Polyvinyl chloride (PVC) pipes refer to tubular structures made from a synthetic thermoplastic polymer called PVC. They are manufactured using an extrusion process, which involves multiple steps, including heating, mixing, die casting, cooling, sizing, cutting, and stacking. PVC pipes are widely used in plumbing, sewers, irrigation systems, electrical conduits, water treatment plants, construction activities, ventilation systems, and recreational equipment. They are cost-effective, durable, and lightweight products that require low maintenance, offer long service life, and provide resistance against mold, rust, chemicals, fire, and moisture.

The widespread product adoption in renewable energy projects to install underground cables, conduits, and water systems is boosting the market growth. Furthermore, the increasing product adoption in the manufacturing of recreation equipment, such as playground structures, water slides, and portable sports equipment, is contributing to the market growth. Additionally, the implementation of supportive policies by the Government of Spain to ensure the quality, safety, and performance of PVC pipes is positively influencing the market growth. Moreover, the growing emphasis on sustainability and environmental considerations is facilitating product demand as they are recyclable and manufactured using energy-efficient processes. Other factors, including rising urbanization activities, increasing investment in the development of advanced products, and the rapid modernization of aging infrastructure, are anticipated to drive the market growth.

Spain PVC Pipes Market Trends/Drivers:

The increasing product utilization in the agriculture industry

PVC pipes are widely used in agricultural irrigation systems to transport water from sources to the fields efficiently. Furthermore, the increasing product applications to create water supply networks in agrarian settings for transporting water from reservoirs to the livestock watering, cleaning, and processing areas is contributing to the market growth. Moreover, the growing product adoption in the agricultural drainage system to remove access water from crop fields, prevent waterlogging, and maintain adequate soil moisture is strengthening the market growth. Additionally, the rising product applications in hydroponic systems to ensure the delivery of nutrient-rich waters directly to plant roots is supporting the market growth. Apart from this, the widespread product utilization in greenhouse structures, animal shelters, and livestock handling equipment is favoring the market growth.The growing demand for PVC pipes in water distribution and treatment plants

PVC pipes are extensively used in water distribution networks to transport treated water from treatment plants to consumers. They are cost-effective, durable, and corrosion-resistant products that ensure the safe and efficient delivery of potable water to households, businesses, and public facilities. Furthermore, the widespread product adoption in raw water intake systems to draw water from natural sources, such as rivers, lakes, and groundwater wells, is strengthening the market growth. Moreover, the increasing product installation in chemical feed systems to transport coagulants, flocculants, disinfectants, and pH-adjusting agents from storage tanks to the water treatment process is favoring the market growth. Apart from this, the growing product applications in backwash systems to remove accumulated particles and debris from filtration media are supporting the market growth.Extensive research and development (R&D) activities

The introduction of high-strength PVC pipes that are reinforced with fiberglass and carbon fibers to impart additional structural strength and enhanced resistance to external pressures is positively influencing the market growth. Furthermore, the recent development of lead-free PVC pipes that are safe, environment-friendly, and maintain the quality of drinking water is contributing to the market growth. Moreover, the growing emphasis on sustainability has prompted manufacturers to produce recycled PVC pipes, which reduces carbon footprint, lowers waste generation, and minimizes the need for virgin material. Additionally, the incorporation of specialized additives to enhance product durability, extend service life, and provide resistance against ultraviolet (UV) radiation is strengthening the market growth.Spain PVC Pipes Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the Spain PVC pipes market report, along with forecasts for the period 2025-2033. Our report has categorized the market based on type and application.Breakup by Type:

- Rigid PVC Pipes

- Flexible PVC Pipes

Rigid PVC pipes dominates the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes rigid and flexible PVC pipes. According to the report, rigid PVC pipes represented the largest market segment.Rigid PVC pipes are dominating the market owing to their durability, high strength, and excellent resistance against corrosion, chemicals, and impact. Furthermore, they ensure long-term performance and reduce the need for frequent replacements, which makes them highly suitable for plumbing, construction, irrigation, and drainage applications. Additionally, rigid PVC pipes are cost-effective and lightweight, which helps in easy transportation, handling, and installation in residential and commercial projects. Moreover, they require low maintenance and can withstand extreme weather conditions, which contributes to overall cost savings. Apart from this, rigid PVC pipes are highly versatile and adaptable products that can be used for above-ground and underground installations. They are also hygienic, safe, and non-toxic in nature and do not impart taste, odor, or contaminants to the water.

Breakup by Application:

- Construction

- Water Distribution

- Agriculture

- Others

Construction dominates the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes construction, water distribution, agriculture, and others. According to the report, construction represented the largest market segment.PVC pipes are extensively used in residential and commercial construction activities owing to their high strength, corrosion resistance, low maintenance, and long service life. They are widely adopted in household plumbing applications to transport and distribute potable water and wastewater. Along with this, the widespread product utilization in the drainage and sewage systems, owing to their ability to handle high pressure and flow rates, is acting as another growth-inducing factor. Furthermore, the increasing product application in air conditioning and ventilation systems to facilitate air movement and distribution across the room is contributing to the market growth. Moreover, the rising product adoption as an electrical conduit for wires and cables to ensure safety and prevent damage is catalyzing the market growth.

