medical foods market, by application, 2018 - 2030 (USD Million)

Table 36. UK medical foods market, by module, 2018 - 2030 (USD Million)

Table 37. UK medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 38. France medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 39. France medical foods market, by product type, 2018 - 2030 (USD Million)

Table 40. France medical foods market, by application, 2018 - 2030 (USD Million)

Table 41. France medical foods market, by module, 2018 - 2030 (USD Million)

Table 42. France medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 43. Italy medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 44. Italy medical foods market, by product type, 2018 - 2030 (USD Million)

Table 45. Italy medical foods market, by application, 2018 - 2030 (USD Million)

Table 46. Italy medical foods market, by module, 2018 - 2030 (USD Million)

Table 47. Italy medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 48. Spain medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 49. Spain medical foods market, by product type, 2018 - 2030 (USD Million)

Table 50. Spain medical foods market, by application, 2018 - 2030 (USD Million)

Table 51. Spain medical foods market, by module, 2018 - 2030 (USD Million)

Table 52. Spain medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 53. Denmark medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 54. Denmark medical foods market, by product type, 2018 - 2030 (USD Million)

Table 55. Denmark medical foods market, by application, 2018 - 2030 (USD Million)

Table 56. Denmark medical foods market, by module, 2018 - 2030 (USD Million)

Table 57. Denmark medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 58. Sweden medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 59. Sweden medical foods market, by product type, 2018 - 2030 (USD Million)

Table 60. Sweden medical foods market, by application, 2018 - 2030 (USD Million)

Table 61. Sweden medical foods market, by module, 2018 - 2030 (USD Million)

Table 62. Sweden medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 63. Norway medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 64. Norway medical foods market, by product type, 2018 - 2030 (USD Million)

Table 65. Norway medical foods market, by application, 2018 - 2030 (USD Million)

Table 66. Norway medical foods market, by module, 2018 - 2030 (USD Million)

Table 67. Norway medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 68. Asia Pacific medical foods market, by region, 2018 - 2030 (USD Million)

Table 69. Asia Pacific medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 70. Asia Pacific medical foods market, by product type, 2018 - 2030 (USD Million)

Table 71. Asia Pacific medical foods market, by application, 2018 - 2030 (USD Million)

Table 72. Asia Pacific medical foods market, by module, 2018 - 2030 (USD Million)

Table 73. Asia Pacific medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 74. China medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 75. China medical foods market, by product type, 2018 - 2030 (USD Million)

Table 76. China medical foods market, by application, 2018 - 2030 (USD Million)

Table 77. China medical foods market, by module, 2018 - 2030 (USD Million)

Table 78. China medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 79. Japan medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 80. Japan medical foods market, by product type, 2018 - 2030 (USD Million)

Table 81. Japan medical foods market, by application, 2018 - 2030 (USD Million)

Table 82. Japan medical foods market, by module, 2018 - 2030 (USD Million)

Table 83. Japan medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 84. India medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 85. India medical foods market, by product type, 2018 - 2030 (USD Million)

Table 86. India medical foods market, by application, 2018 - 2030 (USD Million)

Table 87. India medical foods market, by module, 2018 - 2030 (USD Million)

Table 88. India medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 89. South Korea medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 90. South Korea medical foods market, by product type, 2018 - 2030 (USD Million)

Table 91. South Korea medical foods market, by application, 2018 - 2030 (USD Million)

Table 92. South Korea medical foods market, by module, 2018 - 2030 (USD Million)

Table 93. South Korea medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 94. Australia medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 95. Australia medical foods market, by deployment model, 2018 - 2030 (USD Million)

Table 96. Australia medical foods market, by product type, 2018 - 2030 (USD Million)

Table 97. Australia medical foods market, by application, 2018 - 2030 (USD Million)

Table 98. Australia medical foods market, by module, 2018 - 2030 (USD Million)

Table 99. Australia medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 100. Thailand medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 101. Thailand medical foods market, by deployment model, 2018 - 2030 (USD Million)

Table 102. Thailand medical foods market, by product type, 2018 - 2030 (USD Million)

Table 103. Thailand medical foods market, by application, 2018 - 2030 (USD Million)

Table 104. Thailand medical foods market, by module, 2018 - 2030 (USD Million)

Table 105. Thailand medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 106. Latin America medical foods market, by region, 2018 - 2030 (USD Million)

Table 107. Latin America medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 108. Latin America medical foods market, by deployment model, 2018 - 2030 (USD Million)

Table 109. Latin America medical foods market, by product type, 2018 - 2030 (USD Million)

Table 110. Latin America medical foods market, by application, 2018 - 2030 (USD Million)

Table 111. Latin America medical foods market, by module, 2018 - 2030 (USD Million)

Table 112. Latin America medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 113. Brazil medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 114. Brazil medical foods market, by deployment model, 2018 - 2030 (USD Million)

Table 115. Brazil medical foods market, by product type, 2018 - 2030 (USD Million)

