Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The focus on operational efficiency and cost reduction is another driving force, with organizations seeking to optimize their budgets and improve resource utilization. This has spurred the adoption of Integrated Facility Management (IFM) services, allowing clients to consolidate various facility management functions under a single provider and achieve streamlined operations.

Moreover, sustainability and environmental responsibility are prominent drivers, with facility managers implementing green building practices, energy-efficient solutions, and waste reduction programs to align with global environmental goals and reduce operational costs. Technological advancements, particularly in smart building solutions and IoT integration, have revolutionized the industry, enhancing building efficiency, security, and occupant comfort.

The Saudi Arabia Facility Management Market is poised for continued expansion as organizations recognize the strategic value of facility management in achieving their operational and sustainability objectives. Facility management providers are responding to these drivers by offering innovative, technology-driven solutions that cater to the diverse needs of clients in various sectors, from commercial real estate to healthcare and beyond.

Key Market Drivers

Focus on Operational Efficiency and Cost Reduction

In an era marked by economic uncertainties and fiscal responsibility, organizations across industries in Saudi Arabia are placing a heightened emphasis on operational efficiency and cost reduction. Facility management services are viewed as instrumental in achieving these objectives.Facility managers are tasked with optimizing the use of resources, reducing energy consumption, and implementing preventive maintenance strategies to minimize equipment downtime and costly repairs. They leverage technology, such as computerized maintenance management systems (CMMS) and predictive analytics, to proactively identify and address maintenance issues.

By outsourcing facility management functions to specialized providers, organizations can tap into the expertise and experience of professionals who are skilled in streamlining operations while adhering to budget constraints. This focus on cost-effective facility management services is driving the market's growth, as businesses recognize the potential for substantial cost savings and operational improvements.

Key Market Challenges

Regulatory Compliance and Localization

One of the primary challenges in the Saudi Arabia Facility Management market is navigating the complex regulatory landscape and localization requirements. Saudi Arabia has a stringent regulatory environment, including labor laws, building codes, and safety standards. Facility management providers must ensure that their operations comply with these regulations to avoid legal complications and penalties.Moreover, Saudi Arabia has implemented localization policies to increase the employment of Saudi nationals in various industries, including facility management. Companies operating in the facility management sector must meet Saudization quotas, which mandate the employment of a certain percentage of Saudi nationals. Meeting these quotas while maintaining a skilled and efficient workforce can be challenging for facility management firms.

To address this challenge, facility management companies often engage in strategic partnerships and collaborations with local businesses and institutions to meet Saudization requirements and ensure compliance with regulations. They also invest in training and development programs to enhance the skills of Saudi nationals entering the workforce.

Key Market Trends

Smart Building Integration for Enhanced Efficiency

One of the notable trends in the Saudi Arabia Facility Management market is the increasing integration of smart building technologies. As Saudi Arabia seeks to modernize its infrastructure and improve energy efficiency, facility managers are turning to smart building solutions that use sensors, IoT devices, and automation systems to optimize operations.Smart building technology enables real-time monitoring and control of various systems, such as lighting, HVAC (heating, ventilation, and air conditioning), security, and energy management. Facility managers can remotely adjust settings, detect maintenance issues early, and make data-driven decisions to improve building performance and reduce operational costs.

This trend aligns with the Kingdom's Vision 2030 plan, which emphasizes sustainability and the use of technology to enhance infrastructure. As a result, facility management companies in Saudi Arabia are increasingly adopting smart building solutions to meet these goals and provide more efficient services to their clients.

Key Market Players

- Saudi EMCOR Company Ltd (EFS Facility Management)

- Muheel Services for Maintenance & Operations LLC

- Khidmah LLC

- Enova Facilities Management Services LLC

- Saudi Binladin Group Operation & Maintenance

- Musanadah Facilities Management Co. LTD

- Al Mahmal Facilities Services

- Al Khozama Facility Management Services

- Five Moons Company Ltd

- Takamul AlOula Facility Management

- Al Borj Facility Management

- Sodexo Saudi Arabia LLC

- Jones Lang LaSalle Saudi Arabia Limited

- Algosaibi Services Company Limited

- Tamimi Global Co. Ltd.

- Saudi Catering and Contracting Company

- AL Yusr Industrial Contracting Co

- Al Suwaidi Holding Co

- Zamil Operations and Maintenance Company Limited

- Newrest (Saudi Airline Catering Company)

Report Scope:

In this report, the Saudi Arabia Facility Management Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Saudi Arabia Facility Management Market, By Service:

- Property

- Cleaning

- Security

- Support

- Catering

- Others

Saudi Arabia Facility Management Market, By Type:

- Hard Services

- Mechanical

- Electrical and Plumbing

- Preventive Maintenance

- Structural Maintenance

- HVAC and Asset Management

- Others

- Soft Services

- Cleaning Services

- Security Services

- Catering Services

- Health Safety & Waste Management Services

- Others

Saudi Arabia Facility Management Market, By Industry:

- Organized

- Unorganized

Saudi Arabia Facility Management Market, By End User:

- Commercial

- Residential

- Industrial

- Public Sector

Saudi Arabia Facility Management Market, By Sectors:

- Education

- Healthcare

- Real Estate

- Banking

- Hospitality

- Housing

- Others

Saudi Arabia Facility Management Market, By Mode:

- In-House

- Outsourced

- Single

- Bundled

- Integrated

Saudi Arabia Facility Management Market, By Region:

- Makkah

- Riyadh

- Eastern Province

- Dammam

- Rest of Saudi Arabia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi Arabia Facility Management Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Saudi EMCOR Company Ltd (EFS Facility Management)

- Muheel Services for Maintenance & Operations LLC

- Khidmah LLC

- Enova Facilities Management Services LLC

- Saudi Binladin Group Operation & Maintenance

- Musanadah Facilities Management Co. LTD

- Al Mahmal Facilities Services

- Al Khozama Facility Management Services

- Five Moons Company Ltd

- Takamul AlOula Facility Management

- Al Borj Facility Management

- Sodexo Saudi Arabia LLC

- Jones Lang LaSalle Saudi Arabia Limited

- Algosaibi Services Company Limited

- Tamimi Global Co. Ltd.

- Saudi Catering and Contracting Company

- AL Yusr Industrial Contracting Co

- Al Suwaidi Holding Co

- Zamil Operations and Maintenance Company Limited

- Newrest (Saudi Airline Catering Company)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 88 |

| Published | July 2025 |

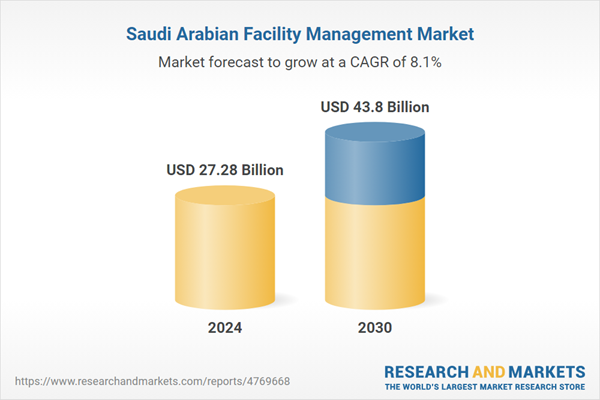

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 27.28 Billion |

| Forecasted Market Value ( USD | $ 43.8 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 20 |