Competitive Landscape:

The leading companies in the market are focusing on product diversification to cater to broader consumer demands and increase sales. Furthermore, several key players are implementing rigorous quality control measures and ensuring compliance with industry standards to build trust and increase customer satisfaction. Moreover, top companies are actively engaged in research and development (R&D) works to improve product durability, corrosion resistance, and installation methods. Along with this, key players are adopting eco-friendly manufacturing processes to increase brand reputation, promote sustainability, and attract environmentally conscious customers. Additionally, aggressive marketing and promotional activities by manufacturers through social media, digital marketing, and television (TV) commercials are positively influencing the market growth.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Adequa

- Cepex

- Molecor

- Ferroplast

- Plomifera

Key Questions Answered in This Report:

- How has the Spain PVC pipes market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the Spain PVC pipes market?

- What is the impact of each driver, restraint, and opportunity on the Spain PVC pipes market?

- What is the breakup of the market based on type?

- Which is the most attractive type in the Spain PVC pipes market?

- What is the breakup of the market based on application?

- Which is the most attractive application in the Spain PVC pipes market?

- What is the competitive structure of the Spain PVC pipes market?

- Who are the key players/companies in the Spain PVC pipes market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Europe PVC Pipes Market

5.1 Market Overview

5.2 Market Performance

5.3 Market Breakup by Type

5.4 Market Breakup by Region

5.5 Market Breakup by Application

5.6 Market Forecast

6 Spain PVC Pipes Market

6.1 Market Overview

6.2 Market Performance

6.2.1 Volume Trends

6.2.2 Value Trends

6.3 Impact of COVID-19

6.4 Price Analysis

6.4.1 Key Price Indicators

6.4.2 Price Structure

6.4.3 Price Trends

6.4.4 Industry Best Practices

6.5 Market Breakup by Type

6.6 Market Breakup by Application

6.7 Market Forecast

6.8 SWOT Analysis

6.8.1 Overview

6.8.2 Strengths

6.8.3 Weaknesses

6.8.4 Opportunities

6.8.5 Threats

6.9 Value Chain Analysis

6.9.1 Overview

6.9.2 Raw Material Procurement

6.9.3 Manufacturer

6.9.4 Distributor

6.9.5 Exporter

6.9.6 Retailer

6.9.7 End-User

6.10 Porters Five Forces Analysis

6.10.1 Overview

6.10.2 Bargaining Power of Buyers

6.10.3 Bargaining Power of Suppliers

6.10.4 Degree of Competition

6.10.5 Threat of New Entrants

6.10.6 Threat of Substitutes

6.11 Key success and Risk Factors

7 Market Performance by Type

7.1 Rigid PVC Pipes

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Flexible PVC Pipes

7.2.1 Market Trends

7.2.2 Market Forecast

8 Market Performance by Application

8.1 Construction

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Water Distribution

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Agriculture

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Others

8.4.1 Market Trends

8.4.2 Market Forecast

9 Import and Export

9.1 Imports

9.2 Exports

10 Competitive Landscape

10.1 Market Structure

10.2 Key Players

11 PVC Pipes Manufacturing Process

11.1 Product Overview

11.2 Detailed Process Flow

11.3 Various Types of Unit Operations Involved

11.4 Mass balance and Raw Material Requirements

12 Requirements for Setting Up a PVC Pipes Manufacturing Plant

12.1 Land Requirements

12.2 Construction Requirements

12.3 Machinery Requirements

12.4 Machinery Pictures

12.5 Raw Material Requirements

12.6 Raw Material and Final Product Pictures

12.7 Packaging Requirements

12.8 Transportation Requirements

12.9 Utilities Requirements

12.10 Manpower Requirements

13 Profiles of Key Players

13.1 Adequa Water Solutions

13.2 Cepex

13.3 Molecor

13.4 Ferroplast

13.5 Plomifera

List of Figures

Figure 1: Spain: PVC Pipes Market: Major Drivers and Challenges

Figure 2: Europe: PVC Pipes Market: Volume Trends (in Million Tons), 2019-2024

Figure 3: Europe: PVC Pipes Market: Breakup by Pipe Type (in %), 2024

Figure 4: Europe: PVC Pipes Market: Breakup by Region (in %), 2024

Figure 5: Europe: PVC Pipes Market: Breakup by Application (in %), 2024

Figure 6: Europe: PVC Pipes Market Forecast: Volume Trends (in Million Tons), 2025-2033

Figure 7: Spain: PVC Pipes Market: Volume Trends (in ‘000 Tons), 2019-2024

Figure 8: Spain: PVC Pipes Market: Value Trends (in Million USD), 2019-2024

Figure 9: Spain: PVC Pipes Market: Average Prices (in USD/Ton), 2019-2024

Figure 10: Spain: PVC Pipes Market Forecast: Average Prices (in USD/Ton), 2025-2033