Table 116. Brazil medical foods market, by application, 2018 - 2030 (USD Million)

Table 117. Brazil medical foods market, by module, 2018 - 2030 (USD Million)

Table 118. Brazil medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 119. Argentina medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 120. Argentina medical foods market, by deployment model, 2018 - 2030 (USD Million)

Table 121. Argentina medical foods market, by product type, 2018 - 2030 (USD Million)

Table 122. Argentina medical foods market, by application, 2018 - 2030 (USD Million)

Table 123. Argentina medical foods market, by module, 2018 - 2030 (USD Million)

Table 124. Argentina medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 125. MEA medical foods market, by region, 2018 - 2030 (USD Million)

Table 126. MEA medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 127. MEA medical foods market, by deployment model, 2018 - 2030 (USD Million)

Table 128. MEA medical foods market, by product type, 2018 - 2030 (USD Million)

Table 129. MEA medical foods market, by application, 2018 - 2030 (USD Million)

Table 130. MEA medical foods market, by module, 2018 - 2030 (USD Million)

Table 131. MEA medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 132. South Africa medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 133. South Africa medical foods market, by deployment model, 2018 - 2030 (USD Million)

Table 134. South Africa medical foods market, by product type, 2018 - 2030 (USD Million)

Table 135. South Africa medical foods market, by application, 2018 - 2030 (USD Million)

Table 136. South Africa medical foods market, by module, 2018 - 2030 (USD Million)

Table 137. South Africa medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 138. Saudi Arabia medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 139. Saudi Arabia medical foods market, by deployment model, 2018 - 2030 (USD Million)

Table 140. Saudi Arabia medical foods market, by product type, 2018 - 2030 (USD Million)

Table 141. Saudi Arabia medical foods market, by application, 2018 - 2030 (USD Million)

Table 142. Saudi Arabia medical foods market, by module, 2018 - 2030 (USD Million)

Table 143. Saudi Arabia medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 144. UAE medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 145. UAE medical foods market, by deployment model, 2018 - 2030 (USD Million)

Table 146. UAE medical foods market, by product type, 2018 - 2030 (USD Million)

Table 147. UAE medical foods market, by application, 2018 - 2030 (USD Million)

Table 148. UAE medical foods market, by module, 2018 - 2030 (USD Million)

Table 149. UAE medical foods market, by sales channel, 2018 - 2030 (USD Million)

Table 150. Kuwait medical foods market, by route of administration, 2018 - 2030 (USD Million)

Table 151. Kuwait medical foods market, by deployment model, 2018 - 2030 (USD Million)

Table 152. Kuwait medical foods market, by product type, 2018 - 2030 (USD Million)

Table 153. Kuwait medical foods market, by application, 2018 - 2030 (USD Million)

Table 154. Kuwait medical foods market, by module, 2018 - 2030 (USD Million)

Table 155. North America medical foods market, by sales channel, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value-chain-based sizing & forecasting

Fig. 6 QFD modeling for market share assessment

Fig. 7 Market formulation & validation

Fig. 8 Medical foods market: Market outlook

Fig. 9 Medical foods competitive insights

Fig. 10 Parent market outlook

Fig. 11 Related/ancillary market outlook

Fig. 12 Penetration and growth prospect mapping

Fig. 13 Industry value chain analysis

Fig. 14 Medical foods market driver impact

Fig. 15 Medical foods market restraint impact

Fig. 16 Medical foods market strategic initiatives analysis

Fig. 17 Medical foods market: Route of administration movement analysis

Fig. 18 Medical foods market: Route of administration outlook and key takeaways

Fig. 19 Oral market estimates and forecast, 2018 - 2030

Fig. 20 Enteral market estimates and forecast, 2018 - 2030

Fig. 21 Medical foods market: Product type analysis

Fig. 22 Medical foods market: Product type outlook and key takeaways

Fig. 23 Pills market estimates and forecast, 2018 - 2030

Fig. 24 Powder market estimates and forecast, 2018 - 2030

Fig. 25 Liquid market estimates and forecast, 2018 - 2030

Fig. 26 Others market estimates and forecast, 2018 - 2030

Fig. 27 Medical foods market: Application movement analysis

Fig. 28 Medical foods market: Application outlook and key takeaways

Fig. 29 Chronic kidney disease market estimates and forecast, 2018 - 2030

Fig. 30 Minimal hepatic encephalopathy market estimates and forecast, 2018 - 2030

Fig. 31 Chemotherapy induced diarrhoea market estimates and forecast, 2018 - 2030

Fig. 32 Pathogen related infections market estimates and forecast, 2018 - 2030

Fig. 33 Diabetic neuropathy market estimates and forecast, 2018 - 2030

Fig. 34 ADHD market estimates and forecast, 2018 - 2030

Fig. 35 Depression market estimates and forecast, 2018 - 2030

Fig. 36 Alzheimer's disease market estimates and forecast, 2018 - 2030

Fig. 37 Nutritional deficiency market estimates and forecast, 2018 - 2030

Fig. 38 Orphan disease market estimates and forecast, 2018 - 2030

Fig. 39 Tyrosinemia market estimates and forecast, 2018 - 2030

Fig. 40 Eosinophilic esophagitis market estimates and forecast, 2018 - 2030

Fig. 41 Food protein module-induced enterocolitis syndrome (Food Protein Module-induced enterocolitis syndrome (FPIES)) market estimates and forecast, 2018 - 2030

Fig. 42 Phenylketonuria (PKU) market estimates and forecast, 2018 - 2030

Fig. 43 Maple syrup urine disease (Maple syrup urine disease (MSUD)) market estimates and forecast, 2018 - 2030

Fig. 44 Homocystinuria market estimates and forecast, 2018 - 2030

Fig. 45 Others (Urea Cycle Disorder (UCD), Glycogen Storage Disease (GSD), etc) market estimates and forecast, 2018 - 2030

Fig. 46 Wound healing market estimates and forecast, 2018 - 2030

Fig. 47 Chronic diarrhea market estimates and forecast, 2018 - 2030

Fig. 48 Constipation relief market estimates and forecast, 2018 - 2030

Fig. 49 Protein booster market estimates and forecast, 2018 - 2030

Fig. 50 Dysphagia market estimates and forecast, 2018 - 2030

Fig. 51 Pain management market estimates and forecast, 2018 - 2030

Fig. 52 Parkinson's disease market estimates and forecast, 2018 - 2030

Fig. 53 Epilepsy market estimates and forecast, 2018 - 2030

Fig. 54 Other cancer related treatments market estimates and forecast, 2018 - 2030

Fig. 55 Severe protein allergy market estimates and forecast, 2018 - 2030

Fig. 56 Cancer market estimates and forecast, 2018 - 2030

Fig. 57 Cachexia market estimates and forecast, 2018 - 2030

Fig. 58 Other (debilitating conditions, COPD, etc) market estimates and forecast, 2018 - 2030

Fig. 59 Medical foods market: Product type analysis

Fig. 60 Medical foods market: Product type outlook and key takeaways

Fig. 61 Pills market estimates and forecast, 2018 - 2030

Fig. 62 Powder market estimates and forecast, 2018 - 2030

Fig. 63 Liquid market estimates and forecast, 2018 - 2030

Fig. 64 Others market estimates and forecast, 2018 - 2030

Fig. 65 Global medical foods market: Regional movement analysis

Fig. 66 Global medical foods market: Regional outlook and key takeaways

Fig. 67 Global medical foods market share and leading players

Fig. 68 North America market share and leading players

Fig. 69 Europe market share and leading players

Fig. 70 Asia Pacific market share and leading players

Fig. 71 Latin America market share and leading players

Fig. 72 Middle East & Africa market share and leading players

Fig. 73 North America: SWOT

Fig. 74 Europe SWOT

Fig. 75 Asia Pacific SWOT

Fig. 76 Latin America SWOT

Fig. 77 MEA SWOT

Fig. 78 North America, by country

Fig. 79 North America

Fig. 80 North America market estimates and forecasts, 2018 - 2030

Fig. 81 US

Fig. 82 US market estimates and forecasts, 2018 - 2030

Fig. 83 Canada

Fig. 84 Canada market estimates and forecasts, 2018 - 2030

Fig. 85 Mexico

Fig. 86 Mexico market estimates and forecasts, 2018 - 2030

Fig. 87 Europe

Fig. 88 Europe market estimates and forecasts, 2018 - 2030

Fig. 89 UK

Fig. 90 UK market estimates and forecasts, 2018 - 2030

Fig. 91 Germany

Fig. 92 Germany market estimates and forecasts, 2018 - 2030

Fig. 93 France

Fig. 94 France market estimates and forecasts, 2018 - 2030

Fig. 95 Italy

Fig. 96 Italy market estimates and forecasts, 2018 - 2030

Fig. 97 Spain

Fig. 98 Spain market estimates and forecasts, 2018 - 2030

Fig. 99 Denmark

Fig. 100 Denmark market estimates and forecasts, 2018 - 2030

Fig. 101 Sweden

Fig. 102 Sweden market estimates and forecasts, 2018 - 2030

Fig. 103 Norway

Fig. 104 Norway market estimates and forecasts, 2018 - 2030

Fig. 105 Asia Pacific

Fig. 106 Asia Pacific market estimates and forecasts, 2018 - 2030

Fig. 107 China

Fig. 108 China market estimates and forecasts, 2018 - 2030

Fig. 109 Japan

Fig. 110 Japan market estimates and forecasts, 2018 - 2030

Fig. 111 India

Fig. 112 India market estimates and forecasts, 2018 - 2030

Fig. 113 Thailand

Fig. 114 Thailand market estimates and forecasts, 2018 - 2030

Fig. 115 South Korea

Fig. 116 South Korea market estimates and forecasts, 2018 - 2030

Fig. 117 Australia