Figure 11: PVC Pipes Market: Price Structure

Figure 12: Spain: PVC Pipes Market: Breakup by Type, (in %), 2024

Figure 13: Spain: PVC Pipes Market: Breakup by Application, (in %), 2024

Figure 14: Spain: PVC Pipes Market Forecast: Volume Trends (in ‘000 Tons), 2025-2033

Figure 15: Spain: PVC Pipes Market Forecast: Production Value (in Million USD), 2025-2033

Figure 16: Spain: PVC Pipes Industry: SWOT Analysis

Figure 17: Spain: PVC Pipes Industry: Value Chain Analysis

Figure 18: Spain: PVC Pipes Industry: Porter’s Five Forces Analysis

Figure 19: Spain: Rigid PVC Pipes Market: Volume Trends (in ‘000 Tons), 2019 & 2024

Figure 20: Spain: Rigid PVC Pipes Market Forecast: Volume Trends (in ‘000 Tons), 2025-2033

Figure 21: Spain: Flexible PVC Pipes Market: Volume Trends (in ‘000 Tons), 2019 & 2024

Figure 22: Spain: Flexible PVC Pipes Market Forecast: Volume Trends (in ‘000 Tons), 2025-2033

Figure 23: Spain: PVC Pipes Market (Applications in Construction Sector): Volume Trends (in ‘000 Tons), 2019 & 2024

Figure 24: Spain: PVC Pipes Market Forecast (Applications in Construction Sector): Volume Trends (in ‘000 Tons), 2025-2033

Figure 25: Spain: PVC Pipes Market (Applications in Water Distribution): Volume Trends (in ‘000 Tons), 2019 & 2024

Figure 26: Spain: PVC Pipes Market Forecast (Applications in Water Distribution): Volume Trends (in ‘000 Tons), 2025-2033

Figure 27: Spain: PVC Pipes Market (Applications in Agriculture): Volume Trends (in ‘000 Tons), 2019 & 2024

Figure 28: Spain: PVC Pipes Market Forecast (Applications in Agriculture): Volume Trends (in ‘000 Tons), 2025-2033

Figure 29: Spain: PVC Pipes Market (Other Applications): Volume Trends (in ‘000 Tons), 2019 & 2024

Figure 30: Spain: PVC Pipes Market Forecast (Other Applications): Volume Trends (in ‘000 Tons), 2025-2033

Figure 31: Spain: PVC Pipes Market: Import Volume Breakup by Country (in %), 2024

Figure 32: Spain: PVC Pipes Market: Export Volume Breakup by Country (in %), 2024

Figure 33: PVC Pipes Manufacturing: Detailed Process Flow

Figure 34: PVC Pipes Manufacturing: Various Types of Unit Operations Involved

Figure 35: PVC Pipes Manufacturing: Conversion Rate of Feedstocks

List of Tables

Table 1: Europe: PVC Pipes Market: Key Industry Highlights, 2024 and 2033

Table 2: Spain: PVC Pipes Market: Key Industry Highlights, 2024 and 2033

Table 3: Spain: PVC Pipes Market Forecast: Breakup by Type (in ‘000 Tons), 2025-2033

Table 4: Spain: PVC Pipes Market Forecast: Breakup by Application (in ‘000 Tons), 2025-2033

Table 5: Spain: PVC Pipes Market: Import Data of Major Countries, 2024

Table 6: Spain: PVC Pipes Market: Export Data of Major Countries, 2024

Table 7: Spain: PVC Pipes Market: Competitive Structure

Table 8: Spain: PVC Pipes Market: Key Players

Table 9: PVC Pipes Manufacturing Plant: Land Requirements

Table 10: PVC Pipes Manufacturing Plant: Construction Requirements

Table 11: PVC Pipes Manufacturing Plant: Machinery Requirements

Table 12: PVC Pipes Manufacturing Plant: Raw Materials Requirements

Table 13: PVC Pipes Manufacturing Plant: Utilities Requirements

Table 14: PVC Pipes Manufacturing Plant: Manpower Requirements

Companies Mentioned

- Adequa

- Cepex

- Molecor

- Ferroplast and Plomifera

Table Information

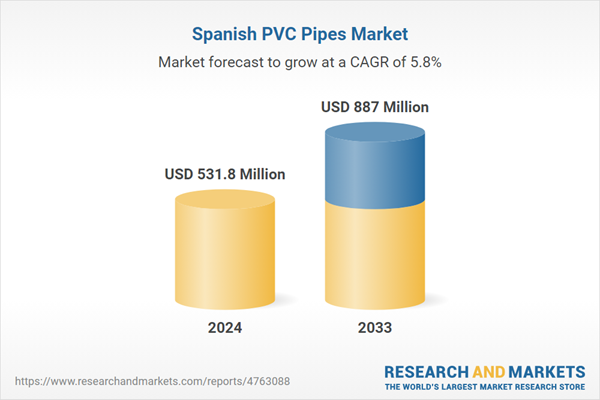

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 531.8 Million |

| Forecasted Market Value ( USD | $ 887 Million |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Spain |

| No. of Companies Mentioned | 4 |